|

Genworth Investor Update May 9, 2022 ©2022 Genworth Financial, Inc. All rights reserved.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Genworth Financial, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On May 10, 2022, Genworth Financial, Inc. (the “Company”) released an investor presentation. A copy of the presentation can be found below.

|

Genworth Investor Update May 9, 2022 ©2022 Genworth Financial, Inc. All rights reserved.

|

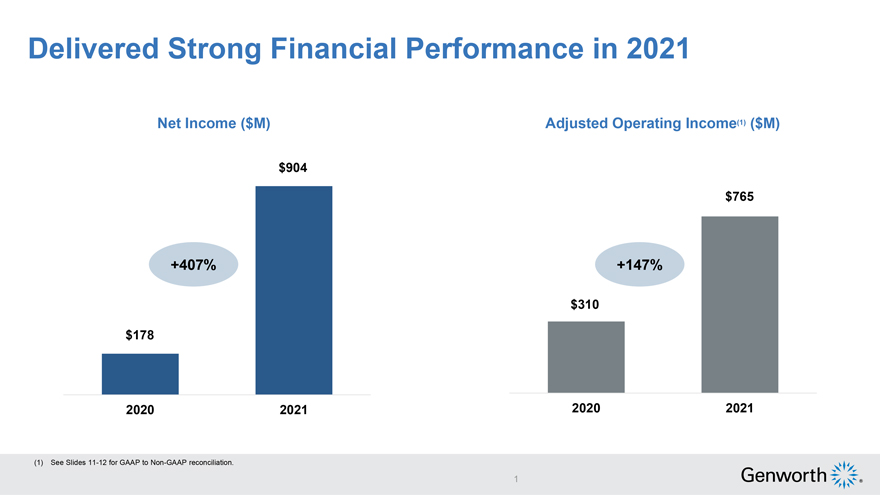

Delivered Strong Financial Performance in 2021 Net Income ($M) Adjusted Operating Income(1) ($M) $904 $765 +407% +147% $310 $178 2020 2021 2020 2021 (1) See Slides 11-12 for GAAP to Non-GAAP reconciliation. 1

