UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Notice of 2023

Annual Meeting and

Proxy Statement

Genworth Financial, Inc.

| Our Purpose | Our Brands | ||

| To empower families to navigate the aging journey with confidence. | |||

| Our Vision | |||

| To be compassionate, experienced allies for those navigating care now and in the future, with guidance, products and services that meet families where they are in the aging journey. | |||

Letter to Our Stockholders

April 5, 2023 Dear Stockholder,

Melina Higgins Non-Executive Chair of the Board

The Board of Directors invites you to attend the 2023 Annual Meeting of Stockholders of Genworth Financial, Inc. (the 2023 Annual Meeting) to be held at 9 a.m. E.T on May 18, 2023. The Annual Meeting will include a report on our business operations, discussion, and voting on the matters set forth in the accompanying Notice of 2023 Annual Meeting of Stockholders and Proxy Statement, and discussion and voting on any other business matters properly brought before the meeting. As in prior years, the Board of Directors has elected to hold a virtual-only Annual Meeting to facilitate stockholder attendance by enabling stockholders to participate from any location and at no cost. The virtual meeting provides similar opportunities for participation as if the meeting were held in person. We are pleased that the virtual format of our last three annual meetings has enabled increased stockholder engagement in this important process. You will be able to attend the meeting online, vote your shares electronically, and submit questions before or during the meeting via www.virtualshareholdermeeting.com/GNW2023. Whether or not you plan to attend the 2023 Annual Meeting, you can ensure your shares are represented at the meeting by promptly submitting your proxy by telephone, by internet or by completing, signing, dating, and returning your WHITE proxy card. Strategic Achievements in 2022 2022 was a year in which we made significant progress against our five strategic priorities as we entered a new phase for the company. By the end of 2022, we successfully reduced holding company debt to our target level; worked toward maximizing the value of our subsidiary Enact Holdings, Inc. by meeting the conditions required to lift restrictions imposed by the government-sponsored enterprises (GSEs); returned capital to stockholders in the form of share repurchases; further executed on our multi-year long-term care insurance (LTC) rate action plan; and began building a foundation for growth with CareScout, our senior care services business. I want to thank Genworth associates, the management team, and my fellow directors for their efforts, which drove positive outcomes for our stockholders in 2022. |

Commitment to Strong Governance and Sustainable Business Practices As we build from a foundation of strength, we have maintained our unwavering focus on strong corporate governance and sustainable business practices. We are committed to maintaining a Board with a diverse set of skills and experiences that will continue to provide invaluable insights to management as it executes Genworth’s strategy. Importantly, our directors bring significant insurance and global financial services expertise to our Board at a critical time as we seek to help families and individuals navigate the aging journey. We also have deep risk management and regulatory experience on our Board, which are critical as the company continues to strengthen its balance sheet and engage with regulators in our work to bring the LTC in-force book to economic breakeven. And as we refine the strategy for growth, we benefit from the perspectives of several directors with experience in launching new business ventures and driving organic revenue growth, which will be crucial to the long-term success of CareScout. We have also taken measures to further align our long-term incentive compensation to company performance and stockholder value. In 2021, Genworth added a Total Shareholder Return metric to our compensation program, and in 2023 we have increased the weighting associated with that metric. The company furthered its commitment to sustainability in 2022, with continued focus on the wellbeing of our colleagues, communities, and climate. We adopted a Statement on Human Rights, made substantial progress in assessing our climate risk exposure while enhancing associated disclosures, and embraced new tools and processes that enable us to provide even greater support to our policyholders as they make decisions about their coverage and care options. 2022 was another very strong year contributing to Genworth’s transformation. I am incredibly pleased with Genworth’s progress and optimistic for our future as we continue to deliver on the company’s purpose to empower families to navigate the aging journey with confidence. Thank you for your continued support. Cordially,

Melina Higgins Non-Executive Chair of the Board

|

2023 Proxy Statement 1

Letter to Our Stockholders

Letter to Our Stockholders

April 5, 2023 Dear Stockholder,

Tom McInerney President, CEO and Director

2022 was an outstanding year for Genworth. We made significant progress on our strategic priorities and reported excellent financial results while delivering on our purpose – empowering families to navigate the aging journey with confidence. Genworth generated U.S. GAAP net income for the full year of $609 million and adjusted operating income of $633 million. These results were led by Enact, which contributed strong adjusted operating earnings to Genworth and ended the year with record insurance in force. Advancing Our Strategic Priorities I am very proud of the important strategic progress we made in 2022. In September, Genworth achieved a critical milestone when we paid off our remaining senior notes due in 2024, marking the achievement of our long-term holding company debt target of less than $1 billion. Genworth ended 2022 with holding company debt under $900 million, reflecting over $3 billion of debt retired since 2013, and putting the company in a stronger financial position. By reaching our holding company debt target, we were able to meet the financial conditions for removing the capital restrictions in 2022 placed on Enact by the GSEs. These restrictions were lifted in March of this year, positioning Enact for incremental growth and value creation. Genworth instituted a new share repurchase program in 2022, marking the first time the company has been able to return capital to stockholders in over 14 years. During 2022, we repurchased approximately $64 million worth of shares at an average price of $3.94 per share. In 2023, we repurchased approximately $36 million worth of shares through February 24th at an average price of $6.08 per share, leaving approximately $250 million remaining under our repurchase authorization. We plan to continue opportunistic repurchases in 2023. We drove strong momentum in our multi-year long-term care insurance (LTC) rate action plan, with a total of approximately $550 million in annual premium rate |

increase approvals achieved in 2022—a new record high for the company—which reduced the LTC premium gap by approximately $2.8 billion on a net present value (NPV) basis. This important work improves cash flow and reduces the liability associated with our legacy long term care insurance business while providing policyholders a range of options for managing rate increases to retain meaningful benefits. As of the end of 2022, the cumulative increase in NPV of future LTC premiums since 2012 was $23.5 billion—a significant component as we work to achieve economic breakeven on the legacy LTC business. Genworth also made progress on our future growth strategy with the development of our senior care services business under the CareScout brand, a crucial first step in our multiphase go-to-market strategy to drive sustainable long-term growth. Operating from a Position of Strength Taken together, these achievements improved Genworth’s financial strength and enabled us to enter 2023 with a solid foundation for the future, as reflected in the nearly 31% total shareholder return that Genworth delivered in 2022. This stockholder value improvement far exceeded returns in the S&P 500 Index and the S&P Insurance 600 Index over the same period. Further, the rating agencies recognized the substantial improvement in our credit profile progress throughout 2022, with credit ratings upgrades from each of the three major agencies. With improved flexibility, we intend to accelerate on share repurchases, subject to market conditions. Genworth stockholders should continue to benefit from strong cash flows from Enact, which have enabled us to achieve our strategic debt reduction and capital return milestones and should fuel our share repurchase program and long-term growth strategy. Welcoming New Leaders Looking ahead, we are confident in Genworth’s ability to create value for stockholders. Joining me in writing the company’s next chapter are two longtime Genworth leaders who have been appointed to new roles—Jerome Upton as our new Chief Financial Officer and Kelly Saltzgaber as our Chief Investment Officer. Jerome and Kelly have both played key roles in successfully transforming Genworth and achieving our financial objectives to date. I am pleased to collaborate with them in their new roles as we find ways to drive value for Genworth stockholders in 2023 and beyond. |

2 Genworth Financial, Inc.

Letter to Our Stockholders

Investing for the Future I am incredibly confident in Genworth’s future given what we have achieved to date. As we look ahead to 2023, we remain focused on solving the critical societal issue of access to affordable quality care for Americans as they age. We are applying Genworth’s unparalleled expertise in long-term care insurance to address this challenge. We have plans to roll out innovative senior care services and solutions over time that deliver value to new and existing customers while building a future growth engine for the benefit of our stockholders. |

We will also continue to prudently allocate capital from Enact across future growth initiatives and returns to stockholders—and we will maintain good stewardship of Genworth’s balance sheet and financial condition, ensuring the company remains on strong footing to address customer needs well into the future. I am highly confident we have the right team, skill sets, experience, and resources to deliver on our strategy and everyone at Genworth is laser focused on continuing to improve long-term value for our stockholders in 2023 and beyond. We appreciate your investment in Genworth as we strive to be compassionate, experienced allies for families navigating senior care now and in the future. Thank you very much,

