Earnings Summary February 7, 2017 Fourth Quarter 2016 Exhibit 99.3

Genworth 4Q16 Earnings Presentation - February 7, 2017 This presentation contains certain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning & include, but are not limited to, statements regarding the outlook for future business and financial performance of Genworth Financial, Inc. (Genworth) and its consolidated subsidiaries. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially due to global political, economic, business, competitive, market, regulatory and other factors and risks, including those discussed at the end of this presentation, as well as in the risk factors section of Genworth’s Annual Report on Form 10-K, filed with the United States Securities and Exchange Commission (SEC) on February 26, 2016 and as updated in Genworth’s Form 10-Q filed with the SEC on November 8, 2016. Genworth undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise. Assumptions This presentation discusses assumptions related to Genworth’s long term care insurance, life insurance and annuities businesses. Genworth calculates and maintains reserves for the estimated future payment of claims to its policyholders and contractholders in accordance with applicable accounting and regulatory requirements. Long term care insurance, life insurance and annuities reserves are based on assumptions which extend for many years into the future about expenses, premium persistency, mortality, morbidity, lapse rates, future yield on related investments and other assumptions. Many factors can affect these reserves, including, but not limited to, interest rates, policyholder behavior, economic and social conditions, mortality and morbidity trends, inflation, healthcare experience, future premium rate increases, changes in doctrines of legal liability and damage awards in litigation. Therefore, the reserves Genworth establishes are necessarily based on estimates, assumptions and its analysis of historical experience and inherently uncertain predictions about the future. Genworth’s results depend significantly upon the extent to which its actual experience (including with respect to future premium increases) is consistent with the assumptions it used in determining its reserves and pricing its products. Genworth’s reserve assumptions and estimates require significant judgment and, therefore, are inherently uncertain. Genworth cannot determine with precision the ultimate amounts that it will pay for actual benefits or the timing of those payments. In addition, where circumstances warrant, Genworth changes its actuarial assumptions based on its monitoring of actual experience. Genworth also bases its reserves on complex calculations run through various models. Refinements to those models also can impact reserve levels. For additional information about Genworth’s assumptions, refer to the Critical Accounting Estimates sub-section of the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016 and as updated in Genworth’s Form 10-Q filed with the SEC on November 8, 2016. Non-GAAP1 And Other Items All financial data is as of December 31, 2016 unless otherwise noted. For additional information, please see Genworth’s fourth quarter of 2016 earnings release and financial supplement posted at genworth.com. For important information regarding the use of non-GAAP and selected operating performance measures, see the Appendix. Unless otherwise noted, all references in this presentation to net income (loss) and adjusted operating income (loss), formally labeled “net operating income (loss)” should be read as net income (loss) available to Genworth’s common stockholders and adjusted operating income (loss) available to Genworth’s common stockholders, respectively. Cautionary Note Regarding Forward-Looking Statements 1U.S. Generally Accepted Accounting Principles

Key Financial Themes For The 4th Quarter Financial Performance GAAP Annual Assumption Review Complete For U.S. Life Insurance Long Term Care Insurance (LTC) Active Life GAAP Margins Of ~$1.0 To $1.5 Billion Universal Life1 (UL) Insurance After-Tax Charges Of $196MM Primarily Reflecting Updates To Mortality Assumptions Statutory & Cash Flow Testing Results For U.S. Life Insurance Companies In Process & Expected To Be Made Available At The Time Of The Form 10-K Filing U.S. Mortgage Insurance (MI) Strong Performance Continued As Full Year Adjusted Operating Income & New Insurance Written (NIW) Increased 40% & 35%, Respectively, Compared To 2015 Strong Loss Ratio & Capital Levels For U.S. MI, Canada MI & Australia MI; Full Year Loss Ratios Within Or Better Than Outlook Holding Company Cash & Liquid Assets Of ~$1.1 Billion 1Includes Both Universal Life & Term Universal Life Insurance Genworth 4Q16 Earnings Presentation - February 7, 2017

U.S. MI 2016 Adjusted Operating Income Of $250MM Is Second Highest Year Since IPO In 2004 Strong Flow Insurance In Force Growth With A 3 Year Compound Annual Growth Rate (“CAGR”) Of ~9% Flow Delinquencies Down To Less Than 25K After Reaching A Crisis Peak Of Over 107K In 4Q09 PMIERs1 Sufficiency Ratio Of 115% Of Required Assets Provides A Strong Capital Level Canada MI Financial Performance Has Driven Strong Capital Level & Sustained Dividends Mortgage Rule Changes Impacting MI Market Size, But Positive Impact On Portfolio Quality Recently Announced Average Premium Rate Increase Of ~20% In Response To Higher Capital Requirements Compliant With New Capital Framework That Was Effective January 1, 2017 Australia MI Regulatory Focus On Mortgage Lending Quality Driving Flow NIW Lower Strong Capital Generation From Portfolio Seasoning & Smaller Recent Books Continued Pressure From Mining Areas … Remaining Portfolio Performing Well Key Genworth Mortgage Insurance Perspectives 1Private Mortgage Insurer Eligibility Requirements Genworth 4Q16 Earnings Presentation - February 7, 2017

