| (1) | The payout that may be earned based on the TSR portion of this Award’s goal will be determined based on the Company’s Percentile Ranking relative to its Peer Group; provided, however, that in no event will the total dollar value of the Confirmed Units with respect to the TSR-goal portion of the Award exceed 800% of grant date fair value of the TSR-goal portion of the Award. |

| (2) | “Peer Group” shall mean the constituents of the S&P 400 Financials Sector on the Grant Date (each such constituent, a “Peer Company”), subject to “Peer Group Adjustments,” which shall mean the following adjustments to the comparison Peer Group in the event of a corporate transaction for a Peer Company: |

| Merger with Company in Peer Group | In the event of a merger, acquisition or business combination transaction of a Peer Company with or by another Peer Company, the surviving entity shall remain a Peer Company. | |

| Merger with Company not in Peer Group where Peer Company survives | In the event of a merger of a Peer Company with an entity that is not a Peer Company, or the acquisition or business combination transaction of a Peer Company by an entity that is not a Peer Company, in each case where the Peer Company is the surviving entity and remains publicly traded, the surviving entity shall remain a Peer Company. | |

| Merger with Company not in Peer Group where Peer Company is not the survivor/Peer Company taken private | In the event of a merger or acquisition or business combination transaction of a Peer Company by or with an entity that is not a Peer Company or a “going private” transaction involving a Peer Company where the Peer Company is not the surviving entity or is otherwise no longer publicly traded, the company shall no longer be a Peer Company. | |

| Bankruptcy, Liquidation or Delisting | In the event of a bankruptcy, liquidation or delisting of a Peer Company at any time during the Performance Period, such company shall remain a Peer Company and be assigned a TSR of -100%. Delisting shall mean that a company ceases to be publicly traded on a national securities exchange as a result of any involuntary failure to meet the listing requirements of such national securities exchange, but shall not include delisting as a result of any voluntary going private or similar transaction. | |

| Spin-off Transaction | In the event of a stock distribution from a Peer Company consisting of the shares of a new publicly-traded company (a “spin-off”), the Peer Company shall remain a Peer Company and the stock distribution shall be treated as a dividend from the Peer Company based on the fair market value of the distribution on the date of such distribution; the performance of the shares of the spun-off company shall not thereafter be tracked for purposes of calculating TSR. | |

| (3) | TSR performance results shall be calculated as follows: |

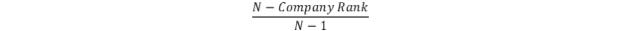

| • | “Percentile Ranking” shall be calculated using the following formula, where N is equal to the total number of Peer Companies (including the Company) and “Company Rank” is a ranking of the Company’s TSR Performance over the Performance Period relative to the Peer Companies (such that the company with the highest TSR Performance is ranked number one): |

| • | “TSR Performance” shall be calculated as follows: |

(Ending Average Share Price – Starting Average Share Price) + Dividends Reinvested

Starting Average Share Price

| • | “Starting Average Share Price” is equal to the average closing price over the 20 trading days beginning on and including the Performance Period start date. |

| • | “Ending Average Share Price” is equal to the average closing price over the last 20 trading days of the Performance Period (Including the final day). |

| • | “Dividends Reinvested” shall mean dividends paid with respect to an ex-dividend date that occurs beginning from the date when the Starting Average Share Price is measured through the end of the Performance Period (whether or not the dividend payment date occurs during this period), which shall be deemed to have been reinvested in the underlying common shares. |