|

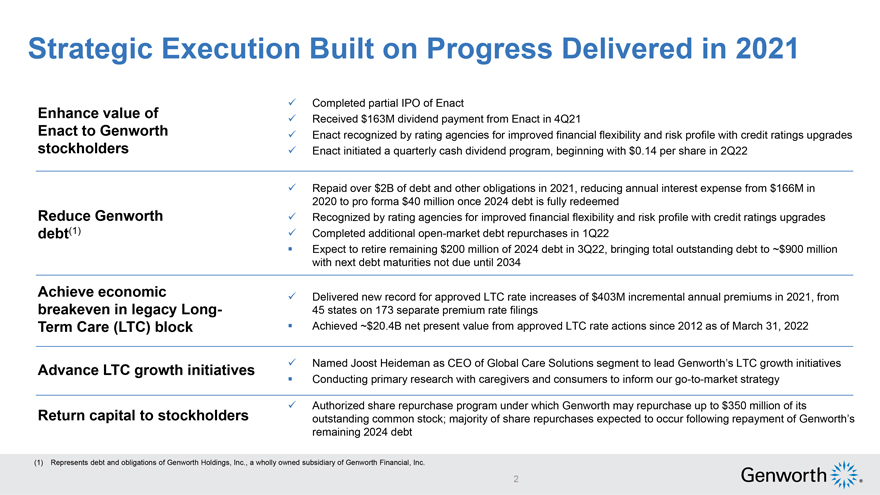

Strategic Execution Built on Progress Delivered in 2021  Completed partial IPO of Enact Enhance value of  Received $163M dividend payment from Enact in 4Q21 Enact to Genworth  Enact recognized by rating agencies for improved financial flexibility and risk profile with credit ratings upgrades stockholders Enact initiated a quarterly cash dividend program, beginning with $0.14 per share in 2Q22  Repaid over $2B of debt and other obligations in 2021, reducing annual interest expense from $166M in Reduce Genworth 2020 to pro forma $40 million once 2024 debt is fully redeemed Recognized by rating agencies for improved financial flexibility and risk profile with credit ratings upgrades debt(1) Completed additional open-market debt repurchases in 1Q22ï,§ Expect to retire remaining $200 million of 2024 debt in 3Q22, bringing total outstanding debt to ~$900 million with next debt maturities not due until 2034 Achieve economic  Delivered new record for approved LTC rate increases of $403M incremental annual premiums in 2021, from breakeven in legacy Long- 45 states on 173 separate premium rate filings Term Care (LTC) blockï,§ Achieved ~$20.4B net present value from approved LTC rate actions since 2012 as of March 31, 2022 Advance LTC growth initiatives Named Joost Heideman as CEO of Global Care Solutions segment to lead Genworth’s LTC growth initiatives ï,§ Conducting primary research with caregivers and consumers to inform our go-to-market strategy  Authorized share repurchase program under which Genworth may repurchase up to $350 million of its Return capital to stockholders outstanding common stock; majority of share repurchases expected to occur following repayment of Genworth’s remaining 2024 debt (1) Represents debt and obligations of Genworth Holdings, Inc., a wholly owned subsidiary of Genworth Financial, Inc. 2

|

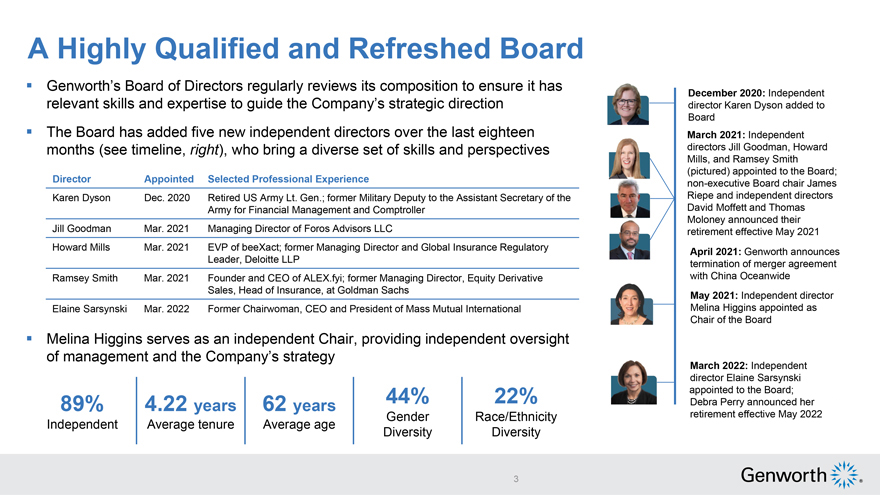

A Highly Qualified and Refreshed Board Genworth’s Board of Directors regularly reviews its composition to ensure it has • December 2020: Independent relevant skills and expertise to guide the Company’s strategic direction director Karen Dyson added to Board The Board has added five new independent directors over the last eighteen • March 2021: Independent months (see timeline, right), who bring a diverse set of skills and perspectives directors Jill Goodman, Howard Mills, and Ramsey Smith (pictured) appointed to the Board; Director Appointed Selected Professional Experience non-executive Board chair James Karen Dyson Dec. 2020 Retired US Army Lt. Gen.; former Military Deputy to the Assistant Secretary of the Riepe and independent directors Army for Financial Management and Comptroller David Moffett and Thomas Moloney announced their Jill Goodman Mar. 2021 Managing Director of Foros Advisors LLC retirement effective May 2021 Howard Mills Mar. 2021 EVP of beeXact; former Managing Director and Global Insurance Regulatory Leader, Deloitte LLP • April 2021: Genworth announces termination of merger agreement Ramsey Smith Mar. 2021 Founder and CEO of ALEX.fyi; former Managing Director, Equity Derivative with China Oceanwide Sales, Head of Insurance, at Goldman Sachs May 2021: • Independent director Elaine Sarsynski Mar. 2022 Former Chairwoman, CEO and President of Mass Mutual International Melina Higgins appointed as Chair of the Board Melina Higgins serves as an independent Chair, providing independent oversight of management and the Company’s strategy • March 2022: Independent director Elaine Sarsynski 44% 22% (pictured) appointed to the Board; 89% 4.22 years 62 years Debra Perry announced her Gender Race/Ethnicity retirement effective May 2022 Independent Average tenure Average age Diversity Diversity 3