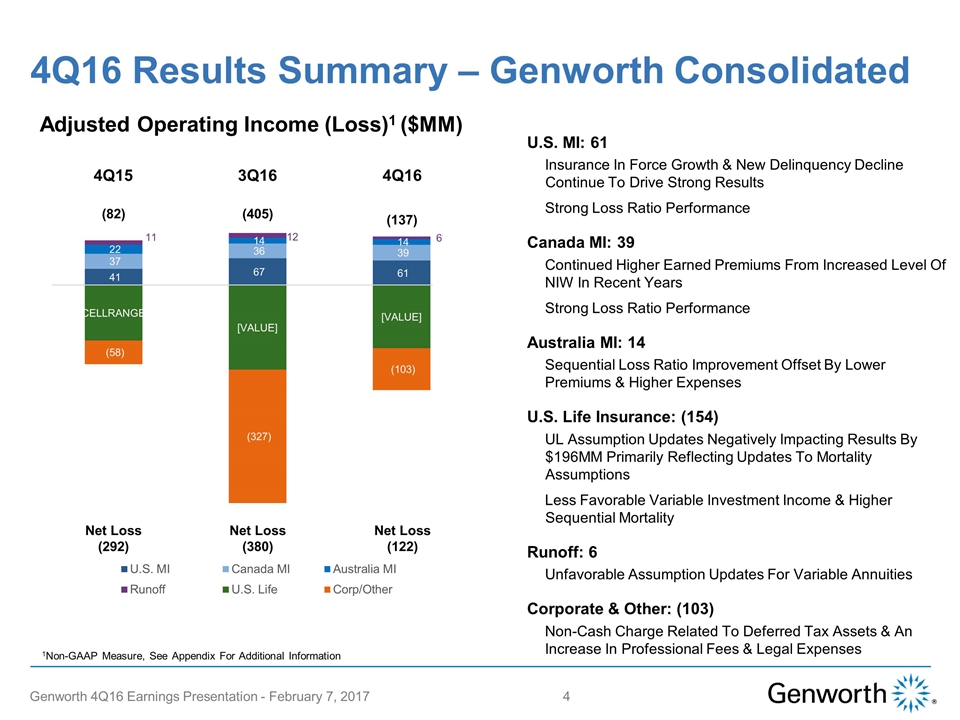

4Q16 Results Summary – Genworth Consolidated U.S. MI: 61 Insurance In Force Growth & New Delinquency Decline Continue To Drive Strong Results Strong Loss Ratio Performance Canada MI: 39 Continued Higher Earned Premiums From Increased Level Of NIW In Recent Years Strong Loss Ratio Performance Australia MI: 14 Sequential Loss Ratio Improvement Offset By Lower Premiums & Higher Expenses U.S. Life Insurance: (154) UL Assumption Updates Negatively Impacting Results By $196MM Primarily Reflecting Updates To Mortality Assumptions Less Favorable Variable Investment Income & Higher Sequential Mortality Runoff: 6 Unfavorable Assumption Updates For Variable Annuities Corporate & Other: (103) Non-Cash Charge Related To Deferred Tax Assets & An Increase In Professional Fees & Legal Expenses Adjusted Operating Income (Loss)1 ($MM) 1Non-GAAP Measure, See Appendix For Additional Information Net Loss (292) (82) (405) (137) Net Loss (122) Net Loss (380) 4Q15 3Q16 4Q16 Genworth 4Q16 Earnings Presentation - February 7, 2017