Thomas J. McInerney President and Chief Executive Officer | |

2023 Proxy Statement 3

| Notice of 2023 Annual Meeting of Stockholders |  |

|

Date and Time Thursday, May 18, 2023, at 9:00 a.m. ET | |

|

Meeting Access www.virtualshareholder meeting.com/GNW2023 Using your 16-digit control number included on your WHITE proxy card or notice | |

|

Who Can Vote Stockholders of record at the close of business on March 20, 2023 |

How to Vote

|

Internet www.proxyvote.com | |

|

Telephone 1-800-579-1639 | |

|

E-mail sendmaterial@ proxyvote.com | |

|

Mail You can vote by mail by requesting a paper copy of the materials, which will include a WHITE proxy card. |

Voting Items

| Proposals | Board Vote

Recommendation |

For Further Details | ||||

| 1. | Election of Nine Directors |  |

FOR each of the Board’s nominees |  Page 14 Page 14 | ||

| 2. | Advisory Vote to Approve Named Executive Officer Compensation |  |

FOR |  Page 45 Page 45 | ||

| 3. | Advisory Vote to Approve the Frequency of the Advisory Vote to Approve Named Executive Officer Compensation |  |

1 YEAR |  Page 90 Page 90 | ||

| 4. | Ratification of the Selection of KPMG LLP as the Independent Registered Public Accounting Firm for 2023 |  |

FOR |  Page 91 Page 91 | ||

Stockholders will also discuss and vote on such other business as may properly come before the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”) or any adjournment thereof.

4 Genworth Financial, Inc.

In accordance with the U.S. Securities and Exchange Commission rule, we are furnishing this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2022 (“2022 Annual Report”) to many of our stockholders solely over the Internet. We believe that posting these materials on the Internet enables us to provide stockholders with the information that they need more quickly. In addition, it lowers our costs of printing and delivering these materials, and reduces the environmental impact of our 2023 Annual Meeting. The Notice of Internet Availability of Proxy Materials sent to many of our stockholders explains how to access the proxy materials online, vote online and obtain a paper copy of our proxy materials.

On February 13, 2023, Mr. Scott Klarquist provided the company with notice of his intent to nominate himself as a candidate for election to the company’s Board of Directors at the 2023 Annual Meeting. The accompanying WHITE proxy card is not a universal proxy card and Mr. Klarquist is not listed thereon because the company did not receive the notice required under Rule 14a-19 under the Securities Exchange Act of 1934, as amended, from any person intending to solicit proxies in support of Mr. Klarquist by the deadline for such notice pursuant to Rule 14a-19. The Board of Directors unanimously recommends that you vote FOR each of the Board’s director nominees to be elected and vote in accordance with the Board’s recommendations on each other proposal before the 2023 Annual Meeting, as described in the Proxy Statement and the accompanying WHITE proxy card.

We urge stockholders to participate in the 2023 Annual Meeting. Stockholders may vote by telephone, through the Internet or by mailing your completed and signed WHITE proxy card (or voting instruction form, if you hold your shares through a broker, bank or other nominee). Each share of Class A Common Stock issued and outstanding as of the record date is entitled to one vote on each matter to be voted upon at our 2023 Annual Meeting. Your vote is important and we urge you to vote.

This Notice, the Proxy Statement and WHITE proxy card are first being made available or mailed to stockholders on or about April 5, 2023.

Cordially,

Michael J. McCullough

Corporate Secretary

| Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Stockholders to be Held on May 18, 2023 Genworth’s Notice of 2023 Annual Meeting of Stockholders, Proxy Statement and 2022 Annual Report are Available, Free of Charge, at: www.proxyvote.com |

2023 Proxy Statement 5

Table of Contents

| Certain statements in this proxy statement, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may appear throughout this report. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements, including the risks and uncertainties set forth in our 2022 Annual Report for the year ended December 31, 2022. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. |

6 Genworth Financial, Inc.

Proxy Summary

This summary highlights information about Genworth Financial, Inc. (the “company,” “Genworth,” “we,” “our” and “us”) and certain information contained elsewhere in this proxy statement (“Proxy Statement”) for Genworth’s 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”). We also make reference to our subsidiary, Enact Holdings, Inc. (formerly known as U.S. Mortgage Insurance) (“Enact”). This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Genworth in 2022

2022 Strategic Priorities

● Reduce parent holding company debt to ~$1B ● Maximize the value of Enact to Genworth stockholders ● Return capital to stockholders |

● Achieve economic breakeven/ stabilize legacy Long-Term Care block ● Advance Global Care Solutions initiatives under CareScout brand |

|

See pages 12-13 for a summary discussion of targets linked to executive officer compensation in 2022 |

2022 Performance Highlights by Business Area

U.S. Life Insurance

| ● | Exceeded our internal targets for in-force rate action approvals and premium rate actions filed on our legacy blocks of long-term care insurance (“LTC”) in execution of our multi-year rate action plan. |

| ● | Did not achieve our targets with respect to Genworth Life Insurance Company (“GLIC”) combined statutory net income and consolidated Risk Based Capital (“RBC”) for the year due primarily to headwinds in the macro-economic environment. |

| ● | Implemented LTC litigation settlements which advance our progress towards economic breakeven, enhanced risk management on LTC, made significant progress on the implementation of new accounting guidance related to the recognition and measurement of long-duration insurance contracts, commonly known as Long-Duration Targeted Improvements (“LDTI”), and enhanced associate engagement objectives with a focus on succession and diversity. |

| ● | Supported the advancement of the CareScout preferred provider network and care navigation services to existing LTC policyholders. |

Enact Holdings, Inc.

| ● | Exceeded financial objectives, including its targets for adjusted operating income and adjusted return on equity (“ROE”). |

| ● | Exceeded strategic objectives through effective loss management and strong capital management. |

Corporate and Other

| ● | Authorized $350 million share repurchase program. Repurchased $64 million worth of outstanding shares at a price less than $4 per share in 2022. Milestone marked the first-time capital has been returned to the stockholders in over 14 years. |

| ● | Reduced outstanding holding company debt to under $900 million thus achieving the long-term holding company debt target of $1 billion or less. |

| ● | Achieved compliance with the Government-Sponsored Enterprise (“GSE”) leverage and interest coverage restrictions as of year end 2022. |

| ● | Received multiple rating agency upgrades confirming the financial strength and flexibility of the holding company. |

| ● | Advanced the strategy to drive future growth through our new senior care services business under the CareScout brand. |

2023 Proxy Statement 7

Proxy Summary

Sustainability: Caring for the Future

Building on our foundation of robust governance practices, we strive to create long-term value for our key stakeholders – executing with competence, compassion, and care.

We invite you to review our 2022 Sustainability Report for more information about how we are Creating a Sustainable Future Built on Compassion and Care.

|

Caring about the Culture Respecting the Dignity of Each Individual: We adopted a Statement on Human Rights to convey our commitment to the wellbeing of each human being. Advancing Diversity, Equity, and Inclusion: We continue to advance diversity, equity, and inclusion (“DEI”) in the workplace with intentional efforts to create a culture that strengthens collaboration, promotes innovative thinking, and allows every employee to thrive. In 2022, we partnered with an external vendor to launch our company wide Inclusion for All training, which 98% of our employees completed. In addition, our thirteen (13) cultural and demographic-based Employee Resource Groups (“ERGs”) connect employees with others who have similar interests or experiences and help to foster a sense of inclusion, value, and respect. Beyond our internal DEI efforts, we contributed over $249,000, along with other resources, to support non-profit organizations that are advancing initiatives to enable more inclusive communities. |

|||

|

Caring about the Community Embracing A Care-Centered Philanthropic Platform: We are committed to active and meaningful community engagement to support health, vitality, and economic empowerment. In 2022, our primary areas of philanthropic focus included Healthy Aging and Caregiving, Senior Affordable Housing and Homelessness, and Sustainability. Encouraging Work Outside Our Walls: The Genworth Foundation awarded grants and other funding totaling nearly $1 million in 2022. Our foundation also contributed over $404,000 in matching gifts, employee volunteer rewards, and other service donations (over $35,000 of which was attributed to engagement by Enact employees). Including matching gifts, Genworth employees donated nearly $1 million to non-profit organizations globally (over $104,000 attributable to Enact employees) and volunteered close to 3,300 hours. In addition, Genworth contributed almost $900,000 in sponsorships to organizations that align with our philanthropic focus areas. |

|||

|

Caring about the Climate Assessing Climate Risk: Genworth has engaged in both qualitative and quantitative analyses to assess climate risk exposure and again achieved a “B” (Management) score on our 2022 CDP (Carbon Disclosure Project) submission (reflecting efforts and initiatives undertaken in 2021). Investing Purposefully and Responsibly: We understand that sustainability begins with our fiduciary responsibility to honor the promises to our policyholders. Accordingly, we pursue investment opportunities that we deem supportive of environmental, social and governance (“ESG”) considerations yet also fall within our core investment parameters and provide sustainable market returns. As of December 31, 2022, Genworth held more than $430 million in green, social, sustainability, and sustainability-linked bonds, with more than $240 million of investment in hydro, wind, solar, and energy-efficiency projects. |

