0001276520PREC14AFalseiso4217:USD00012765202024-01-012024-12-3100012765202023-01-012023-12-3100012765202022-01-012022-12-3100012765202021-01-012021-12-3100012765202020-01-012020-12-310001276520gnw:SubtractAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationTableForApplicableFYMemberecd:PeoMember2024-01-012024-12-310001276520gnw:SubtractAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationTableForApplicableFYMemberecd:NonPeoNeoMember2024-01-012024-12-310001276520gnw:AddASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMemberecd:PeoMember2024-01-012024-12-310001276520gnw:AddASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMemberecd:NonPeoNeoMember2024-01-012024-12-310001276520gnw:AddsubtractForAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndTheChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMemberecd:PeoMember2024-01-012024-12-310001276520gnw:AddsubtractForAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndTheChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMemberecd:NonPeoNeoMember2024-01-012024-12-310001276520gnw:AddsubtractForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYChangeInASC718FairValueFromPriorFYEndToVestingDateMemberecd:PeoMember2024-01-012024-12-310001276520gnw:AddsubtractForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYChangeInASC718FairValueFromPriorFYEndToVestingDateMemberecd:NonPeoNeoMember2024-01-012024-12-310001276520gnw:TotalAdjustmentsMemberecd:PeoMember2024-01-012024-12-310001276520gnw:TotalAdjustmentsMemberecd:NonPeoNeoMember2024-01-012024-12-31000127652012024-01-012024-12-31000127652022024-01-012024-12-31000127652032024-01-012024-12-31

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION—MARCH 25, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | |

CHECK THE APPROPRIATE BOX: |

☑ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

Genworth Financial, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION—MARCH 25, 2025

Our Values in

Action in 2024

Make it happen

Capital Generation from Enact

Enact’s strong performance and shareholder distributions continue to be an important source of cash flows to Genworth. Enact’s quarterly dividends in 2024 delivered proceeds of $91 million to Genworth.

Further, Genworth received $198 million of capital returns from Enact through special dividends and share repurchases. Cumulatively, since its IPO, Enact has delivered a total shareholder return of 91% as of December 31, 2024. Relative to the S&P 500’s total return of 38% over the same period, we believe that Enact creates significant value for Genworth shareholders.

Share Repurchase Program

Genworth’s share repurchase program delivered strong shareholder value again in 2024 and is a key component of our capital management strategy. In October 2024, we surpassed the $500 million milestone in share repurchases, ultimately reaching approximately $[•] million since our program’s inception in May 2022 through April [•], 2025.

Make it human

Associate Feedback Loops

| | | | | |

| As part of our commitment to workplace excellence, we expanded our associate feedback loops in 2024 to better understand what |

we’re doing well and where we have opportunities to improve. We enhanced our engagement pulse checks, asking a variety of cultural and associate experience questions three times a year, along with introducing a series of executive listening tours and focus groups to gather additional perspectives. To help benchmark Genworth against our peers, for the second year in a row, associates completed the Energage engagement survey, and their responses earned us national recognition as a USA Today Top Workplace and a Top Workplace for Compensation & Benefits, Innovation, Work-Life Flexibility, Purpose & Values, and Leadership. Our Richmond, Virginia and Stamford, Connecticut offices were also recognized as regional Top Workplaces. Across our feedback loops, we’ve seen participation rates far above industry benchmarks. Moving into 2025, we will use this data to make feedback-driven decisions as we continue to build an exceptional workplace.

Make it about others

CareScout Quality Network

CareScout helps older adults and their families navigate the aging journey and find quality care. Through our CareScout Quality Network, a group of long-term care providers committed to delivering person-centered care, we’re reframing quality as not just safety, but an experience that is dignified, connected, and fulfilling. Providers in the network offer special pricing so older adults and their families can find high-quality home care at lower rates.

After launching the CareScout Quality Network in 2023 for our long-term care insurance policyholders, the network expanded in 2024 to provide nationwide coverage and, as of December 31, 2024, included close to 500 credentialed home care providers. In 2025, we plan to add assisted living communities in statistically large metropolitan areas, offer network access to other long-term care insurers’ policyholders, and introduce a direct-to-consumer offering in select states so more Americans with aging care needs can benefit from high-quality care at preferred pricing.

Make it better

Enhancing the Customer Experience

In 2024, we made big strides in enhancing our customer-centric experience in the U.S. Life Insurance business, while also increasing our operational efficiency and leveraging data and technology more effectively. We converted our contact center to a cloud-based platform with redesigned Interactive Voice Response flows, intelligent routing, self-service integrations, and the ability to auto-identify callers. Since this launch, we’ve seen an increase in first-call resolutions and reduced call handle times. We also implemented the first phase of a 2.5 year-long initiative to consolidate five legacy administration platforms, enabling better service and addressing system obsolescence risks. Lastly, we began building out our Customer Experience Solutions Delivery organization and capabilities with the goal of ensuring we have the right talent, frameworks, and structure to help deliver the best end-to-end customer experience now and in the future.

| | | | | | | | |

| | |

| “We are thrilled with our progress building the CareScout Quality Network in 2024. With nationwide coverage, CareScout is now able to help more Genworth policyholders and their loved ones find quality home care providers at preferred prices.” – Samir Shah, President & CEO, CareScout Services | |

| | |

| | | | | |

2 | Genworth Financial, Inc. |

Stockholder Letter from Chair

Dear Stockholder,

The Board of Directors invites you to attend the 2025 Annual Meeting of Stockholders of Genworth Financial, Inc. (the 2025 Annual Meeting), to be held virtually at 9 a.m. E.T. on May 22, 2025. You will be able to attend the meeting online, vote your shares electronically, and submit questions before or during the meeting via www.virtualshareholdermeeting.com/GNW2025.

The 2025 Annual Meeting will include a report on our business operations, discussion and voting on the proposals set forth in the accompanying Notice of 2025 Annual Meeting of Stockholders and Proxy Statement, and discussion and voting on any other business matters properly brought before the meeting.

Whether or not you plan to attend the 2025 Annual Meeting, you can ensure your shares are represented by promptly submitting your proxy by telephone, internet, or completing, signing, dating, and returning your WHITE proxy card.

Strategic achievements in 2024

Genworth continued to build on its momentum in 2024, thanks to the hard work and dedication of our management team and workforce. We saw continued success with our multi-year rate action plan (MYRAP), securing significant rate action approvals on our oldest long-term care insurance (LTC) products and in historically challenging states. We expanded the CareScout Quality Network to nationwide coverage with home care providers and leveraged our significant LTC claims experience to develop and file CareScout's inaugural LTC insurance product ahead of our planned return to the market in 2025. Lastly, we returned significant value to shareholders in 2024. Enact, which had a record year of adjusted operating income of $718 million in 2024, continued to deliver significant capital returns enabling strong execution of our share buyback program. We repurchased approximately $186 million of shares of our common stock and have $155 million remaining under the current authorization, as of December 31, 2024. The Board is proud of these key achievements and confident in Genworth's strategic path forward.

Listening to our stakeholders

As part of our continued efforts to engage our stakeholders, we continued our practice of off-season proxy engagement, offering to meet with the entities and individuals collectively representing approximately 60% of our shareholder base. Additionally, we completed a materiality assessment in 2024 to better understand the various views and expectations on how we support sustainability. The feedback from both of these efforts allows us to better understand the perspectives of our stakeholders and helps us to further refine our focus areas, strategic goals, and investments.

Furthering our commitment to strong governance

Genworth's strong governance framework ensures we have a culture of management accountability, which allows us to uphold our commitments and protect the interests of our stakeholders. Genworth's Directors bring an array of perspectives, skills, and deep expertise that is critical to supporting our growth strategy. We believe these qualities, combined with their unique lived experiences, enable the Board to provide informed strategic leadership and sound judgment. We have a strong, dynamic Board that is closely engaged in charting Genworth's and CareScout's next chapters.

To that end, I'm pleased to welcome Steven Van Wyk, who was elected to the Genworth Board of Directors on March 19. He brings extensive experience building information technology capabilities and leading technical organizations that will be a strong addition to our Board's collective skillset and experience. I'm confident that Steve's contributions will further enable our continued progress in returning value to shareholders.

2024 was another strong year of value creation for Genworth. I am proud of the company's achievements and excited for our future as we continue to deliver on our mission to empower more families to navigate the aging journey with confidence. Thank you for your continued support.

Cordially,

Melina Higgins

Non-Executive Chair of the Board

Stockholder Letter from CEO

Dear Stockholder,

2024 was a year of continued momentum in Genworth's work to empower families to navigate the aging journey with confidence. We delivered value for stockholders, employees, and policyholders while we built for the future and executed on our three strategic priorities.

