UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement | |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 | |

Genworth Financial, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

|

6620 West Broad Street Richmond, Virginia 23230 |

November 1, 2019

Dear Stockholder,

You are invited to attend the 2019 Annual Meeting of Stockholders of Genworth Financial, Inc. to be held at 3:00 p.m. local time on Thursday, December 12, 2019, at The Westin Richmond, 6631 West Broad Street, Richmond, Virginia 23230.

As previously announced, on October 21, 2016, we entered into an agreement and plan of merger (the “Merger Agreement”) with Asia Pacific Global Capital Co., Ltd. (“Parent”), a limited liability company incorporated in the People’s Republic of China, and Asia Pacific Global Capital USA Corporation, a Delaware corporation and an indirect, wholly-owned subsidiary of Parent, a subsidiary of China Oceanwide Holdings Group Co., Ltd. (together with its affiliates, “Oceanwide”). Pursuant to the Merger Agreement, Oceanwide has agreed to acquire all of our outstanding common stock for a total transaction value of approximately $2.7 billion, or $5.43 per share in cash. At a special meeting held on March 7, 2017, our stockholders voted on and approved a proposal to adopt the Merger Agreement.

Genworth and Oceanwide remain committed to satisfying the closing conditions under the Merger Agreement as soon as possible, subject to receipt of the required regulatory approvals. Because the pending transaction has not yet been completed, the 2019 Annual Meeting of Stockholders has been scheduled in order to ensure that we remain in compliance with the listing standards of the New York Stock Exchange, which require each listed issuer to hold an annual meeting of stockholders no later than one year after the end of the issuer’s fiscal year. In the event the proposed merger is completed by December 12, 2019, the 2019 Annual Meeting will not be held.

The 2019 Annual Meeting of Stockholders will include a report on our business operations, discussion and voting on the matters set forth in the accompanying Notice of 2019 Annual Meeting of Stockholders and Proxy Statement, and discussion and voting on any other business matters properly brought before the meeting.

The compensation information included in the Proxy Statement reflects compensation paid to our directors and named executive officers in 2018. This information was previously disclosed in an amendment to our Form 10-K for the fiscal year ended December 31, 2018, which was filed with the U.S. Securities and Exchange Commission on April 15, 2019.

Whether or not you plan to attend the 2019 Annual Meeting of Stockholders, you can ensure your shares are represented at the meeting by promptly submitting your proxy by telephone, by Internet or by completing, signing, dating and returning your proxy card.

| Cordially, |

||||

| /s/ James S. Riepe |

/s/ Thomas J. McInerney | |||

| James S. Riepe |

Thomas J. McInerney | |||

| Non-Executive Chairman of the Board |

President and Chief Executive Officer | |||

|

|

| |||

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

3:00 p.m., December 12, 2019

The Westin Richmond

6631 West Broad Street

Richmond, Virginia 23230

November 1, 2019

To our Stockholders:

NOTICE IS HEREBY GIVEN that Genworth Financial, Inc.’s 2019 Annual Meeting of Stockholders will be held at The Westin Richmond, 6631 West Broad Street, Richmond, Virginia 23230, on Thursday, December 12, 2019, at 3:00 p.m. local time, to address all matters that may properly come before the 2019 Annual Meeting of Stockholders. In addition to receiving a report on our business operations, stockholders will be asked:

| (1) | to elect the eight nominees named in this Proxy Statement as directors until the next annual meeting; |

| (2) | to approve, on an advisory basis, the compensation of our named executive officers; |

| (3) | to ratify the selection of KPMG LLP as our independent registered public accounting firm for 2019; and |

| (4) | to transact such other business as may properly come before the 2019 Annual Meeting or any adjournment thereof. |

Stockholders of record at the close of business on October 18, 2019 will be entitled to vote at the meeting and any adjournments. In accordance with the U.S. Securities and Exchange Commission rule, we are furnishing this Proxy Statement and our 2018 Annual Report to many of our stockholders solely over the Internet. We believe that posting these materials on the Internet enables us to provide stockholders with the information that they need more quickly. In addition, it lowers our costs of printing and delivering these materials, and reduces the environmental impact of our 2019 Annual Meeting of Stockholders. The Notice of Internet Availability of Proxy Materials sent to many of our stockholders explains how to access the proxy materials online, vote online and obtain a paper copy of our proxy materials.

We urge you to participate in the 2019 Annual Meeting of Stockholders, either by attending and voting in person or by voting through other acceptable means as promptly as possible. You may vote by telephone, through the Internet or by mailing your completed and signed proxy card (or voting instruction form, if you hold your shares through a broker, bank or other nominee). Each share of Class A Common Stock issued and outstanding as of the record date is entitled to one vote on each matter to be voted upon at our 2019 Annual Meeting of Stockholders. Your vote is important and we urge you to vote.

This Notice, the Proxy Statement and proxy card are first being made available or mailed to stockholders on or about November 1, 2019.

| Cordially, |

| /s/ Michael J. McCullough |

| Michael J. McCullough |

| Corporate Secretary |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 12, 2019

GENWORTH’S NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS, PROXY STATEMENT AND 2018 ANNUAL REPORT ARE AVAILABLE, FREE OF CHARGE, AT: WWW.PROXYVOTE.COM

|

• To be voted on at the meeting

Every stockholder’s vote is important. Please complete, sign,

date and return your proxy card, or submit your

proxy by telephone or by Internet.

|

Richmond, Virginia 23230 | |||

November 1, 2019

Dear Stockholder,

As the chair of the Management Development and Compensation Committee of Genworth Financial, Inc.’s Board of Directors, and on behalf of the Board, I thank you for your continued investment in Genworth.

The Board of Directors and management remain wholly focused on closing the Oceanwide transaction. This pending transaction has impacted our compensation decisions over the last three years, as we have had to balance trying to close the deal with pay for performance based on the accomplishment of financial and strategic results that improve the value of our company. We also remain committed to sound corporate governance practices and holding ourselves accountable to our stockholders. As part of our commitment, our management team began a stockholder engagement effort at the end of 2018 on a number of important issues including our executive compensation programs, and these efforts have continued throughout 2019. In addition, over the last several weeks I reached out to our largest institutional stockholders, representing in aggregate approximately 60% of our outstanding shares, in order to solicit specific feedback on our compensation program and proactively discuss a number of program design elements. I spoke with all stockholders who accepted this invitation for a discussion.

Over the next several pages of the Proxy Summary section, we outline the feedback we’ve received through these conversations, as well as changes we have made and plan to make to our compensation programs in response to this feedback.

On behalf of the Board of Directors, I’d like to personally thank those stockholders who took the time to speak with me and other members of management. You provided a critical source of feedback on our compensation programs, which will be central to the work of the Management Development and Compensation Committee as we evaluate and review our programs for the future. I appreciate your commitment to Genworth’s future success and your candor in sharing your views on our path to get there.

Thank you again for your investment and continued interest in Genworth.