8 Genworth Financial, Inc.

Proxy Summary

Human Capital Management

Genworth is committed to helping families become more financially secure, self-reliant, and prepared for the future – and that philosophy isn’t just towards our customers; it extends to our employees too. At Genworth, we take a holistic approach to human capital management practices, from attracting and retaining talent with comprehensive benefits and compensation packages, to professional development and learning opportunities, to dedicated resources for fostering an equitable and inclusive environment, to our sincere commitment to community service and involvement.

| ● | We believe our compensation package, including salary, incentive bonus, and long-term incentives, aligns employee and stockholder interests, as well as rewards our employees for serving all of our current and future policyholders. |

| ● | In addition to a competitive compensation program, we also offer our employees benefits such as life and health (medical, dental & vision) insurance, paid time off, paid parental leave, financial planning, and a 401(k) plan. |

| ● | To further support our employees, we continue to provide additional financial, health and wellbeing resources, as well as a flexible work schedule to allow employees additional time for selfcare and the care of family members. We currently are operating under a hybrid approach organizationally, allowing employees to choose whether to work from home or in the office, with some teams working a few days a week in the office. |

| ● | We offer a multitude of professional development enrichment courses, whether on leadership and professional skills training or industry-specific matters, as well as tuition reimbursement benefits to aide career progression. |

| ● | Our cultural and demographic-based employee resource groups (“ERGs”) help to build an inclusive culture through company-wide events, participation in our recruitment efforts, and input into our hiring strategies. We continue to focus on building a pipeline for talent to create more opportunities for workplace diversity and to support greater representation within the company. |

| ● | We champion civic engagement through paid volunteer time for our employees, our event sponsorship program, employee-directed charitable gifts through the Genworth Foundation, and our commitment to environmental sustainability. |

As of December 31, 2022, we employed approximately 2,500 full-time and part-time employees. None of our employees are subject to a collective bargaining agreement.

2023 Proxy Statement 9

Item 1 Election of Nine Directors |

|

The Board recommends a vote FOR

each of the Board’s director nominees. The Board recommends a vote FOR

each of the Board’s director nominees. |

See

page 14 See

page 14 |

Our Director Nominees

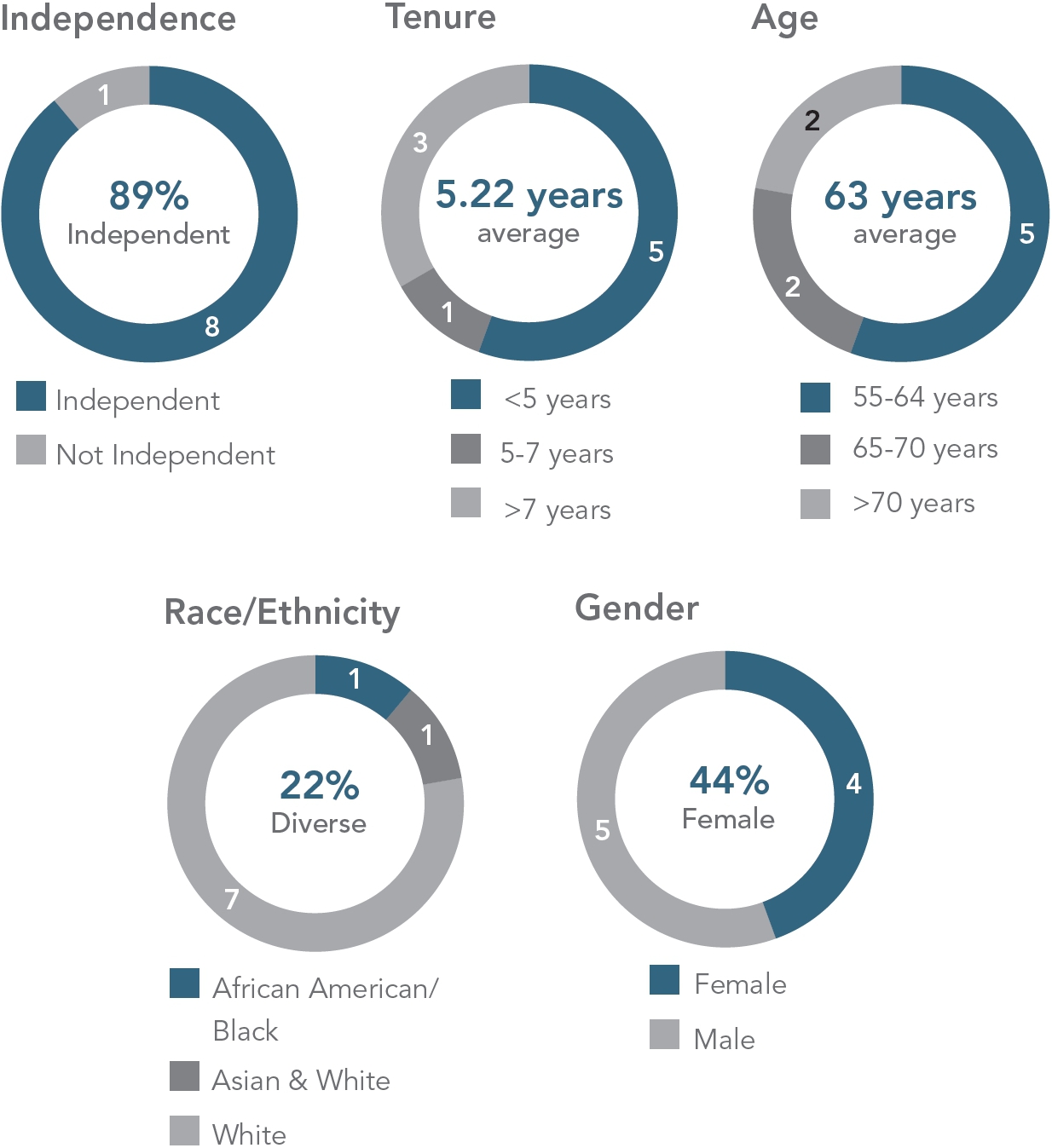

The table below sets forth information about our director nominees, each of whom is an incumbent member of the Genworth Board of Directors (the “Board”). The Board has determined that eight of the nine nominees of the Board are independent directors under the New York Stock Exchange (“NYSE”) listing requirements and our Governance Principles.

| Director | Other Public Company |

Committee Membership | |||||||||

| Name and Primary Occupation | Age | Since | Boards | A | COMP | NOM | R | ||||

|

G.

Kent Conrad Former U.S. Senator |

75 | 2013 | 0 |  |

|

|

| |||

|

Karen

E. Dyson Lieutenant General, U.S. Army, Retired |

63 | 2020 | 0 |  |

|

|

| |||

|

Jill

R. Goodman Managing Director, Foros Advisors LLC |

56 | 2021 | 1 |  |

|

|

| |||

|

Melina

E. Higgins* Former Partner, The Goldman Sachs Group, Inc. |

55 | 2013 | 1 |  |

|

|

| |||

|

Thomas

J. McInerney President and Chief Executive Officer, Genworth Financial, Inc. |

66 | 2013 | 1 |  |

|

|

| |||

|

Howard

D. Mills, III Executive Vice President of Business Development and External Affairs, beeXact |

58 | 2021 | 0 |  |

|

|

| |||

|

Robert

P. Restrepo Jr. Former Chairman and President and Chief Executive Officer, State Auto Financial Corporation |

72 | 2016 | 2 |  |

|

|

| |||

|

Elaine

A. Sarsynski Former Chairwoman, Chief Executive Officer and President, Mass Mutual International |

67 | 2022 | 3 |  |

|

|

| |||

|

Ramsey

D. Smith Founder and Chief Executive Officer, ALEX.fyi |

55 | 2021 | 0 |  |

|

|

| |||

| * | Non-Executive Chair of the Board |

| A Audit |  |

Chair |

| COMP Management Development and Compensation |  |

Member |

| NOM Nominating and Corporate Governance | ||

| R Risk |

10 Genworth Financial, Inc.

Proxy Summary

| Board’s

Director Nominee Attributes |

Board’s

Director Nominee Skills | |

|

|

| Governance Highlights/Best Practices | ||

| Board Independence and Composition | Board Performance | |

|

● Non-Executive Chair of Board ● 50% of Committee Chairs Stockholder Rights

|

Policies, Programs and Guidelines

| |

2023 Proxy Statement 11

Proxy Summary

Item 2 Advisory Vote to Approve Named Executive Officer Compensation | |

The Board recommends a vote FOR this proposal. The Board recommends a vote FOR this proposal. |

See

page 45 See

page 45 |

Executive Compensation Highlights

Compensation Program Features

Our 2022 annual executive compensation program consisted of the following key elements: base salary, annual incentive, and annual long-term incentive grants (which includes performance stock units (“PSUs”) and restricted stock units (“RSUs”)). A significant portion of target executive compensation is completely at risk.

