September 30, 2025 Third Quarter Financial Supplement Exhibit 99.2

Table of Contents Page Investor Letter.............................................................................................................................................................................................................................. 3 Use of Non-GAAP Measures...................................................................................................................................................................................................... 4 Results of Operations and Selected Operating Performance Measures...................................................................................................................................... 5 Financial Highlights..................................................................................................................................................................................................................... 6 Consolidated Quarterly Results Consolidated Net Income (Loss) by Quarter............................................................................................................................................................................... 8 Reconciliation of Net Income (Loss) to Adjusted Operating Income......................................................................................................................................... 9 Consolidated Balance Sheets....................................................................................................................................................................................................... 10-11 Consolidated Balance Sheets by Segment................................................................................................................................................................................... 12-13 Quarterly Results by Business Adjusted Operating Income and Selected Operating Metrics - Enact Segment.......................................................................................................................... 15-16 Adjusted Operating Income (Loss) and Statutory Impact of In-Force Rate Actions - Long-Term Care Insurance Segment..................................................... 18-19 Adjusted Operating Income (Loss) - Life and Annuities Segment.............................................................................................................................................. 21-24 Adjusted Operating Loss - Corporate and Other......................................................................................................................................................................... 26 Additional Financial Data Investments Summary.................................................................................................................................................................................................................. 28 Fixed Maturity Securities Summary............................................................................................................................................................................................ 29 U.S. GAAP Net Investment Income Yields................................................................................................................................................................................ 30 Net Investment Gains (Losses) - Detail....................................................................................................................................................................................... 31 Reconciliations of Non-GAAP Measures Reconciliation of Operating Return On Equity (ROE)................................................................................................................................................................ 33 Reconciliation of Consolidated Expense Ratio............................................................................................................................................................................ 34 Reconciliation of Reported Yield to Core Yield.......................................................................................................................................................................... 35 GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 2 Note: Unless otherwise stated, all references in this financial supplement to income (loss) from continuing operations, income (loss) from continuing operations per share, net income (loss), net income (loss) per share, adjusted operating income (loss), adjusted operating income (loss) per share, book value and book value per share should be read as income (loss) from continuing operations available to Genworth Financial, Inc.’s common stockholders, income (loss) from continuing operations available to Genworth Financial, Inc.’s common stockholders per share, net income (loss) available to Genworth Financial, Inc.’s common stockholders, net income (loss) available to Genworth Financial, Inc.’s common stockholders per share, non-U.S. Generally Accepted Accounting Principles (U.S. GAAP) adjusted operating income (loss) available to Genworth Financial, Inc.’s common stockholders, non-GAAP adjusted operating income (loss) available to Genworth Financial, Inc.’s common stockholders per share, book value available to Genworth Financial, Inc.’s common stockholders and book value available to Genworth Financial, Inc.’s common stockholders per share, respectively.

Investors are encouraged to listen to the company’s earnings call on the third quarter 2025 results at 10:00 a.m. (ET) on November 6, 2025. The company’s conference call will be accessible via telephone and internet. The dial-in number for Genworth’s November 6 conference call is 800-330-6710 or 213-279-1505 (outside the U.S.); conference ID #2260685. To participate in the call by webcast, register at least 15 minutes in advance at https://investor.genworth.com. Dear Investor, Thank you for your continued interest in Genworth Financial, Inc. Please see the accompanying press release and summary presentation posted to the company’s website at https://investor.genworth.com for additional information regarding its third quarter 2025 earnings results. Regards, Christine Jewell Investor Relations InvestorInfo@genworth.com GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 3

GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 4 Use of Non-GAAP Measures Management evaluates performance and allocates resources based on a non-GAAP financial measure entitled “adjusted operating income (loss).” Management evaluates adjusted operating income (loss) as a key measure to assess performance and support new business initiatives because the measure more accurately reflects overall operating performance, as it minimizes the impact of macroeconomic volatility. The company’s legacy U.S. life insurance subsidiaries, which comprise the Long-Term Care Insurance and Life and Annuities segments, are managed on a standalone basis; therefore, the company does not allocate capital to its Long-Term Care Insurance and Life and Annuities segments. The company defines adjusted operating income (loss) as income (loss) from continuing operations excluding the after-tax effects of income (loss) attributable to noncontrolling interests, net investment gains (losses), changes in fair value of market risk benefits attributable to interest rates, equity markets and associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual non-operating items. A component of the company’s net investment gains (losses) is the result of estimated future credit losses, the size and timing of which can vary significantly depending on market credit cycles. In addition, the size and timing of other investment gains (losses) can be subject to the company’s discretion and are influenced by market opportunities, as well as asset- liability matching considerations. The company excludes net investment gains (losses), changes in fair value of market risk benefits attributable to interest rates, equity markets and associated hedges, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, restructuring costs and infrequent or unusual non- operating items from adjusted operating income (loss) because, in the company’s opinion, they are not indicative of overall operating performance. While some of these items may be significant components of net income (loss) determined in accordance with U.S. GAAP, the company believes that adjusted operating income (loss), and measures that are derived from or incorporate adjusted operating income (loss), are appropriate measures that are useful to investors because they identify the income (loss) attributable to the ongoing operations of the business. Adjusted operating income (loss) is not a substitute for net income (loss) determined in accordance with U.S. GAAP. In addition, the company’s definition of adjusted operating income (loss) may differ from the definitions used by other companies. Adjustments to reconcile net income (loss) to adjusted operating income (loss) assume a 21% current tax rate, plus any associated deferred taxes, and are net of the portion attributable to noncontrolling interests. Changes in fair value of market risk benefits and associated hedges are adjusted to exclude changes in reserves, attributed fees and benefit payments. The table on page 9 of this financial supplement provides a reconciliation of net income (loss) to adjusted operating income for the periods presented and reflects adjusted operating income (loss) as determined in accordance with accounting guidance related to segment reporting. This financial supplement includes other non-GAAP measures management believes enhances the understanding and comparability of performance by highlighting underlying business activity and profitability drivers. These additional non-GAAP measures are on pages 33 to 35 of this financial supplement. Statutory Accounting Data The company presents certain supplemental statutory data for Genworth Life Insurance Company (GLIC) and its consolidating life insurance subsidiaries that has been prepared on the basis of statutory accounting principles (SAP). GLIC and its consolidating life insurance subsidiaries file financial statements with state insurance regulatory authorities and the National Association of Insurance Commissioners that are prepared using SAP, an accounting basis either prescribed or permitted by such authorities. Due to differences in methodology between SAP and U.S. GAAP, the values for assets, liabilities and equity, and the recognition of income and expenses, reflected in financial statements prepared in accordance with U.S. GAAP are materially different from those reflected in financial statements prepared under SAP. This supplemental statutory data should not be viewed as an alternative to, or used in lieu of, U.S. GAAP. This supplemental statutory data includes the impact from in-force rate actions on pre-tax long-term care insurance statutory earnings. Statutory pre-tax earnings represent the net gain from operations, including the impact from in-force rate actions, before dividends to policyholders, refunds to members and federal income taxes and before realized capital gains or (losses). Management uses and provides this supplemental statutory data because it believes it provides a useful measure of, among other things, statutory pre-tax earnings and the adequacy of capital. Management uses this data to measure against its policy to manage the U.S. life insurance companies with internally generated capital.

GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 5 Results of Operations and Selected Operating Performance Measures The company allocates tax to its businesses at the U.S. corporate federal income tax rate of 21%. Each segment is then adjusted to reflect the unique tax attributes of that segment, such as permanent differences between U.S. GAAP and tax law. The difference between the consolidated provision for income taxes and the sum of the provision for income taxes in each segment is reflected in Corporate and Other. The annually-determined tax rates and adjustments to each segment’s provision for income taxes are estimates which are subject to review and could change from year to year. U.S. GAAP generally requires an annualized effective tax rate to be used for interim reporting periods, utilizing projections of full year results. However, in certain circumstances, it is appropriate to record the actual effective tax rate for the period if a reliable estimate cannot be made for the full year. For the three months ended September 30, 2025, June 30, 2025, March 31, 2025, September 30, 2024 and June 30, 2024, the company utilized the actual effective tax rate for the interim period to record the provision for income taxes for its Long-Term Care Insurance and Life and Annuities segments and the annualized projected effective tax rate for its Enact segment and Corporate and Other. For the three months ended March 31, 2024, the company used the annualized projected effective tax rate for all segments and Corporate and Other. This financial supplement contains selected operating performance measures including “new insurance written,” “insurance in-force” and “risk in-force,” which are commonly used in the insurance industry as measures of operating performance. Management regularly monitors and reports new insurance written for the company’s Enact segment as a measure of volume of new business generated in a period. The company considers new insurance written to be a measure of the operating performance of its Enact segment because it represents a measure of new sales of mortgage insurance policies during a specified period, rather than a measure of revenues or profitability during that period. Management also regularly monitors and reports insurance in-force and risk in-force for the company’s Enact segment. Insurance in-force is a measure of the aggregate unpaid principal balance as of the respective reporting date for loans insured by the company’s U.S. mortgage insurance subsidiaries. Risk in-force is based on the coverage percentage applied to the estimated current outstanding loan balance. These metrics are presented on a direct basis and exclude reinsurance. The company considers insurance in-force and risk in-force to be measures of the operating performance of its Enact segment because they represent measures of the size of its business at a specific date which will generate revenues and profits in a future period, rather than measures of its revenues or profitability during that period. Management also regularly monitors and reports a loss ratio for the company’s Enact segment. The company considers the loss ratio, which is the ratio of benefits and other changes in policy reserves to net earned premiums, to be a measure of underwriting performance. The company believes the loss ratio helps to enhance the understanding of the operating performance of the Enact segment. These operating performance measures enable the company to compare its operating performance across periods without regard to revenues or profitability related to policies or contracts sold in prior periods or from investments or other sources.

September 30, June 30, March 31, December 31, September 30, Balance Sheet Data 2025 2025 2025 2024 2024 Total Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other comprehensive income (loss) $ 10,207 $ 10,160 $ 10,131 $ 10,136 $ 10,182 Total accumulated other comprehensive income (loss)(1) (1,395) (1,372) (1,421) (1,642) (1,871) Total Genworth Financial, Inc.’s stockholders’ equity $ 8,812 $ 8,788 $ 8,710 $ 8,494 $ 8,311 Book value per share $ 21.88 $ 21.35 $ 20.94 $ 20.16 $ 19.40 Book value per share, excluding accumulated other comprehensive income (loss) $ 25.35 $ 24.68 $ 24.36 $ 24.05 $ 23.77 Common shares outstanding as of the balance sheet date 402.7 411.7 415.9 421.4 428.4 September 30, June 30, March 31, December 31, September 30, Twelve Month Rolling Average ROE 2025 2025 2025 2024 2024 U.S. GAAP Basis ROE 2.2 % 1.9 % 2.1 % 3.0 % 0.9 % Operating ROE(2) 1.5 % 1.8 % 2.4 % 2.7 % 0.3 % September 30, June 30, March 31, December 31, September 30, Quarterly Average ROE 2025 2025 2025 2024 2024 U.S. GAAP Basis ROE 4.6 % 2.0 % 2.1 % — % 3.3 % Operating ROE(2) 0.7 % 2.7 % 1.5 % 0.6 % 1.9 % Three months ended Nine months ended Basic and Diluted Shares September 30, 2025 September 30, 2025 Weighted-average common shares used in basic earnings per share calculations 408.0 413.2 Potentially dilutive securities: Performance stock units, restricted stock units and other equity-based awards 5.3 4.7 Weighted-average common shares used in diluted earnings per share calculations 413.3 417.9 Three months ended Twelve months ended GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Financial Highlights (amounts in millions, except per share data) 6 (1)As of September 30, 2025, June 30, 2025, March 31, 2025, December 31, 2024 and September 30, 2024, total accumulated other comprehensive income (loss) includes $143 million, $770 million, $704 million, $1,023 million and $(1,341) million, net of taxes, respectively, related to changes in the discount rate used to remeasure the liability for future policy benefits and related reinsurance recoverables. (2)See page 33 herein for a reconciliation of U.S. GAAP Basis ROE to Operating ROE.