Cordially,

/s/ David M. Moffett

David M. Moffett

Chairman of the Management Development & Compensation Committee

i

This summary highlights information about Genworth Financial, Inc. (the “company,” “Genworth,” “we,” “our” and “us”) and certain information contained elsewhere in this proxy statement (“Proxy Statement”) for Genworth’s 2019 Annual Meeting of Stockholders (the “2019 Annual Meeting”). This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

2019 Annual Meeting of Stockholders Information

| Date and Time: |

Thursday, December 12, 2019 at 3:00 p.m. local time | |

| Place: |

The Westin Richmond, 6631 West Broad St., Richmond, Virginia 23230 | |

| Record Date: |

October 18, 2019 |

Voting Matters and Board Recommendations

| Proposals |

Board Recommendation |

Page Number for Additional Information | ||

| 1. Election of Directors |

FOR each nominee |

2 | ||

| 2. Advisory Vote to Approve Named Executive Officer Compensation |

FOR |

62 | ||

| 3. Ratification of Independent Registered Public Accounting Firm |

FOR |

66 |

We encourage you to participate in the 2019 Annual Meeting, either by attending and voting in person or by voting through other acceptable means as promptly as possible. You may vote by telephone, through the Internet or by mailing your completed and signed proxy card (or voting instruction form, if you hold your shares through a broker, bank or other nominee). Each share of Class A Common Stock issued and outstanding as of the record date is entitled to one vote for each director nominee and one vote for each of the other proposals properly presented at the meeting. Your vote is important, and we urge you to vote.

If you plan to attend the 2019 Annual Meeting, please follow the instructions on page 68 of the accompanying Proxy Statement.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 accompanies this Proxy Statement.

The Notice, the Proxy Statement and proxy card are first being made available or mailed to stockholders on or about November 1, 2019.

The compensation information included in the Proxy Statement reflects compensation paid to our directors and named executive officers in 2018, which was previously disclosed in Amendment No. 1 to our Form 10-K for the fiscal year ended December 31, 2018, filed with the U.S. Securities and Exchange Commission (“SEC”) on April 15, 2019 (“Amendment No. 1 to Form 10-K”). Certain additional information, including information about our corporate governance, director independence, our policy for related party transactions, and accounting fees and services, was also disclosed in Amendment No. 1 to Form 10-K.

ii

Company Performance and Executive Compensation Highlights

|

2018 Company Performance Highlights | ||||||||||

|

|

• Delivered full year net income of $119 million, or $0.24 per diluted share, and adjusted operating income of $179 million*, or $0.36 per diluted share. |

|

• U.S. MI 2018 full year adjusted operating income of $490 million*, the highest annual income ever for that business and a 58% increase over 2017. |

|

• Continued progress on multi-year LTC rate action plan with ~$400 million incremental annual premium increases approved in 2018, with an NPV of over $2 billion. | |||||

|

• Improved holding company financial strength, completing a bondholder consent solicitation to eliminate a technical default risk and issued a $450 million secured term loan. |

• U.S. MI’s first dividend to the holding company since 2007.

• Canada and Australia MI delivered $180 million in dividends to the holding company in 2018. |

• Cumulative NPV of $10.5 billion of approved LTC rate actions since 2012.

• Actively engaged with the NAIC for a national approach to review LTC insurance premium rates.

| ||||||||

Despite a challenging geopolitical landscape, and low interest rate environment, Genworth’s performance highlights in 2018 include:

| • | Full year net income of $119 million, or $0.24 per diluted share, and adjusted operating income of $179 million*, or $0.36 per diluted share; |

| • | Continued progress on our multi-year long-term care (“LTC”) rate action plan with nearly $400 million incremental annual premium increases approved in 2018, with a net present value (“NPV”) of over $2 billion and cumulative NPV of $10.5 billion of approved rate actions since 2012; |

| • | Active engagement with the National Association of Insurance Commissioners (“NAIC”) for a national approach to review long-term care insurance premium rates; |

| • | Improved holding company financial strength, with completion of a bondholder consent solicitation to eliminate a technical default risk and completion of a $450 million secured term loan issuance; |

| • | U.S. Mortgage Insurance (“MI”) 2018 full year adjusted operating income of $490 million*, the highest annual income ever for that business and a 58% increase over 2017; |

| • | U.S. MI’s first dividend to the holding company since 2007; |

| • | Strong capital levels with substantial capital above management targets in Canada and Australia MI; |

| • | Canada and Australia MI provided $180 million in dividends to the holding company in 2018; and |

| • | Negative performance in U.S. Life Insurance driven by actuarial assumption updates on legacy LTC and life insurance policies. We expect to manage these businesses with their existing capital and future LTC premium rate actions, with no further plans to infuse or extract capital. |

| * | Non-U.S. generally accepted accounting principles (“GAAP”) measure. For a reconciliation of U.S. GAAP and non-GAAP financial measures, see Exhibit 99.2 to the company’s Current Report on Form 8-K filed with the SEC on February 5, 2019. |

iii

Oceanwide Transaction Highlights

|

2018 & 2019 Oceanwide Transaction Highlights | ||||||||||||

|

|

• Genworth and Oceanwide have made significant progress towards closing the proposed transaction. |

|

• Received clearance from CFIUS following 18-month review process. |

|

|

|

• Agreed to a new capital investment plan under which Oceanwide will contribute $1.5 billion to Genworth following the successful closing of the transaction to facilitate regulatory approval of the transaction.

| |||||

|

• Genworth and Oceanwide agreed to extend the merger agreement deadline to not later than December 31, 2019.

• Both parties remain committed to closing the transaction as soon as possible.

|

• Received regulatory approvals from remaining U.S. regulators including Delaware, New York, Virginia and North Carolina.

• China’s NDRC accepted Oceanwide’s filing. |

|||||||||||

|

|

• Announced sale of Genworth’s

| |||||||||||

As previously announced, China Oceanwide Holdings Group, Ltd. (together with its affiliates, “Oceanwide”) has agreed to acquire all of our outstanding common stock for a total transaction value of approximately $2.7 billion, or $5.43 per share in cash. The transaction has been approved by Genworth’s stockholders, and is subject to other closing conditions, including the receipt of regulatory approvals. While Genworth and Oceanwide experienced continued delays in the regulatory review process, the parties have made significant progress towards closing the proposed transaction.

In 2018 and 2019, Genworth and Oceanwide worked diligently to satisfy many of the necessary criteria of our regulators to ultimately approve the transaction, including:

Clearance from the Committee on Foreign Investment in the United States.

| • | This roughly 18-month process—from Oceanwide’s initial filing in January 2017 to completion in June 2018—demanded a multi-disciplinary approach resulting in an innovative solution to provide additional protections for our policyholders’ data to best address the concerns of the Committee on Foreign Investment in the United States (“CFIUS”). |

Receipt of required regulatory approvals from the remainder of our domestic insurance regulators, as well as one Chinese regulator.

| • | Following the filing of supplemental information on the transaction in September 2018, Genworth and Oceanwide received conditional approvals from all of the Company’s U.S.-based insurance regulators, including Delaware, New York, Virginia and North Carolina. |

| • | Additionally, the National Development and Reform Commission (“NDRC”) of the People’s Republic of China accepted Oceanwide’s filing in connection with the merger agreement in October 2018. |

iv

Announced the planned sale of Genworth’s approximately 57% stake in Genworth MI Canada Inc. (“Genworth Canada”) to Brookfield Business Partners L.P. (“Brookfield”) for approximately USD$1.8 billion on August 13, 2019.

| • | Although Genworth Canada is one of Genworth’s top-performing businesses, the lack of transparent feedback or guidance from Canadian regulators about their review of the proposed merger with Oceanwide compelled us to look at strategic alternatives for Genworth Canada that would eliminate the need for Canadian regulatory approval. |

| • | The proposed sale of our stake in Genworth Canada also increases Genworth’s financial flexibility whether or not the Oceanwide transaction is consummated. |

| • | Additionally, as part of the terms of the Genworth Canada transaction, Brookfield agreed to provide Genworth with up to USD$850 million in bridge financing to meet Genworth liquidity needs in the event regulatory approvals for the transaction are not received by October 31, 2019. |

In conjunction with the announcement of the proposed sale of Genworth Canada to Brookfield, Genworth and Oceanwide entered into an additional waiver and agreement extending the merger agreement deadline to not later than December 31, 2019. Both Genworth and Oceanwide remain committed to closing the transaction as soon as possible. The closing of the merger remains subject to other closing conditions and approvals. In addition, Oceanwide will need to receive clearance in China for currency conversion and the transfer of funds.