2022 CEO Target Compensation

2022 Other NEO Target Compensation

12 Genworth Financial, Inc.

Proxy Summary

Funding Outcomes for Incentive Programs

Genworth met or exceeded key financial and non-financial objectives for 2022 across its business portfolio. These results were achieved amidst an often uncertain and dynamic macro-economic environment and have directly impacted our named executive officer compensation, as follows:

| Payout Funding | Results Summary | |||||

| Key Annual Incentive Financial Objectives |  |

Above

Target |

The Enact mortgage insurance business exceeded goals for adjusted operating income and adjusted return on equity The U.S. Life Insurance business surpassed its 2022 multi-year LTC premium rate action plans Investments income, purchase yields, and impairments performance all exceeded targets | |||

| Key Annual Incentive Non-Financial Objectives |  |

Above Target |

The U.S. Life Insurance Businesses exceeded targets for successful management of LTC in-force non-financial priorities Capital Management Program results exceeded targets due to strong holding company debt reduction and the initiation of a stock repurchase program | |||

| Long-Term Financial Objectives |  |

Above

Target |

Our 2020-2022 PSU awards payout was driven by strong Enact mortgage insurance performance and LTC in-force rate action approvals |

Item 3 Advisory Vote on the Frequency of the Advisory Vote to Approve Named Executive Officer Compensation | |

The Board

recommends a vote FOR an annual advisory vote to approve named executive officer compensation The Board

recommends a vote FOR an annual advisory vote to approve named executive officer compensation |

See

page 90 See

page 90 |

Item 4 Ratification of the Selection of KPMG LLP as the Independent Registered Public Accounting Firm for 2023 | |

The

Board recommends a vote FOR this proposal. The

Board recommends a vote FOR this proposal. |

See

page 91 See

page 91 |

2023 Proxy Statement 13

Genworth Board of Directors

Proposal 1 Election of Nine Directors |

Currently, nine directors serve on our Board, the terms for whom all expire at the 2023 Annual Meeting. At the 2023 Annual Meeting, nine directors are to be elected to hold office until the 2024 Annual Meeting of Stockholders and until their successors have been duly elected and qualified or until the earlier of their resignation or removal in a manner provided for in the Bylaws. Working through its Governance Committee, our Board continually evaluates the optimal size for the Board and will continue to evaluate Board composition.

The Board’s nine nominees for election at the 2023 Annual Meeting are listed on pages 15-23 with brief biographies, a list of their current committee memberships and descriptions of their qualifications and skills to serve as our directors. See the Board of Directors and Committees—Board Composition section below for a description of how our directors’ blend of backgrounds benefits our company. The Board has determined that eight of the nine nominees are independent directors under the NYSE listing requirements and our Governance Principles, which are discussed below in the Corporate Governance section.

On February 13, 2023, Mr. Scott Klarquist provided the company with notice of his intent to nominate himself as a candidate for election to the Board at the 2023 Annual Meeting. The accompanying WHITE proxy card is not a universal proxy card and Mr. Klarquist is not listed thereon because the company did not receive the notice required under Rule 14a-19 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), from any person intending to solicit proxies in support of Mr. Klarquist by the deadline for such notice pursuant to Rule 14a-19 under the Exchange Act.

Sen. Conrad, Lt. Gen. Dyson, Ms. Goodman, Ms. Higgins, Mr. McInerney, Mr. Mills, Mr. Restrepo, Ms. Sarsynski and Mr. Smith have been nominated by our Board to be elected by holders of our common stock at the 2023 Annual Meeting. We are not aware of any reason why any Board nominee would be unable to serve as a director. If a nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of any other person that our Board may nominate as a substitute.

The

Board recommends that stockholders vote FOR the election of Sen. Conrad, Lt. Gen. Dyson, Ms. Goodman, Ms. Higgins, Mr. McInerney,

Mr. Mills, Mr. Restrepo, Ms. Sarsynski and Mr. Smith. The

Board recommends that stockholders vote FOR the election of Sen. Conrad, Lt. Gen. Dyson, Ms. Goodman, Ms. Higgins, Mr. McInerney,

Mr. Mills, Mr. Restrepo, Ms. Sarsynski and Mr. Smith. |

14 Genworth Financial, Inc.

Genworth Board of Directors

Board’s Nominees

Director Bios

G. Kent Conrad Former U.S. Senator |

|||

|

|

BACKGROUND

Sen. Conrad served as a U.S. Senator representing the State of North Dakota from January 1987 to January 2013. He served as Chairman or Ranking Member of the Senate Budget Committee for 12 years. Prior to serving in the U.S. Senate, Sen. Conrad served as the Tax Commissioner for the State of North Dakota from 1981 to 1986 and as Assistant Tax Commissioner from 1974 to 1980. Sen. Conrad currently serves as a Strategic Advisor to Molina Healthcare, as co-chair of the Economic Advisory Committee for American Edge, as a member of the board of directors of the Committee for a Responsible Federal Budget, and as a Senior Fellow for The Bipartisan Policy Center. Sen. Conrad received an A.B. in Political Science from Stanford University and an M.B.A. from George Washington University. |

QUALIFICATIONS

Sen. Conrad served 26 years as a U.S. Senator for North Dakota, including as Chairman or Ranking Member on the Senate Budget Committee for 12 years. Sen. Conrad brings to the Board extensive knowledge of and insights into public policy, fiscal affairs, government relations and regulatory affairs. Sen. Conrad’s formidable experience in both Federal and State government positions brings a valuable perspective to his role as Chair of the Nominating and Corporate Governance Committee, as well as the Board’s handling of governance, risk, and regulatory issues, and the company’s engagement with regulators on certain public policy issues. SKILLS

| |

|

Committees: Nominating Age: 75 Director Since: March 2013

| |||

2023 Proxy Statement 15

Genworth Board of Directors

Karen E. Dyson Lieutenant General, U.S. Army, Retired |

|||

|

|

BACKGROUND

Lt. Gen. Dyson was the first female finance officer to achieve three-star general officer rank in August 2014. She retired as Military Deputy to the Assistant Secretary of the Army for Financial Management and Comptroller in August 2017. During her career she led efforts building, executing and reporting on the Army’s multi-appropriation budget; commanded units and led troops in war operations; and led strategic transformation initiatives. Lt. Gen. Dyson is a strategic leader with board experience in corporate governance, finance and audit committees, risk oversight and management development and compensation. She currently serves on the boards of USAA Federal Savings Bank since October 2017 (serving as nominations and governance committee chair); CALIBRE Systems, Inc. since October 2018 (serving as audit committee chair); and Army Emergency Relief Organization since 2020. Lt. Gen. Dyson received a B.S. in Business Management from Missouri State University, an M.B.A. from Austin Peay State University and an M.S. in National Resource Strategy from the Eisenhower School of National Security and Resources Strategy. Lt. Gen. Dyson is National Association of Corporate Directors (NACD) Directorship Certified. |