First, we created significant shareholder value through our mortgage insurance subsidiary Enact's growing market value and capital returns. With cash flows driven by the continued strength of Enact's performance, we repurchased $186 million of Genworth shares of common stock outstanding year-to-date through December. We have employed a disciplined approach to repurchases, buying back shares at an average share price of $5.62, relative to the share price at December 31, 2024 of $6.99.

Second, we continued work to maintain self-sustaining, customer-centric legacy insurance companies. In 2024, we delivered $343 million of gross incremental long-term care insurance (LTC) premium increase approvals, bringing the net present value total achieved from in-force rate actions to an estimated $31.2 billion since our multi-year rate action plan (MYRAP) began in 2012. We also invested in the capabilities and technology platforms—like a suite of cloud-based contact center tools—that will enhance both our understanding of customer needs and their experience interacting with us.

Finally, we made significant strides in building our growth platform through CareScout Services. The CareScout Quality Network grew from 93 providers at the end of 2023 to almost 500 by year-end 2024. Over the course of the year, we saw increased adoption of the network from our US Life policyholders and remain confident in the offering providing an estimated $1.0 to $1.5 billion in claims savings to our US Life companies over time. We also reached a milestone in our CareScout Insurance offering, completing our initial product filing on our new product, which is designed with conservative assumptions to help meet the strong demand in the United States for aging care funding solutions. Looking at the marketplace more

broadly, the need for affordable, high-quality long-term care solutions in the U.S. has never been greater. As detailed in our annual Cost of Care report, the cost of long-term care services continues to increase across care types, with growing demand from the Baby Boomer generation and a shortage of healthcare workers. We believe public-private collaboration in the long-term care space is an integral pathway to reduce costs, and we encourage constructive dialogue between policymakers and private insurers to discuss this issue. Moving forward, Genworth will continue engaging with state and federal government leaders to advance responsible solutions that help more Americans access high-quality long-term care as they age.

2024 was a strong year for our company—and as always, our people underpin that success. Last summer, I was joined by company leadership to ring the opening bell at the New York Stock Exchange to celebrate the 20th anniversary of Genworth's IPO. It was a great moment to celebrate both the resilience and dedication that brought us to this milestone and the incredible opportunity ahead of us as we work to make the aging journey more dignified, connected, and fulfilling. I remain certain that we have the right talent and resources to deliver on our growth strategy and create even more value for our stakeholders for years to come.

Thank you for your continued investment and support of Genworth.

Sincerely,

Thomas J. McInerney

President and Chief Executive Officer

| | | | | |

4 | Genworth Financial, Inc. |

| | | | | |

Notice of 2025 Annual Meeting of Stockholders | |

| | |

|

Date and Time Thursday, May 22, 2025, at 9:00 a.m. ET Meeting Access www.virtualshareholder meeting.com/GNW2025 using your 16-digit control number included on your WHITE proxy card or notice Who Can Vote Stockholders of record at the close of business on March 24, 2025 |

|

How to Vote

| | |

|

Internet www.proxyvote.com Telephone 1-800-579-1639 E-mail sendmaterial@proxyvote.com Mail You can vote by mail by requesting a paper copy of the materials, which will include a WHITE proxy card. |

|

Voting Matters

| | | | | | | | | | | |

| Proposals | Board Vote

Recommendation | For Further

Details |

| | | |

1. Election of Ten Directors Named in the Proxy Statement | | |  Page 18 Page 18 |

FOR each of the Board’s nominees |

| | | |

| | | |

2. Advisory Vote to Approve Named Executive Officer Compensation | | |  Page 62 Page 62 |

| FOR |

| | | |

| | | |

3. Approval of the 2025 Genworth Financial, Inc. Omnibus Incentive Plan | | |  Page 104 Page 104 |

| FOR |

| | | |

| | | |

4. Ratification of the Selection of KPMG LLP as the Independent Registered Public Accounting Firm for 2025 | | |  Page 110 Page 110 |

| FOR |

| | | |

| | | |

5. Approval of an Amendment to the Amended and Restated Certificate of Incorporation of Genworth Holdings, Inc. to Remove “Pass-Through Voting” Provision | | FOR |  Page 114 Page 114 |

| | | |

Stockholders will also discuss and vote on such other business as may properly come before the 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”) or any adjournment thereof.

In accordance with the U.S. Securities and Exchange Commission (“SEC”) rule, we are furnishing this proxy statement (“Proxy Statement”) and our Annual Report on Form 10-K for the year ended December 31, 2024 (“2024 Annual Report”) to many of our stockholders solely over the internet. We believe that posting these materials on the internet enables us to provide stockholders with the information that they need more quickly. In addition, it lowers our costs of printing and delivering these materials and reduces the environmental impact of our 2025 Annual Meeting. The Notice of Internet Availability of Proxy Materials sent to many of our stockholders explains how to access the proxy materials online, vote online and obtain a paper copy of our proxy materials.

We urge our stockholders to participate in the 2025 Annual Meeting. Stockholders may vote by telephone, through the internet or by mailing your completed and signed WHITE proxy card (or voting instruction form, if you hold your shares through a broker, bank or other nominee). Each share of Common Stock issued and outstanding as of the record date is entitled to one vote on each matter to be voted upon at our 2025 Annual Meeting. Your vote is important and we urge you to vote.

This Notice, the Proxy Statement and WHITE proxy card are first being made available or mailed to stockholders on or about April [•], 2025. The accompanying Proxy Statement is hereby incorporated by reference to this Notice.

Cordially,

Michael J. McCullough

Corporate Secretary

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the 2025 Annual Meeting to be Held on May 22, 2025: Genworth’s Notice of 2025 Annual Meeting of Stockholders, Proxy Statement and 2024 Annual Report are available, free of charge, at: www.proxyvote.com |

|

Table of Contents

| | |

|

Certain statements in this Proxy Statement, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this Proxy Statement. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements, including the risks and uncertainties set forth in our 2024 Annual Report for the year ended December 31, 2024. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. |

|

| | | | | |

6 | Genworth Financial, Inc. |

Proxy Statement Summary

This summary highlights information about Genworth Financial, Inc. (the “company,” “Genworth,” “we,” “our” and “us”) and certain information contained elsewhere in this proxy statement (“Proxy Statement”) for Genworth’s 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”). In this Proxy Statement, references to “U.S. Life Insurance” refer to both our Long-Term Care Insurance segment ("LTC") and our Life and Annuities segment. In addition, we reference both our CareScout services business ("CareScout Services") and CareScout insurance business ("CareScout Insurance"), collectively ("CareScout"). Lastly, we make reference to our subsidiary, Enact Holdings, Inc. (“Enact”). This summary does not contain all of the information that you should consider in making your voting decisions, and you should read the entire Proxy Statement carefully before voting.

Meeting Information

| | | | | | | | |

| Date & Time | Location | Record Date |

| | |

Thursday, May 22, 2025

9:00 a.m. ET | www.virtualshareholdermeeting.com/GNW2025 | Monday, March 24, 2025 |

Voting Matters

Stockholders will be asked to vote on the following matters at the 2025 Annual Meeting:

| | | | | | | | | | | |

| Voting Matters | Board Vote Recommendation | For Further Details |

| | | |

Proposal 1. Election of Ten Directors Named in the Proxy Statement | | | |

FOR each of the Board’s director nominees |

| | | |

Proposal 2. Advisory Vote to Approve Named Executive Officer Compensation | | | |

| FOR |

| | | |

Proposal 3. Approval of the 2025 Genworth Financial, Inc. Omnibus Incentive Plan | | | |

| FOR |

| | | |

Proposal 4. Ratification of the Selection of KPMG LLP as the Independent Registered Public Accounting Firm for 2025 | | | |

| FOR |

| | | |

Proposal 5. Approval of an Amendment to the Amended and Restated Certificate of Incorporation of Genworth Holdings, Inc. to Remove “Pass-Through Voting” Provision | | | |

| FOR |

2024 Genworth Performance

2024 Strategic Priorities

| | | | | | | | | | | | | | | | | |

| | | | | |

| •Create shareholder value through Enact's growing market value and capital returns •Maintain self-sustaining, customer-centric legacy insurance companies, including LTC, life and annuity businesses •Drive future growth through CareScout with innovative, consumer-focused aging care services and funding solutions | | | See page 12 for a summary discussion of targets linked to executive officer compensation in 2024 | |

| | | | | |

2024 Performance Highlights by Business Area

| | | | | | | | |

| | |

| Enact •Exceeded financial objectives, including its targets for adjusted operating income and adjusted return on equity. •Non-financial objectives, including effective risk and pricing management, strong capital management and growth initiatives were at target. | |