Our Executive Compensation Philosophy and Principles

Genworth’s executive compensation philosophy is to establish target total direct compensation with reference to our peer group and to tie a substantial portion of our executives’ compensation to performance against objective business goals. This approach helps us to recruit and retain talented executives, incentivizes our executives to achieve desired business goals and aligns their interests with the interests of our stockholders.

Our guiding principles are:

| ✓ | Compensation should be primarily performance-based and align executive officer incentives with stockholder interests across multiple timeframes |

| ✓ | At-risk pay and compensation design should reflect an executive officer’s impact on company performance over time |

| ✓ | Total compensation opportunities should be competitive within the relevant marketplace |

| ✓ | Incentive compensation should reward financial and operational performance, and allow for some qualitative adjustment, if appropriate |

| ✓ | Plan designs and incentives should support appropriate risk management practices |

v

How our Executive Compensation Program Supports our Business Strategy

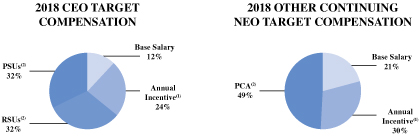

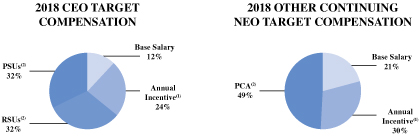

Our executive compensation program supports our business strategy through program design that links executive compensation to achievement of business and financial growth goals. As a result, our executive compensation programs are closely aligned with Company performance. A significant portion of our targeted executive pay (79% or more in 2018) is variable and covers annual and multi-year performance periods.

| (1) | Represents 2018 annual incentive at target. |

| (2) | Represents grant date fair value of long-term incentive awards made in 2018. “PSUs” means performance stock units and “RSUs” means restricted stock units. “PCA” means performance-based cash awards. |

vi

Below is a summary of the financial and strategic objectives of our named executive officers under our annual incentive plan for 2018. For further details around our annual incentive performance metrics see pages 30-31.

| Financial Objectives |

Strategic Objectives | |||

| Chief Executive Officer |

• U.S. Life Insurance: Operating Income metrics

• Global Mortgage Insurance (“GMI”): Operating Income and Return on Equity (“ROE”) metrics

Note: At the request of certain state insurance regulators, the company did not set specific incremental LTC premium increase financial targets for Genworth’s Chief Executive Officer. |

• Close Oceanwide Transaction & Transition Execution

• Meaningful Progress in Addressing NAIC LTC Regulatory Framework

| ||

| Other Named Executive Officers (“NEOs”) (Excluding Chief Investment Officer) | • U.S. Life Insurance: Operating Income metrics; Gross incremental premiums for LTC in-force rate actions

• GMI: Operating Income and ROE metrics |

• Close Oceanwide Transaction & Transition Execution | ||

| Chief Investment Officer |

• Net Investment Income

• Total Company U.S. GAAP Impairments and trading losses

• U.S. Life Insurance Impairments and trading losses and Capital/Credit Migration Impact

• Purchase Yield vs. External Benchmark |

• U.S. Life Insurance Private Asset Production

• GMI Global Asset Production

• Strategic Asset Production | ||

We believe that the largest component of our annual compensation opportunities for named executive officers should be in the form of longer-term incentives, including annual long-term equity and cash grants. Taken together, we believe our annual long-term incentive grants provide our continuing named executive officers with effective retention value and appropriate incentives to achieve long-term company performance objectives, while aligning our executive officer compensation programs with the long-term interests of our stockholders. For 2018, our continuing named executive officers’ long-term equity grants were awarded 50% in PSUs and 50% in RSUs for our CEO, and 100% in PCAs for our other eligible named executive officers. As discussed below, beginning in 2019, our CEO’s long-term equity is 100% performance-based.

It is important to note that as a result of the transaction with Oceanwide, we believe our stock price has been effectively capped at the merger consideration of $5.43 per share, which limits both stockholder return and gains on equity awards provided to executives. Additionally, challenges from our legacy long-term care insurance blocks of business (underwritten or assumed from 1974 to 2007) have materially impaired the financial performance and stockholder value of the company. Therefore, as a result of these factors, the Management Development and Compensation

vii

Committee (the “Compensation Committee”) chose long-term incentive award vehicles in 2018 that are retentive and/or based on operating income performance rather than tied to total stockholder return or other stock price metrics.

Impact of Oceanwide Transaction on Compensation

While we acknowledge the length of the pending transaction with Oceanwide is unusual because of unanticipated regulatory delays, our Board of Directors has continued to believe that completion of this transaction is the best strategic outcome for Genworth and its stockholders. Our continued work toward closing the merger with Oceanwide has taken considerable effort and resources to obtain the various regulatory approvals necessary to consummate the transaction. Our compensation programs have continued to include incentives that encourage the achievement of metrics that will provide long-term value to Genworth, but we have also provided incentives to encourage the closing of the Oceanwide transaction as soon as possible despite geopolitical uncertainty.

We have had to maintain certain elements of our business and compensation structures in a consistent manner pursuant to the Merger Agreement with Oceanwide. In light of this obligation, considerations were made regarding annual and long-term incentives paid in 2018, to not penalize executives for previously set goals that conflict with our commitments to Oceanwide under the pending transaction.

The Merger Agreement with Oceanwide does not include any special compensation awards for any continuing named executive officer. No cash payments or acceleration of equity awards will be triggered for executive officers based solely on the closing of the Oceanwide transaction. Outstanding equity awards held by executive officers immediately prior to the closing of the Oceanwide transaction will be automatically converted into the right to receive a cash payment equal to $5.43 per share, but will remain subject to their existing vesting schedule. For further information regarding executive compensation in connection with the Oceanwide transaction, see our proxy statement for the special meeting of stockholders held on March 7, 2017, which was filed on January 25, 2017.

Consideration of Last Year’s Advisory Stockholder Vote on Executive Compensation

Annual advisory votes to approve named executive officer compensation serve as a tool to help guide the Compensation Committee in evaluating the alignment of the company’s executive compensation programs with the interests of the company and our stockholders. In preparation for the 2018 advisory vote, we contacted many of our institutional stockholders in the Fall of 2018 for their input on the company’s compensation and governance practices, and to address their questions. At the 2018 Annual Meeting, over 55% of the shares voted were cast in favor of the compensation paid to the named executive officers in 2017, as discussed and disclosed in the 2018 proxy statement.