Consolidated Quarterly Results 7

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 886 $ 865 $ 862 $ 2,613 $ 876 $ 874 $ 855 $ 875 $ 3,480 799 802 739 2,340 793 777 808 782 3,160 99 (28) 27 98 (41) 66 (61) 49 13 151 157 158 466 154 163 167 158 642 1,935 1,796 1,786 5,517 1,782 1,880 1,769 1,864 7,295 1,227 1,195 1,217 3,639 1,199 1,213 1,151 1,203 4,766 106 60 4 170 88 34 39 (8) 153 (1) (10) 18 7 (3) 21 (8) (23) (13) 96 94 99 289 101 102 125 125 453 259 249 236 744 253 259 229 236 977 57 57 60 174 62 62 60 65 249 27 26 26 79 27 28 30 30 115 1,771 1,671 1,660 5,102 1,727 1,719 1,626 1,628 6,700 164 125 126 415 55 161 143 236 595 9 35 36 80 20 40 32 66 158 155 90 90 335 35 121 111 170 437 (8) (7) (5) (20) (5) (3) (1) (1) (10) 147 83 85 315 30 118 110 169 427 31 32 31 94 31 33 34 30 128 $ 116 $ 51 $ 54 $ 221 $ (1) $ 85 $ 76 $ 139 $ 299 Basic $ 0.30 $ 0.14 $ 0.14 $ 0.58 $ 0.01 $ 0.20 $ 0.18 $ 0.32 $ 0.71 Diluted $ 0.30 $ 0.14 $ 0.14 $ 0.58 $ 0.01 $ 0.20 $ 0.17 $ 0.31 $ 0.70 Basic $ 0.29 $ 0.12 $ 0.13 $ 0.54 $ 0.00 $ 0.20 $ 0.17 $ 0.31 $ 0.69 Diluted $ 0.28 $ 0.12 $ 0.13 $ 0.53 $ 0.00 $ 0.19 $ 0.17 $ 0.31 $ 0.68 Basic 408.0 413.2 418.3 413.2 425.3 430.8 436.4 443.0 433.9 Diluted 413.3 417.5 422.9 417.9 431.0 435.8 440.7 450.3 439.4 2024 Total revenues Policy fees and other income REVENUES: Premiums Net investment gains (losses) Net investment income 2025 BENEFITS AND EXPENSES: Benefits and other changes in policy reserves Changes in fair value of market risk benefits and associated hedges Liability remeasurement (gains) losses Acquisition and operating expenses, net of deferrals Interest credited Amortization of deferred acquisition costs and intangibles Interest expense INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Total benefits and expenses INCOME FROM CONTINUING OPERATIONS Provision for income taxes Net income (loss) available to Genworth Financial, Inc.’s common stockholders per share Weighted-average common shares outstanding Loss from discontinued operations, net of taxes(1) NET INCOME Less: net income attributable to noncontrolling interests Income from continuing operations available to Genworth Financial, Inc.’s common Earnings Per Share Data: GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Consolidated Net Income (Loss) by Quarter (amounts in millions, except per share amounts) 8 (1)Loss from discontinued operations primarily relates to legal costs related to litigation involving the company’s former lifestyle protection insurance business. NET INCOME (LOSS) AVAILABLE TO GENWORTH FINANCIAL, INC.’S COMMON STOCKHOLDERS stockholders per share

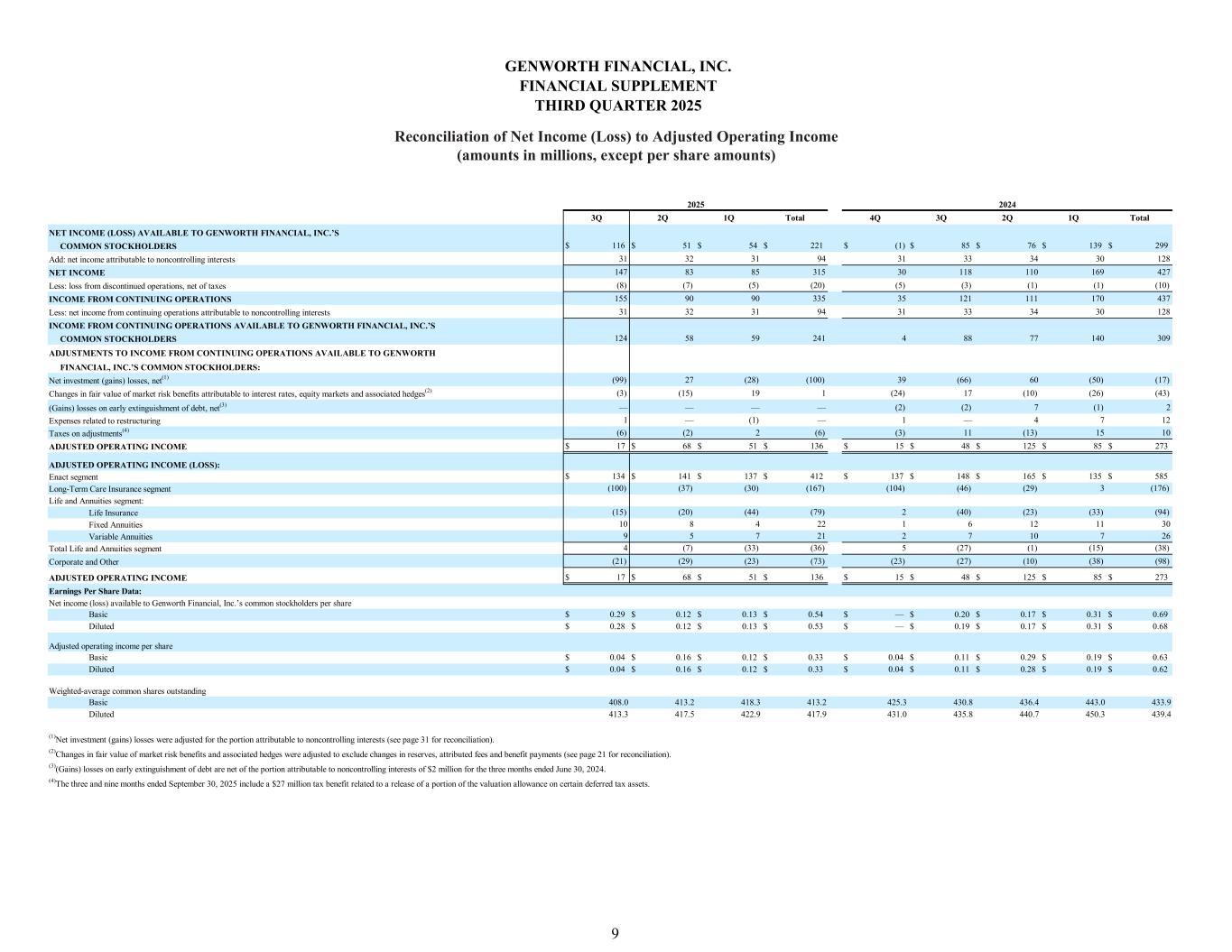

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 116 $ 51 $ 54 $ 221 $ (1) $ 85 $ 76 $ 139 $ 299 31 32 31 94 31 33 34 30 128 147 83 85 315 30 118 110 169 427 (8) (7) (5) (20) (5) (3) (1) (1) (10) 155 90 90 335 35 121 111 170 437 31 32 31 94 31 33 34 30 128 124 58 59 241 4 88 77 140 309 (99) 27 (28) (100) 39 (66) 60 (50) (17) (3) (15) 19 1 (24) 17 (10) (26) (43) — — — — (2) (2) 7 (1) 2 1 — (1) — 1 — 4 7 12 (6) (2) 2 (6) (3) 11 (13) 15 10 $ 17 $ 68 $ 51 $ 136 $ 15 $ 48 $ 125 $ 85 $ 273 $ 134 $ 141 $ 137 $ 412 $ 137 $ 148 $ 165 $ 135 $ 585 (100) (37) (30) (167) (104) (46) (29) 3 (176) (15) (20) (44) (79) 2 (40) (23) (33) (94) 10 8 4 22 1 6 12 11 30 9 5 7 21 2 7 10 7 26 4 (7) (33) (36) 5 (27) (1) (15) (38) (21) (29) (23) (73) (23) (27) (10) (38) (98) $ 17 $ 68 $ 51 $ 136 $ 15 $ 48 $ 125 $ 85 $ 273 Basic $ 0.29 $ 0.12 $ 0.13 $ 0.54 $ — $ 0.20 $ 0.17 $ 0.31 $ 0.69 Diluted $ 0.28 $ 0.12 $ 0.13 $ 0.53 $ — $ 0.19 $ 0.17 $ 0.31 $ 0.68 Basic $ 0.04 $ 0.16 $ 0.12 $ 0.33 $ 0.04 $ 0.11 $ 0.29 $ 0.19 $ 0.63 Diluted $ 0.04 $ 0.16 $ 0.12 $ 0.33 $ 0.04 $ 0.11 $ 0.28 $ 0.19 $ 0.62 Basic 408.0 413.2 418.3 413.2 425.3 430.8 436.4 443.0 433.9 Diluted 413.3 417.5 422.9 417.9 431.0 435.8 440.7 450.3 439.4 (4)The three and nine months ended September 30, 2025 include a $27 million tax benefit related to a release of a portion of the valuation allowance on certain deferred tax assets. 2024 INCOME FROM CONTINUING OPERATIONS Less: loss from discontinued operations, net of taxes NET INCOME (LOSS) AVAILABLE TO GENWORTH FINANCIAL, INC.’S COMMON STOCKHOLDERS NET INCOME Add: net income attributable to noncontrolling interests 2025 Less: net income from continuing operations attributable to noncontrolling interests INCOME FROM CONTINUING OPERATIONS AVAILABLE TO GENWORTH FINANCIAL, INC.’S ADJUSTMENTS TO INCOME FROM CONTINUING OPERATIONS AVAILABLE TO GENWORTH COMMON STOCKHOLDERS Net investment (gains) losses, net(1) FINANCIAL, INC.’S COMMON STOCKHOLDERS: Changes in fair value of market risk benefits attributable to interest rates, equity markets and associated hedges(2) (Gains) losses on early extinguishment of debt, net(3) Taxes on adjustments(4) Expenses related to restructuring ADJUSTED OPERATING INCOME (LOSS): ADJUSTED OPERATING INCOME Enact segment Long-Term Care Insurance segment Life Insurance Life and Annuities segment: Variable Annuities Fixed Annuities Total Life and Annuities segment Corporate and Other Earnings Per Share Data: ADJUSTED OPERATING INCOME (3)(Gains) losses on early extinguishment of debt are net of the portion attributable to noncontrolling interests of $2 million for the three months ended June 30, 2024. Net income (loss) available to Genworth Financial, Inc.’s common stockholders per share Adjusted operating income per share Weighted-average common shares outstanding (1)Net investment (gains) losses were adjusted for the portion attributable to noncontrolling interests (see page 31 for reconciliation). (2)Changes in fair value of market risk benefits and associated hedges were adjusted to exclude changes in reserves, attributed fees and benefit payments (see page 21 for reconciliation). GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Reconciliation of Net Income (Loss) to Adjusted Operating Income (amounts in millions, except per share amounts) 9