| | |

| | |

| U.S. Life Insurance •Exceeded our targets for in-force rate action (“IFA”) approvals and premium rate actions filed on our legacy blocks of long-term care insurance in execution of our multi-year rate action plan ("MYRAP"). •Exceeded the targets on LTC risk reduction through increasing Genworth Life Insurance Company's ("GLIC") policy level reduction elections and reducing GLIC's exposure to compound inflation. •Exceeded the targets for CareScout Services customer network matches. •Positioned the business for long-term sustainability through: (i) operational excellence in meeting performance goals; (ii) continued focus on customer experience; and (iii) services and solutions for new and existing customers. | |

| | |

| | |

| Corporate and Other •Returned capital to stockholders through the repurchase of $186 million worth of our outstanding shares of common stock at an average price of $6.52 per share under our share repurchase program in 2024. •Reduced outstanding holding company debt to $790 million as of December 31, 2024 through opportunistic debt repurchases and continued to maintain the company's debt to capital ratio (excluding U.S. Life Insurance) below 25%. •Exceeded CareScout Services' goal for CareScout Services customer network matches and advanced the development of the CareScout Insurance business to help Americans afford long-term care. •Strengthened and expanded our focus on human capital through talent management and succession planning initiatives as well as inclusion and well-being and engagement programs, which led to the company again being recognized in national and local "Top Workplace" awards. | |

| | |

| | | | | |

8 | Genworth Financial, Inc. |

Our Director Nominees

The table below sets forth information about our director nominees, each of whom is an incumbent member of the Genworth Board of Directors (the “Board” or “Board of Directors”). The Board has determined that nine of the ten nominees are independent directors under the New York Stock Exchange (“NYSE”) listing requirements and our Governance Principles.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Director

Since | Other Public

Company

Boards | | Committee

Membership |

| Name and Primary Occupation | Age | | A | COMP | NOM | R |

| G. Kent Conrad Former U.S. Senator | 77 | 2013 | 0 | | | | | |

| Karen E. Dyson Lieutenant General, U.S. Army, Retired | 65 | 2020 | 0 | | | | | |

| Jill R. Goodman Managing Director, Foros Advisors LLC | 58 | 2021 | 1 | | | | | |

| Melina E. Higgins, Non-Executive Chair of the Board* Former Partner, The Goldman Sachs Group, Inc. | 57 | 2013 | 1 | | | | | |

| Thomas J. McInerney President and Chief Executive Officer, Genworth Financial, Inc. | 68 | 2013 | 1 | | | | | |

| Howard D. Mills, III Former Superintendent of the New York State Insurance Department | 60 | 2021 | 0 | | | | | |

| Robert P. Restrepo Jr. Former Chairman and President and Chief Executive Officer, State Auto Financial Corporation | 74 | 2016 | 2 | | | | | |

| Elaine A. Sarsynski Former Chairwoman, Chief Executive Officer and President, MassMutual International | 69 | 2022 | 3 | | | | | |

| Ramsey D. Smith Founder and Chief Executive Officer, ALEX.fyi | 57 | 2021 | 0 | | | | | |

| Steven C. Van Wyk** Former Group Chief Information Officer, HSBC Bank | 66 | 2025 | 2 | | | | | |

| | | | | |

* Non-Executive Chair of the Board | |

| ** Elected to the Board of Directors on March 19, 2025. Committee appointments will occur after the 2025 Annual Meeting. |

| |

A Audit |  Chair Chair |

COMP Management Development and Compensation |  Member Member |

NOM Nominating and Corporate Governance | |

R Risk | |

Board’s Director Nominee Skills and Attributes

The Board and the Nominating and Corporate Governance Committee (“Governance Committee”) believe it is important that our Board is composed of directors who possess a range of key qualities, experience and skills and bring varying perspectives. Our Board and Governance Committee believe that each of the Board’s director nominees bring a unique set of qualities, experience and skills, and the blend of our directors’ qualities, experience, skills and perspectives helps ensure that our Board is well-positioned to examine, address and provide oversight of the issues facing the company and its business.

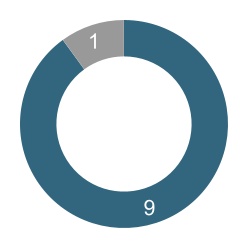

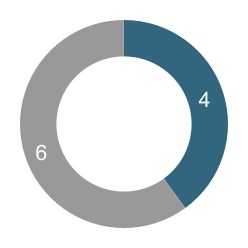

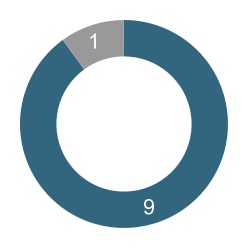

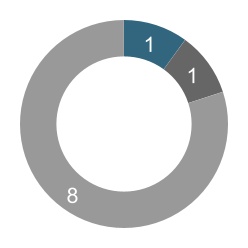

Independence

90%

Independent

| | | | | |

| g | Independent |

| g | Not Independent |

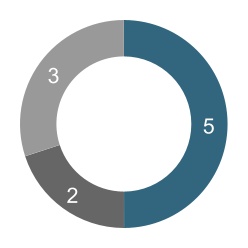

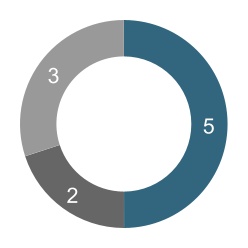

Tenure

6.5 years

average

| | | | | |

| g | <5 years |

| g | 5-9 years |

| g | >9 years |

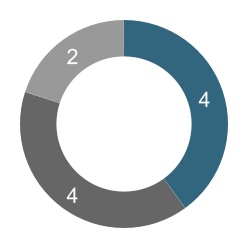

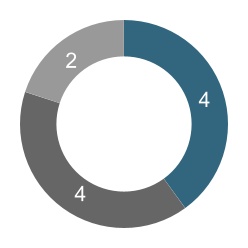

Age

65.1 years

average

| | | | | |

| g | 55-64 years |

| g | 65-70 years |

| g | >70 years |

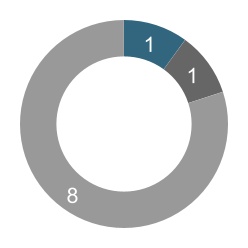

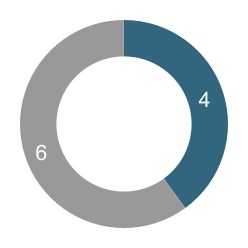

Race/Ethnicity

20%

Diverse

| | | | | |

| g | African American/Black |

| g | Asian & White |

| g | White |

Core Competencies

| | | | | |

| Corporate Governance/Public Company Board |

Strategic Skills

| | | | | |

| Technology/ Information & Cybersecurity |

| | | | | |

| Mergers & Acquisitions/ Restructuring |

For more information on our directors’ skills and why these skills are important to the Board and Genworth’s business, please see Skills Matrix on page 30.

| | | | | |

10 | Genworth Financial, Inc. |

Corporate Governance Highlights

Our corporate governance practices are designed to help advance the interests of our stockholders, provide for strong Board and management oversight and accountability and provide guidelines for responsible decision-making. Some of our key governance principles and practices are set forth below, and more information can be found in the Corporate Governance at Genworth section of this Proxy Statement.

Executive Compensation Highlights

Compensation Program Features

Our 2024 annual executive compensation program consisted of the following key elements: base salary, annual incentive, and annual long-term incentive grants (which includes performance stock units (“PSUs”) and restricted stock units (“RSUs”)). A significant portion of target executive compensation is completely at risk.