We have historically had a very high Say on Pay approval rate, and the results in 2018 were quite different from prior year results. Our Compensation Committee chair, David Moffett, recently reached out to our largest institutional stockholders, representing in aggregate approximately 60% of our outstanding shares, to solicit their feedback and input on our compensation programs. He, our Executive Vice President—Human Resources, and our Corporate Secretary spoke with all stockholders who accepted his invitation for a discussion. Mr. Moffett then reviewed the feedback received from these stockholders with the other members of the Compensation Committee.

viii

The table below highlights key points of discussion during these stockholder calls with Mr. Moffett in 2019, along with certain changes that the Compensation Committee has implemented in connection with future compensation decisions. The Compensation Committee believes the changes to our program described below ensure better alignment with market best practices and address key stockholder feedback.

| What We Heard |

Response | |

|

Desire to have Chief Executive Officer’s long-term incentive awards utilize more performance-based vehicles |

• CHANGE: Eliminated time-based awards from the Chief Executive Officer pay program and transitioned target long-term award values to 100% performance stock unit grants starting in 2019 | |

| Increase long-term focus of performance stock awards | • CHANGE: Starting with the 2019 performance stock unit grant, the performance will be measured over a three-year cumulative period instead of three separate one-year measurement periods | |

| Support for existing annual incentive structure, however, consider disclosure that sets forth the components of annual incentive awards for each NEO in a simplified and more straightforward manner | • The Compensation Committee agrees that our current annual incentive structure is appropriate to ensure that pay is tied not only to the short-term financial results, but also strategic work required in running our business as well as working towards a successful completion of the Oceanwide transaction

• CHANGE: The

Compensation Discussion and Analysis section for 2018 executive compensation has been supplemented to | |

| Prioritization on completing the Oceanwide transaction as soon as possible, while continuing to focus on metrics to drive long-term stockholder value | • The Compensation Committee will continue to consider all aspects of the Oceanwide transaction when reviewing short- and long-term incentive pay performance to ensure that both company financial performance and transaction related activities are incentivized and recognized

• We continue to believe a successful completion of the Oceanwide transaction is in the best interest of our stockholders and our company |

The compensation information set forth in this proxy statement relates to 2018 and therefore does not reflect all of the benefits of the stockholder feedback we received in 2019. Our Compensation Committee, however, has already incorporated certain changes for 2019 compensation decisions, as noted above, and will continue to consider changes to our executive compensation program that incorporate feedback from our stockholders and help to ensure that our executive compensation is aligned with the interests of our stockholders.

ix

The table below sets forth information about our director nominees, each of whom is an incumbent member of the Genworth Financial, Inc. Board of Directors (the “Board” or the “Board of Directors”), including their ages, length of service on our Board and relevant experience. The Board has determined that seven of the eight nominees are independent directors under the New York Stock Exchange listing requirements and our Governance Principles.

| Director Nominee |

Age | Director Since |

Experience | |||||||||

| G. Kent Conrad |

|

71 |

|

2013 |

Former U.S. Senator | |||||||

|

Melina E. Higgins |

|

52 |

|

|

2013 |

|

Former Partner at The Goldman Sachs Group, Inc. | |||||

|

Thomas J. McInerney |

|

63 |

|

|

2013 |

|

President and Chief Executive Officer of Genworth Financial, Inc. | |||||

|

David M. Moffett |

|

67 |

|

|

2012 |

|

Former Chief Executive Officer and a director of Federal Home Loan Mortgage Corporation | |||||

|

Thomas E. Moloney |

|

75 |

|

|

2009 |

|

Former Senior Executive Vice President and Chief Financial Officer of John Hancock Financial Services, Inc. | |||||

|

Debra J. Perry |

|

68 |

|

|

2016 |

|

Former Executive at Moody’s Investor Service, Inc. | |||||

|

Robert P. Restrepo Jr. |

|

69 |

|

|

2016 |

|

Former Chairman and President

and Chief Executive Officer of State Auto Financial | |||||

|

James S. Riepe+ |

|

76 |

|

|

2006 |

|

Former Vice Chairman of T. Rowe Price Group, Inc. | |||||

| + | Non-Executive Chairman of the Board |

Our Corporate Governance Facts

| Size of Board as of November 1, 2019 |

9 | |

| Number of Independent Directors as of November 1, 2019 |

8 | |

| Board Committees Consist Entirely of Independent Directors |

Yes | |

| All Director Nominees Attended at least 75% of Meetings Held in 2018 |

Yes | |

| Annual Election of All Directors |

Yes | |

| Majority Voting for Directors |

Yes | |

| Separate Independent Chairman and CEO |

Yes | |

| Independent Directors Meet Regularly in Executive Session |

Yes | |

| Annual Board and Committee Self-Evaluations |

Yes | |

| Stockholders Holding at least 40% of Outstanding Common Stock Have Ability to Call Special Meeting |

Yes | |

| Stock Ownership Requirements for Directors |

Yes | |

| Anti-Hedging and Anti-Pledging Policies for Directors and Executive Officers |

Yes | |

| Corporate Social Responsibility Section of Our Corporate Website |

Yes | |

| Poison Pill |

No |

x

Additional Executive Compensation Governance Facts

| Annual Advisory Approval of Executive Compensation |

Yes | |

| Use of Performance-Based Long-Term Incentives |

Yes | |

| Stock Ownership Requirements for Executive Officers |

Yes | |

| Stock Ownership Requirement for CEO, as a Multiple Of Base Salary |

7x | |

| Retention Requirements for Equity Awards |

Yes | |

| Clawback Policy |

Yes | |

| Double-Trigger for Change of Control Benefits |

Yes | |

| Excise Tax Gross-Ups for Change of Control Benefits |

No |

xi

Genworth Financial, Inc.

6620 West Broad Street

Richmond, Virginia 23230

As previously announced, on October 21, 2016, we entered into an agreement and plan of merger (the “Merger Agreement”) with Asia Pacific Global Capital Co., Ltd. (“Parent”), a limited liability company incorporated in the People’s Republic of China, and Asia Pacific Global Capital USA Corporation, a Delaware corporation and a direct subsidiary of China Oceanwide Holdings Group Co., Ltd. (together with its affiliates, “Oceanwide”). Pursuant to the Merger Agreement, Oceanwide has agreed to acquire all of our outstanding common stock for a total transaction value of approximately $2.7 billion, or $5.43 per share in cash. At a special meeting held on March 7, 2017, our stockholders voted on and approved a proposal to adopt the Merger Agreement.

Genworth and Oceanwide remain committed to satisfying the closing conditions under the Merger Agreement as soon as possible, subject to receipt of the required regulatory approvals. Because the pending transaction has not yet been completed, the 2019 Annual Meeting of Stockholders has been scheduled in order to ensure that we remain in compliance with the listing standards of the New York Stock Exchange (“NYSE”), which require each listed issuer to hold an annual meeting of stockholders no later than one year after the end of the issuer’s fiscal year. In the event the proposed merger is completed by December 12, 2019, the 2019 Annual Meeting will not be held.

This Proxy Statement is furnished in connection with the solicitation of proxies by Genworth on behalf of the Board of Directors for the 2019 Annual Meeting. The Notice of 2019 Annual Meeting of Stockholders, the Proxy Statement and proxy card are first being made available or mailed to stockholders on or about November 1, 2019.

Your vote is important. Whether or not you plan to attend the 2019 Annual Meeting, please take the time to vote your shares as soon as possible. You can ensure that your shares are voted at the meeting by submitting your proxy by telephone, by Internet or by completing, signing, dating and returning the proxy card. Submitting your proxy by any of these methods will not affect your right to attend the meeting and vote. A stockholder who gives a proxy may revoke it by voting in person at the 2019 Annual Meeting, by delivering a subsequent proxy or by notifying Genworth’s Corporate Secretary in writing of such revocation. Attendance at the meeting alone will not revoke a previously submitted proxy.

INTERNET AVAILABILITY OF PROXY MATERIALS

We are making this Proxy Statement and our 2018 Annual Report, which includes our Form 10-K for the fiscal year ended December 31, 2018 (the “2018 Annual Report”), available to our stockholders on the Internet. We mailed to many of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including this Proxy Statement and our 2018 Annual Report. The Notice of Internet Availability of Proxy Materials also provides instructions on how to vote online, by mail or by telephone. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request these materials. Other stockholders, in accordance with their prior requests, have received e-mail notification of how to access our proxy materials and vote online, or have been mailed paper copies of our proxy materials and a proxy card (or a voting instruction form from their broker, bank or other nominee).