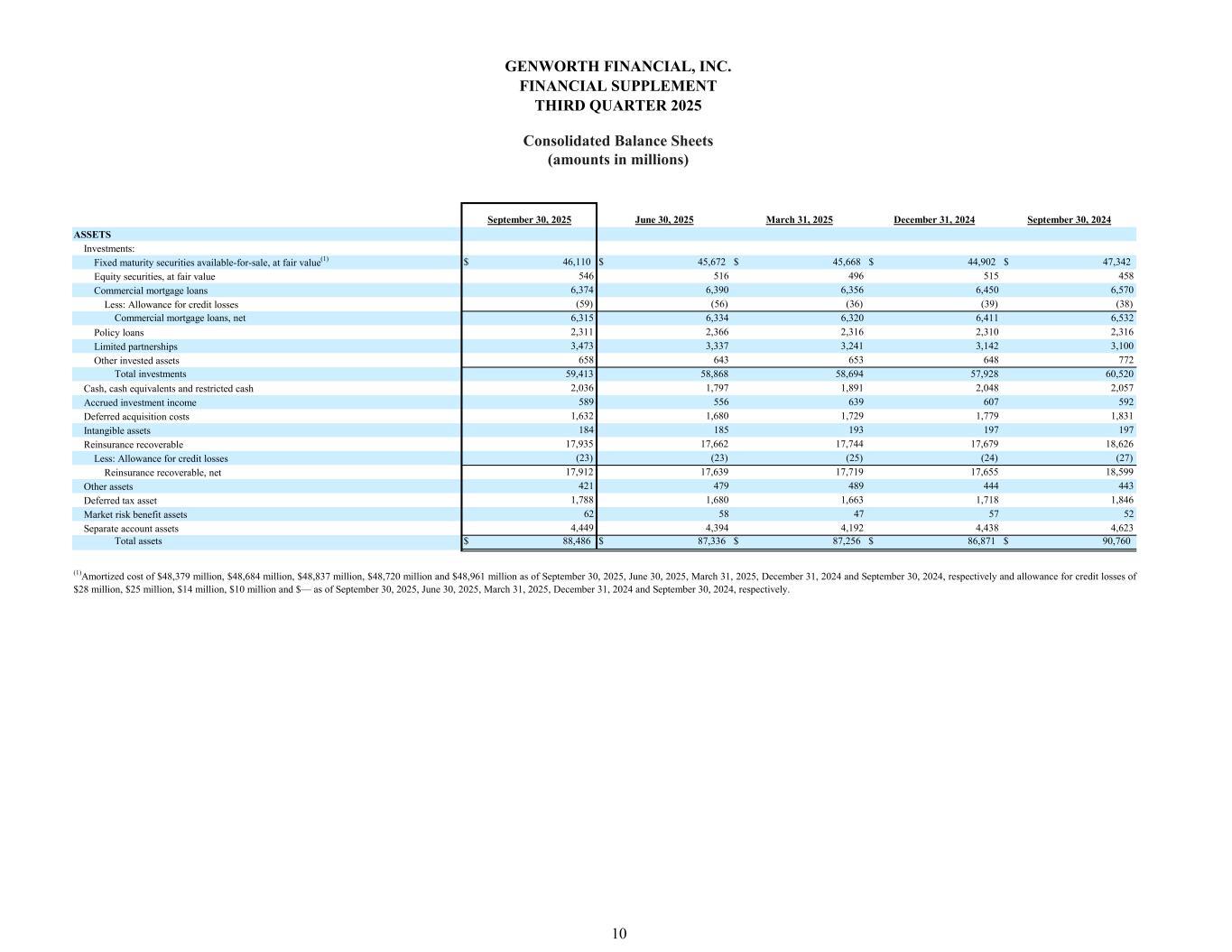

September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 $ 46,110 $ 45,672 $ 45,668 $ 44,902 $ 47,342 546 516 496 515 458 6,374 6,390 6,356 6,450 6,570 (59) (56) (36) (39) (38) Commercial mortgage loans, net 6,315 6,334 6,320 6,411 6,532 2,311 2,366 2,316 2,310 2,316 3,473 3,337 3,241 3,142 3,100 658 643 653 648 772 Total investments 59,413 58,868 58,694 57,928 60,520 2,036 1,797 1,891 2,048 2,057 589 556 639 607 592 1,632 1,680 1,729 1,779 1,831 184 185 193 197 197 17,935 17,662 17,744 17,679 18,626 (23) (23) (25) (24) (27) 17,912 17,639 17,719 17,655 18,599 421 479 489 444 443 1,788 1,680 1,663 1,718 1,846 62 58 47 57 52 4,449 4,394 4,192 4,438 4,623 Total assets $ 88,486 $ 87,336 $ 87,256 $ 86,871 $ 90,760 Commercial mortgage loans Equity securities, at fair value Fixed maturity securities available-for-sale, at fair value(1) ASSETS Investments: Limited partnerships Policy loans Less: Allowance for credit losses Other invested assets Cash, cash equivalents and restricted cash Accrued investment income Reinsurance recoverable Less: Allowance for credit losses Intangible assets Deferred acquisition costs Market risk benefit assets Deferred tax asset Reinsurance recoverable, net Other assets Separate account assets GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Consolidated Balance Sheets (amounts in millions) 10 (1)Amortized cost of $48,379 million, $48,684 million, $48,837 million, $48,720 million and $48,961 million as of September 30, 2025, June 30, 2025, March 31, 2025, December 31, 2024 and September 30, 2024, respectively and allowance for credit losses of $28 million, $25 million, $14 million, $10 million and $— as of September 30, 2025, June 30, 2025, March 31, 2025, December 31, 2024 and September 30, 2024, respectively.

September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 $ 55,364 $ 54,111 $ 54,158 $ 53,610 $ 57,303 14,039 14,163 14,447 14,594 14,864 429 453 516 465 532 710 763 698 670 655 96 101 108 115 121 2,056 2,052 1,933 2,026 1,859 1,520 1,520 1,519 1,518 1,548 4,449 4,394 4,192 4,438 4,623 2 — 4 4 — Total liabilities 78,665 77,557 77,575 77,440 81,505 1 1 1 1 1 11,879 11,871 11,862 11,875 11,868 143 770 704 1,023 (1,341) (1,538) (2,142) (2,125) (2,665) (530) (1,395) (1,372) (1,421) (1,642) (1,871) 1,731 1,615 1,565 1,511 1,512 (3,404) (3,327) (3,297) (3,251) (3,199) Total Genworth Financial, Inc.’s stockholders’ equity 8,812 8,788 8,710 8,494 8,311 1,009 991 971 937 944 Total equity 9,821 9,779 9,681 9,431 9,255 Total liabilities and equity $ 88,486 $ 87,336 $ 87,256 $ 86,871 $ 90,760 Liabilities: Liability for policy and contract claims Market risk benefit liabilities Policyholder account balances Future policy benefits LIABILITIES AND EQUITY Unearned premiums Other liabilities Long-term borrowings Separate account liabilities Equity: Common stock Liabilities related to discontinued operations(1) All other Change in the discount rate used to measure future policy benefits Accumulated other comprehensive income (loss): Additional paid-in capital Total accumulated other comprehensive income (loss) Retained earnings Treasury stock, at cost Noncontrolling interests GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Consolidated Balance Sheets (amounts in millions) 11 (1)Liabilities related to discontinued operations primarily relates to legal costs related to litigation involving the sale of the company’s former lifestyle protection insurance business.

Enact Long-Term Care Insurance Life and Annuities Corporate and Other(1) Total $ 6,691 $ 36,635 $ 17,231 $ 1,481 $ 62,038 57 800 945 14 1,816 4 7,522 10,386 — 17,912 123 1,697 274 115 2,209 — — 62 — 62 — — 4,449 — 4,449 Total assets $ 6,875 $ 46,654 $ 33,347 $ 1,610 $ 88,486 $ — $ 43,017 $ 12,347 $ — $ 55,364 — — 14,039 — 14,039 — — 429 — 429 572 — 132 6 710 96 — — — 96 134 1,091 271 560 2,056 744 — — 776 1,520 — — 4,449 — 4,449 — — — 2 2 Total liabilities 1,546 44,108 31,667 1,344 78,665 4,354 2,730 2,447 676 10,207 (34) (184) (767) (410) (1,395) 4,320 2,546 1,680 266 8,812 1,009 — — — 1,009 5,329 2,546 1,680 266 9,821 $ 6,875 $ 46,654 $ 33,347 $ 1,610 $ 88,486 ASSETS Deferred acquisition costs and intangible assets Reinsurance recoverable, net Cash and investments September 30, 2025 Separate account assets Deferred tax and other assets Market risk benefit assets LIABILITIES AND EQUITY Liabilities: Future policy benefits Policyholder account balances Unearned premiums Other liabilities Liability for policy and contract claims Market risk benefit liabilities Liabilities associated with discontinued operations Borrowings Separate account liabilities Equity: Allocated equity, excluding accumulated other comprehensive income (loss) (1)Includes inter-segment eliminations and other businesses that are not individually reportable, including start-up businesses that offer fee-based services, advice, consulting and other aging care services, as well as long- term care insurance products, through the company’s CareScout business (“CareScout”), and certain international businesses. Allocated accumulated other comprehensive income (loss) Total Genworth Financial, Inc.’s stockholders’ equity Total liabilities and equity Total equity Noncontrolling interests GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Consolidated Balance Sheet by Segment (amounts in millions) 12

Enact Long-Term Care Insurance Life and Annuities Corporate and Other(1) Total $ 6,589 $ 36,013 $ 17,281 $ 1,338 $ 61,221 55 814 982 14 1,865 3 7,313 10,323 — 17,639 130 1,585 317 127 2,159 — — 58 — 58 — — 4,394 — 4,394 Total assets $ 6,777 $ 45,725 $ 33,355 $ 1,479 $ 87,336 $ — $ 41,800 $ 12,311 $ — $ 54,111 — — 14,163 — 14,163 — — 453 — 453 552 — 203 8 763 101 — — — 101 145 1,138 297 472 2,052 744 — — 776 1,520 — — 4,394 — 4,394 — — — — — Total liabilities 1,542 42,938 31,821 1,256 77,557 4,329 2,668 2,440 723 10,160 (85) 119 (906) (500) (1,372) 4,244 2,787 1,534 223 8,788 991 — — — 991 5,235 2,787 1,534 223 9,779 $ 6,777 $ 45,725 $ 33,355 $ 1,479 $ 87,336 ASSETS Deferred acquisition costs and intangible assets Reinsurance recoverable, net Cash and investments June 30, 2025 Separate account assets Deferred tax and other assets Market risk benefit assets LIABILITIES AND EQUITY Liabilities: Future policy benefits Policyholder account balances Unearned premiums Other liabilities Liability for policy and contract claims Market risk benefit liabilities Liabilities related to discontinued operations Borrowings Separate account liabilities Equity: Allocated equity, excluding accumulated other comprehensive income (loss) Allocated accumulated other comprehensive income (loss) Total Genworth Financial, Inc.’s stockholders’ equity Total liabilities and equity Total equity Noncontrolling interests GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Consolidated Balance Sheet by Segment (amounts in millions) 13 (1)Includes inter-segment eliminations and other businesses that are not individually reportable, including CareScout and certain international businesses.

14 Enact Segment

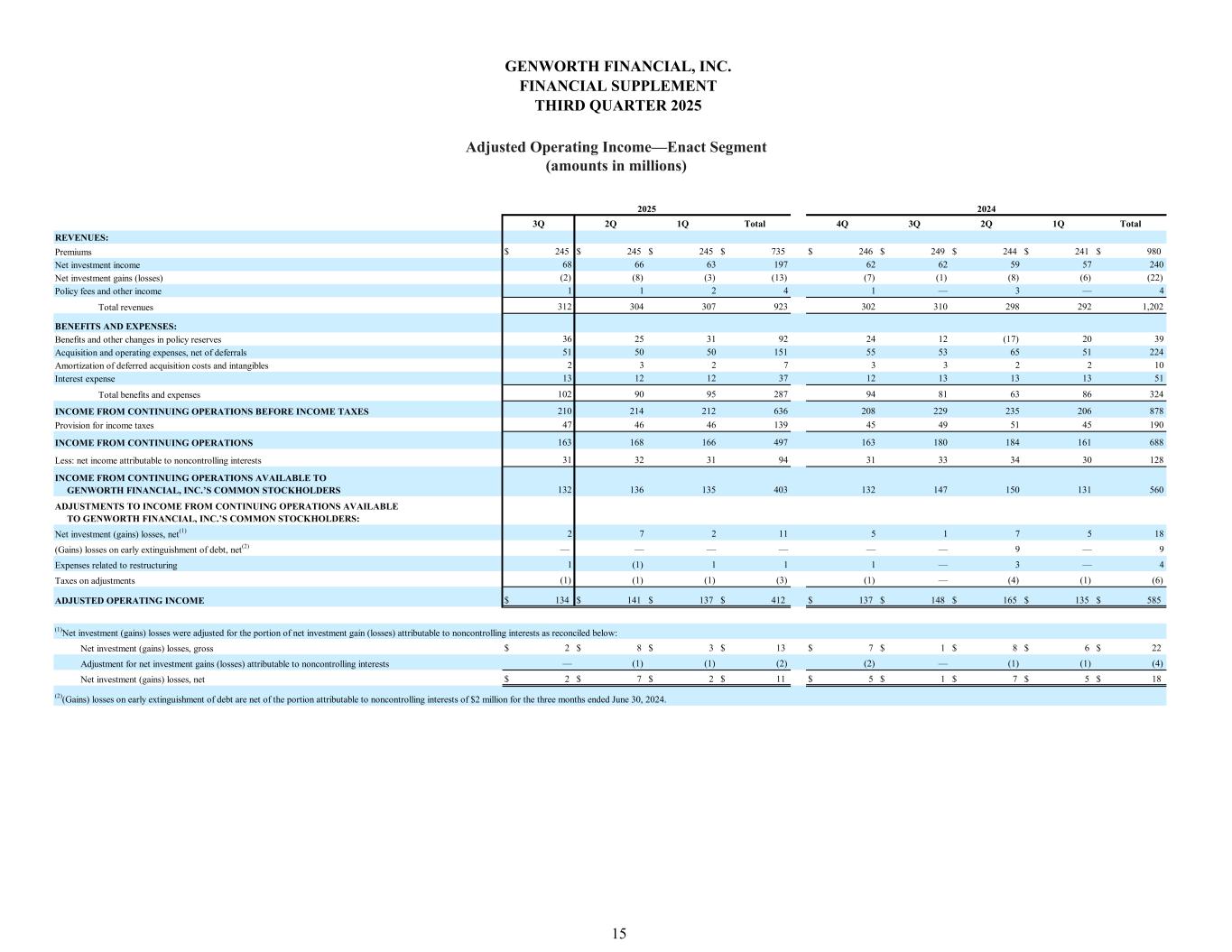

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 245 $ 245 $ 245 $ 735 $ 246 $ 249 $ 244 $ 241 $ 980 68 66 63 197 62 62 59 57 240 (2) (8) (3) (13) (7) (1) (8) (6) (22) 1 1 2 4 1 — 3 — 4 312 304 307 923 302 310 298 292 1,202 36 25 31 92 24 12 (17) 20 39 51 50 50 151 55 53 65 51 224 2 3 2 7 3 3 2 2 10 13 12 12 37 12 13 13 13 51 102 90 95 287 94 81 63 86 324 210 214 212 636 208 229 235 206 878 47 46 46 139 45 49 51 45 190 163 168 166 497 163 180 184 161 688 31 32 31 94 31 33 34 30 128 132 136 135 403 132 147 150 131 560 2 7 2 11 5 1 7 5 18 — — — — — — 9 — 9 1 (1) 1 1 1 — 3 — 4 (1) (1) (1) (3) (1) — (4) (1) (6) $ 134 $ 141 $ 137 $ 412 $ 137 $ 148 $ 165 $ 135 $ 585 $ 2 $ 8 $ 3 $ 13 $ 7 $ 1 $ 8 $ 6 $ 22 — (1) (1) (2) (2) — (1) (1) (4) $ 2 $ 7 $ 2 $ 11 $ 5 $ 1 $ 7 $ 5 $ 18 ADJUSTED OPERATING INCOME Net investment (gains) losses, gross (1)Net investment (gains) losses were adjusted for the portion of net investment gain (losses) attributable to noncontrolling interests as reconciled below: (2)(Gains) losses on early extinguishment of debt are net of the portion attributable to noncontrolling interests of $2 million for the three months ended June 30, 2024. Net investment (gains) losses, net Adjustment for net investment gains (losses) attributable to noncontrolling interests ADJUSTMENTS TO INCOME FROM CONTINUING OPERATIONS AVAILABLE TO GENWORTH FINANCIAL, INC.’S COMMON STOCKHOLDERS: (Gains) losses on early extinguishment of debt, net(2) Net investment (gains) losses, net(1) Taxes on adjustments Expenses related to restructuring INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Provision for income taxes Less: net income attributable to noncontrolling interests INCOME FROM CONTINUING OPERATIONS GENWORTH FINANCIAL, INC.’S COMMON STOCKHOLDERS INCOME FROM CONTINUING OPERATIONS AVAILABLE TO BENEFITS AND EXPENSES: Benefits and other changes in policy reserves Amortization of deferred acquisition costs and intangibles Acquisition and operating expenses, net of deferrals Total benefits and expenses Interest expense 2025 2024 Total revenues Policy fees and other income REVENUES: Premiums Net investment gains (losses) Net investment income GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 15 Adjusted Operating Income—Enact Segment (amounts in millions)