|

An Experienced and Independent Management Development and Compensation Committee The Management Development and Compensation Committee (the “Compensation Committee”) oversees executive compensation and succession planning All members are highly qualified, independent directors with the right skills, experience, and judgment—gained from leadership at the policy-making levels of business and government and other public company director service—to oversee an effective compensation program aligned with Genworth’s strategic objectives and stockholder value Director since December 2020 Karen E. Dyson Retired US Army Lt. Gen.; former Military Deputy to the Assistant Secretary of the Army for Financial Management Committee Chair and Comptroller; Deputy Assistant Secretary of the Army for Budget; and Deputy for Business Transformation to the Assistant Secretary of the Army Director since March 2021 Jill R. Goodman Managing Director of Foros Advisors LLC; former Managing Director and Head, Special Committee and Fiduciary Practice—U.S. at Rothchild; and Managing Director at Lazard Director of Cboe Global Markets (BATS: CBOE) since 2012 Director since September 2013; Chair of the Board since May 2021 Melina E. Higgins Former Partner at Goldman Sachs, including service as Head of the Americas for Private Debt and Co-Chairperson of the Investment Advisory Committee for the GS Mezzanine Partners funds Director of Viatris Inc. (Nasdaq: VTRS) since 2020, where she chairs its Compensation Committee Director since December 2016 Robert P. Restrepo Jr. Former Chairman, President and CEO of State Auto Financial Corporation Services, Inc. Director of RLI Corp. (NYSE: RLI) since 2016, where he serves on its Human Capital and Compensation Committee, and Enact Holdings Inc. (Nasdaq: ACT) since 2021 4