Internet distribution of proxy materials is designed to expedite receipt by stockholders, lower the costs associated with our 2019 Annual Meeting, and reduce the environmental impact of our 2019 Annual Meeting. However, if you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of our proxy materials, please follow the instructions for requesting such materials contained on the Notice of Internet Availability of Proxy Materials. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

1

Currently, nine directors serve on our Board of Directors, the terms for whom all expire at the 2019 Annual Meeting. One of our current directors, William H. Bolinder, will not stand for re-election at the 2019 Annual Meeting. Our Board of Directors adopted a resolution in October 2019 setting the size of the Board of Directors at eight members, effective as of the 2019 Annual Meeting. Accordingly, at the 2019 Annual Meeting, eight directors are to be elected to hold office until the 2020 Annual Meeting and until their successors have been duly elected and qualified or until the earlier of their resignation or removal in a manner provided for in the Bylaws and our Board of Directors will be reduced to eight. Working through its Nominating and Corporate Governance Committee, our Board of Directors continually evaluates the optimal size for the Board and may consider the addition of one or more independent directors to the Board.

The eight nominees for election at the 2019 Annual Meeting are listed on pages 3-6 with brief biographies, a list of their current committee memberships and descriptions of their qualifications and skills to serve as our directors. See the Board of Directors and Committees—Board Composition section below for a description of how our directors’ blend of backgrounds benefits our company. The Board of Directors has determined that seven of the eight nominees are independent directors under the NYSE listing requirements and our Governance Principles, which are discussed below in the Corporate Governance section.

All of the nominees named in this Proxy Statement have been nominated by our Board of Directors to be elected by holders of our common stock. We are not aware of any reason why any nominee would be unable to serve as a director. If a nominee for election is unable to serve, the shares represented by all valid proxies will be voted for the election of any other person that our Board of Directors may nominate as a substitute.

Our Governance Principles state that directors generally will not be nominated for election to our Board of Directors after their 73rd birthday, although the Board may nominate candidates over 73 for special circumstances. The Board of Directors has determined that special circumstances exist to nominate each of Mr. Moloney and Mr. Riepe for election to the Board after his 73rd birthday. Each of Mr. Moloney and Mr. Riepe have served in key leadership roles while providing financial and/or insurance industry expertise to our Board. In addition, they each have actively participated in our strategic review process and we believe that their background and knowledge of our businesses and strategy is important at this time to provide Board continuity in light of the pending merger with Oceanwide and as Genworth continues to pursue actions to maximize stockholder value. As a result, the Board believes that retaining each of Mr. Moloney and Mr. Riepe on the Board of Directors is in the best interest of our stockholders, and has nominated each of Mr. Moloney and Mr. Riepe for election as directors to hold office until the 2020 Annual Meeting and until his successor has been elected and qualified.

2

Committees

Nominating and Corporate Governance

Risk |

G. Kent Conrad, 71, former U.S. Senator. Director since March 2013.

Sen. Conrad served as a U.S. Senator representing the State of North Dakota from January 1987 to January 2013. He served as the Chair of the Senate Budget Committee from 2006 until his retirement. Prior to serving in the U.S. Senate, Sen. Conrad served as the Tax Commissioner for the State of North Dakota from 1981 to 1986 and as Assistant Tax Commissioner from 1974 to 1980. Sen. Conrad received an A.B. in Political Science from Stanford University and an M.B.A. from George Washington University.

Qualifications: Sen. Conrad’s 26 years of experience as a U.S. Senator, including serving as Chair of the Senate Budget Committee for approximately eight years, provides the Board with extensive information and insight into public policy, fiscal affairs, governmental relations and legislative and regulatory issues. |

Committees

Management Development and Compensation

Nominating and Corporate Governance |

Melina E. Higgins, 52, former Partner at The Goldman Sachs Group. Director since September 2013.

Ms. Higgins retired in 2010 from a nearly 20-year career at The Goldman Sachs Group Inc., where she served as a Managing Director from 2001 and a Partner from 2002. During her tenure at Goldman Sachs, Ms. Higgins served as Head of the Americas and Co-Chairperson of the Investment Advisory Committee for the GS Mezzanine Partners funds, which managed over $30 billion of assets. She also served as a member of the Investment Committee for the Principal Investment Area, which oversaw and approved global private equity and private debt investments. Goldman’s Principal Investment Area was one of the largest alternative asset managers in the world. Ms. Higgins has served as a director of Mylan N.V. since February 2013. Ms. Higgins has also served as non-executive chairman of the board of Antares Midco, Inc. since January 2016 and is a member of the Women’s Leadership Board of Harvard University’s John F. Kennedy School of Government. Ms. Higgins received a B.A. in Economics and Spanish from Colgate University and an M.B.A. from Harvard Business School.

Qualifications: Ms. Higgins’ extensive finance and investment experience, having spent nearly 20 years with The Goldman Sachs Group, Inc., as well as serving as a director for both public and private companies, provides the board with significant insight in connection with our restructuring and turnaround initiatives. |

3

|

Thomas J. McInerney, 63, President and Chief Executive Officer of Genworth Financial, Inc. Director since January 2013.

Mr. McInerney has been our President and Chief Executive Officer and a director since January 2013. Before joining our company, Mr. McInerney had served as a Senior Advisor to the Boston Consulting Group from June 2011 to December 2012, providing consulting and advisory services to leading insurance and financial services companies in the United States and Canada. From October 2009 to December 2010, Mr. McInerney was a member of ING Groep’s Management Board for Insurance, where he was the Chief Operating Officer of ING’s insurance and investment management business worldwide. Prior to that, he served in a variety of senior roles with ING Groep NV after serving in many leadership positions with Aetna, where he began his career as an insurance underwriter in June 1978. Mr. McInerney is a member of the American Council of Life Insurers and serves, and has served, on its CEO Steering Committees and Board. Mr. McInerney received a B.A. in Economics from Colgate University and an M.B.A. from the Tuck School of Business at Dartmouth College and serves on Tuck’s Board of Advisors.

Qualifications: Mr. McInerney offers insight into our company from his current role as the President and Chief Executive Officer. He also brings extensive knowledge of the insurance and financial services industries gained through over 40 years of experience serving in significant leadership positions with Genworth, ING Groep NV and Aetna. |

Committees

Management

Nominating and Corporate Governance |

David M. Moffett, 67, former Chief Executive Officer and director of Federal Home Loan Mortgage Corporation. Director since December 2012.

Mr. Moffett was the Chief Executive Officer and a director of the Federal Home Loan Mortgage Corporation from September 2008 until his retirement in March 2009. Prior to this position, Mr. Moffett served as a Senior Advisor with the Carlyle Group LLC from May 2007 to September 2008. Mr. Moffett also served as the Vice Chairman and Chief Financial Officer of U.S. Bancorp from 2001 to 2007, after its merger with Firstar Corporation, having previously served as Vice Chairman and Chief Financial Officer of Firstar Corporation from 1998 to 2001 and as Chief Financial Officer of StarBanc Corporation, a predecessor to Firstar Corporation, from 1993 to 1998. Mr. Moffett has served as a director of CSX Corporation since May 2015, and PayPal Holdings, Inc. since July 2015 (currently serving as its Lead Director). He also previously served on the boards of directors of CIT Group Inc. from July 2010 to May 2016, eBay Inc. from July 2007 to July 2015, MBIA Inc. from May 2007 to September 2008, The E.W. Scripps Company from May 2007 to September 2008 and Building Materials Holding Corporation from May 2006 to November 2008. Mr. Moffett also serves as a trustee on the boards of Columbia Fund Series Trust I and Columbia Funds Variable Insurance Trust, overseeing approximately 52 funds within the Columbia Funds mutual fund complex. He also serves as a trustee for the University of Oklahoma Foundation. Mr. Moffett holds a B.A. degree in Economics from the University of Oklahoma and an M.B.A. degree from Southern Methodist University.