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total Direct Primary New Insurance Written $ 14,048 $ 13,254 $ 9,818 $ 37,120 $ 13,266 $ 13,591 $ 13,619 $ 10,526 $ 51,002 Direct Primary Insurance In-Force $ 272,349 $ 269,754 $ 268,366 $ 268,825 $ 268,003 $ 266,060 $ 263,645 Direct Primary Risk In-Force $ 71,144 $ 70,401 $ 69,937 $ 69,985 $ 69,611 $ 68,878 $ 67,950 Primary Delinquencies 23,382 22,118 22,349 67,849 23,566 21,027 19,051 19,492 23,566 New Delinquencies 12,998 11,567 12,237 36,802 13,717 12,964 10,461 11,395 48,537 Paid Claims (253) (218) (179) (650) (191) (220) (160) (172) (743) Primary Cures(1) (11,481) (11,580) (13,275) (36,336) (10,987) (10,768) (10,742) (12,163) (44,660) Loss Ratio(2) 15 % 10 % 12 % 12 % 10 % 5 % (7)% 8 % 4 % Available Assets Above PMIERs Requirements(3) $ 1,904 $ 1,961 $ 1,966 $ 2,052 $ 2,190 $ 2,057 $ 1,883 PMIERs Sufficiency Ratio(3) 162 % 165 % 165 % 167 % 173 % 169 % 163 % Reserves: Direct primary case(4) $ 520 $ 500 $ 489 $ 472 $ 461 $ 462 $ 486 All other(4) 52 52 54 53 49 46 46 Total Reserves $ 572 $ 552 $ 543 $ 525 $ 510 $ 508 $ 532 2025 2024 GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Selected Operating Metrics - Enact Segment (dollar amounts in millions) 16 (1)Includes rescissions and claim denials. The loss ratio is calculated using whole dollars and may be different than the ratio calculated using the rounded numbers included herein. (3)The Private Mortgage Insurer Eligibility Requirements (PMIERs) sufficiency ratio is calculated as available assets divided by required assets as defined within PMIERs. The current period PMIERs sufficiency ratio is an estimate due to the timing of the PMIERs filing. (4)Direct primary case reserves exclude loss adjustment expenses (LAE), pool, incurred but not reported (IBNR) and reinsurance reserves. Other includes LAE, pool, IBNR and reinsurance reserves. For additional information related to the Enact segment, refer to the current quarter Quarterly Financial Supplement posted to the Enact Holdings, Inc. investor page: https://ir.enactmi.com/financials-and-filings/quarterly-results (2)

17 Long-Term Care Insurance Segment

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 597 $ 578 $ 571 $ 1,746 $ 587 $ 581 $ 564 $ 578 $ 2,310 505 516 451 1,472 499 483 494 464 1,940 104 25 29 158 (21) 71 (47) 63 66 Total revenues 1,206 1,119 1,051 3,376 1,065 1,135 1,011 1,105 4,316 972 951 944 2,867 955 949 934 936 3,774 113 50 (18) 145 117 28 43 (16) 172 118 115 109 342 121 118 82 102 423 17 16 17 50 17 17 18 17 69 1,220 1,132 1,052 3,404 1,210 1,112 1,077 1,039 4,438 (14) (13) (1) (28) (145) 23 (66) 66 (122) 4 4 6 14 (24) 13 — 14 3 (18) (17) (7) (42) (121) 10 (66) 52 (125) (104) (25) (29) (158) 21 (71) 47 (63) (66) — — — — — — — 1 1 22 5 6 33 (4) 15 (10) 13 14 $ (100) $ (37) $ (30) $ (167) $ (104) $ (46) $ (29) $ 3 $ (176) $ 6 $ 8 $ (1) $ 13 $ 20 $ (63) $ (24) $ (2) $ (69) 107 42 (17) 132 97 91 67 (14) 241 $ 113 $ 50 $ (18) $ 145 $ 117 $ 28 $ 43 $ (16) $ 172 0.27 % 0.11 % (0.04)% 0.34 % 0.28 % 0.07% 0.10% (0.04)% 0.41 % 2024 BENEFITS AND EXPENSES: Benefits and other changes in policy reserves REVENUES: Premiums Net investment gains (losses) Net investment income 2025 Liability remeasurement (gains) losses Amortization of deferred acquisition costs and intangibles Acquisition and operating expenses, net of deferrals Total benefits and expenses INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Provision (benefit) for income taxes INCOME (LOSS) FROM CONTINUING OPERATIONS Net investment (gains) losses ADJUSTMENTS TO INCOME (LOSS) FROM CONTINUING OPERATIONS: Taxes on adjustments Expenses related to restructuring Ratio of the liability remeasurement (gains) losses to beginning reserves(2) (1)In the fourth quarter of 2024, the liability remeasurement loss of $117 million in the company's long-term care insurance business included an unfavorable impact from annual cash flow assumption updates of $20 million, reflecting net unfavorable updates to healthy life assumptions to better align with near-term experience, as well as an unfavorable impact related to higher assumed benefit utilization related to cost of care inflation. These unfavorable impacts were partially offset by favorable assumption updates for future in-force rate action approvals based on recent experience and short-term incidence assumptions for incurred but not reported claims. Also included in the liability remeasurement loss of $117 million were unfavorable actual variances from expected experience of $97 million associated with lower terminations and higher claims. (2)The ratio of the liability remeasurement (gains) losses to beginning reserves is calculated by dividing the liability remeasurement (gains) losses by the beginning liability for future policy benefits at the locked-in discount rate as of each applicable quarter. ADJUSTED OPERATING INCOME (LOSS) Cash flow assumption updates Liability remeasurement (gains) losses(1): Total Actual variances from expected experience GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Adjusted Operating Income (Loss)—Long-Term Care Insurance Segment (amounts in millions) 18

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 256 $ 247 $ 240 $ 743 $ 245 $ 232 $ 220 $ 217 $ 914 81 95 97 273 97 90 102 114 403 — — 5 5 19 133 222 240 614 — — (2) (2) (6) (45) (99) (109) (259) — — 3 3 13 88 123 131 355 $ 337 $ 342 $ 340 $ 1,019 $ 355 $ 410 $ 445 $ 462 $ 1,672 2024 (1)Includes all implemented in-force rate actions since 2012. (2)Earned premium and reserve change estimates for statutory earnings reflect certain simplifying assumptions that may vary materially from actual historical results, including but not limited to, a uniform rate of coinsurance and premium taxes in addition to consistent policyholder behavior over time. Actual behavior may differ significantly from these assumptions and these impacts exclude reserve updates. Settlement impacts, net Settlement impacts - litigation expenses and settlement payments Statutory earnings from in-force rate actions Impact of in-force rate actions on pre-tax statutory earnings(1) Premiums, premium tax, commissions and other expenses, net(2) Settlement impacts - reserve changes Reserve changes(2) 2025 GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Statutory Impact of In-Force Rate Actions—Long-Term Care Insurance Segment (amounts in millions) 19

20 Life and Annuities Segment

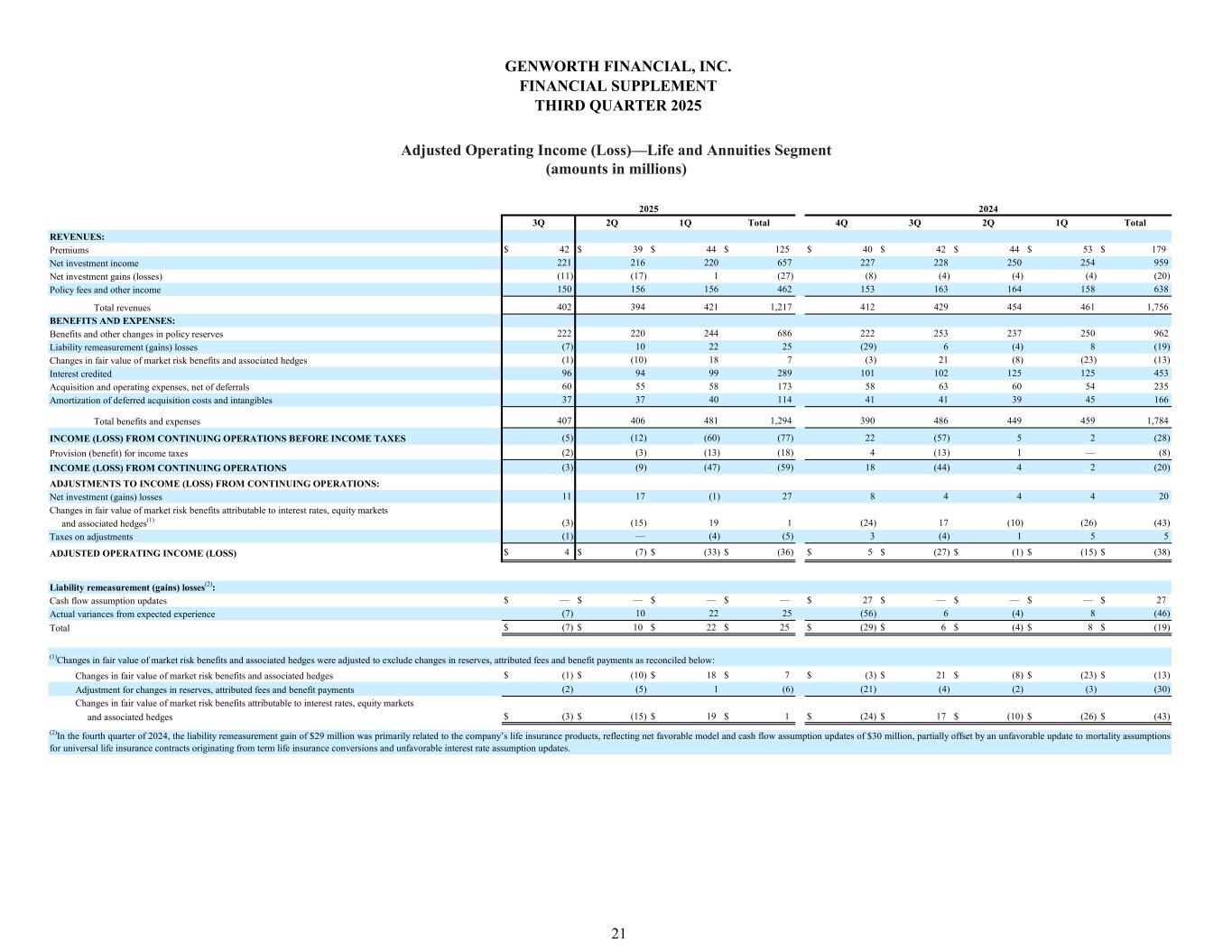

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 42 $ 39 $ 44 $ 125 $ 40 $ 42 $ 44 $ 53 $ 179 221 216 220 657 227 228 250 254 959 (11) (17) 1 (27) (8) (4) (4) (4) (20) 150 156 156 462 153 163 164 158 638 402 394 421 1,217 412 429 454 461 1,756 222 220 244 686 222 253 237 250 962 (7) 10 22 25 (29) 6 (4) 8 (19) (1) (10) 18 7 (3) 21 (8) (23) (13) 96 94 99 289 101 102 125 125 453 60 55 58 173 58 63 60 54 235 37 37 40 114 41 41 39 45 166 407 406 481 1,294 390 486 449 459 1,784 (5) (12) (60) (77) 22 (57) 5 2 (28) (2) (3) (13) (18) 4 (13) 1 — (8) (3) (9) (47) (59) 18 (44) 4 2 (20) 11 17 (1) 27 8 4 4 4 20 (3) (15) 19 1 (24) 17 (10) (26) (43) (1) — (4) (5) 3 (4) 1 5 5 $ 4 $ (7) $ (33) $ (36) $ 5 $ (27) $ (1) $ (15) $ (38) $ — $ — $ — $ — $ 27 $ — $ — $ — $ 27 (7) 10 22 25 (56) 6 (4) 8 (46) $ (7) $ 10 $ 22 $ 25 $ (29) $ 6 $ (4) $ 8 $ (19) $ (1) $ (10) $ 18 $ 7 $ (3) $ 21 $ (8) $ (23) $ (13) (2) (5) 1 (6) (21) (4) (2) (3) (30) $ (3) $ (15) $ 19 $ 1 $ (24) $ 17 $ (10) $ (26) $ (43) 2025 2024 Total revenues Policy fees and other income REVENUES: Premiums Net investment gains (losses) Net investment income BENEFITS AND EXPENSES: Benefits and other changes in policy reserves Changes in fair value of market risk benefits and associated hedges Liability remeasurement (gains) losses Acquisition and operating expenses, net of deferrals Interest credited Amortization of deferred acquisition costs and intangibles Provision (benefit) for income taxes INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Total benefits and expenses ADJUSTMENTS TO INCOME (LOSS) FROM CONTINUING OPERATIONS: INCOME (LOSS) FROM CONTINUING OPERATIONS Net investment (gains) losses Changes in fair value of market risk benefits attributable to interest rates, equity markets Taxes on adjustments and associated hedges(1) ADJUSTED OPERATING INCOME (LOSS) Liability remeasurement (gains) losses(2): Cash flow assumption updates Total Actual variances from expected experience (2)In the fourth quarter of 2024, the liability remeasurement gain of $29 million was primarily related to the company’s life insurance products, reflecting net favorable model and cash flow assumption updates of $30 million, partially offset by an unfavorable update to mortality assumptions for universal life insurance contracts originating from term life insurance conversions and unfavorable interest rate assumption updates. (1)Changes in fair value of market risk benefits and associated hedges were adjusted to exclude changes in reserves, attributed fees and benefit payments as reconciled below: Changes in fair value of market risk benefits and associated hedges Adjustment for changes in reserves, attributed fees and benefit payments and associated hedges Changes in fair value of market risk benefits attributable to interest rates, equity markets GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Adjusted Operating Income (Loss)—Life and Annuities Segment (amounts in millions) 21