QUALIFICATIONS

Lt. Gen. Karen Dyson is a qualified financial expert, whose distinguished military career spanned more than 35 years. Lt. Gen. Dyson served as Military Deputy to the Assistant Secretary of the Army for Financial Management and Comptroller, which is the highest military position within that office. Her extensive financial management experience and her service as a director for private companies provide the Board with critical insight into corporate financials, macroeconomic trends and risk mitigation. Her background in financial oversight, talent development, and succession planning in the U.S. Army, along with her development of the framework for the Army’s first ever financial statements audit, position her well to serve on the Audit Committee and Chair the Management Development and Compensation Committee. SKILLS

| |

|

Committee: Audit, Age: 63 Director Since:

| |||

16 Genworth Financial, Inc.

Genworth Board of Directors

Jill R. Goodman Managing Director, Foros Advisors LLC |

|||

|

|

BACKGROUND

Ms. Goodman is currently Managing Director of Foros Advisors LLC, a strategic financial and mergers and acquisitions advisory firm, a position she has held since November 2013. Ms. Goodman advises companies and special committees with regard to mergers and acquisitions. Previously, she served as a Managing Director and Head, Special Committee and Fiduciary Practice—U.S. at Rothschild from 2010 to October 2013. From 1998 to 2010, Ms. Goodman was with Lazard in the Mergers & Acquisitions and Strategic Advisory Group, most recently as Managing Director. Ms. Goodman has served as a director of Cboe Global Markets, a leading provider of trading, clearing and investment solutions to market participants around the world, since 2012 (serving as finance and strategy chair and as a member of the executive and nominating and governance committees). She has also served as a director of Cover Genius, a private global insurance technology company, since February 2022. Ms. Goodman graduated magna cum laude from Rice University with a B.A. degree. She received her J.D. degree, with honors, from the University of Chicago Law School. |

QUALIFICATIONS

Ms. Goodman has a distinguished background in strategic advisory work, with more than 25 years of experience advising corporations on mergers and acquisitions, capital structure and restructuring. As a result of these experiences, she has a sharp understanding of how to assess organic business plans and create and execute concrete plans to enhance long-term value creation. Given her particular expertise in complex corporate governance matters and long history in the boardroom as both a director and advisor, she is a valuable member of both the Nominating and Corporate Governance and Management Development and Compensation Committees. SKILLS

| |

|

Committees: Management Age: 56 Director Since:

| |||

2023 Proxy Statement 17

Genworth Board of Directors

Melina E. Higgins Former Partner, The Goldman Sachs Group |

|||

|

|

BACKGROUND

Ms. Higgins retired in 2010 from a nearly 20-year career at The Goldman Sachs Group, Inc., where she served as a Managing Director from 2001 and a Partner from 2002. During her tenure at Goldman Sachs, Ms. Higgins served as Head of the Americas for Private Debt and Co-Chairperson of the Investment Advisory Committee for the GS Mezzanine Partners funds. She also served as a member of the Investment Committee for the Principal Investment Area, which oversaw and approved global private equity and private debt investments. Goldman’s Principal Investment Area was one of the largest alternative asset managers in the world. Ms. Higgins has served as a director of Viatris Inc. since November 2020 (serving as compensation committee chair, finance committee chair, and as a member of the executive committee and governance and nominating committee). She previously served on the boards of Mylan N.V. from February 2013 to November 2020 and NextGen Acquisition Corp. II from March 2021 to December 2021. Ms. Higgins has also served as Non-Executive Chair of the board of Antares Midco, Inc. since January 2016 and is a member of the Women’s Leadership Board of Harvard University’s John F. Kennedy School of Government. Ms. Higgins received a B.A. in Economics and Spanish from Colgate University and an M.B.A. from Harvard Business School. |

QUALIFICATIONS

Ms. Higgins is a qualified financial expert and has extensive financial services and investment experience. Having spent nearly 20 years building and leading a successful investment business at Goldman Sachs, Ms. Higgins is well-versed in portfolio management, assessing market risks and building businesses. As Genworth pursues future growth opportunities, Ms. Higgins’ skills and her extensive experience on numerous public and private boards, as well as her current or previous positions on all of Genworth’s standing Board committees, are valuable in her role as Board Chair and as a member of the Audit and Management Development and Compensation Committees. SKILLS

| |

|

Committees: Audit, Age: 55 Director Since: Non-Executive Chair of the

| |||

18 Genworth Financial, Inc.

Genworth Board of Directors

Thomas J. McInerney President and Chief Executive Officer, Genworth Financial, Inc. |

|||

|

BACKGROUND

Mr. McInerney has been our President and Chief Executive Officer and a director since January 2013. Before joining our company, Mr. McInerney had served as a Senior Advisor to the Boston Consulting Group from June 2011 to December 2012, providing consulting and advisory services to leading insurance and financial services companies in the United States and Canada. From October 2009 to December 2010, Mr. McInerney was a member of ING Groep’s Management Board for Insurance, where he was the Chief Operating Officer of ING’s insurance and investment management business worldwide. Prior to that, he served in a variety of senior roles with ING Groep NV after serving in many leadership positions with Aetna, where he began his career as an insurance underwriter in June 1978. Mr. McInerney has served as a director of Enact Holdings, Inc., a majority-owned subsidiary of Genworth, since its IPO in September 2021. He is also on the boards of Virginia Learns, Reves International Center at William & Mary and VA Ready, where he serves as Chair of the Board. Mr. McInerney is a member of the American Council of Life Insurers and serves, and has served, on its CEO Steering Committees and Board. Mr. McInerney received a B.A. in Economics with Honors from Colgate University and an M.B.A. from the Tuck School of Business at Dartmouth College. |

QUALIFICATIONS

Mr. McInerney currently serves as President and Chief Executive Officer of Genworth and is a member of its Board. Mr. McInerney brings to his roles extensive knowledge of the insurance and financial services industries through his more than 40 years of experience, including previous roles at ING Groep NV, Aetna and Boston Consulting Group. Mr. McInerney began his career with Aetna, ultimately becoming President of Aetna Financial Services (AFS) which was acquired by ING. Mr. McInerney later served as Chairman and Chief Executive Officer of ING Insurance Americas. Mr. McInerney’s broad operating experience over many decades leading complex global insurance businesses provides Genworth with sage insights into navigating market dynamics, establishing new business lines and leading organizations through significant change.

SKILLS

| |

Committees: None Age: 66 Director Since:

| |||

2023 Proxy Statement 19

Genworth Board of Directors

Howard D. Mills, III Executive Vice President of Business Development and External Affairs, beeXact |

|||

|

|

BACKGROUND

Mr. Mills is currently Executive Vice President of Business Development and External Affairs of beeXact, a geospatial data management/EngineeringTech company that designs and permits fiber optic networks. He also currently serves as a Senior Advisor to McKinsey & Company, where he advises boards and executives on in the areas of regulatory and reputational risk, executive positioning, strategy, environmental, social, and governance (ESG) matters, financial communications, crisis management, mergers and acquisitions and public policy. Mr. Mills had a 12-year career at Deloitte LLP, where he served as Managing Director and Global Insurance Regulatory Leader from 2007 to May 2019. During his tenure at Deloitte, Mr. Mills served Deloitte’s largest U.S. and global insurance clients. Prior to his management consulting career, Mr. Mills was the Superintendent of the New York State Insurance Department from 2005 to 2006. Mr. Mills served three terms in the New York State Assembly from 1999 to 2004, where he was an active member of the National Council of Insurance Legislators. Mr. Mills has served as a director of The Doctors Company since May 2019, the largest physician-owned medical liability insurer in the U.S. (serving as a member of the audit committee). Mr. Mills previously served on the board of directors of Ensight, a cloud-based insurance sales platform, from June 2019 to January 2022. Mr. Mills currently serves as President and a Director of the Insurance Federation of New York and as a Trustee of The Institutes Griffith Insurance Education Foundation. Mr. Mills received a B.A. in political science from Marist College and an M.A. in public administration from The American University. Mr. Mills is a NACD Governance Fellow. |

QUALIFICATIONS

Mr. Mills has extensive experience leading global insurance regulatory functions for both private and government entities, including at Deloitte as Global Insurance Regulatory Leader and as Superintendent of the New York State Insurance Department. During his tenure as Superintendent, Mr. Mills worked closely with insurance companies to advance critical regulations aimed at strengthening risk-based examinations. Mr. Mills brings to the Nominating and Corporate Governance and Risk Committees a keen understanding of state insurance regulatory frameworks and agencies, as well as various aspects of risk preparedness, including enterprise risk and strategic risk.