Qualifications: Mr. Moffett has many years of experience as the chief financial officer of public financial services companies. He also has experience as the chief executive officer of an entity in the housing finance industry, including related public policy experience. |

4

Committees

Audit

Risk (Chair) |

Thomas E. Moloney, 75, former Senior Executive Vice President and Chief Financial Officer of John Hancock Financial Services, Inc. Director since October 2009.

Mr. Moloney served as the interim Chief Financial Officer of MSC—Medical Services Company (“MSC”) from December 2007 to March 2008. He retired as the Senior Executive Vice President and Chief Financial Officer of John Hancock Financial Services, Inc. in December 2004. He had served in this position since 1992. Mr. Moloney served in various roles at John Hancock Financial Services, Inc. during his tenure from 1965 to 1992, including Vice President, Controller, and Senior Accountant. Mr. Moloney has served as a director of SeaWorld Entertainment, Inc. since January 2015. He also previously served as a director of MSC from 2005 to 2012 (MSC was acquired in 2012 and ceased to be a public company in 2008). Mr. Moloney is on the boards of Nashoba Learning Group and the Boston Children’s Museum (past Chairperson), both non-profit organizations. Mr. Moloney received a B.A. in Accounting from Bentley University and holds a Silver Level Executive Masters Professional Director Certification from the Corporate Directors Group.

Qualifications: Mr. Moloney provides almost 40 years of insurance industry and accounting experience, including having served as the chief financial officer of a public insurance company. He provides extensive knowledge of accounting and finance in regard to insurance products as well as risk assessment and risk oversight. |

Committees

Audit

Risk |

Debra J. Perry, 68, former Executive at Moody’s Investor Service, Inc. Director since December 2016.

Ms. Perry worked at Moody’s Corporation from 1992 to 2004. From 2001 to 2004, Ms. Perry was a senior managing director in the Global Ratings and Research Unit of Moody’s Investors Service, Inc. where she oversaw the Americas Corporate Finance and U.S. Public Finance Groups. From 1999 to 2001, Ms. Perry served as Chief Administrative Officer and Chief Credit Officer, and from 1996 to 1999, she was a group managing director for the Finance, Securities and Insurance Rating Groups of Moody’s Corporation. Ms. Perry has served as a director of Assurant, Inc., a provider of risk management solutions, since August 2017 and as risk committee chair since May 2019; and as a director of Korn/Ferry International, a talent management and executive search firm, since 2008. She has also served as a director of The Bernstein Funds (which currently oversees the Sanford C. Bernstein Fund, the Bernstein Fund and the Alliance Multi-Manager Alternative Fund) since July 2011 and has served as chair since July 2018. She was a member of the board of PartnerRe, a Bermuda-based reinsurance company, from June 2013 to March 2016. She was also a trustee of the Bank of America Funds from June 2011 until April 2016. Ms. Perry served on the board of directors of CNO Financial Group, Inc. from 2004 to 2011. In 2014, Ms. Perry was named to the National Association of Corporate Directors’ Directorship 100, which recognizes the most influential people in the boardroom and corporate governance community. From September 2012 to December 2014, Ms. Perry served as a member of the Executive Committee of the Committee for Economic Development (“CED”) in Washington, D.C. a non-partisan, business-led public policy organization, until its merger with the Conference Board, and she continues as a member of CED. Ms. Perry received her B.A. in History from the University of Wisconsin and her M.A. in European History from Yale University.

Qualifications: Ms. Perry brings extensive knowledge of corporate governance as a result of her many years of board and board committee experience, including service on multiple audit committees, two of which she has chaired. Ms. Perry also has significant experience in executive management at a Nationally Recognized Statistical Rating Organization, or “NRSRO,” where she oversaw the financial analysis and assignment of credit and financial strength ratings to financial and industrial companies and public sector entities, including the global insurance industry. |

5

Committees

Audit (Chair)

Management Compensation |

Robert P. Restrepo Jr., 69, former Chairman and President and Chief Executive Officer of State Auto Financial Corporation. Director since December 2016.

Mr. Restrepo retired from State Auto Financial Corporation in 2015, having served as its Chairman from 2006 to December 2015 and as its President and Chief Executive Officer from 2006 to May 2015. Mr. Restrepo has over 40 years of insurance industry experience, having held executive roles at Main Street America Group, Hanover Insurance Group Inc. (formerly Allmerica Financial Corp), Travelers and Aetna. Mr. Restrepo has served as a director of Majesco, a provider of insurance software and consulting services, since August 2015, and RLI Corp., a property and casualty insurance company, since July 2016. Mr. Restrepo also currently serves on the boards of directors of The Larry H. Miller Group of Companies and Nuclear Electric Insurance Limited. Mr. Restrepo received a B.A. in English from Yale University.

Qualifications: Mr. Restrepo offers over 40 years of experience managing and operating insurance companies and has expertise in corporate governance, acquisitions, risk, strategic planning and leadership development. |

Committees

Audit

Management Compensation |

James S. Riepe, 76, Senior Advisor and former Vice Chairman of T. Rowe Price Group, Inc. Director since March 2006, Lead Director from February 2009 to May 2012 and Non-Executive Chairman of the Board since May 2012.

Mr. Riepe is a retired Vice Chairman and a Senior Advisor at T. Rowe Price Group, Inc. Mr. Riepe served as the Vice Chairman of T. Rowe Price Group, Inc. from 1997 until his retirement in December 2005. Prior to joining T. Rowe Price Group, Inc. in 1981, Mr. Riepe was an Executive Vice President of The Vanguard Group. He has served as a director of LPL Financial Holdings Inc. since February 2008. Mr. Riepe also previously served on the boards of directors of The NASDAQ OMX Group, Inc. from May 2003 to May 2014, T. Rowe Price Group, Inc. from 1981 to 2006 and 57 T. Rowe Price registered investment companies (mutual funds) until his retirement in 2006. He is an Emeritus member of the University of Pennsylvania’s Board of Trustees and Trustee of Penn Medicine. Mr. Riepe received a B.S. in Industrial Management, M.B.A. and Honorary Doctor of Laws degree from the University of Pennsylvania.

Qualifications: Mr. Riepe brings to the Board significant expertise in finance and investments, as well as extensive management and operating experience, gained through his role as a senior executive in the investment management industry, including 23 years with T. Rowe Price. |

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE

ELECTION OF SEN. CONRAD, MS. HIGGINS, MR. MCINERNEY,

MR. MOFFETT, MR. MOLONEY, MS. PERRY, MR. RESTREPO AND MR. RIEPE.

6

Governance Principles

Our Governance Principles are published on Genworth’s website, as are our other corporate governance materials, including the charters adopted by the Board for each of our standing committees and any key practices adopted by the committees. To view these materials, go to www.genworth.com, select “Investors” and then select “Corporate Governance.” The Board regularly reviews corporate governance developments and may modify these principles, charters and key practices as warranted. Any modifications will be reflected in the documents on Genworth’s website.

Meeting Attendance

The Board and its committees held the following number of meetings during 2018:

| Number of Meetings |

||||

|

Board of Directors

|

|

14

|

| |

|

Audit Committee

|

|

12

|

| |

|

Management Development and Compensation Committee

|

|

5

|

| |

|

Nominating and Corporate Governance Committee

|

|

6

|

| |

|

Risk Committee

|

|

7

|

| |

During 2018, each of our director nominees attended more than 75% of the aggregate of (1) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director) and (2) the total number of meetings held by all committees of the Board on which he or she served (during the periods that he or she served). As set forth in the Governance Principles, directors are expected to attend the 2019 Annual Meeting. All of our current directors, other than Mr. Moffett and Ms. Perry, attended the 2018 Annual Meeting of Stockholders.