|

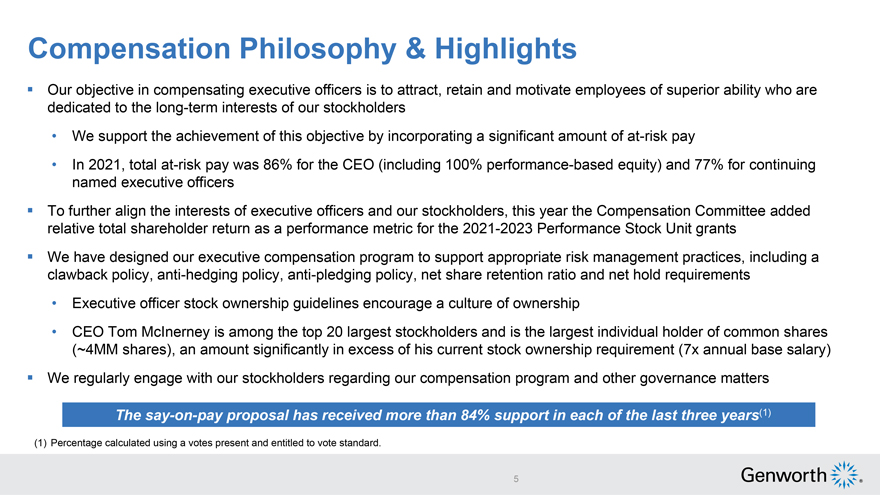

Compensation Philosophy & Highlights ï,§ Our objective in compensating executive officers is to attract, retain and motivate employees of superior ability who are dedicated to the long-term interests of our stockholders • We support the achievement of this objective by incorporating a significant amount of at-risk pay • In 2021, total at-risk pay was 86% for the CEO (including 100% performance-based equity) and 77% for continuing named executive officers ï,§ To further align the interests of executive officers and our stockholders, this year the Compensation Committee added relative total shareholder return as a performance metric for the 2021-2023 Performance Stock Unit grantsï,§ We have designed our executive compensation program to support appropriate risk management practices, including a clawback policy, anti-hedging policy, anti-pledging policy, net share retention ratio and net hold requirements • Executive officer stock ownership guidelines encourage a culture of ownership • CEO Tom McInerney is among the top 20 largest stockholders and is the largest individual holder of common shares (~4MM shares), an amount significantly in excess of his current stock ownership requirement (7x annual base salary)ï,§ We regularly engage with our stockholders regarding our compensation program and other governance matters The say-on-pay proposal has received more than 84% support in each of the last three years(1) (1) Percentage calculated using a votes present and entitled to vote standard. 5

|

Design of Compensation Program ï,§ The Compensation Committee typically utilizes a combination of publicly available information related to a specific list of peer companies (the “Peer Group”), as well as information available through market compensation surveysï,§ The Compensation Committee engages an independent third-party compensation consultant every year to facilitate a more informed decision-making process and objective perspective. The independent compensation consultant proposed the Peer Group used for evaluating 2021 executive compensation decisions. ï,§ The Peer Group is intended to represent other complex insurance companies with revenue sources and talent demands similar to Genworthï,§ We use distinct financial measures for the annual incentive and long-term incentive programs, with goals that are based on our business objectives at the time the goals are approved o These measures include adjusted operating income (loss), incremental premiums approved for LTC in-force rate actions, operating income metrics, and consolidated risk-based capital targets Proxy advisors ISS and Glass Lewis recommend voting FOR Genworth’s executive compensation program 6

|

Genworth CEO Compensation In Line with Best Practices ï,§ The 2021 annual incentive award to our CEO Tom McInerney was tied to financial and strategic measures that support the creation of long-term value. Mr. McInerney’s approved 2021 incentive award was ~150% of his targeted amount due to strong financial performance and strategic execution. ï,§ McInerney’s long-term incentive award is 100% performance-based, consisting of Performance Stock Units (PSU) tied to multi-year performance targets Total CEO Target Compensation 14% Base Salary 58% 86% Total PSUs At-Risk Pay 28% Annual Incentive 7