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 42 $ 39 $ 44 $ 125 $ 40 $ 42 $ 44 $ 53 $ 179 148 139 144 431 147 146 167 167 627 (3) (9) — (12) (3) (2) 5 5 5 123 130 129 382 125 135 136 129 525 310 299 317 926 309 321 352 354 1,336 186 183 201 570 187 213 200 208 808 — 9 25 34 (28) 5 — 11 (12) 75 73 77 225 78 78 101 99 356 39 36 36 111 38 41 43 35 157 32 33 34 99 35 36 33 38 142 332 334 373 1,039 310 373 377 391 1,451 (22) (35) (56) (113) (1) (52) (25) (37) (115) (4) (8) (12) (24) (1) (11) (5) (8) (25) (18) (27) (44) (89) — (41) (20) (29) (90) 3 9 — 12 3 2 (5) (5) (5) — (2) — (2) (1) (1) 2 1 1 $ (15) $ (20) $ (44) $ (79) $ 2 $ (40) $ (23) $ (33) $ (94) 2024 Total revenues Policy fees and other income REVENUES: Premiums Net investment gains (losses) Net investment income BENEFITS AND EXPENSES: Benefits and other changes in policy reserves Interest credited Liability remeasurement (gains) losses Amortization of deferred acquisition costs and intangibles Acquisition and operating expenses, net of deferrals Taxes on adjustments ADJUSTED OPERATING INCOME (LOSS) Total benefits and expenses LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES LOSS FROM CONTINUING OPERATIONS Benefit for income taxes Net investment (gains) losses ADJUSTMENTS TO LOSS FROM CONTINUING OPERATIONS: GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Adjusted Operating Income (Loss)—Life and Annuities Segment—Life Insurance (amounts in millions) 22

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 67 $ 70 $ 70 $ 207 $ 73 $ 76 $ 77 $ 80 $ 306 (8) (8) 1 (15) (5) (2) (9) (9) (25) 1 1 2 4 2 1 2 2 7 60 63 73 196 70 75 70 73 288 30 30 34 94 30 34 33 36 133 (7) 1 (3) (9) (1) 1 (4) (3) (7) 2 (4) 9 7 (4) 8 (4) (7) (7) 20 20 21 61 22 23 23 25 93 11 9 12 32 10 12 9 8 39 2 2 2 6 2 2 2 3 9 58 58 75 191 59 80 59 62 260 2 5 (2) 5 11 (5) 11 11 28 — 1 — 1 2 (1) 3 2 6 2 4 (2) 4 9 (4) 8 9 22 8 8 (1) 15 5 2 9 9 25 2 (4) 9 7 (15) 9 (3) (7) (16) (2) — (2) (4) 2 (1) (2) — (1) $ 10 $ 8 $ 4 $ 22 $ 1 $ 6 $ 12 $ 11 $ 30 $ 2 $ (4) $ 9 $ 7 $ (4) $ 8 $ (4) $ (7) $ (7) — — — — (11) 1 1 — (9) $ 2 $ (4) $ 9 $ 7 $ (15) $ 9 $ (3) $ (7) $ (16) 2025 2024 Total revenues BENEFITS AND EXPENSES: REVENUES: Net investment income Policy fees and other income Net investment gains (losses) Benefits and other changes in policy reserves Liability remeasurement (gains) losses Interest credited Changes in fair value of market risk benefits and associated hedges Amortization of deferred acquisition costs and intangibles Acquisition and operating expenses, net of deferrals INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES INCOME (LOSS) FROM CONTINUING OPERATIONS Provision (benefit) for income taxes Total benefits and expenses Net investment (gains) losses ADJUSTMENTS TO INCOME (LOSS) FROM CONTINUING OPERATIONS: Adjustment for changes in reserves, attributed fees and benefit payments and associated hedges Changes in fair value of market risk benefits attributable to interest rates, equity markets (1)Changes in fair value of market risk benefits and associated hedges were adjusted to exclude changes in reserves, attributed fees and benefit payments as reconciled below: Changes in fair value of market risk benefits attributable to interest rates, equity markets and associated hedges(1) ADJUSTED OPERATING INCOME Taxes on adjustments Changes in fair value of market risk benefits and associated hedges GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Adjusted Operating Income—Life and Annuities Segment—Fixed Annuities (amounts in millions) 23

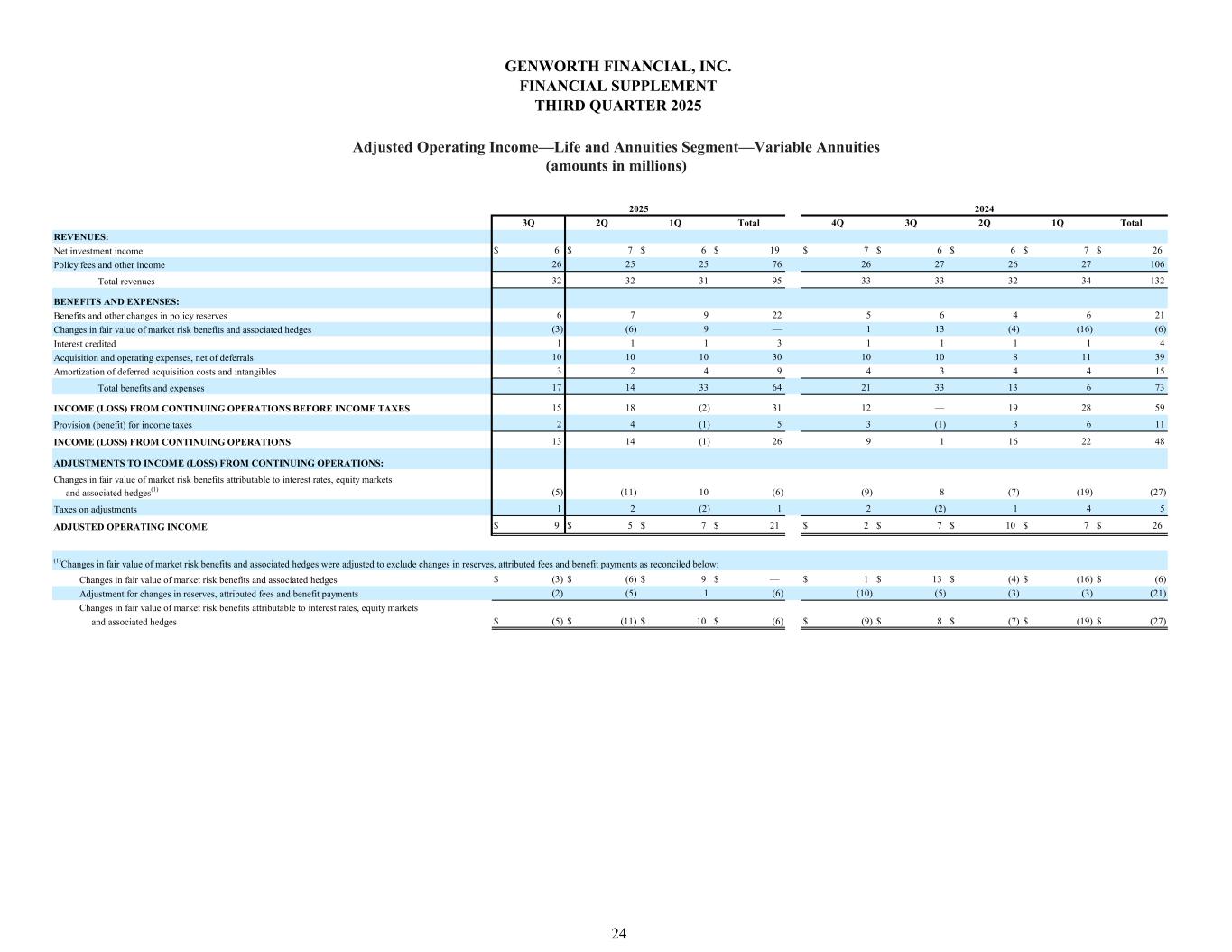

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 6 $ 7 $ 6 $ 19 $ 7 $ 6 $ 6 $ 7 $ 26 26 25 25 76 26 27 26 27 106 32 32 31 95 33 33 32 34 132 6 7 9 22 5 6 4 6 21 (3) (6) 9 — 1 13 (4) (16) (6) 1 1 1 3 1 1 1 1 4 10 10 10 30 10 10 8 11 39 3 2 4 9 4 3 4 4 15 17 14 33 64 21 33 13 6 73 15 18 (2) 31 12 — 19 28 59 2 4 (1) 5 3 (1) 3 6 11 13 14 (1) 26 9 1 16 22 48 (5) (11) 10 (6) (9) 8 (7) (19) (27) 1 2 (2) 1 2 (2) 1 4 5 $ 9 $ 5 $ 7 $ 21 $ 2 $ 7 $ 10 $ 7 $ 26 $ (3) $ (6) $ 9 $ — $ 1 $ 13 $ (4) $ (16) $ (6) (2) (5) 1 (6) (10) (5) (3) (3) (21) $ (5) $ (11) $ 10 $ (6) $ (9) $ 8 $ (7) $ (19) $ (27) 2025 2024 Benefits and other changes in policy reserves BENEFITS AND EXPENSES: REVENUES: Net investment income Policy fees and other income Total revenues Changes in fair value of market risk benefits and associated hedges Interest credited Amortization of deferred acquisition costs and intangibles Acquisition and operating expenses, net of deferrals Total benefits and expenses INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Provision (benefit) for income taxes INCOME (LOSS) FROM CONTINUING OPERATIONS Changes in fair value of market risk benefits attributable to interest rates, equity markets ADJUSTMENTS TO INCOME (LOSS) FROM CONTINUING OPERATIONS: and associated hedges (1)Changes in fair value of market risk benefits and associated hedges were adjusted to exclude changes in reserves, attributed fees and benefit payments as reconciled below: Taxes on adjustments and associated hedges(1) ADJUSTED OPERATING INCOME Changes in fair value of market risk benefits and associated hedges Changes in fair value of market risk benefits attributable to interest rates, equity markets Adjustment for changes in reserves, attributed fees and benefit payments GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Adjusted Operating Income—Life and Annuities Segment—Variable Annuities (amounts in millions) 24