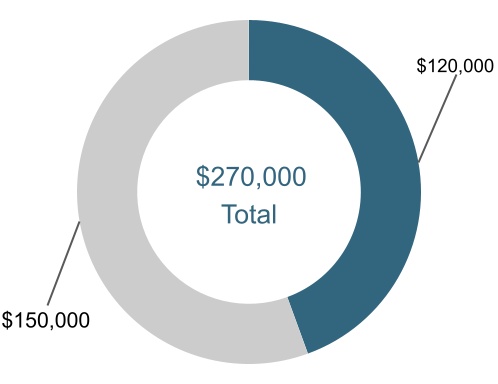

2024 CEO Target Compensation

2024 Other NEO Target Compensation

Funding Outcomes for Incentive Pay Programs

| | | | | | | | | | | |

| Payout Funding | Results Summary |

| | | |

Key Annual

Incentive Financial

Objectives | | Above Target | Enact exceeded its goals for adjusted operating income and adjusted return on equity. U.S. Life Insurance exceeded its internal targets in 2024 for IFA approvals and premium rate actions filed under our multi-year rate action plan and LTC risk reduction. CareScout Services exceeded its goal for CareScout Services customer network matches. |

| | | |

| | | |

Key Annual

Incentive

Non-Financial

Objectives | | Target | We returned capital to stockholders through share buybacks, opportunistically repurchased debt, and managed the company’s leverage ratio below 25%, attributing no equity value to U.S. Life Insurance. We strengthened and expanded the focus on human capital through talent management and succession planning initiatives as well as inclusion and well-being and engagement programs, which led to the company again being recognized in national and local "Top Workplace" Awards. |

| | | |

| | | |

Long-Term

Financial

Objectives | | Below Target | Our 2022-2024 PSU awards payout was significantly below target driven by U.S. Life Insurance's Statutory Net Income. Enact's Adjusted Operating Income and Total Shareholder Return (“TSR”) did exceed target. |

| | | |

| | | | | |

12 | Genworth Financial, Inc. |

Stockholder Engagement

Our Board and management value the insights and feedback from our stockholders. We regularly communicate with our stockholders through a variety of channels, including quarterly earnings calls and investor meetings and conferences, and we also actively engage with them throughout the year to discuss matters significant to our business. We seek our stockholders’ input on a variety of matters, including corporate governance, executive compensation and sustainability, among other matters. Over the last year, based on feedback we received from stockholders, we lowered the ownership threshold needed to request the calling of special meetings by stockholders from 40% to 25%.

Stockholder engagement usually involves a cross-functional team, representing investor relations, sustainability, corporate governance and compensation and benefits, to ensure key topics are covered. Management provides regular updates to the Board throughout the year on stockholder engagement, including insights and feedback received from our stockholders.

| | | | | | | | |

FEBRUARY – APRIL Ahead of annual meeting, conduct engagement with stockholders that have expressed any concerns or questions over ballot items and proxy statement, and finalize Sustainability Report | | MAY – AUGUST Review and summarize feedback from annual meeting, identify potential areas of focus and track governance trends |

| |

DECEMBER – JANUARY Enhance proxy statement and annual report content based on feedback, and address stockholder concerns | SEPTEMBER – NOVEMBER Conduct general off-season engagement outreach with stockholders |

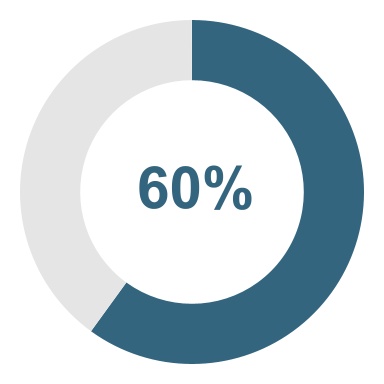

During 2024, we engaged in a stockholder outreach campaign to understand our key investors’ views on our strategy, performance, governance practices, Board composition and oversight, compensation programs, and sustainability initiatives, among other topics. In our outreach campaign, we targeted our top 20 stockholders, representing approximately 60% of shares outstanding.

Through our stockholder engagement, we strive to be responsive to our stockholders and use the input received from our stockholders to help inform our strategies and priorities.

| | |

Outreach to our Stockholders Representing Approximately 60% of Shares Outstanding |

|

Discussed the following key topics: •Corporate Governance, Board Composition and Director Qualifications •Executive Compensation Programs •Sustainability •Pay-versus-Performance Disclosures •Ownership Threshold to Call Special Meeting of Stockholders |

|

Sustainable Compassion & Care

Building on our foundation of robust governance practices, we strive to create long-term value for our key stakeholders – executing with competence, compassion, and care.

We believe our sustainability efforts contribute meaningfully to our success as a company and we remain committed to continuing to integrate our sustainability strategy into our business strategy. We invite you to review our 2024 Sustainability Report to learn more about our collective accomplishments and plans to continue serving our customers, our colleagues and our community.

| | | | | | | | | | | | | | | | | |

| Our People | | | | |

| |

| | | | |

| We are committed to helping families become more financially secure, self-reliant and prepared for the future, and that philosophy extends to our employees. We take a holistic approach to human capital management, including attracting and retaining talent with comprehensive benefits and compensation packages, providing professional development and learning opportunities, facilitating access to dedicated resources that foster an equitable and inclusive environment and encouraging a sincere commitment to community service and involvement. |

|

| | | | | |

| | | | | |

| Total Rewards Our compensation package, including salary, bonus and long-term incentives, aligns employee and stockholder interests. In addition to a competitive compensation program, we also offer our employees benefits such as life and health insurance, paid time off, paid family leave, identity theft protection, financial planning and a retirement savings plan. | | Well-Being To further support our employees, we continue to provide financial, health and well-being resources, as well as a flexible work schedule to allow employees additional time for self-care and the care of family members. |

| | | | | |

| | | | | |

| We have a rewards and recognition platform that encourages our employees to recognize one another for exemplifying our values to make it human, make it about others, make it happen, and make it better as they serve our current and future customers. |

| | | | | |

| | | | | |

| Learning & Development We offer a multitude of professional development and career enrichment opportunities, including building leadership skills, professional skills training and industry-specific matters, as well as education reimbursement benefits and student loan repayments to aid career progression. Additionally, we facilitate an annual organization-wide talent management process to support career development, progression and succession planning. | | Social Responsibility We use our outreach platforms, including the Genworth Foundation, to extend our very purposeful impact in our communities through grants, program sponsorships, paid volunteer time for our employees, and employee-directed charitable giving. We align philanthropic efforts with our primary business focus areas, our commitment to sustainability, and other programs that are important to our employees. |

| | | | | |

14 | Genworth Financial, Inc. |

| | | | | |

| |

| Our Culture At Genworth, we believe that diversity of all kinds — viewpoints, perspectives, backgrounds, and ideas — makes us stronger as a company. That is why we are committed to fostering an inclusive work environment that encourages employees to be their authentic selves. We strongly oppose all forms of discrimination and base our decisions on merit. With these philosophies as our guideposts, we are proud to embrace a future where our associates, leadership and executives contribute to a culture of belonging and inclusion. To show our commitment to creating an inclusive environment for employees and embracing diversity, we established a steering committee made up for executive leaders to emphasize the importance of our philosophy. We have built and continue to actively engage strong community connections and partnerships with diverse organizations to promote equal opportunities and have implemented training initiatives to enhance employee inclusivity and self-awareness. We empower our employees to embrace their differences and commonalities to contribute to a culture of belonging. To help in this important work, we have 13 Employee Resource Groups (ERGs) which are voluntary, associate-led groups that are open to all employees. The ERGs connect associates who share affinities, characteristics, life experiences, or who are interested in supporting these groups as allies. Our ERGs host events and learning opportunities to celebrate the culture, heritage and contributions of the communities they represent. We are proud to embrace a future where the diversity of our associates, leadership and executives contribute to a culture of belonging and inclusion. As of December 31, 2024, we employed approximately 2,960 full-time and part-time employees globally, none of which are subject to a collective bargaining agreement. |

| |

| | | | | | | | | | | | | | | | | |

| Our Community | | | | |

| |

| | | | | |

| We are committed to improving the communities where we live, work, and visit. We support organizations that align with our primary business focus areas of supporting healthy aging and caregiving, programs that enable affordable senior housing to help eliminate homelessness, and other sustainable efforts that are important to our associates and promote well-being around the world. |

| | | | | |

| | | | | |

| Care-Centered Philanthropic Platform We are committed to active and meaningful community engagement to support health, vitality, and economic empowerment. In 2024, our primary areas of philanthropic focus included Healthy Aging and Caregiving, Senior Affordable Housing and Homelessness, and Sustainability. Genworth contributed over $1 million in sponsorships to organizations that align with our philanthropic focus areas in 2024. | | Employee Engagement We support civic engagement through paid volunteer time for our employees, our event sponsorship program, employee-directed charitable gifts through the Genworth Foundation, and our commitment to environmental sustainability. Including matching gifts, Genworth employees donated nearly $870,000 to non-profit organizations globally and volunteered over 9,300 hours during 2024. |

| | | | | |

| | | | | |

| Genworth Foundation The Genworth Foundation awarded grants and other funding totaling nearly 2.6 million in 2024. Our foundation also contributed more than $400,000 in matching gifts, employee volunteer rewards, and other service donations. | | |

| | | | | | | | | | | | | | | | | |

| The Environment | | | | |

| |

| | | | |

| We are committed to operating efficiently, monitoring our emissions, and promoting environmental awareness. We are taking a responsible approach to preserve the environment, build trust, and create long-term value for all our stakeholders. By doing so, we can create a sustainable future for generations to come. |