|

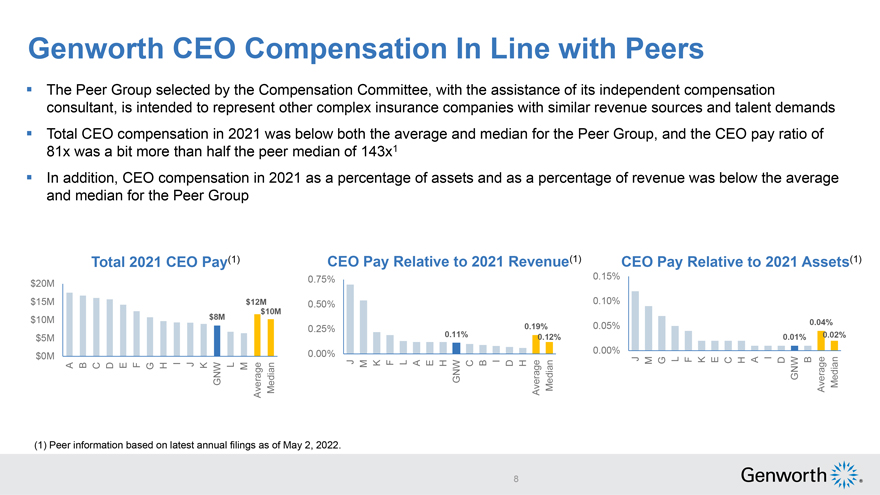

Genworth CEO Compensation In Line with Peers ï,§ The Peer Group selected by the Compensation Committee, with the assistance of its independent compensation consultant, is intended to represent other complex insurance companies with similar revenue sources and talent demands ï,§ Total CEO compensation in 2021 was below both the average and median for the Peer Group, and the CEO pay ratio of 81x was a bit more than half the peer median of 143x1ï,§ In addition, CEO compensation in 2021 as a percentage of assets and as a percentage of revenue was below the average and median for the Peer Group Total 2021 CEO Pay(1) CEO Pay Relative to 2021 Revenue(1) CEO Pay Relative to 2021 Assets(1) 0.75% 0.15% $20M $15M $12M 0.50% 0.10% $10M $10M $8M 0.19% 0.05% 0.04% 0.25% $5M 0.11% 0.12% 0.01% 0.02% 0.00% 0.00% $0M J L I A B C D E F G H I J K GNW L M Average Median J M K F L A E H GNW C B I D H Average Median M G F K E C H A D GNW B Average Median (1) Peer information based on latest annual filings as of May 2, 2022. 8

|

Peer Group Includes Other Complex Insurance Companies ISS and Company Peer Groups ISS Selected (7) (1) American Equity Investment Life Arch Capital Group Ltd. American National Group, Inc. Brighthouse Financial, Inc. Globe Life Inc. Kemper Corporation W.R. Berkley Corp. Shared (11) Aflac Incorporated American Financial Group, Inc. Assurant, Inc. CNA Financial Corporation CNO Financial Group, Inc. Fidelity National Financial, Inc. First American Financial Corporation Lincoln National Corporation Principal Financial Group, Inc. The Hanover Insurance Group, Inc. Unum Group Company-disclosed (3) MGIC Investment Corporation Radian Group Inc. Reinsurance Group of America, Incorporated (1) ISS Proxy Analysis & Benchmark Policy Voting Recommendations, May 6, 2022. 9

|

Important Additional Information and Where to Find It Genworth Financial, Inc. (the “Company” or “Genworth”) has filed a definitive proxy statement on Schedule 14A, an accompanying WHITE proxy card and other relevant documents with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies from the Company’s stockholders for the Company’s 2022 annual meeting of stockholders. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO CAREFULLY READ THE COMPANY’S DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS FILED WITH THE SEC IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and stockholders may obtain a copy of the definitive proxy statement, an accompanying WHITE proxy card, any amendments or supplements to the definitive proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge on our website at https://genworth2014.q4web.com/investors/Financials—Reports/sec-filings/default.aspx, or by contacting investorinfo@genworth.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. Cautionary Note Regarding Forward-Looking Statements This communication contains certain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for future business and financial performance of Genworth and its consolidated subsidiaries. Examples of forward-looking statements include statements Genworth makes relating to future reductions of debt, potential dividends or share repurchases, future Enact Holdings, Inc. dividends, the cumulative amount of rate action benefits required for the company’s long-term care insurance business to achieve break-even, future financial performance of the company’s businesses, liquidity and future strategic investments, including new products and services designed to assist individuals with navigating and financing long-term care. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially due to global political, economic, business, competitive, market, regulatory and other factors and risks, as well as risks discussed in the risk factor section of Genworth’s Annual Report on Form 10-K, filed with the SEC on February 28, 2022. Genworth undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise. 10