Board Leadership Structure

Our Board of Directors functions in a collaborative fashion that emphasizes active participation and leadership by all of its members. As further described in our Governance Principles, the company’s business is conducted day-to-day by its officers, under the direction of our Chief Executive Officer (“CEO”) and the oversight of the Board, to enhance the long-term value of the company for its stockholders. Our Bylaws require our Board of Directors to appoint a Chairman of the Board but give it the flexibility to appoint as Chairman (i) our CEO, (ii) an independent director or (iii) a non-independent director other than the CEO. Our Board of Directors determines who to appoint as our Chairman based on the knowledge and experience of the people then serving on our Board of Directors and as CEO and chooses the person whom it believes best meets the needs of our company at that time. Our Board of Directors has determined that having Thomas J. McInerney serve as our CEO and a director and James S. Riepe serve as our Non-Executive Chairman of the Board is the appropriate leadership structure for our company at this time. In May 2012, our Board selected Mr. Riepe, one of our independent directors since 2006 and formerly our Lead Director, to serve as our Non-Executive Chairman of the Board due to Mr. Riepe’s service with and knowledge of our company and his significant leadership experience.

As more fully set forth in our Governance Principles, available on our website (to view, go to www.genworth.com, select “Investors,” then select “Corporate Governance” and then select “Governance Principles”), the Non-Executive Chairman’s responsibilities and authority include:

| • | presiding at all meetings of the Board, stockholders and non-management and independent directors; |

| • | facilitating efficient Board operations through regular engagement with standing committees of the Board and individual directors; |

7

| • | regularly communicating with the CEO to provide him or her with advice and counsel, and to share information about recent developments; |

| • | serving as a liaison between the CEO and the non-management and independent directors; |

| • | consulting on meeting agendas; |

| • | working with management to assure that meeting materials are fulfilling the needs of directors; |

| • | consulting on the meeting calendar and meeting schedules to assure there is sufficient time to discuss all agenda items; |

| • | periodically calling meetings of the non-management and independent directors, including at the request of such directors; |

| • | working with the CEO to respond to stockholder inquiries involving the Board; and |

| • | fulfilling other responsibilities as determined by the Board. |

Role of Board in the Oversight of Risk

Our Board of Directors recognizes that, although risk management is primarily the responsibility of Genworth’s management, the Board plays a critical role in the oversight of risk. As a financial services company, the very nature of our business involves the underwriting, management and assumption of risks on behalf of our customers. The Board believes it is an important part of its responsibilities to oversee the company’s overall risk assessment processes and management thereof. The Board as a whole has historically discussed with management specific business risks as part of its regular reviews of the individual business units and also on a company-wide basis as part of its strategic reviews.

Our Board established the Risk Committee to be specifically responsible for overseeing Genworth’s enterprise risk management policies and related risk profile, including but not limited to the following major risk exposures: credit risks, market risks, insurance risks, housing risks, operational risks, model risks, information technology risks, and any other risk that poses a material threat to the viability of Genworth. In connection with reviewing and overseeing the control, management and mitigation processes relating to Genworth’s enterprise management policies and risk appetite, the Risk Committee recommends annually for Board approval: (i) enterprise risk management policies and (ii) the risk appetite of the company. The Risk Committee oversees the implementation and maintenance of such policies and appetite. All members of the Risk Committee are independent, as discussed below, and Genworth’s Chief Risk Officer also has a direct reporting obligation to the Risk Committee.

The Board also utilizes its other committees to oversee specific risks and receives regular reports from the committees on the areas of risk for which they have oversight. The Audit Committee has responsibility for oversight of risks associated with financial accounting and reporting, including the system of internal control. The Management Development and Compensation Committee oversees the risks relating to compensation plans and programs, as well as management development and leadership succession in the company’s various business units. Our Nominating and Corporate Governance Committee is responsible for the oversight of risks relating to corporate governance.

We believe that our risk oversight structure is supported by our current Board leadership structure, with the Non-Executive Chairman of the Board working together with our independent Risk Committee and our other standing committees.

Board Self-Evaluation

The Board and each of its committees follow a specific process, overseen by the Nominating and Corporate Governance Committee, to determine their effectiveness and opportunities for improvement. The Board and each

8

respective committee conduct a self-evaluation annually, focusing on how the Board can improve its key functions of overseeing personnel development, financials, and other major issues of strategy, risk, integrity, reputation and governance. During the process, ideas are solicited from directors about:

| • | improving prioritization of issues; |

| • | improving quality of written, chart and oral presentations from management; |

| • | improving quality of Board or committee discussions on these key matters; |

| • | improving communication and feedback regarding observations of fellow Board members; |

| • | identifying ways to improve the effectiveness of the Board and its committees; |

| • | identifying how specific issues in the past year could have been handled better; |

| • | identifying specific issues which should be discussed in the future; and |

| • | identifying any other matter of importance to Board functioning. |

The Nominating and Corporate Governance Committee coordinates with the Non-Executive Chairman of the Board to organize the comments received in a manner that identifies options for changes at either the Board or committee level. The Board and each committee then review and discuss the results of the self-assessments, and the Non-Executive Chairman of the Board and chairpersons of each committee coordinate any necessary follow-up actions.

Director Independence

Our Board currently consists of nine directors, eight of whom are independent (as defined by our Governance Principles and NYSE listing standards) and one of whom is our CEO, Mr. McInerney. For a director to be independent, the Board must determine that the director does not have any direct or indirect material relationship with Genworth. The Board has established guidelines to assist it in determining director independence, which conform to, or are more exacting than, the independence requirements of the NYSE. The independence guidelines are set forth in Section 4 of our Governance Principles, which are available on our website (to view, go to www.genworth.com, select “Investors,” then select “Corporate Governance” and then select “Governance Principles”). In addition to applying these guidelines, the Board will consider all relevant facts and circumstances in making an independence determination. Our Board has determined that the purchase of Genworth products and services on the same terms available to unaffiliated entities or persons does not impair a director’s independence and therefore such purchases are not considered by our Board when making independence determinations. The Board has determined that Sen. Conrad, Ms. Higgins, Mr. Moffett, Mr. Moloney, Ms. Perry, Mr. Restrepo and Mr. Riepe satisfy the NYSE’s independence requirements and Genworth’s independence guidelines. In addition, the Board has determined that Mr. Bolinder, who is currently serving on the Board but not standing for re-election at the 2019 Annual Meeting, also satisfies the NYSE’s independence requirements and Genworth’s independence guidelines.

In addition to the independence guidelines discussed above, members of the Audit Committee must satisfy additional independence requirements established by the SEC and the NYSE. Specifically, they may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from Genworth or any of its subsidiaries other than their directors’ compensation and they may not be affiliated with Genworth or any of its subsidiaries. The Board has determined that all of the members of the Audit Committee satisfy the relevant SEC and NYSE independence requirements.

Further, in affirmatively determining the independence of any director who will serve on the Management Development and Compensation Committee, the Board has also considered all factors specifically relevant to determining whether a director has a relationship to Genworth that is material to that director’s ability to be independent from management in connection with the duties of a member of the Management Development and

9

Compensation Committee, including: (1) the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by Genworth to such director; and (2) whether the director is affiliated with Genworth, its subsidiaries or its affiliates.