| | | | | |

| | | | | |

| Assessing Climate Risk Genworth has engaged in both qualitative and quantitative analyses to assess climate risk exposure. We have continued enhancing our climate disclosures and reporting. We published our third annual TCFD Report and completed our 2024 CDP submission (FY2023). These reports included environmental disclosures and information about our governance structures, strategy, risk management processes, and metrics. | | Investing Purposefully and Responsibly We understand that sustainability begins with our fiduciary responsibility to honor the promises to our policyholders. Accordingly, we integrate sustainability risk and opportunity considerations into our analysis of investments that fall within our core investment parameters and provide sustainable market returns. |

| | | | | |

16 | Genworth Financial, Inc. |

| | | | | | | | | | | |

| Our Board Oversight of Sustainability | | |

|

| | |

| We believe that effective corporate governance helps promote the long-term interests of our stockholders and strengthens Board and management oversight and accountability. We have created a governance framework that ensures we have a culture of management accountability, which helps us to uphold Genworth’s commitment to corporate responsibility and protects the interests of our stakeholders. |

| | | |

| | | |

| Governance Committee The Nominating and Corporate Governance Committee has general oversight of our sustainability platform, including reviewing, on a periodic basis, activities related to environmental, social and governance matters of significance to the company and its stakeholders. In addition, this committee has specific oversight responsibilities over our: •Political contributions and expenditures, including periodically reviewing the nature and amount of the company’s political contributions and expenditures, the operations of the company’s Political Action Committee and the company’s public disclosure regarding such activities; •Philanthropic programs and financial and other support of charitable, education and cultural organizations as well as the company’s community volunteer activities; and •Environmental policy and practices. |

| | | | | | | | | | | | | | |

| | | | |

| Compensation Committee The Management Development and Compensation Committee (the “Compensation Committee”) has oversight responsibility relating to executive compensation and succession planning. This committee also oversees matters related to Genworth’s human capital management. In 2024, this committee received updates on recruitment, retention, and engagement of our associates. In addition, this committee also oversees our Human Rights Policy. | | | Risk Committee The Risk Committee is responsible for oversight of enterprise risk management, our information security programs, and our investment portfolio and strategy, among other things. This committee considers climate-related risks in its assessments of standard operational risks, including risks related to the regulatory environment, technology, and Genworth’s reputation. In 2024, the Risk Committee received regular updates related to data security and cybersecurity matters and discussed emerging risks including artificial intelligence and the potential impact of climate risk. |

Genworth Board of Directors

| | | | | | | | |

| | |

| Proposal 1 Election of Ten Directors Named in the Proxy Statement | |

| | |

At the 2025 Annual Meeting, ten directors are to be elected to hold office until the 2026 Annual Meeting of Stockholders and until their successors have been duly elected and qualified or until the earlier of their resignation or removal in a manner provided for in our Bylaws. Our Board has nominated Sen. Conrad, Lt. Gen. Dyson, Ms. Goodman, Ms. Higgins, Mr. McInerney, Mr. Mills, Mr. Restrepo, Ms. Sarsynski, Mr. Smith and Mr. Van Wyk to be elected by the holders of our common stock at the 2025 Annual Meeting. Each of the Board’s ten director nominees currently serves on our Board. We are not aware of any reason why any Board nominee would be unable to serve as a director. If a nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of any other person that our Board may nominate as a substitute.

The Board’s ten nominees for election at the 2025 Annual Meeting are individuals with diverse experience at policy-making levels in business and government and in other areas that are relevant to our company. In addition, our Board believes that a range of tenures helps foster different perspectives and experience as longer-tenured directors provide continuity and important historical insights into the company and its operations, while newer directors bring fresh perspectives. As discussed in the following pages, each of the Board’s director nominees was nominated on the basis of the unique set of qualities, experience and skills he or she brings to the Board, as well as how those qualities, experience and skills blend with those of the other directors on the Board as a whole. The combination of these nominees’ different qualities, experience and skills ensures that issues facing our company are examined and addressed with the benefit of a broad array of perspectives and expertise. The Board has determined that nine of the ten nominees are independent directors under the NYSE listing requirements and our Governance Principles, which are discussed below under Corporate Governance Policies and Procedures.

| | | | | | | | | | | |

| | | |

| | | |

| The Board recommends that stockholders vote FOR the election of Sen. Conrad, Lt. Gen. Dyson, Ms. Goodman, Ms. Higgins, Mr. McInerney, Mr. Mills, Mr. Restrepo, Ms. Sarsynski, Mr. Smith and Mr. Van Wyk. | |

| | | |

| | | | | |

18 | Genworth Financial, Inc. |

| | |

| Genworth Board of Directors |

|

Board’s Nominees

Director Bios

G. Kent Conrad, 77, Independent Director

Former U.S. Senator

| | | | | | | | | | | | | | | | | | | | |

Committees: •Nominating and Corporate Governance

(Chair) •Risk Director Since:

March 2013 | QUALIFICATIONS Sen. Conrad brings to the Board extensive knowledge of and insights into public policy, fiscal affairs, government relations and regulatory affairs through his 26 years serving as a U.S. Senator for North Dakota. During his service as a United States senator, Sen. Conrad successfully negotiated the budget for the United States as Chairman of the Senate Budget Committee, oversaw Social Security and Medicare programs and U.S. tax policy as a Senior Member of the Senate Finance Committee, and helped oversee the Intelligence function of the United States as a member of the Senate Select Committee on Intelligence. Sen. Conrad’s formidable experience in both Federal and State government positions brings significant leadership experience and a valuable perspective to his role as Chair of the Nominating and Corporate Governance Committee, as well as the Board’s handling of governance, risk, and regulatory issues, and the company’s engagement with regulators on certain public policy issues. |

SKILLS |

| Risk Management | | Corporate Governance/

Public Company Board | | Healthcare/

Medical |

| Public Policy/

Regulatory | | Technology/Information & Cybersecurity | | International |

| | | | | |

| | |

PROFESSIONAL EXPERIENCE •Strategic advisor to Molina Healthcare, Inc. since 2014 •Advisor to the CEO of the Baltimore Orioles from January 2020 to December 2024 •U.S. Senator representing the State of North Dakota from January 1987 to January 2013 •Chairman or Ranking Member of the Senate Budget Committee for 12 years, Senior Member of the Senate Finance Committee and Member of the Senate Select Committee on Intelligence •Tax Commissioner for the State of North Dakota from 1981 to 1986 and Assistant to the Tax Commissioner from 1974 to 1980 |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Co-chair of the Economic Advisory Board for The American Edge Project since 2022 •Member of the board of directors of the Committee for a Responsible Federal Budget since 2014 •Senior Fellow for the Bipartisan Policy Center since 2014 |

|

| | |

| Genworth Board of Directors |

|

Karen E. Dyson, 65, Independent Director

Lieutenant General, U.S. Army, Retired

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Committees: •Audit •Management Development and Compensation (Chair) Director Since:

December 2020 | QUALIFICATIONS Lt. Gen. Karen Dyson is a qualified financial expert, whose distinguished military career spanned more than 35 years. During her career, she led efforts building, executing and reporting on the Army’s multi-appropriation budget; commanded units and led troops in war operations; and led strategic transformation initiatives. Lt. Gen. Dyson is a strategic leader with corporate governance, risk oversight and management development and compensation experience. Her extensive financial management and board experience also provide the Board with critical insight into corporate financials, macroeconomic trends and risk mitigation. Her background in financial oversight, talent development and succession planning in the U.S. Army, along with her development of the framework for the Army’s first ever financial statements audit, position her well to chair the Management Development and Compensation Committee and serve on the Audit Committee. |

SKILLS | | |

| Financial/ Investment | | Risk Management | | Corporate Governance/ Public Company Board | | Public Policy/ Regulatory |

| Technology/ Information & Cybersecurity | | International | |

| |

|

| | | | | | | |

| | |

PROFESSIONAL EXPERIENCE •Military Deputy to the Assistant Secretary of the Army for Financial Management and Comptroller from August 2014 to August 2017 •First female finance officer to achieve three-star general officer rank in August 2014 •National Association of Corporate Directors (NACD) Directorship Certified |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Director of USAA Federal Savings Bank since October 2017 (serving as nominations and governance committee chair) •Director of CALIBRE Systems, Inc. since October 2018 (serving as audit committee chair) •Director of Army Emergency Relief Organization since 2020 |

|

| | | | | |

20 | Genworth Financial, Inc. |

| | |

| Genworth Board of Directors |

|

Jill R. Goodman, 58, Independent Director

Managing Director, Foros Advisors LLC

| | | | | | | | | | | | | | | | | | | | |

Committees: •Management Development and Compensation •Nominating and Corporate Governance Director Since:

March 2021 | QUALIFICATIONS Ms. Goodman has a distinguished background in strategic advisory work, with more than 25 years of experience advising corporations on mergers and acquisitions, including issues related to capital structure and financing. As a result of these experiences, she has a sharp understanding of how to assess organic business plans and create and execute concrete plans to enhance long-term value creation. As a former corporate and securities lawyer, Ms. Goodman also brings important insights in those areas to the Board. Given her particular expertise in complex corporate governance matters and long history in the boardroom as both a director and advisor, she is a valuable member of both the Nominating and Corporate Governance and Management Development and Compensation Committees. |

SKILLS |

| CEO/Business

Head | | Financial/Investment | | Risk

Management |

| Corporate

Governance/Public

Company Board | | Healthcare/ Medical | | Mergers and

Acquisitions/

Restructuring |

| | | | | |

| | |

PROFESSIONAL EXPERIENCE •Managing Director of Foros Advisors LLC, a strategic financial and mergers and acquisitions advisory firm, since November 2013 •Managing Director and Head, Special Committee and Fiduciary Practice—U.S. at Rothschild & Co. from 2010 to October 2013 •Managing Director in the Mergers & Acquisitions and Strategic Advisory Group of, and various prior positions with, Lazard from 1998 to 2010 |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Director of Cboe Global Markets, Inc. (BATS: CBOE), a leading provider of trading, clearing and investment solutions to market participants around the world, since 2012 (serving as finance and strategy committee chair and as a member of the executive and nominating and governance committees) •Director of Cover Genius Pty Ltd, a private global insurance technology company, since February 2022 (serving as audit committee chair and risk committee chair and as a member of the compensation committee) |

|

| | |

| Genworth Board of Directors |

|

Melina E. Higgins, 57, Non-Executive Chair of the Board

Former Partner, The Goldman Sachs Group, Inc.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Committees: •Audit •Management, Development and Compensation Director Since:

September 2013 | QUALIFICATIONS Ms. Higgins is a qualified financial expert and has extensive financial services and investment experience. Having spent nearly 20 years building and leading a successful investment business at Goldman Sachs, Ms. Higgins is well-versed in portfolio management, assessing market risks and building businesses. During her tenure on the Board, Ms. Higgins has also served on all of Genworth’s standing Board committees. Ms. Higgins’ skills, extensive experience on numerous public and private companies’ boards and service on all of the Board’s standing committees, are valuable in her role as Board Chair and as a member of the Audit and Management Development and Compensation Committees. |

SKILLS | | |

| CEO/Business Head | | Financial/ Investment | | Risk Management | | Corporate Governance/ Public Company Board |

| Healthcare/ Medical | | Mergers and Acquisitions/ Restructuring | | International | |

|

| | | | | | | |

| | |

PROFESSIONAL EXPERIENCE •Retired in 2010 from a nearly 20-year career in various positions at The Goldman Sachs Group, Inc., where she served as Managing Director from 2001 and as Partner from 2002 •Other notable positions during her tenure include Head of the Americas for Private Debt; Co-Chairperson of the Investment Advisory Committee for the GS Mezzanine Partners funds; and a member of the Investment Committee for the Principal Investment Area (one of the largest alternative asset managers in the world), which oversaw and approved global private equity and private debt investments |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Director of Viatris Inc. (Nasdaq: VTRS) since November 2020 (serving as non-executive chair, finance committee chair and executive committee chair) •Non-executive chair of the Board of Antares Midco, Inc. since January 2016 •Member of the Women’s Leadership Board of Harvard University’s John F. Kennedy School of Government since March 2015 •Former director of Mylan N.V. (Nasdaq: MYL) from February 2013 to November 2020 •Former director of NextGen Acquisition Corp. II (Nasdaq: NGCA) from March 2021 to December 2021 |

|

| | | | | |

22 | Genworth Financial, Inc. |

| | |

| Genworth Board of Directors |

|

Thomas J. McInerney, 68

President and Chief Executive Officer, Genworth Financial, Inc.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Committees: None Director Since:

January 2013 | QUALIFICATIONS Mr. McInerney brings to his role extensive knowledge of the insurance and financial services industries and risk management within those industries through his more than 45 years of experience, including previous leadership roles at ING Groep NV, Aetna and Boston Consulting Group, Inc. Mr. McInerney’s broad operating experience over many decades leading complex global insurance businesses provides Genworth with important, well-informed insights into navigating market dynamics, establishing new business lines and leading organizations through significant change. |

SKILLS | | |

| CEO/

Business Head | | Financial/ Investment | | Risk Management | | Corporate Governance/ Public Company Board |

| Industry | | Healthcare/ Medical | | Marketing | | Public Policy/ Regulatory |

| Technology/Information & Cybersecurity | | Mergers and Acquisitions/ Restructuring | | International | |

|

| | | | | | | | |

| | |

PROFESSIONAL EXPERIENCE •President and Chief Executive Officer of Genworth since January 2013 •Senior Advisor to the Boston Consulting Group, Inc. from June 2011 to December 2012, providing consulting and advisory services to leading insurance and financial services companies in the United States and Canada •Member of ING Groep NV’s Management Board for Insurance from October 2009 to December 2010, where he was the Chief Operating Officer of ING Groep NV’s insurance and investment management business worldwide •Variety of senior roles with ING Groep NV and leadership positions with Aetna Inc., where he began his career as an insurance underwriter in June 1978 |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Director of Enact Holdings, Inc. (Nasdaq: ACT), a majority-owned subsidiary of Genworth, since its IPO in September 2021 •Director of The Conference Board and on its Committee on Economic Development since 2024 •Director of United Way Worldwide since 2023 •Director of Virginia Learns since 2022 •Director of Global Research Institute at William & Mary since 2021 •Trustee of the U.S. Ski and Snowboard Foundation since 2020 •Member of the American Council of Life Insurers since 1995 and serves, and has served, on its CEO Steering Committees and Board |

|

| | |

| Genworth Board of Directors |

|

Howard D. Mills, III, 60, Independent Director

Former Superintendent of the New York State Insurance Department

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Committees: •Nominating and Corporate Governance •Risk Director Since:

March 2021 | QUALIFICATIONS Mr. Mills has extensive experience leading global insurance regulatory functions for both private and government entities, including at Deloitte LLP as Global Insurance Regulatory Leader and as Superintendent of the New York State Insurance Department. During his tenure as Superintendent, Mr. Mills worked closely with insurance companies to advance critical regulations and led the New York Department’s transition to risk-based examinations. During his 17-year management consulting career, Mr. Mills advised boards and executives on regulatory and reputational risk, Enterprise Risk Management, executive positioning, strategy, financial communications, crisis management, mergers and acquisitions and public policy, allowing him to provide significant insights to the Board on these topics. Mr. Mills also brings to the Nominating and Corporate Governance and Risk Committees a keen understanding of state insurance regulatory frameworks and agencies, as well as various aspects of risk preparedness, including enterprise risk and strategic risk. |

SKILLS | | |

| Risk Management | | Corporate Governance/

Public Company Board | | Industry | | Healthcare/

Medical |

| Marketing | | Public Policy/ Regulatory | | Technology/

Information & Cybersecurity | | International |

| | | | | | | |

| | |

PROFESSIONAL EXPERIENCE •Partner in Pavement Management Group since 2024 •Executive Vice President of Business Development and External Affairs of beeXact, a geospatial data management/EngineeringTech company that designs fiber optic networks and provides municipal digital twin services, from February 2023 to June 2024 •Senior Advisor to McKinsey & Company from October 2021 to November 2024 •Managing Director and Global Insurance Regulatory Leader at Deloitte LLP from 2007 to May 2019, serving Deloitte LLP’s largest U.S. and global insurance clients •Superintendent of the New York State Insurance Department from 2005 to 2006 •Served three terms in the New York State Assembly from 1999 to 2004, where he was Deputy Minority Leader and a member of the National Council of Insurance Legislators •NACD Governance Fellow |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Director of The Doctors Company Group since May 2019, the largest physician-owned medical liability insurer in the U.S. (serving as a member of the audit committee and technology and cybersecurity committee) •President and Director of the Insurance Federation of New York since 2020 •Trustee of The Institutes Griffith Insurance Education Foundation since 2011 •Former director of Ensight, a SaaS insurance sales platform, from June 2019 to January 2022 |

|

| | | | | |

24 | Genworth Financial, Inc. |

| | |

| Genworth Board of Directors |

|

Robert P. Restrepo Jr., 74, Independent Director

Former Chairman and President and Chief Executive Officer, State Auto Financial Corporation