|

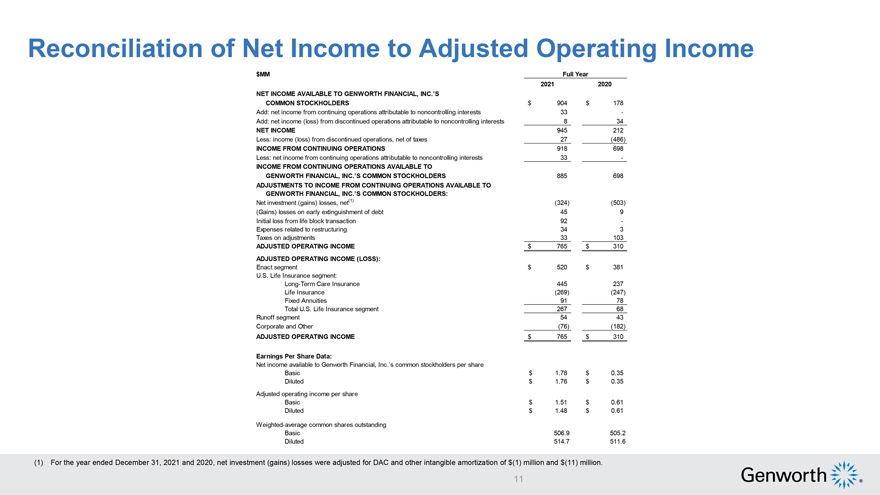

Reconciliation of Net Income to Adjusted Operating Income $MM Full Year 2021 2020 NET INCOME AVAILABLE TO GENWORTH FINANCIAL, INC.’S COMMON STOCKHOLDERS $ 904 $ 178 Add: net income from continuing operations attributable to noncontrolling interests 33 -Add: net income (loss) from discontinued operations attributable to noncontrolling interests 8 34 NET INCOME 945 212 Less: income (loss) from discontinued operations, net of taxes 27 (486) INCOME FROM CONTINUING OPERATIONS 918 698 Less: net income from continuing operations attributable to noncontrolling interests 33 —INCOME FROM CONTINUING OPERATIONS AVAILABLE TO GENWORTH FINANCIAL, INC.’S COMMON STOCKHOLDERS 885 698 ADJUSTMENTS TO INCOME FROM CONTINUING OPERATIONS AVAILABLE TO GENWORTH FINANCIAL, INC.’S COMMON STOCKHOLDERS: Net investment (gains) losses, net(1) (324) (503) (Gains) losses on early extinguishment of debt 45 9 Initial loss from life block transaction 92 -Expenses related to restructuring 34 3 Taxes on adjustments 33 103 ADJUSTED OPERATING INCOME $ 765 $ 310 ADJUSTED OPERATING INCOME (LOSS): Enact segment $ 520 $ 381 U.S. Life Insurance segment: Long-Term Care Insurance 445 237 Life Insurance (269) (247) Fixed Annuities 91 78 Total U.S. Life Insurance segment 267 68 Runoff segment 54 43 Corporate and Other (76) (182) ADJUSTED OPERATING INCOME $ 765 $ 310 Earnings Per Share Data: Net income available to Genworth Financial, Inc.’s common stockholders per share Basic $ 1.78 $ 0.35 Diluted $ 1.76 $ 0.35 Adjusted operating income per share Basic $ 1.51 $ 0.61 Diluted $ 1.48 $ 0.61 Weighted-average common shares outstanding Basic 506.9 505.2 Diluted 514.7 511.6 (1) For the year ended December 31, 2021 and 2020, net investment (gains) losses were adjusted for DAC and other intangible amortization of $(1) million and $(11) million. 11