25 Corporate and Other

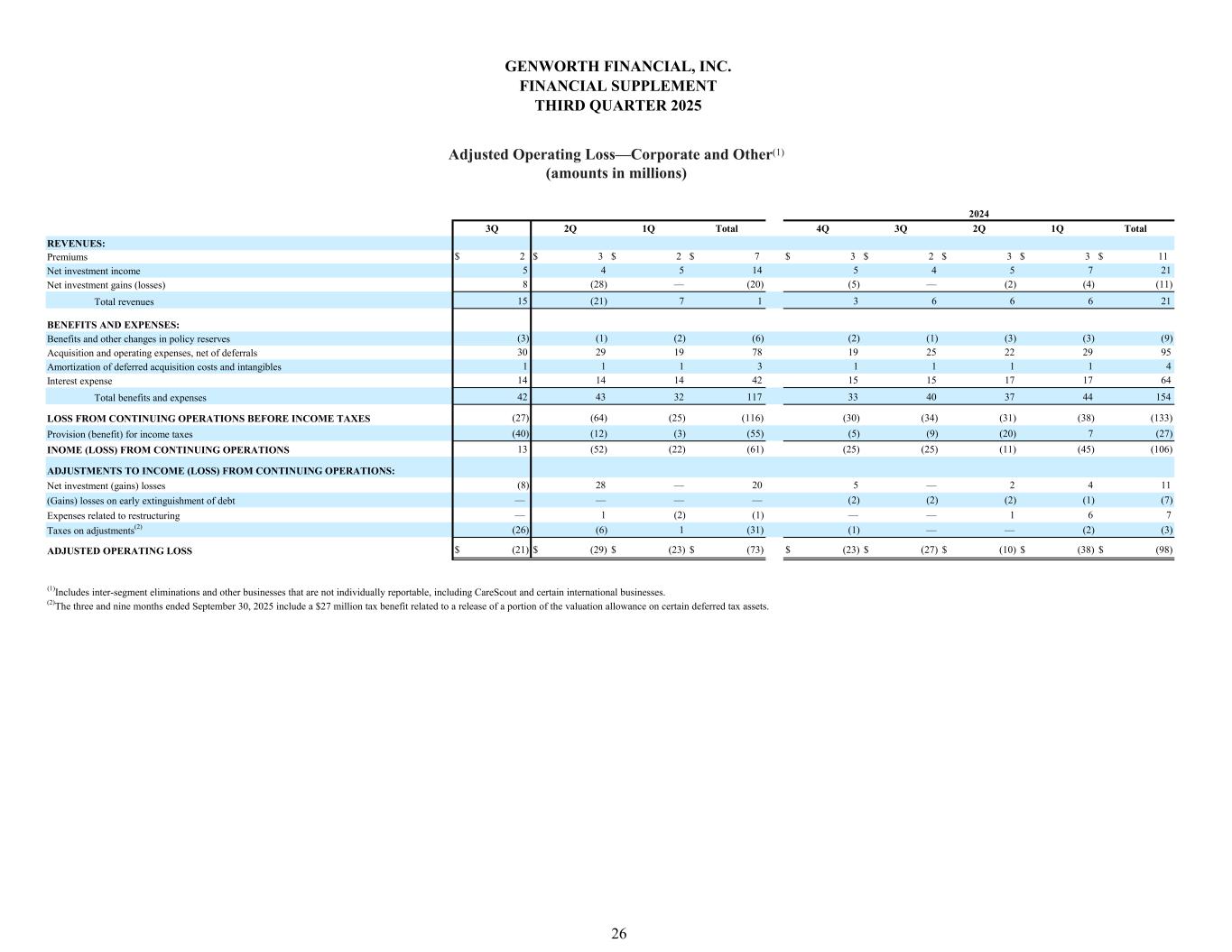

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 2 $ 3 $ 2 $ 7 $ 3 $ 2 $ 3 $ 3 $ 11 5 4 5 14 5 4 5 7 21 8 (28) — (20) (5) — (2) (4) (11) 15 (21) 7 1 3 6 6 6 21 (3) (1) (2) (6) (2) (1) (3) (3) (9) 30 29 19 78 19 25 22 29 95 1 1 1 3 1 1 1 1 4 14 14 14 42 15 15 17 17 64 42 43 32 117 33 40 37 44 154 (27) (64) (25) (116) (30) (34) (31) (38) (133) (40) (12) (3) (55) (5) (9) (20) 7 (27) 13 (52) (22) (61) (25) (25) (11) (45) (106) (8) 28 — 20 5 — 2 4 11 — — — — (2) (2) (2) (1) (7) — 1 (2) (1) — — 1 6 7 (26) (6) 1 (31) (1) — — (2) (3) $ (21) $ (29) $ (23) $ (73) $ (23) $ (27) $ (10) $ (38) $ (98) Total benefits and expenses Taxes on adjustments(2) ADJUSTED OPERATING LOSS (1) Provision (benefit) for income taxes INOME (LOSS) FROM CONTINUING OPERATIONS Net investment (gains) losses ADJUSTMENTS TO INCOME (LOSS) FROM CONTINUING OPERATIONS: Expenses related to restructuring (Gains) losses on early extinguishment of debt (2) Includes inter-segment eliminations and other businesses that are not individually reportable, including CareScout and certain international businesses. The three and nine months ended September 30, 2025 include a $27 million tax benefit related to a release of a portion of the valuation allowance on certain deferred tax assets. 2024 BENEFITS AND EXPENSES: Total revenues REVENUES: Premiums Net investment gains (losses) Net investment income Benefits and other changes in policy reserves Acquisition and operating expenses, net of deferrals Interest expense Amortization of deferred acquisition costs and intangibles LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Adjusted Operating Loss—Corporate and Other(1) (amounts in millions) 26

Additional Financial Data 27

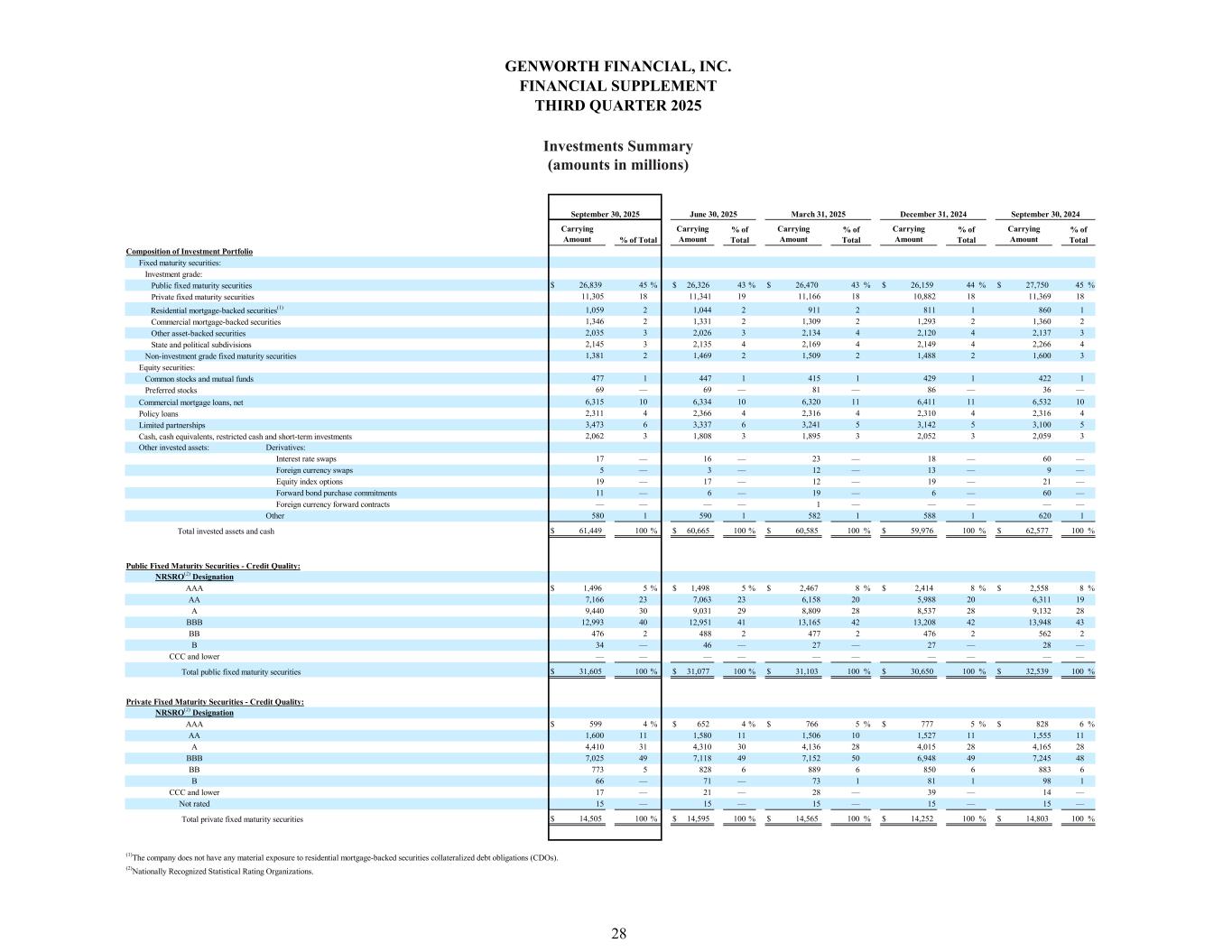

Carrying Amount Carrying Amount Carrying Amount Carrying Amount Carrying Amount $ 26,839 45 % $ 26,326 43 % $ 26,470 43 % $ 26,159 44 % $ 27,750 45 % 11,305 18 11,341 19 11,166 18 10,882 18 11,369 18 1,059 2 1,044 2 911 2 811 1 860 1 1,346 2 1,331 2 1,309 2 1,293 2 1,360 2 2,035 3 2,026 3 2,134 4 2,120 4 2,137 3 2,145 3 2,135 4 2,169 4 2,149 4 2,266 4 1,381 2 1,469 2 1,509 2 1,488 2 1,600 3 477 1 447 1 415 1 429 1 422 1 69 — 69 — 81 — 86 — 36 — 6,315 10 6,334 10 6,320 11 6,411 11 6,532 10 2,311 4 2,366 4 2,316 4 2,310 4 2,316 4 3,473 6 3,337 6 3,241 5 3,142 5 3,100 5 2,062 3 1,808 3 1,895 3 2,052 3 2,059 3 Other invested assets: Derivatives: Interest rate swaps 17 — 16 — 23 — 18 — 60 — Foreign currency swaps 5 — 3 — 12 — 13 — 9 — Equity index options 19 — 17 — 12 — 19 — 21 — Forward bond purchase commitments 11 — 6 — 19 — 6 — 60 — Foreign currency forward contracts — — — — 1 — — — — — Other 580 1 590 1 582 1 588 1 620 1 $ 61,449 100 % $ 60,665 100 % $ 60,585 100 % $ 59,976 100 % $ 62,577 100 % NRSRO(2) Designation AAA $ 1,496 5 % $ 1,498 5 % $ 2,467 8 % $ 2,414 8 % $ 2,558 8 % AA 7,166 23 7,063 23 6,158 20 5,988 20 6,311 19 A 9,440 30 9,031 29 8,809 28 8,537 28 9,132 28 BBB 12,993 40 12,951 41 13,165 42 13,208 42 13,948 43 BB 476 2 488 2 477 2 476 2 562 2 B 34 — 46 — 27 — 27 — 28 — CCC and lower — — — — — — — — — — $ 31,605 100 % $ 31,077 100 % $ 31,103 100 % $ 30,650 100 % $ 32,539 100 % NRSRO(2) Designation AAA $ 599 4 % $ 652 4 % $ 766 5 % $ 777 5 % $ 828 6 % AA 1,600 11 1,580 11 1,506 10 1,527 11 1,555 11 A 4,410 31 4,310 30 4,136 28 4,015 28 4,165 28 BBB 7,025 49 7,118 49 7,152 50 6,948 49 7,245 48 BB 773 5 828 6 889 6 850 6 883 6 B 66 — 71 — 73 1 81 1 98 1 CCC and lower 17 — 21 — 28 — 39 — 14 — Not rated 15 — 15 — 15 — 15 — 15 — $ 14,505 100 % $ 14,595 100 % $ 14,565 100 % $ 14,252 100 % $ 14,803 100 % March 31, 2025 % of Total % of Total September 30, 2025 % of Total Private fixed maturity securities Residential mortgage-backed securities(1) Commercial mortgage-backed securities Other asset-backed securities June 30, 2025 Composition of Investment Portfolio Fixed maturity securities: Investment grade: Public Fixed Maturity Securities - Credit Quality: % of Total December 31, 2024 September 30, 2024 % of Total Commercial mortgage loans, net Policy loans Limited partnerships Cash, cash equivalents, restricted cash and short-term investments Total invested assets and cash State and political subdivisions Non-investment grade fixed maturity securities Equity securities: Common stocks and mutual funds Preferred stocks Public fixed maturity securities Total public fixed maturity securities Private Fixed Maturity Securities - Credit Quality: Total private fixed maturity securities GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Investments Summary (amounts in millions) 28 (1) (2) The company does not have any material exposure to residential mortgage-backed securities collateralized debt obligations (CDOs). Nationally Recognized Statistical Rating Organizations.