Code of Business Conduct and Ethics

All of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller, must act ethically at all times and in accordance with the policies comprising our code of business conduct and ethics set forth in Genworth’s Code of Ethics (“Code of Ethics”). If an actual or potential conflict of interest arises for a director, the director shall promptly inform the chief executive officer. To view our Code of Ethics, go to www.genworth.com, select “Investors,” then select “Corporate Governance,” then select “Code of Business Conduct & Ethics” and finally select “Genworth Code of Ethics.” Section 11 of our Governance Principles, which are available on our website, more fully addresses our Code of Ethics. Under our Governance Principles, the Board will not permit any waiver of any ethics policy for any director or executive officer. Within the time period required by the SEC and the NYSE, we will post on our website any amendment to our Code of Ethics.

BOARD OF DIRECTORS AND COMMITTEES

Board Composition

Our Board of Directors is composed of individuals with diverse experience at policy-making levels in business and government in areas that are relevant to the company. Each director was nominated on the basis of the unique set of qualifications and skills he or she brings to the Board, as well as how those qualifications and skills blend with those of the others on the Board as a whole. The blend of our directors’ diverse backgrounds ensures that issues facing the company are examined and addressed with the benefit of a broad array of perspectives and expertise.

10

We believe that our director nominees have demonstrated leadership in a variety of positions across various professions and industries. As a group, apart from Mr. McInerney, our director nominees’ experiences, qualifications and skills include:

|

INDEPENDENT DIRECTOR NOMINEE

|

| ||||||||||||||||||||||||||||||||||

| Sen. Conrad |

Ms. Higgins |

Mr. Moffett |

Mr. Moloney |

Ms. Perry |

Mr. Restrepo |

Mr. Riepe | |||||||||||||||||||||||||||||

| Chief Executive Officer Experience |

✓ |

✓ |

|||||||||||||||||||||||||||||||||

| Chief Financial Officer Experience |

✓ |

✓ |

|||||||||||||||||||||||||||||||||

| Insurance |

✓ |

✓ |

✓ |

✓ |

|||||||||||||||||||||||||||||||

| Mortgage |

✓ |

||||||||||||||||||||||||||||||||||

| Risk |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|||||||||||||||||||||||||||||

| Mergers & Acquisitions |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

||||||||||||||||||||||||||||

| Finance and Investment Management |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|||||||||||||||||||||||||||||

| Healthcare/Medical |

✓ |

✓ |

|||||||||||||||||||||||||||||||||

| Consumer Marketing |

✓ |

|

|||||||||||||||||||||||||||||||||

| Distribution |

✓ |

✓ |

✓ |

|

|||||||||||||||||||||||||||||||

| Public Policy/Political |

✓ |

✓ |

✓ |

||||||||||||||||||||||||||||||||

| Public Company Board Experience |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|||||||||||||||||||||||||||

| Technology/IT |

✓ |

✓ |

|

||||||||||||||||||||||||||||||||

| Restructuring and Turnaround |

✓ |

✓ |

✓ |

||||||||||||||||||||||||||||||||

| Asset Management |

✓ |

✓ |

✓ |

✓ |

|

||||||||||||||||||||||||||||||

| International |

✓ |

✓ |

✓ |

✓ |

✓ |

|

|||||||||||||||||||||||||||||

See the Election of Directors section above for a description of each director nominee’s complete biographical information, qualifications and skills.

Subject to the rights of the holders of any outstanding series of our preferred stock, our certificate of incorporation provides that the number of authorized directors of our company will be fixed from time to time by a resolution adopted by our Board of Directors, but will not be less than one nor more than 15. Our Governance Principles further state that the size of the Board should be in the range of seven to 15 directors. Our Board of Directors has set the size of the Board of Directors at eight members, effective as of the 2019 Annual Meeting, but continues to evaluate the optimal size for the Board and may consider the addition of one or more independent directors to the Board in the future.

Each director elected by the holders of our common stock will serve until the 2020 Annual Meeting and until his or her successor is duly elected and qualified, or until the earlier of their resignation or removal in a manner provided for in the Bylaws. The holders of our common stock do not have cumulative voting rights in the election of directors.

Our Governance Principles provide that directors who serve as chief executive officers or in equivalent positions for other public companies should not serve on more than two other boards of public companies in addition to the Genworth Board and other directors should not serve on more than four other boards of public companies in addition to the Genworth Board.

11

Board Committees

The four standing committees of the Board are the Audit Committee, Management Development and Compensation Committee, Nominating and Corporate Governance Committee and Risk Committee. These committees are described below. The Board has established written charters for each of its four standing committees. Our Board of Directors may also establish various other committees to assist it in carrying out its responsibilities.

Audit Committee

The Board has established the Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee consists solely of “independent” directors as defined by the applicable rules of the NYSE and the SEC and by our Governance Principles. In addition, the Board has determined that all four of the Audit Committee’s current members, Messrs. Moloney, Restrepo, and Riepe and Ms. Perry, are “audit committee financial experts,” as defined by SEC rules.

As more fully set forth in its charter, which can be found in the corporate governance section of our website (to view, go to www.genworth.com, select “Investors,” then select “Corporate Governance,” then select “Audit Committee” and finally select “Charter”), the purpose of the Audit Committee is to assist the Board in its oversight of the integrity of the company’s financial statements, the company’s compliance with legal and regulatory requirements, the independence and qualifications of the company’s independent registered public accounting firm and the performance of the company’s internal audit function and independent auditors. The Audit Committee’s duties include:

| • | discussing with management and our independent registered public accounting firm our annual and quarterly financial statements, earnings releases and financial information and earnings guidance provided to analysts and rating agencies; |

| • | selecting our independent registered public accounting firm and approving the terms of its engagement; |

| • | discussing with management and our independent registered accounting firm any audit problems or difficulties and management’s response; |

| • | independently and/or in coordination with the Risk Committee, overseeing risks associated with financial accounting and reporting, including the system of internal control, which includes reviewing and discussing with management and our independent registered public accounting firm the company’s risk assessment process and management policies with respect to the company’s major financial risk exposure and the procedures utilized by management to identify and mitigate the exposure to such risks; |

| • | reviewing our financial reporting and accounting standards and principles; |

| • | reviewing our internal system of financial controls and the results of internal audits; |

| • | obtaining and reviewing formal written reports from the independent registered public accounting firm regarding its internal quality-control procedures; |

| • | reviewing and investigating any matters pertaining to the integrity of management, including conflicts of interest, or adherence to standards of business conduct; |

| • | preparing and publishing a committee report for inclusion in the proxy statement; |

| • | establishing procedures for the hiring of employees or former employees of our independent registered public accounting firm; |

| • | establishing procedures for the receipt, retention and treatment of complaints on accounting, internal accounting controls or auditing matters; and |

| • | establishing policies and procedures for the review and approval of all proposed transactions with “Related Persons,” as that term is defined in Section 11(b) of our Governance Principles. |

12

The Audit Committee has determined that in view of the increased demands and responsibilities of the committee, its members generally should not serve on more than two additional audit committees of other public companies. The Audit Committee’s report appears on page 64 of this Proxy Statement.

Management Development and Compensation Committee

The Management Development and Compensation Committee (the “Compensation Committee”) consists solely of “independent” directors as defined by the applicable rules of the NYSE and by our Governance Principles. As more fully set forth in its charter, which can be found in the corporate governance section of our website (to view, go to www.genworth.com, select “Investors,” then select “Corporate Governance,” then select “Management Development and Compensation Committee” and finally select “Charter”), the Compensation Committee’s responsibilities include:

| • | reviewing and approving on an annual basis the corporate goals and objectives with respect to the compensation of our CEO, evaluating our CEO’s performance in light of these goals and objectives and setting our CEO’s compensation based on such evaluation; |

| • | reviewing and approving on an annual basis the evaluation process and compensation structure for our other officers, including evaluating and setting the compensation for our senior executive officers; |