SKILLS

| |

|

Committees: Nominating Age: 58 Director Since:

| |||

20 Genworth Financial, Inc.

Genworth Board of Directors

Robert P. Restrepo Jr. Former Chairman and President and Chief Executive Officer, State Auto Financial Corporation Services, Inc. | |||

|

BACKGROUND

Mr. Restrepo retired from State Auto Financial Corporation in 2015, having served as its Chairman from 2006 to December 2015 and as its President and Chief Executive Officer from 2006 to May 2015. Mr. Restrepo has over 40 years of insurance industry experience, having held executive roles at Main Street America Group, Hanover Insurance Group Inc. (formerly Allmerica Financial Corp), Travelers and Aetna. Mr. Restrepo has served as a director of RLI Corp., a property and casualty insurance company, since July 2016 (serving as a member of the human capital and compensation and strategy and risk committees) and of Enact Holdings, Inc., a majority-owned subsidiary of Genworth, since its IPO in September 2021 (serving as a member of the audit and nominating and corporate governance committees). Mr. Restrepo also currently serves on the board of directors of The Larry H. Miller Group of Companies. He also previously served as a director of Majesco, a provider of insurance software and consulting services, from August 2015 to September 2020. Mr. Restrepo received a B.A. in English from Yale University. Mr. Restrepo is NACD Directorship Certified and has obtained the Professional Director - Public Company credential from the American College of Corporate Directors. |

QUALIFICATIONS

Mr. Restrepo is a qualified financial expert and has more than 40 years of insurance, finance and risk management experience as the Chairman, President and Chief Executive Officer of the State Automobile Insurance Companies, along with various roles at several of the country’s leading insurers. Mr. Restrepo brings to the Board deep knowledge of and perspective on leading corporate governance, organizational management, strategic planning and risk mitigation. His extensive experience leading large insurance companies is vital to his role as Chair of the Audit Committee, as well as his service on the Management Development and Compensation Committee.

SKILLS

| |

|

Committees: Audit (Chair), Age: 72 Director Since:

| |||

2023 Proxy Statement 21

Genworth Board of Directors

Elaine A. Sarsynski Former Chairwoman, Chief Executive Officer and President, Mass Mutual International | |||

|

|

BACKGROUND

Ms. Sarsynski was Chairwoman, Chief Executive Officer and President of MassMutual International, an insurance company, until her retirement in 2017. She joined Mass Mutual Life Insurance Company in 2005 as Managing Director at Babson Capital Management LLC, a MassMutual subsidiary. She became Executive Vice President, Chief Administrative Officer, Chief Executive Officer and President of MassMutual International in 2006 and Executive Vice President, member of the Office of the Chief Executive Officer and President of MassMutual Retirement Services, as well as Chairwoman of MassMutual International, in 2008. Prior to joining Babson Capital, she served two elected terms as First Selectman for the town of Suffield, Connecticut. In 1998, she founded Sun Consulting Group LLC, offering consulting services to the real estate industry. Ms. Sarsynski previously spent 17 years at Aetna where she held multiple senior management positions overseeing segments of the company’s Investments Division and leading the Corporate Finance Department. She currently serves on the board of directors of TI Fluid Systems PLC, Horizon Technology Finance Corporation and Horace Mann Educators Corporation. Ms. Sarsynski previously served on the Board of Directors of AXA S.A. from 2018 to 2021. Ms. Sarsynski received a B.A. from Smith College and an M.B.A. from Columbia University. |

QUALIFICATIONS

Ms. Sarsynski is a qualified financial expert and has extensive experience as both an executive and Director at certain of the nation’s largest insurance companies, including MassMutual and Aetna. In her decades of service at both public and private companies, she has led strategic turnarounds for global businesses and overseen significant growth across business units and geographies. Ms. Sarsynski provides the Board with strong experience in financial services, insurance, compliance, risk management, operations, investments and real estate. These experiences position her well to Chair the Risk Committee and serve on the Audit Committee.

SKILLS

| |

|

Committees: Audit, Risk Age: 67 Director Since:

| |||

22 Genworth Financial, Inc.

Genworth Board of Directors

Ramsey D. Smith Founder and Chief Executive Officer, ALEX.fyi |

|||

|

|

BACKGROUND

Mr. Smith is the founder and CEO of ALEX.fyi, a retirement solutions company. Before founding ALEX.fyi in 2016, Mr. Smith spent over two decades at Goldman Sachs, most recently as Managing Director, Equity Derivative Sales, Head of Insurance. Mr. Smith built out the Life Insurance business at Goldman Sachs from 2007 to 2016. Prior to his tenure at Goldman Sachs, Mr. Smith worked as an analyst at Credit Suisse from 1990 to 1993. Mr. Smith is active in philanthropic activities, including serving on the Board of Sponsors for Educational Opportunity. Mr. Smith received an A.B. degree in Romance Languages and Literature from Princeton University and an M.B.A. from Harvard Business School. |

QUALIFICATIONS

Mr. Smith has extensive experience in securities and annuities businesses, having spent more than 20 years leading Equity Derivatives teams and as a mergers and acquisitions analyst with Goldman Sachs and Credit Suisse, respectively, as well as founding and leading ALEX.fyi, a retirement solutions company. His experience developing and launching a new business venture provides valuable insight as the company pursues growth and establishes new business lines. Mr. Smith brings to the Board, along with the Nominating and Corporate Governance and Risk Committees, a deep understanding of risk management, finance and insurance markets.

SKILLS

| |

|

Committees: Nominating Age: 55 Director Since:

| |||

2023 Proxy Statement 23

Genworth Board of Directors

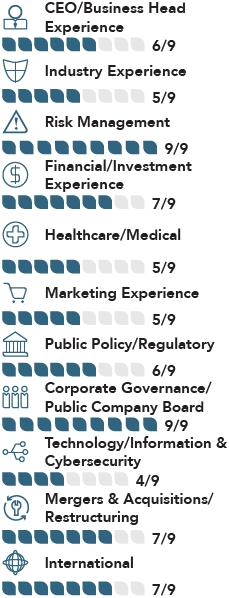

Board’s Director Nominee Skills Matrix

Our Board is composed of individuals with diverse experience at policy-making levels in business and government in areas that are relevant to the company. All of the Board’s director nominees meet the qualifications and possess the qualities and skills outlined in the How We Select Our Directors section. In addition, each director was nominated on the basis of the unique set of qualifications and skills he or she brings to the Board, as well as how those qualifications and skills blend with those of the other directors on the Board as a whole. The blend of our directors’ diverse backgrounds ensures that issues facing the company are examined and addressed with the benefit of a broad array of perspectives and expertise.

We believe that the Board’s director nominees have demonstrated leadership, sound judgment and integrity in a variety of positions across various professions and industries. The Board has identified key experiences, qualifications and skills that are important to be represented on the Board as a whole and were among the items considered by the Governance Committee in evaluating the director nominees. Each director nominee is not expected to possess every attribute - rather the attributes of each director nominee are considered in the context of the Board’s overall make-up of experiences, qualifications and skills. The skills matrix below is intended as a high-level summary and not an exhaustive list of each director’s skills or contributions to the Board. It also summarizes why these key experiences, qualifications and skills are important to the Board and Genworth’s business.

|

|

|

|

|

|

|

|

| ||

|

CEO/Business Head Experience – Provides leadership perspectives with practical understanding of organizations, operations, strategy, and risk management. |  |

|

|

|

|

| |||

|

Industry Experience – Provides insight on issues specific to our businesses within the financial services industry. |  |

|

|

|

| ||||

|

Risk Management – Provides critical perspectives for the Board’s role in overseeing the risks facing Genworth. |  |

|

|

|

|

|

|

|

|

|

Financial/Investment Experience – Assists our directors in understanding and overseeing our financial reporting and internal controls, as well as evaluating our financial statements and investment strategy. |  |

|

|

|

|

|

| ||

|

Healthcare/Medical – Assists our directors in understanding and reviewing our business and strategy. |  |

|

|

|

|

||||

|

Marketing Experience – Relevant to Genworth as it seeks to identify and develop new markets for its financial products and services. |  |

|

|

|

| ||||

|

Public Policy/Regulatory – Provides valuable insight and guidance to Genworth to help navigate governmental and regulatory actions that impact our businesses. |  |

|

|

|

|

|

|||

|

Corporate Governance/Public Company Board – Supports our goals of strong governance with Board and management accountability, transparency and protection of stockholder interests. |  |

|

|

|

|

|

|

|

|

|

Technology/Information & Cybersecurity – Provides relevant insight as Genworth looks for ways to enhance the customer experience and internal operations and oversee technology/information & cybersecurity risk. |  |

|

|

| |||||

|

Mergers and Acquisition/Restructuring – Provides experience to assist Genworth with a practical understanding of developing, implementing and assessing our operating plan and business strategy. |  |

|

|

|

|

|

| ||

|

International – Provides helpful perspectives as Genworth evaluates growing our businesses outside of the United States. |  |

|

|

|

|

|

|

24 Genworth Financial, Inc.

Genworth Board of Directors

How We Select Our Directors

The Governance Committee recommends director candidates to the Board for election, and our Board nominates director candidates and makes voting recommendations to our stockholders.