Fair Value Fair Value Fair Value Fair Value Fair Value $ 3,593 8 % $ 3,527 8 % $ 3,594 8 % $ 3,493 8 % $ 3,717 8 % 2,145 5 2,135 5 2,169 5 2,149 5 2,266 5 1,203 3 1,121 2 1,029 2 909 2 863 2 27,391 59 27,154 59 27,229 59 26,771 59 28,313 60 7,301 16 7,302 16 7,260 16 7,327 16 7,804 16 1,059 2 1,044 2 911 2 811 2 859 2 1,360 3 1,340 3 1,318 3 1,301 3 1,360 3 2,058 4 2,049 5 2,158 5 2,141 5 2,160 4 $ 46,110 100 % $ 45,672 100 % $ 45,668 100 % $ 44,902 100 % $ 47,342 100 % $ 8,675 25 % $ 8,587 25 % $ 8,532 25 % $ 8,546 26 % $ 9,089 25 % 5,149 15 5,043 15 4,991 15 4,899 14 5,189 14 3,292 10 3,265 10 3,253 9 3,167 9 3,436 10 4,928 15 4,871 14 4,884 15 4,822 14 5,100 14 1,375 4 1,403 4 1,474 4 1,471 4 1,556 4 2,876 8 2,818 8 2,791 8 2,699 8 2,755 8 1,653 5 1,641 5 1,679 5 1,689 5 1,802 5 3,365 9 3,345 9 3,365 9 3,268 10 3,454 10 1,508 4 1,495 4 1,502 4 1,485 4 1,538 4 688 2 697 2 700 2 744 2 780 2 33,509 97 33,165 96 33,171 96 32,790 96 34,699 96 128 — 135 — 140 1 139 — 185 1 49 — 69 — 73 — 76 1 80 — 126 — 129 — 163 1 151 1 167 1 127 — 137 1 123 — 121 — 134 — 228 1 249 1 258 1 256 1 270 1 136 1 143 1 133 — 135 — 138 — 144 — 166 — 166 — 149 1 160 — 184 1 206 1 181 1 181 — 182 1 — — — — 25 — 25 — 24 — 61 — 57 — 56 — 75 — 78 — 1,183 3 1,291 4 1,318 4 1,308 4 1,418 4 $ 34,692 100 % $ 34,456 100 % $ 34,489 100 % $ 34,098 100 % $ 36,117 100 % $ 1,648 4 % $ 1,481 3 % $ 1,413 3 % $ 1,419 3 % $ 1,311 3 % 8,309 18 8,573 19 8,474 19 7,895 18 8,238 17 11,230 24 11,040 24 11,132 24 11,431 25 11,895 26 20,446 45 20,145 44 20,262 44 19,904 44 21,519 45 41,633 91 41,239 90 41,281 90 40,649 90 42,963 91 4,477 9 4,433 10 4,387 10 4,253 10 4,379 9 $ 46,110 100 % $ 45,672 100 % $ 45,668 100 % $ 44,902 100 % $ 47,342 100 % June 30, 2025 % of Total Foreign government December 31, 2024 % of Total % of Total September 30, 2024 Fixed Maturity Securities - Security Sector: U.S. government, agencies and government-sponsored enterprises State and political subdivisions % of Total September 30, 2025 Corporate Bond Holdings - Industry Sector: Investment Grade: Finance and insurance Utilities U.S. corporate Foreign corporate Residential mortgage-backed securities Commercial mortgage-backed securities Other asset-backed securities Finance and insurance Utilities Energy % of Total March 31, 2025 Technology and communications Transportation Other Subtotal Non-Investment Grade: Energy Consumer - non-cyclical Consumer - cyclical Capital goods Industrial Total fixed maturity securities Consumer - non-cyclical Consumer - cyclical Capital goods Industrial Technology and communications Transportation Other Subtotal Total Fixed Maturity Securities - Contractual Maturity Dates: Mortgage and asset-backed securities Total fixed maturity securities Due in one year or less Due after one year through five years Due after five years through ten years Due after ten years Subtotal GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Fixed Maturity Securities Summary (amounts in millions) 29

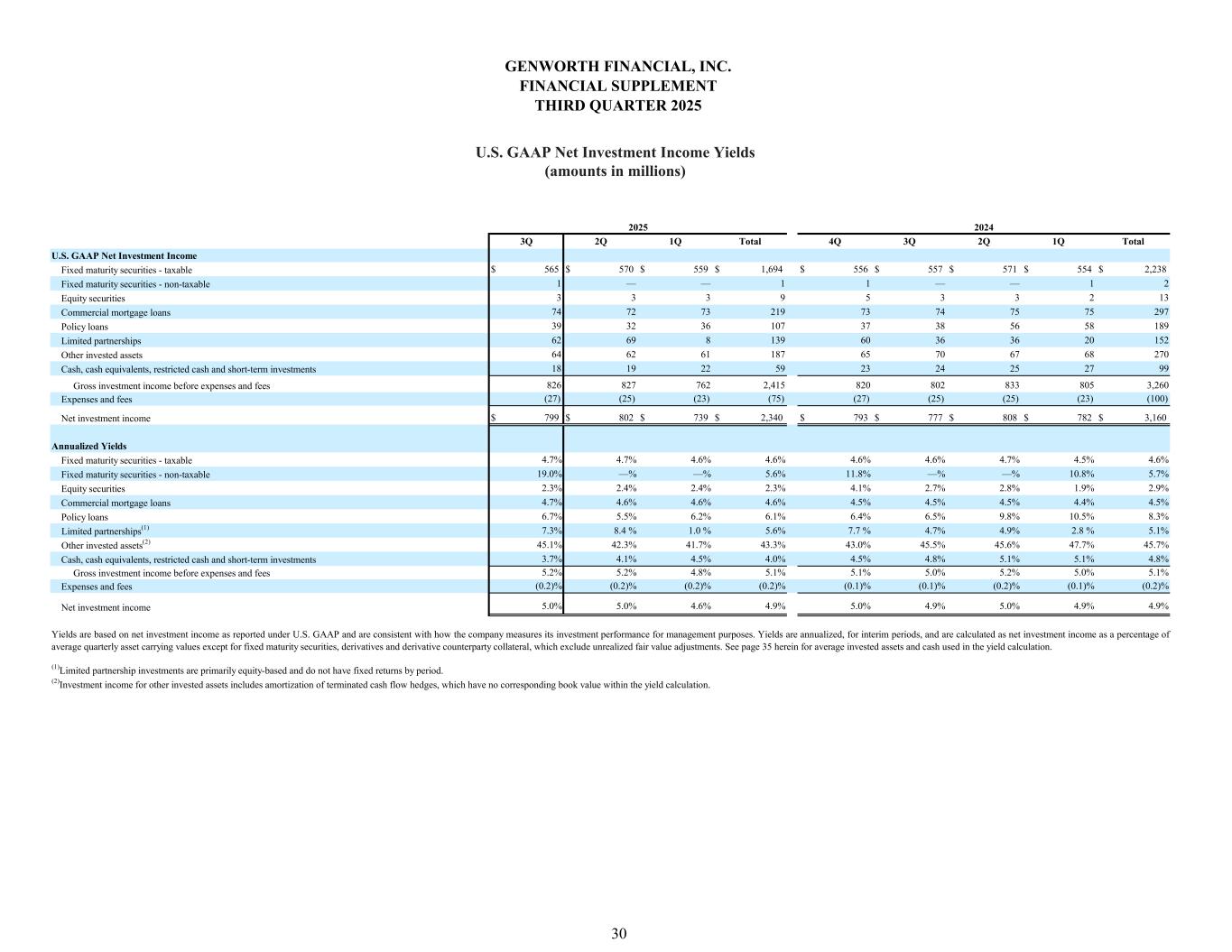

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ 565 $ 570 $ 559 $ 1,694 $ 556 $ 557 $ 571 $ 554 $ 2,238 1 — — 1 1 — — 1 2 3 3 3 9 5 3 3 2 13 74 72 73 219 73 74 75 75 297 39 32 36 107 37 38 56 58 189 62 69 8 139 60 36 36 20 152 64 62 61 187 65 70 67 68 270 18 19 22 59 23 24 25 27 99 826 827 762 2,415 820 802 833 805 3,260 (27) (25) (23) (75) (27) (25) (25) (23) (100) $ 799 $ 802 $ 739 $ 2,340 $ 793 $ 777 $ 808 $ 782 $ 3,160 4.7% 4.7% 4.6% 4.6% 4.6% 4.6% 4.7% 4.5% 4.6% 19.0% —% —% 5.6% 11.8% —% —% 10.8% 5.7% 2.3% 2.4% 2.4% 2.3% 4.1% 2.7% 2.8% 1.9% 2.9% 4.7% 4.6% 4.6% 4.6% 4.5% 4.5% 4.5% 4.4% 4.5% 6.7% 5.5% 6.2% 6.1% 6.4% 6.5% 9.8% 10.5% 8.3% 7.3% 8.4 % 1.0 % 5.6% 7.7 % 4.7% 4.9% 2.8 % 5.1% 45.1% 42.3% 41.7% 43.3% 43.0% 45.5% 45.6% 47.7% 45.7% 3.7% 4.1% 4.5% 4.0% 4.5% 4.8% 5.1% 5.1% 4.8% 5.2% 5.2% 4.8% 5.1% 5.1% 5.0% 5.2% 5.0% 5.1% (0.2)% (0.2)% (0.2)% (0.2)% (0.1)% (0.1)% (0.2)% (0.1)% (0.2)% 5.0% 5.0% 4.6% 4.9% 5.0% 4.9% 5.0% 4.9% 4.9% (2)Investment income for other invested assets includes amortization of terminated cash flow hedges, which have no corresponding book value within the yield calculation. (1)Limited partnership investments are primarily equity-based and do not have fixed returns by period. Yields are based on net investment income as reported under U.S. GAAP and are consistent with how the company measures its investment performance for management purposes. Yields are annualized, for interim periods, and are calculated as net investment income as a percentage of average quarterly asset carrying values except for fixed maturity securities, derivatives and derivative counterparty collateral, which exclude unrealized fair value adjustments. See page 35 herein for average invested assets and cash used in the yield calculation. Limited partnerships(1) Other invested assets(2) Gross investment income before expenses and fees Cash, cash equivalents, restricted cash and short-term investments Net investment income Expenses and fees Annualized Yields Fixed maturity securities - taxable Equity securities Fixed maturity securities - non-taxable Policy loans Commercial mortgage loans Limited partnerships Other invested assets Gross investment income before expenses and fees Cash, cash equivalents, restricted cash and short-term investments Net investment income Expenses and fees 2024 Policy loans Commercial mortgage loans U.S. GAAP Net Investment Income Fixed maturity securities - taxable Equity securities Fixed maturity securities - non-taxable 2025 GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 U.S. GAAP Net Investment Income Yields (amounts in millions) 30

3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total $ (4) $ (15) $ — $ (19) $ (8) $ (1) $ (9) $ (17) $ (35) — 1 — 1 — — 3 1 4 (4) (1) (2) (7) 3 (6) (7) (3) (13) — (3) (2) (5) (3) 2 1 — — (2) — — (2) (1) (2) (7) (3) (13) Total net realized gains (losses) on available-for-sale securities (10) (18) (4) (32) (9) (7) (19) (22) (57) — 4 1 5 9 — — — 9 (10) (14) (3) (27) — (7) (19) (22) (48) (3) (11) (4) (18) (10) — 7 — (3) — (4) — (4) (9) — — — (9) 30 32 (14) 48 17 22 12 32 83 66 25 38 129 (3) 55 (52) 43 43 (3) (20) 3 (20) (5) (8) (1) (2) (16) 17 (36) 6 (13) (21) 10 (8) 1 (18) 2 — 1 3 (10) (6) — (3) (19) 99 (28) 27 98 (41) 66 (61) 49 13 — 1 1 2 2 — 1 1 4 $ 99 $ (27) $ 28 $ 100 $ (39) $ 66 $ (60) $ 50 $ 17 Net investment gains (losses), gross Net investment gains (losses), net Adjustment for net investment (gains) losses attributable to noncontrolling interests Net change in allowance for credit losses on available-for-sale fixed maturity securities Write-down of available-for-sale fixed maturity securities Net unrealized gains (losses) on limited partnerships Net unrealized gains (losses) on equity securities still held Derivative instruments Commercial mortgage loans Foreign government Mortgage-backed securities Total net realized investment gains (losses) Net realized gains (losses) on equity securities sold Other 2024 Foreign corporate U.S. government, agencies and government-sponsored enterprises Realized investment gains (losses): Net realized gains (losses) on available-for-sale securities: U.S. corporate Fixed maturity securities: 2025 GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Net Investment Gains (Losses)—Detail (amounts in millions) 31

32 Reconciliations of Non-GAAP Measures

September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 $ 220 $ 189 $ 214 $ 299 $ 88 $ 10,163 $ 10,151 $ 10,145 $ 10,120 $ 10,148 2.2 % 1.9 % 2.1 % 3.0 % 0.9 % $ 151 $ 182 $ 239 $ 273 $ 28 $ 10,163 $ 10,151 $ 10,145 $ 10,120 $ 10,148 1.5 % 1.8 % 2.4 % 2.7 % 0.3 % September 30, June 30, March 31, December 31, September 30, 2025 2025 2025 2024 2024 $ 116 $ 51 $ 54 $ (1) $ 85 $ 10,184 $ 10,146 $ 10,131 $ 10,159 $ 10,164 4.6% 2.0% 2.1 % — % 3.3 % $ 17 $ 68 $ 51 $ 15 $ 48 $ 10,184 $ 10,146 $ 10,131 $ 10,159 $ 10,164 0.7 % 2.7 % 2.0 % 0.6 % 1.9 % Twelve months ended Three months ended Operating ROE(1)/(2) Quarterly average Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other comprehensive income (loss)(2) Operating ROE Adjusted operating income (loss) for the twelve months ended(1) Quarterly Average ROE Twelve Month Rolling Average ROE Quarterly average Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other comprehensive income (loss)(2) U.S. GAAP Basis ROE(1)/(2) Net income available to Genworth Financial, Inc.’s common stockholders for the twelve months ended(1) U.S. GAAP Basis ROE U.S. GAAP Basis ROE Net income (loss) available to Genworth Financial, Inc.’s common stockholders for the period ended(3) Operating ROE Adjusted operating income for the period ended(3) Annualized U.S. GAAP Quarterly Basis ROE(3)/(4) Quarterly average Genworth Financial, Inc.’s stockholders’ equity for the period, excluding accumulated other comprehensive income (loss)(4) Non-GAAP Definition for Operating ROE The company references the non-GAAP financial measure entitled “operating return on equity” or “operating ROE.” The company defines operating ROE as adjusted operating income (loss) divided by average ending Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other comprehensive income (loss). Management believes that analysis of operating ROE enhances understanding of the efficiency with which the company deploys its capital. However, operating ROE is not a substitute for net income (loss) available to Genworth Financial, Inc.’s common stockholders divided by average ending Genworth Financial, Inc.’s stockholders’ equity determined in accordance with U.S. GAAP. Quarterly average Genworth Financial, Inc.’s stockholders’ equity for the period, excluding accumulated other comprehensive income (loss)(4) Annualized Operating Quarterly Basis ROE(3)/(4) (4)Quarterly average Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other comprehensive income (loss), is derived by averaging ending Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other comprehensive income (loss), over two consecutive quarters. (3)Net income (loss) available to Genworth Financial, Inc.’s common stockholders and adjusted operating income from page 9 herein. (2)Quarterly average Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other comprehensive income (loss), is derived by averaging ending Genworth Financial, Inc.’s stockholders’ equity, excluding accumulated other comprehensive income (loss), for the most recent five quarters. (1)The twelve months ended information is derived by adding the four quarters of net income (loss) available to Genworth Financial, Inc.’s common stockholders and adjusted operating income (loss) from page 9 herein. GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Reconciliation of Operating ROE (amounts in millions) 33