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Committees: •Audit (Chair) •Management Development and Compensation Director Since:

December 2016 | QUALIFICATION Mr. Restrepo is a qualified financial expert and has more than 40 years of insurance, finance and risk management experience after serving as the Chairman, President and Chief Executive Officer of State Auto Financial Corporation and holding other roles at several of the country’s leading insurers. Mr. Restrepo brings to the Board deep knowledge of and perspective on leading corporate governance, organizational management, strategic planning and risk mitigation. His extensive experience leading large insurance companies is vital to his role as Chair of the Audit Committee and his service on the Management Development and Compensation Committee. |

SKILLS | | |

| CEO/

Business Head | | Financial/

Investment | | Risk Management | | Corporate Governance/ Public Company Board |

| Industry | | Marketing | | Public Policy/

Regulatory | | Technology/

Information & Cybersecurity |

| Mergers and Acquisitions/

Restructuring | | | | | | |

| | | | | | | | |

| | |

PROFESSIONAL EXPERIENCE •Retired from State Auto Financial Corporation in 2015, having served as its Chairman from 2006 to December 2015 and as its President and Chief Executive Officer from 2006 to May 2015 •Over 40 years of insurance industry experience, having held executive roles at Main Street America Group, Inc., The Hanover Insurance Group Inc. (formerly Allmerica Financial Corp.), The Travelers Companies, Inc. and Aetna Inc. •Professional Director – Public Company credential from the American College of Corporate Directors |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Director of RLI Corp. (NYSE: RLI), a property and casualty insurance company, since July 2016 (serving as chair of the nominating/governance committee) •Director of Enact Holdings, Inc. (Nasdaq: ACT), a majority-owned subsidiary of Genworth, since its IPO in September 2021 (serving as a member of the audit and nominating and corporate governance committees) •Director of The Larry H. Miller Group of Companies since November 2015 •Former director of Majesco, a provider of insurance software and consulting services, from August 2015 to September 2020 |

|

| | |

| Genworth Board of Directors |

|

Elaine A. Sarsynski, 69, Independent Director

Former Chairwoman, Chief Executive Officer and President, MassMutual International

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Committees: •Audit •Risk (Chair) Director Since:

March 2022 | QUALIFICATIONS Ms. Sarsynski is a qualified financial expert and has extensive experience as both an executive and director at certain of the nation’s largest insurance companies, including MassMutual and Aetna. In her decades of service at both public and private companies, she has led strategic turnarounds for global businesses and overseen significant growth and risks across business units and geographies. Ms. Sarsynski provides the Board with strong experience in financial services, insurance, compliance, risk management, operations, investments and real estate. These experiences position her well to chair the Risk Committee and serve on the Audit Committee. |

SKILLS | | |

| CEO/

Business Head | | Financial/

Investment | | Risk Management | | Corporate Governance/ Public Company Board |

| Industry | | Healthcare/ Medical | | Marketing | | Public Policy/

Regulatory |

| Technology/

Information & Cybersecurity | | Mergers and Acquisitions/

Restructuring | | International | |

|

| | | | | | | | |

| | |

PROFESSIONAL EXPERIENCE •Chairwoman, Chief Executive Officer and President of MassMutual International from 2006 to 2017 •President of MassMutual Retirement Services from 2008 to 2016 •Executive Vice President from 2006 to 2017 of MassMutual, member of MassMutual’s Office of the Chief Executive Officer from 2008 to 2017 and Chief Administrative Officer of MassMutual from September 2005 to 2008 •Managing Director at Babson Capital Management LLC, a MassMutual subsidiary in 2005 •Served two elected terms as First Selectman for the town of Suffield, Connecticut from 2001 to 2005 •Founded Sun Consulting Group LLC in 1998, offering real estate advisory and consulting services •Multiple senior management positions for 17 years at Aetna Inc., overseeing segments of the company’s Investments Division and leading the Corporate Finance Department •NACD CERT certificate in Cybersecurity Oversight earned in 2023 •FINRA Registrations for Series 7 and 24 from 2009 to 2019 |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Director of TI Fluid Systems PLC (LSE: TIFS) since 2018 •Director of Horizon Technology Finance Corporation (Nasdaq: HRZN, NYSE: HTFB, HFTC) since 2012 •Director of Horace Mann Educators Corporation (NYSE: HMN) since 2021 •Former director of AXA S.A. from 2018 to 2021 |

|

| | | | | |

26 | Genworth Financial, Inc. |

| | |

| Genworth Board of Directors |

|

Ramsey D. Smith, 57, Independent Director

Founder and Chief Executive Officer, ALEX.fyi

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Committees: •Nominating and Corporate Governance •Risk Director Since:

March 2021 | QUALIFICATIONS Mr. Smith has extensive experience in securities and annuities businesses, having spent more than 20 years leading equity derivatives teams and as a mergers and acquisitions analyst with The Goldman Sachs Group, Inc. and Credit Suisse AG, respectively, as well as founding and leading ALEX.fyi, a retirement solutions company, and ALEXIncome, a retirement consulting company. His experience developing and launching a new business venture provides valuable insight as the company pursues growth and establishes new business lines. Mr. Smith brings to the Board, along with the Nominating and Corporate Governance and Risk Committees, a deep understanding of risk management, finance and insurance markets. |

SKILLS | | |

| CEO/

Business Head | | Financial/

Investment | | Risk Management | | Corporate Governance/ Public Company Board |

| Industry | | Marketing | | Public Policy/

Regulatory | | Technology/

Information & Cybersecurity |

| Mergers and

Acquisitions/

Restructuring | | International | | | | |

| | | | | | | | |

| | |

PROFESSIONAL EXPERIENCE •Founder and CEO of ALEX.fyi, a retirement solutions company, since 2016 and founding partner of ALEXIncome, a retirement consulting company, since 2023 •Various positions at The Goldman Sachs Group, Inc. for two decades from 1995 to 2016, most recently as Managing Director, Equity Derivative Sales, Head of Insurance •Built out the Life Insurance business at The Goldman Sachs Group, Inc. from 2007 to 2016 •Analyst at Credit Suisse AG from 1990 to 1993 |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Active in philanthropic activities, including serving on the Board of Sponsors for Educational Opportunity since 2008 and previously serving for 6 years on the Board of Trustees at the Dalton School in New York City |

|

| | |

| Genworth Board of Directors |

|

Steven C. Van Wyk, 66, Independent Director

Former Group Chief Information Officer, HSBC Bank

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Committees: None Director Since:

March 2025 | QUALIFICATIONS Mr. Van Wyk provides almost 30 years of technology and cybersecurity experience, including his capacities at various international organizations. His extensive global leadership experience in structuring, building and improving technology organizations and operations, as well as significant accounting experience, will provide important insight to our Board. |

SKILLS | | |

| CEO/ Business Head | | Financial/ Investment | | Risk Management | | Corporate Governance/ Public Company Board |

| Industry | | Public Policy/ Regulatory | | Technology/

Information & Cybersecurity | | Mergers and

Acquisitions/

Restructuring |

| International | | | | | | |

| | | | | | | | |

| | |

PROFESSIONAL EXPERIENCE •Former Group Chief Information Officer of HSBC Bank from December 2020 to May 2024 •Chief Information Officer and Head of Technology & Innovation at PNC Financial Services Group, Inc. (PNC) from 2017 to 2020 •Chief Information Officer and Head of Operations at PNC from 2013 to 2017 •Certified Public Accountant (CPA), Certified Internal Auditor (CIA) and a Series 27 Financial/Operations Principal |

|

|

OTHER BOARD OR LEADERSHIP POSITIONS •Director, Reinsurance Group of America, Incorporated (NYSE: RGA), since 2019 (serving as chair of cybersecurity and technology) •Director, Bank of Nova Scotia (TXS: BNS, NYSE: BNS), since December 2024 (serving as chair of technology committee) •Chairman of the Board of the Banking Industry Architecture Network |

|

| | | | | |

28 | Genworth Financial, Inc. |

| | |

| Genworth Board of Directors |

|

Board’s Director Nominee Selection

Board Size

The number of directors of our company is fixed from time to time by a resolution adopted by our Board, but will not be less than one nor more than 15. Our Governance Principles state that the size of the Board should generally be in the range of seven to 15 directors and the actual size will be affected by practical considerations as the needs of the Board evolve over time. Our Board currently consists of ten members, nine of whom the Board has affirmatively determined are independent. Each of our current directors has been nominated by the Board to stand for election.