Director Recruitment Priorities

In addition to considering candidates suggested by stockholders, the Governance Committee considers potential candidates recommended by current directors, company officers, employees and others. We have also historically engaged an outside search firm to assist us in identifying and evaluating potential director candidates.

The Governance Committee believes all director nominees should meet certain qualifications and possess certain qualities or skills that, when considered in light of the qualities and skills of the other director nominees, assist the Board in overseeing our operations and developing and pursuing our strategic objectives.

The Governance Committee believes each director nominee should at a minimum:

● possess the highest personal and professional ethics, integrity and values;

● be committed to representing the long-term interests of our stockholders;

● have an inquisitive and objective perspective, practical wisdom and mature judgment;

● bring a distinct skill set of value to the Board and the company when viewed alone and in combination with other directors;

● be willing and able to devote sufficient time to carrying out his or her duties and responsibilities effectively; and

● be committed to serve on the Board for an extended period of time.

Commitment to Board Diversity

The Governance Committee endeavors to have a board representing diverse experience at policy-making and in other areas that are relevant to the company’s businesses. When deciding whether to renominate a director for election, the Governance Committee and the Board also consider the director’s tenure in the context of the overall mix of tenures of Board members. The qualifications, qualities and skills required for directors are further set forth in Section 3 of Genworth’s Governance Principles, which are available on our website.

The Board also believes that Board diversity is important to serving the long-term interests of stockholders. The Governance Committee, as a matter of practice, takes diversity factors into account when considering potential director nominees and actively seeks to achieve a diversity of occupational and personal backgrounds, viewpoints, education and skills on the Board, including diversity with respect to demographics such as gender, race, ethnicity, national origin and age.

Director Candidate Recommendations

The Governance Committee will consider all stockholder recommendations for candidates to the Board, which should be sent to:

Nominating and Corporate Governance Committee c/o Corporate Secretary |

2023 Proxy Statement 25

Genworth Board of Directors

Selection Process Highlights

The Governance Committee considers all potential candidates regardless of the source of the recommendation and determines whether potential candidates meet our qualifications, qualities and skills for directors. Where there is an interest in a particular candidate, the Governance Committee’s evaluation is multi-faceted and typically includes:

26 Genworth Financial, Inc.

Genworth Board of Directors

Director Independence

Our Board currently consists of nine directors, eight of whom are independent (as defined by our Governance Principles and NYSE listing standards) and one of whom is our CEO, Mr. McInerney. For a director to be independent, the Board must determine that the director does not have any material relationship with Genworth either directly or as a partner, stockholder or officer of an organization that has a relationship with Genworth. The Board has established guidelines to assist it in determining director independence, which conform to, or are more exacting than, the independence requirements in the applicable rules and listing standards of the NYSE. The independence guidelines are set forth in Section 4 of our Governance Principles, which are available on our website: www.genworth.com. In addition to applying these guidelines, the Board will consider all relevant facts and circumstances in making an independence determination. Our Board has determined that the purchase of Genworth products and services on the same terms available to unaffiliated entities or persons does not impair a director’s independence and therefore such purchases are not considered by our Board when making independence determinations. The Board has determined that:

| Sen. Conrad, Lt. Gen. Dyson, Ms. Goodman, Ms. Higgins, Mr. Mills, Mr. Restrepo, Ms. Sarsynski and Mr. Smith satisfy the NYSE’s independence requirements and Genworth’s independence guidelines. |

In addition to the independence guidelines discussed above, members of the Audit Committee must satisfy additional independence requirements established by the Securities and Exchange Commission (“SEC”) and the NYSE. Specifically, they may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from Genworth or any of its subsidiaries other than their directors’ compensation and they may not be affiliated with Genworth or any of its subsidiaries. Notwithstanding the foregoing, a director of both Genworth and an affiliate of Genworth who otherwise satisfies the independence requirements may serve on the audit committee pursuant to the exemption provided in Rule 10A-3 under the Exchange Act. The Board has determined that:

| All of the current members of the Audit Committee satisfy the relevant SEC and NYSE independence requirements. |

Further, in affirmatively determining the independence of any director who will serve on the Management Development and Compensation Committee (the “Compensation Committee”), the Board also considers all factors specifically relevant to determining whether a director has a relationship to Genworth that is material to that director’s ability to be independent from management in connection with the duties of a member of the Compensation Committee, including: (1) the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by Genworth to such director; and (2) whether the director is affiliated with Genworth, its subsidiaries or its affiliates. The Board has determined that:

| All of the current members of the Compensation Committee satisfy the relevant SEC and NYSE independence requirements. |

2023 Proxy Statement 27

Corporate Governance at Genworth

Board Overview and Governance Principles

Our Governance Principles are published on Genworth’s website, as are our other corporate governance materials, including the charters adopted by the Board for each of our standing committees and any key practices adopted by the committees. To view these materials, visit our website: www.genworth.com. The Board regularly reviews corporate governance developments and may modify these principles, charters and key practices as warranted. Any modifications will be reflected in the documents on Genworth’s website.

Board Composition

The number of directors of our company is fixed from time to time by a resolution adopted by our Board, but will not be less than one nor more than 15. Our Governance Principles state that the size of the Board should be in the range of seven to 15 directors. Our Board has set the size of the Board at nine members.

Each director elected by the holders of our common stock will serve until the 2024 Annual Meeting and until his or her successor is duly elected and qualified, or until the earlier of their resignation or removal in a manner provided for in the Bylaws. The holders of our common stock do not have cumulative voting rights in the election of directors.

We believe the Board’s director nominees are a talented group of individuals with a variety of relevant qualifications, skillsets and professional backgrounds, as reflected in their biographies beginning on page 15. We believe our Board benefits significantly from this diversity of experience, as well as the tenure, racial/ ethnic and gender diversity of its members.

Board Leadership Structure

Our Board functions in a collaborative fashion that emphasizes active participation and leadership by all of its members. Our Bylaws require our Board to appoint a Chair of the Board but give it the flexibility to appoint as Chair (i) our CEO, (ii) an independent director or (iii) a non-independent director other than the CEO. Our Board determines who to appoint as our Chair based on the knowledge and experience of the people then serving on our Board and as CEO and chooses the person whom it believes best meets the needs of our company and our stockholders at that time. In May 2021, our Board selected Ms. Higgins, one of our independent directors since 2013, to serve as our Non-Executive Chair of the Board due to Ms. Higgins’ service with and knowledge of our company and her significant leadership experience. Ms. Higgins is a qualified financial expert and has broad financial services and investment experience. In addition, she has extensive experience on numerous public and private company boards and during her tenure on our Board has served on each of the Board’s standing committees. Our Board has determined that having Thomas J. McInerney serve as our CEO and a director and Melina E. Higgins serve as our Non-Executive Chair of the Board is the appropriate leadership structure for our company at this time.

28 Genworth Financial, Inc.

Corporate Governance at Genworth

Role of the Non-Executive Chair of the Board

As more fully set forth in our Governance Principles, available on our website: www.genworth.com, the Non-Executive Chair’s responsibilities and authority include:

Responsibilities of the Non-Executive Chair include:

● presiding at all meetings of the Board, stockholders and non-management and independent directors;

● facilitating efficient Board operations through regular engagement with standing committees of the Board and individual directors;

● regularly communicating with the CEO to provide him or her with advice and counsel, and to share information about recent developments;

● serving as a liaison between the CEO and the non-management and independent directors;

● consulting on meeting agendas;

● working with management to assure that meeting materials are fulfilling the needs of directors;

● consulting on the meeting calendar and meeting schedules to assure there is sufficient time to discuss all agenda items;

● periodically calling meetings of the non-management and independent directors, including at the request of such directors;

● working with the CEO to respond to stockholder inquiries involving the Board; and

● fulfilling other responsibilities as determined by the Board.