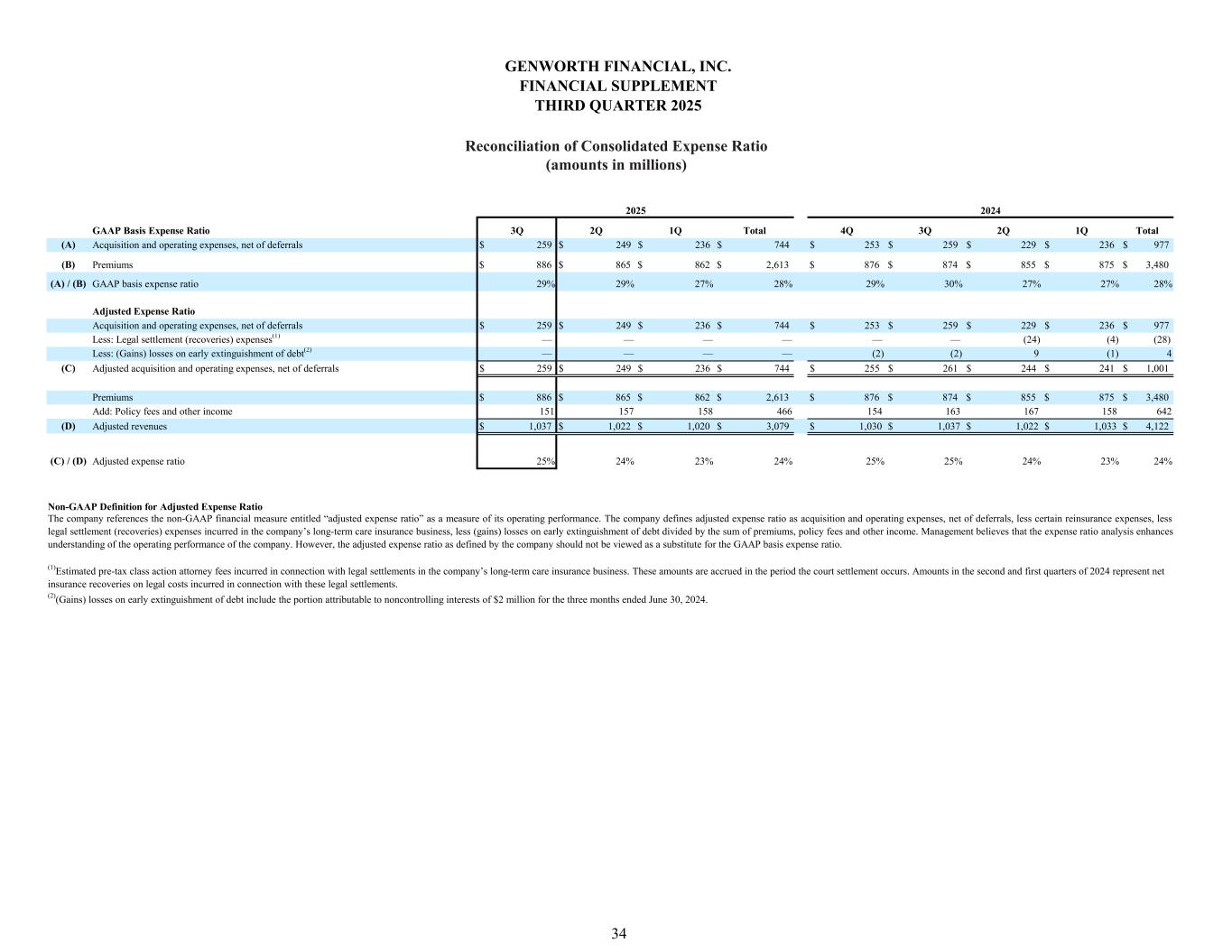

GAAP Basis Expense Ratio 3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total (A) Acquisition and operating expenses, net of deferrals $ 259 $ 249 $ 236 $ 744 $ 253 $ 259 $ 229 $ 236 $ 977 (B) Premiums $ 886 $ 865 $ 862 $ 2,613 $ 876 $ 874 $ 855 $ 875 $ 3,480 (A) / (B) GAAP basis expense ratio 29% 29% 27% 28% 29% 30% 27% 27% 28% Adjusted Expense Ratio Acquisition and operating expenses, net of deferrals $ 259 $ 249 $ 236 $ 744 $ 253 $ 259 $ 229 $ 236 $ 977 Less: Legal settlement (recoveries) expenses(1) — — — — — — (24) (4) (28) Less: (Gains) losses on early extinguishment of debt(2) — — — — (2) (2) 9 (1) 4 (C) Adjusted acquisition and operating expenses, net of deferrals $ 259 $ 249 $ 236 $ 744 $ 255 $ 261 $ 244 $ 241 $ 1,001 Premiums $ 886 $ 865 $ 862 $ 2,613 $ 876 $ 874 $ 855 $ 875 $ 3,480 Add: Policy fees and other income 151 157 158 466 154 163 167 158 642 (D) Adjusted revenues $ 1,037 $ 1,022 $ 1,020 $ 3,079 $ 1,030 $ 1,037 $ 1,022 $ 1,033 $ 4,122 (C) / (D) Adjusted expense ratio 25% 24% 23% 24% 25% 25% 24% 23% 24% 2025 2024 GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 Reconciliation of Consolidated Expense Ratio (amounts in millions) 34 Non-GAAP Definition for Adjusted Expense Ratio The company references the non-GAAP financial measure entitled “adjusted expense ratio” as a measure of its operating performance. The company defines adjusted expense ratio as acquisition and operating expenses, net of deferrals, less certain reinsurance expenses, less legal settlement (recoveries) expenses incurred in the company’s long-term care insurance business, less (gains) losses on early extinguishment of debt divided by the sum of premiums, policy fees and other income. Management believes that the expense ratio analysis enhances understanding of the operating performance of the company. However, the adjusted expense ratio as defined by the company should not be viewed as a substitute for the GAAP basis expense ratio. (1)Estimated pre-tax class action attorney fees incurred in connection with legal settlements in the company’s long-term care insurance business. These amounts are accrued in the period the court settlement occurs. Amounts in the second and first quarters of 2024 represent net insurance recoveries on legal costs incurred in connection with these legal settlements. (2)(Gains) losses on early extinguishment of debt include the portion attributable to noncontrolling interests of $2 million for the three months ended June 30, 2024.

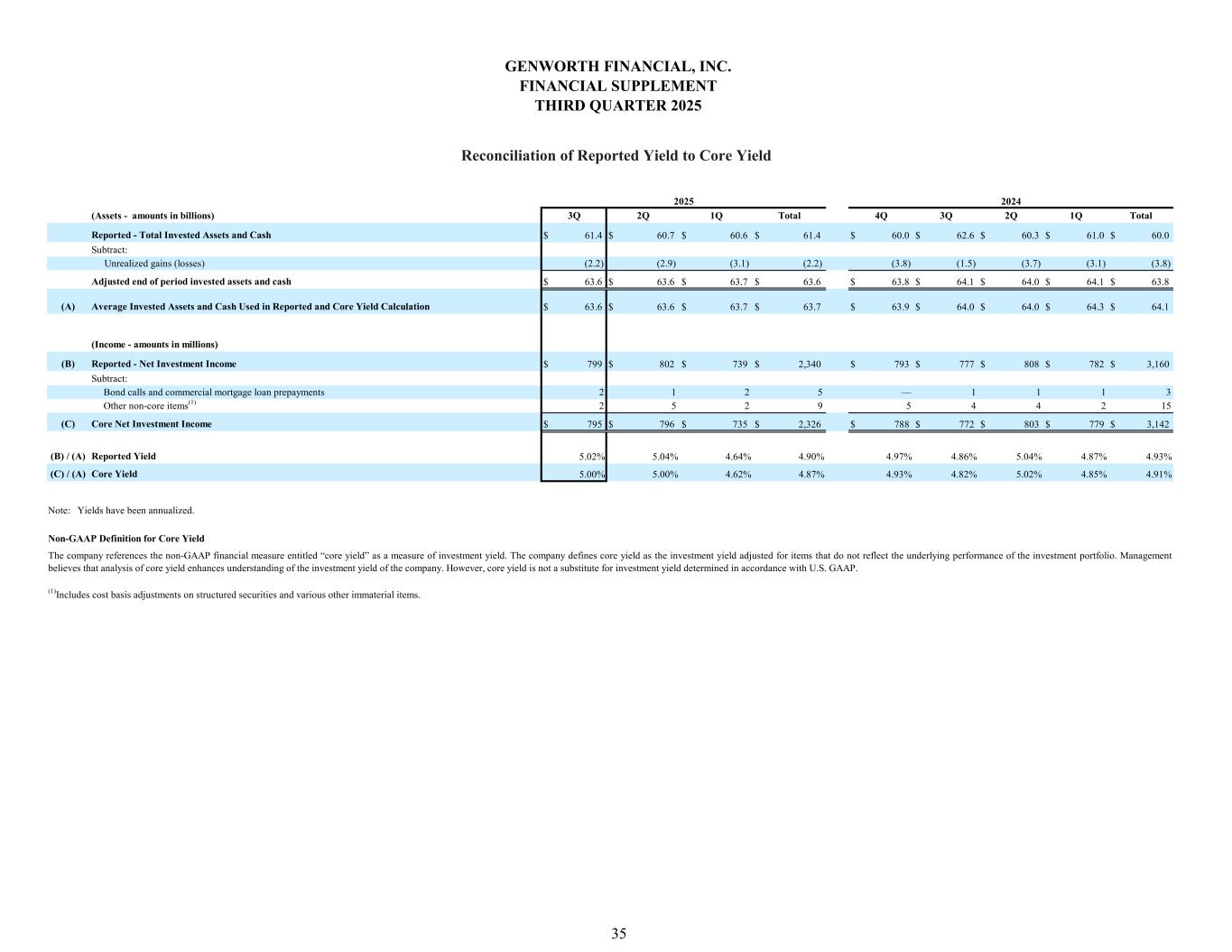

(Assets - amounts in billions) 3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total Reported - Total Invested Assets and Cash $ 61.4 $ 60.7 $ 60.6 $ 61.4 $ 60.0 $ 62.6 $ 60.3 $ 61.0 $ 60.0 Subtract: Unrealized gains (losses) (2.2) (2.9) (3.1) (2.2) (3.8) (1.5) (3.7) (3.1) (3.8) Adjusted end of period invested assets and cash $ 63.6 $ 63.6 $ 63.7 $ 63.6 $ 63.8 $ 64.1 $ 64.0 $ 64.1 $ 63.8 (A) Average Invested Assets and Cash Used in Reported and Core Yield Calculation $ 63.6 $ 63.6 $ 63.7 $ 63.7 $ 63.9 $ 64.0 $ 64.0 $ 64.3 $ 64.1 (Income - amounts in millions) (B) Reported - Net Investment Income $ 799 $ 802 $ 739 $ 2,340 $ 793 $ 777 $ 808 $ 782 $ 3,160 Subtract: Bond calls and commercial mortgage loan prepayments 2 1 2 5 — 1 1 1 3 Other non-core items(1) 2 5 2 9 5 4 4 2 15 (C) Core Net Investment Income $ 795 $ 796 $ 735 $ 2,326 $ 788 $ 772 $ 803 $ 779 $ 3,142 (B) / (A) Reported Yield 5.02% 5.04% 4.64% 4.90% 4.97% 4.86% 5.04% 4.87% 4.93% (C) / (A) Core Yield 5.00% 5.00% 4.62% 4.87% 4.93% 4.82% 5.02% 4.85% 4.91% 2025 2024 GENWORTH FINANCIAL, INC. FINANCIAL SUPPLEMENT THIRD QUARTER 2025 35 Reconciliation of Reported Yield to Core Yield Note: Yields have been annualized. Non-GAAP Definition for Core Yield The company references the non-GAAP financial measure entitled “core yield” as a measure of investment yield. The company defines core yield as the investment yield adjusted for items that do not reflect the underlying performance of the investment portfolio. Management believes that analysis of core yield enhances understanding of the investment yield of the company. However, core yield is not a substitute for investment yield determined in accordance with U.S. GAAP. (1)Includes cost basis adjustments on structured securities and various other immaterial items.