Each director elected by the holders of our common stock will serve until the 2026 Annual Meeting and until his or her successor is duly elected and qualified, or until the earlier of his or her resignation or removal in a manner provided for in the Bylaws.

We believe our Board benefits significantly from having members with, among other things, different characteristics, attributes, qualities, experiences, skills, and backgrounds. We believe the Board’s director nominees are a talented group of individuals with a variety of relevant qualities, experience, skills and professional backgrounds, as reflected in their biographies beginning on page 19.

Director Selection

Our Governance Committee oversees the director selection and nomination process by considering potential candidates and evaluating such candidates’ independence, qualities, experience and skills, including in the context of the full Board. In recommending the Board’s director nominees, our Governance Committee considers, among other things, the qualities, tenure, experience and skills discussed below and in Section 3 of our Governance Principles, which are available on our website: investor.genworth.com/corporate-governance/governance-documents. Our Governance Committee and Board believe that each of the Board’s director nominees possesses the core qualities discussed below and brings a unique set of qualities, experience and skills that are reflected below in the skills matrix.

Independence

In consultation with our Governance Committee, our Board assesses independence for each director when the director is first elected to the Board and annually thereafter for all director nominees.

For a director to be independent, the Board must determine that the director does not have any material relationship with Genworth either directly or as a partner, stockholder or officer of an organization that has a relationship with Genworth.

The Board has established guidelines to assist it in determining director independence, which conform to, or are more exacting than, the independence requirements in the applicable rules and listing standards of the NYSE. The independence guidelines are set forth in Section 6 of our Governance Principles, which are available on our website: investor.genworth.com/corporate-governance/governance-documents. The Board also will consider all relevant facts and circumstances in making an independence determination, and not merely from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation. Our Board has determined that the purchase of Genworth products and services on the same terms available to unaffiliated entities or persons does not impair a director’s independence and therefore such purchases are not considered by our Board when making independence determinations.

Our Board has determined that Sen. Conrad, Lt. Gen. Dyson, Ms. Goodman, Ms. Higgins, Mr. Mills, Mr. Restrepo, Ms. Sarsynski, Mr. Smith and Mr. Van Wyk satisfy the NYSE’s independence requirements and Genworth’s independence guidelines.

| | |

| Genworth Board of Directors |

|

Core Qualities

Our Board looks for directors who possess the following core qualities that the Board believes assist it in overseeing our operations and developing and pursuing our strategic objectives:

| | |

|

•highest personal and professional ethics, integrity and values; •commitment to representing the long-term interests of our stockholders; •inquisitive and objective perspective, practical wisdom and mature judgment; •a distinct skill set of value to the Board and the company when viewed alone and in combination with the skills of other directors; •willingness and ability to devote sufficient time to carrying out his or her duties and responsibilities effectively; and •commitment to serve on the Board for an extended period of time. |

|

Additional Qualities

In addition to the core qualities discussed above, the Board identifies certain key qualities, experience and skills, from time to time, that it believes are currently important to Genworth’s business, and therefore, significant to have represented on the Board as a whole.

These qualities, experience and skills are among the items considered by the Governance Committee in evaluating the Board’s director nominees. Each director nominee is not expected to possess every attribute – rather the attributes of each director nominee are considered in the context of the Board’s overall make-up of qualities, experience and skills. The blend of our directors’ qualities, experience and skills helps ensure that our Board is well-positioned to examine, address and provide oversight of the issues facing the company and its business. We believe that the Board’s director nominees have demonstrated leadership, sound judgment and integrity in a variety of positions across various professions and industries.

Skills Matrix

The skills matrix below is intended as a high-level summary and not an exhaustive list of each director’s skills or contributions to the Board. Additional information about each director nominee’s qualities, experience and skills can be found under Director Bios. Also summarized below is why these key qualities, experience and skills are important to the Board and Genworth’s business.

| | | | | |

30 | Genworth Financial, Inc. |

| | |

| Genworth Board of Directors |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | CEO/Business Head Provides leadership perspectives with practical understanding of organizations, operations, strategy and risk management. | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Financial/Investment Assists our directors in understanding and overseeing our financial reporting and internal controls, as well as evaluating our financial statements and investment strategy. | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Risk Management Provides critical perspectives for the Board’s role in overseeing the risks facing Genworth. | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Corporate Governance/Public Company Board Supports our goals of strong governance with Board and management accountability, transparency and protection of stockholder interests. | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Industry Provides insight on issues specific to our businesses within the financial services industry. | | | | | | | | | | |

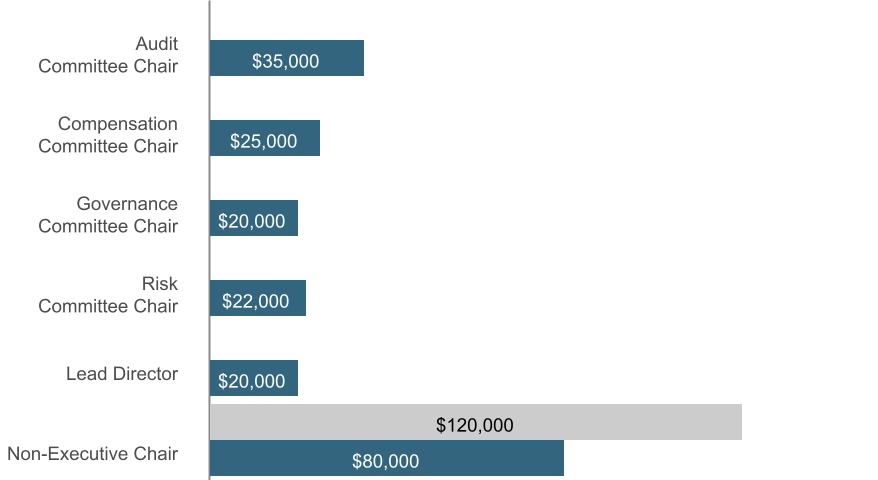

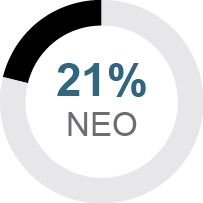

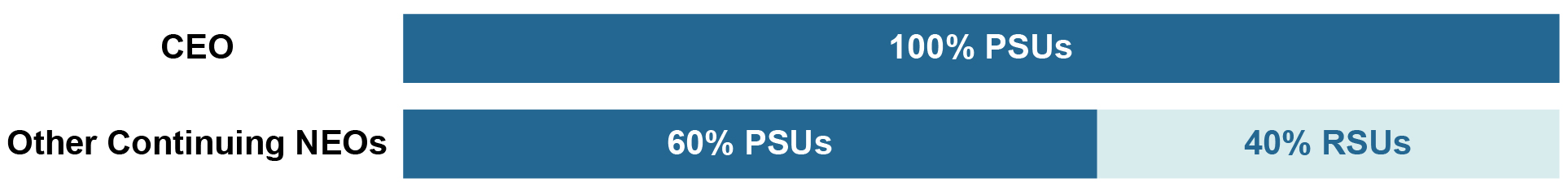

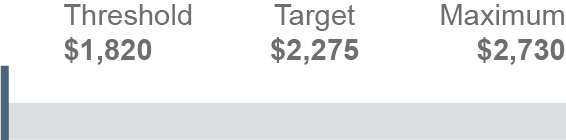

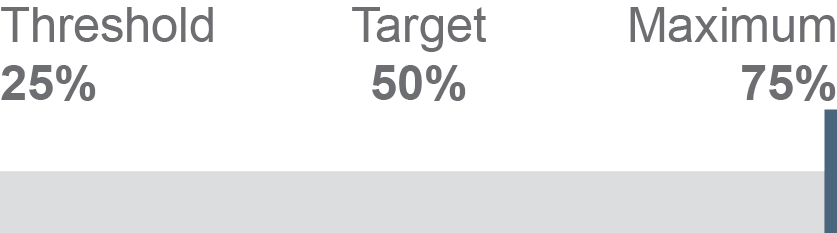

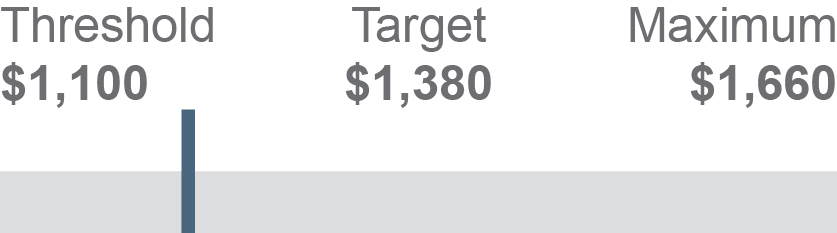

| | | | | | | | | | | |