Meetings of Non-Management and Independent Directors

All of our current non-management directors are independent (as determined in accordance with the NYSE listing standards and our Governance Principles) and our non-management directors met without management present at regularly scheduled Board meetings during 2022, as provided in our Governance Principles. Mr. McInerney, our CEO, is currently the only employee of the company who serves on our Board. In addition, our Governance Principles provide that if the non-management directors include individuals who are not independent, as determined in accordance with the NYSE listing standards and our Governance Principles, then the independent directors on our Board will separately meet at least one time each year. Our Governance Principles provide that the Non-Executive Chair of the Board, currently Ms. Higgins, will preside at the meetings of the non-management directors and the independent directors; in the absence of Ms. Higgins, the non-management directors present will select an independent committee chair to preside at such session. The independent Non-Executive Chair of the Board may periodically call meetings of the non-management and independent directors, including at the request of the non-management or independent directors.

2023 Proxy Statement 29

Corporate Governance at Genworth

Meeting Attendance

Directors are expected to attend the annual meeting of stockholders and all scheduled Board meetings and meetings of the committees on which they serve. During 2022, our Board held 8 meetings. Each of our then current directors attended more than 75% of the aggregate of (1) the total number of meetings of the Board (held during the period for which he or she served as a director) and (2) the total number of meetings held by all committees of the Board on which he or she served (during the periods that he or she served). All of our current directors attended the 2022 Annual Meeting of Stockholders (the “2022 Annual Meeting”). As set forth in the Governance Principles, directors are expected to attend the 2023 Annual Meeting.

| 8 Board Meetings in 2022 | 2022 Director Meeting Attendance | |

● All directors attended the 2022 Annual Meeting ● All directors attended >75% of Board and Committee Meetings |

Board Responsibilities

Board Oversight of Strategy

The business of Genworth is conducted by its employees, managers and officers, under the direction of its CEO and the oversight of the Board, to enhance the long-term value of Genworth and its stockholders. The Board is elected by the stockholders to oversee management and to assure that the long-term interests of the stockholders are being served. Specifically, the Board reviews, monitors and, where appropriate, approves fundamental financial and business strategies and major corporate actions. The Board reviews and evaluates Genworth’s strategy at each regularly scheduled meeting and frequently engages with management and outside advisors regarding the competitive landscape, regulatory environment, operational challenges and opportunities, and strategic alternatives to ensure Genworth pursues and makes progress on its strategic plan.

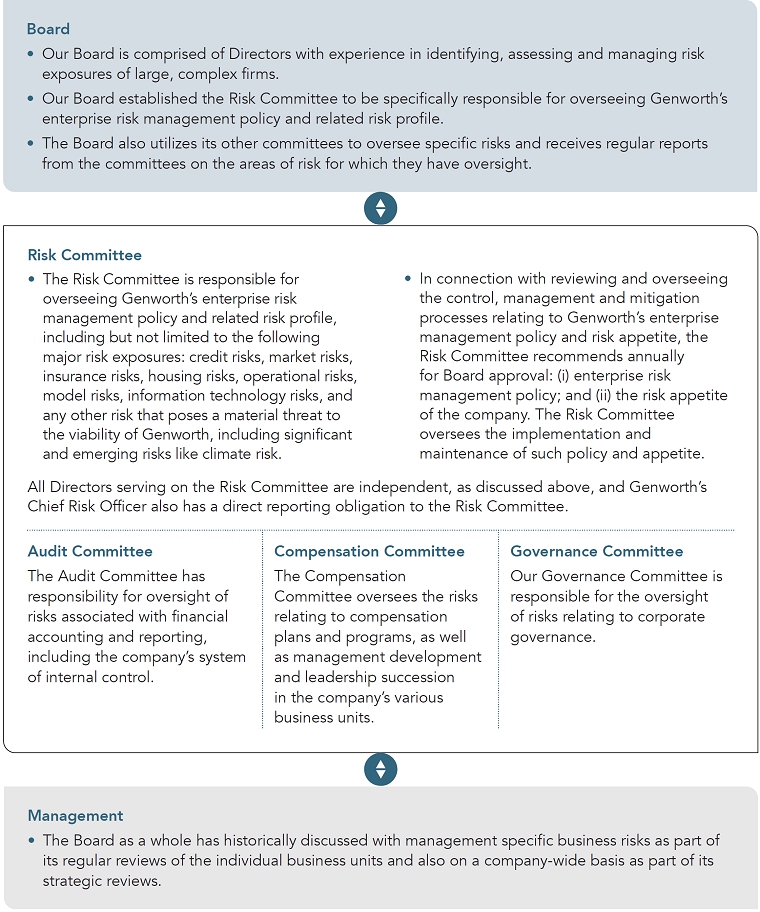

Board Oversight of Risk

Our Board recognizes that, although risk management is primarily the responsibility of Genworth’s management, the Board plays a critical role in the oversight of risk. As a financial services company, the very nature of our business involves the underwriting, management and assumption of risks on behalf of our customers. The Board believes it is an important part of its responsibilities to oversee the company’s overall risk assessment processes and management thereof.

30 Genworth Financial, Inc.

Corporate Governance at Genworth

Below is a high-level summary of the key responsibilities and roles for Board oversight of risk at Genworth.

2023 Proxy Statement 31

Corporate Governance at Genworth

Spotlight on Cybersecurity Risk

Genworth recognizes the significant operational risk, including risk of losses, from cyberattacks and the importance of a strong cybersecurity program for effective risk management. Our Board recognizes the importance of maintaining the privacy and security of customer information, as well as the availability of our systems and consequently dedicates meaningful time and attention to oversight of cybersecurity risk. In light of these risks, our Board is actively engaged in the oversight of our Company’s Information Security and Information Technology (“IT”) Risk Program, which includes periodic briefings on cybersecurity threats and participation in cybersecurity preparedness exercises.

The Risk Committee has primary responsibility for cybersecurity oversight. In this capacity, the Risk Committee oversees the Company’s processes for identifying, assessing and managing technology and cybersecurity risk. Our program employs various controls and policies to secure our operations and information which includes monitoring, reporting, managing, and remediating cybersecurity threats. Key features of the program include access controls, security training, dedicated security personnel, security event monitoring, and when necessary, consultation with third-party data security experts. Additionally, we have procedures set forth for reporting and responding to potential security incidents as well as determining applicable disclosure requirements. At least annually, the Board reviews and discusses our Information Security Program and IT Risk Management Program.

Genworth’s Chief Information Security Officer and Chief Risk Officer, both members of management, support the cybersecurity risk oversight responsibilities of the Board and its committees and involve applicable management personnel in cybersecurity risk management. The Risk Committee receives periodic reports from the Chief Information Security Officer and Chief Risk Officer on the Company’s technology and cybersecurity risk profile, Information Security Program, and key cybersecurity initiatives. Additionally, the Chief Information Security Officer and Chief Risk Officer follow a risk-based escalation process to notify the Risk Committee outside of the regular reporting cycle when they identify potential substantive risks or issues.

Board Committees

The four standing committees of the Board are the Audit Committee, Compensation Committee, Governance Committee and Risk Committee. Our Board may also establish various other standing or special committees as required or appropriate for purposes of executing any delegated responsibilities from the Board.

The Board has established written charters for each of its four standing committees. Each Committee’s responsibilities are more fully set forth in its charter, which can be found in the corporate governance section of our website: www.genworth.com.

The four standing committees of the Board are described below.

32 Genworth Financial, Inc.

Corporate Governance at Genworth

Audit Committee

The purpose of the Audit Committee is to assist the Board in its oversight of the integrity and compliance of the company’s financial statements, of the independence, qualifications and performance of the independent auditor, and of the performance of the company’s internal audit function.

MEMBERS

Robert P. Restrepo Jr. (Chair)

Karen E. Dyson

Melina E. Higgins

Elaine A. Sarsynski |

PRINCIPAL RESPONSIBILITIES The Audit Committee’s responsibilities include: ● discussing with management and our auditor our annual and quarterly financial statements, earnings releases and financial information and earnings guidance provided to analysts and rating agencies; ● recommending the annual audited financial statements be included in the Annual Report on Form 10-K; ● reviewing reports regarding any significant deficiencies or material weaknesses in internal controls, as well as reports regarding any fraud that involves management or other employees who have a significant role in the company’s internal controls; ● selecting our independent registered public accounting firm and approving the terms of its engagement; ● reviewing and discussing with management and our independent registered accounting firm, as appropriate, critical audit matters as well as any other matters required to be discussed under applicable regulations, including any audit problems or difficulties and management’s response; ● overseeing the company’s compliance with legal and regulatory requirements relating to the company’s financial statements; |