|

Use of Non-GAAP Measures This presentation includes the non-GAAP financial measures entitled “adjusted operating income (loss)” and “adjusted operating income (loss) per share.” Adjusted operating income (loss) per share is derived from adjusted operating income (loss). The chief operating decision maker evaluates segment performance and allocates resources on the basis of adjusted operating income (loss). The company defines adjusted operating income (loss) as income (loss) from continuing operations excluding the after-tax effects of income (loss) from continuing operations attributable to noncontrolling interests, net investment gains (losses), gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, initial gains (losses) on insurance block transactions, restructuring costs and infrequent or unusual non-operating items. Initial gains (losses) on insurance block transactions are defined as gains (losses) on the early extinguishment of non-recourse funding obligations, early termination fees for other financing restructuring and/or initial gains (losses) on reinsurance restructuring for certain blocks of business. The company excludes net investment gains (losses) and infrequent or unusual non-operating items because the company does not consider them to be related to the operating performance of the company’s segments and Corporate and Other activities. A component of the company’s net investment gains (losses) is the result of estimated future credit losses, the size and timing of which can vary significantly depending on market credit cycles. In addition, the size and timing of other investment gains (losses) can be subject to the company’s discretion and are influenced by market opportunities, as well as asset-liability matching considerations. Gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, initial gains (losses) on insurance block transactions and restructuring costs are also excluded from adjusted operating income (loss) because, in the company’s opinion, they are not indicative of overall operating trends. Infrequent or unusual non-operating items are also excluded from adjusted operating income (loss) if, in the company’s opinion, they are not indicative of overall operating trends. While some of these items may be significant components of net income (loss) available to Genworth Financial, Inc.’s common stockholders in accordance with U.S. GAAP, the company believes that adjusted operating income (loss) and measures that are derived from or incorporate adjusted operating income (loss), including adjusted operating income (loss) per share on a basic and diluted basis, are appropriate measures that are useful to investors because they identify the income (loss) attributable to the ongoing operations of the business. Management also uses adjusted operating income (loss) as a basis for determining awards and compensation for senior management and to evaluate performance on a basis comparable to that used by analysts. However, the items excluded from adjusted operating income (loss) have occurred in the past and could, and in some cases will, recur in the future. Adjusted operating income (loss) and adjusted operating income (loss) per share on a basic and diluted basis are not substitutes for net income (loss) available to Genworth Financial, Inc.’s common stockholders or net income (loss) available to Genworth Financial, Inc.’s common stockholders per share on a basic and diluted basis determined in accordance with U.S. GAAP. In addition, the company’s definition of adjusted operating income (loss) may differ from the definitions used by other companies Adjustments to reconcile net income (loss) available to Genworth Financial, Inc.’s common stockholders to adjusted operating income (loss) assume a 21% tax rate and are net of the portion attributable to noncontrolling interests. Net investment gains (losses) are also adjusted for DAC and other intangible amortization and certain benefit reserves. In the fourth and third quarters of 2021, the company paid a pre-tax make-whole premium of $20 million and $6 million, respectively, related to the early redemption of Genworth Holdings, Inc.’s (Genworth Holdings) senior notes originally scheduled to mature in August 2023 and September 2021, respectively. In the fourth quarter of 2021, the company repurchased $209 million principal amount of Genworth Holdings’ senior notes due in 2023 and 2024 for a pre-tax loss of $15 million. In the first quarter of 2021, the company repurchased $146 million principal amount of Genworth Holdings’ senior notes due in September 2021 for a pre-tax loss of $4 million. During 2020, the company repurchased $84 million principal amount of Genworth Holdings’ senior notes with 2021 maturity dates for a pre-tax gain of $3 million and $1 million in the second and first quarters of 2020, respectively. In January 2020, the company paid a pre-tax make-whole expense of $9 million related to the early redemption of Genworth Holdings’ senior notes originally scheduled to mature in June 2020 and Rivermont Life Insurance Company I, the company’s indirect wholly-owned special purpose consolidated captive insurance subsidiary, early redeemed all of its $315 million outstanding non-recourse funding obligations originally due in 2050 resulting in a pre-tax loss of $4 million from the write-off of deferred borrowing costs. These transactions were excluded from adjusted operating income (loss) as they relate to gains (losses) on the early extinguishment of debt. In the fourth quarter of 2021, the company recorded a pre-tax loss of $92 million as a result of ceding certain term life insurance policies as part of a life block transaction. The company recorded a pre-tax expense of $34 million and $3 million for the years ended December 31, 2021 and 2020, respectively, related to restructuring costs as it continues to evaluate and appropriately size its organizational needs and expenses. There were no infrequent or unusual items excluded from adjusted operating income during the periods presented. The tables at the end of this presentation provide a reconciliation of net income available to Genworth Financial, Inc.’s common stockholders to adjusted operating income for the years ended December 31, 2021 and 2020, and reflect adjusted operating income (loss) as determined in accordance with accounting guidance related to segment reporting. 12