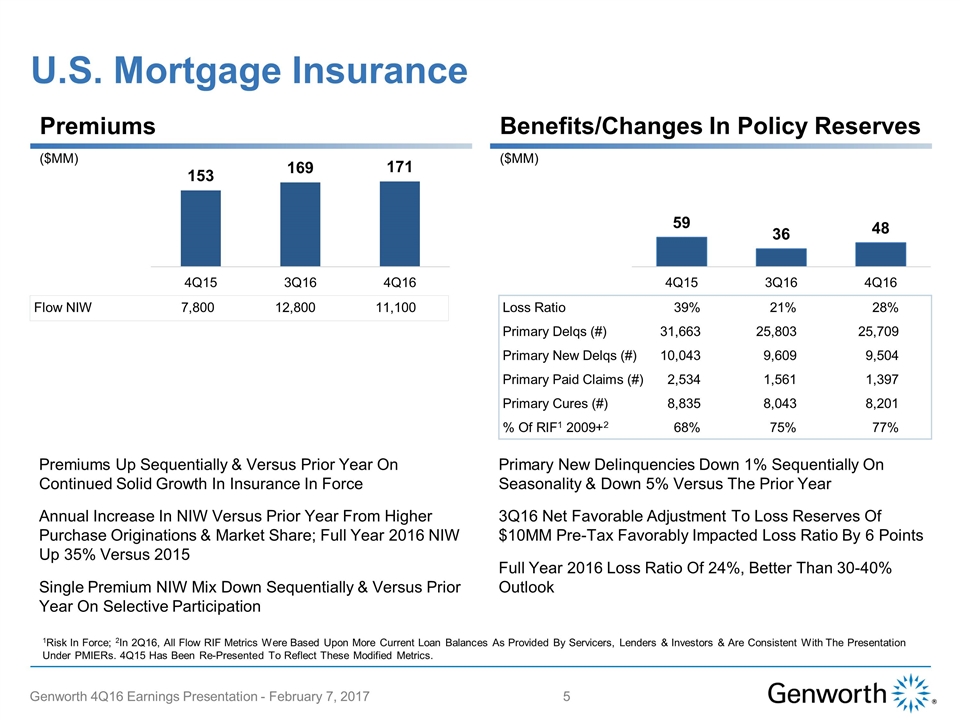

U.S. Mortgage Insurance ($MM) ($MM) Benefits/Changes In Policy Reserves Premiums Flow NIW7,80012,80011,100 Loss Ratio39%21%28% Primary Delqs (#)31,66325,80325,709 Primary New Delqs (#)10,0439,6099,504 Primary Paid Claims (#)2,5341,5611,397 Primary Cures (#)8,8358,0438,201 % Of RIF1 2009+268%75%77% Premiums Up Sequentially & Versus Prior Year On Continued Solid Growth In Insurance In Force Annual Increase In NIW Versus Prior Year From Higher Purchase Originations & Market Share; Full Year 2016 NIW Up 35% Versus 2015 Single Premium NIW Mix Down Sequentially & Versus Prior Year On Selective Participation Primary New Delinquencies Down 1% Sequentially On Seasonality & Down 5% Versus The Prior Year 3Q16 Net Favorable Adjustment To Loss Reserves Of $10MM Pre-Tax Favorably Impacted Loss Ratio By 6 Points Full Year 2016 Loss Ratio Of 24%, Better Than 30-40% Outlook 1Risk In Force; 2In 2Q16, All Flow RIF Metrics Were Based Upon More Current Loan Balances As Provided By Servicers, Lenders & Investors & Are Consistent With The Presentation Under PMIERs. 4Q15 Has Been Re-Presented To Reflect These Modified Metrics. Genworth 4Q16 Earnings Presentation - February 7, 2017

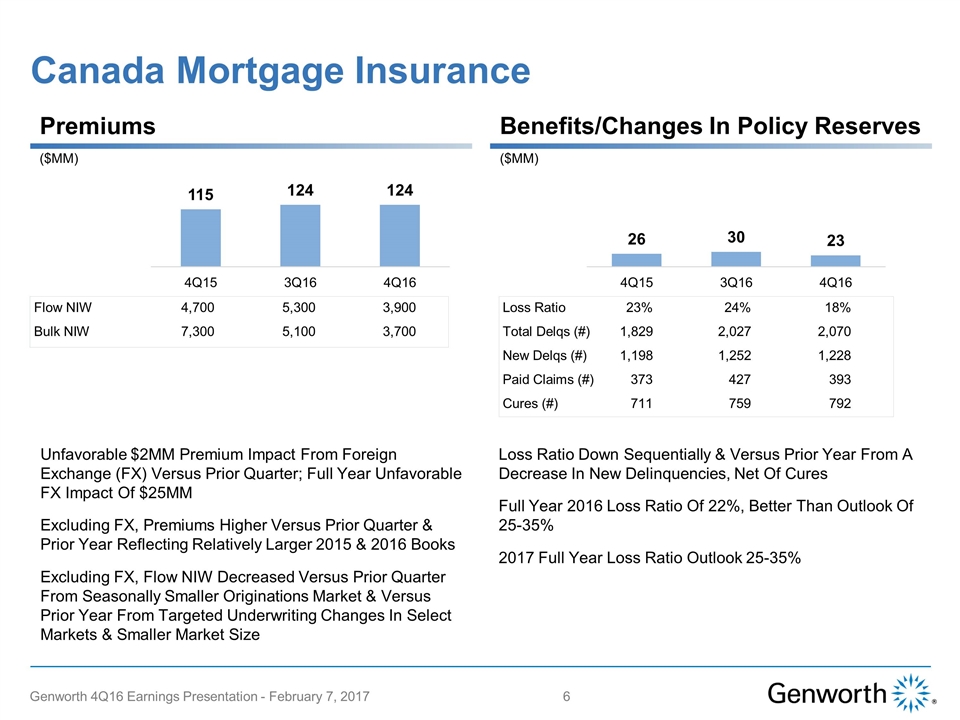

Flow NIW4,7005,3003,900 Bulk NIW7,3005,1003,700 Canada Mortgage Insurance ($MM) ($MM) Loss Ratio23%24%18% Total Delqs (#)1,8292,0272,070 New Delqs (#)1,1981,2521,228 Paid Claims (#)373427393 Cures (#)711759792 Benefits/Changes In Policy Reserves Premiums Unfavorable $2MM Premium Impact From Foreign Exchange (FX) Versus Prior Quarter; Full Year Unfavorable FX Impact Of $25MM Excluding FX, Premiums Higher Versus Prior Quarter & Prior Year Reflecting Relatively Larger 2015 & 2016 Books Excluding FX, Flow NIW Decreased Versus Prior Quarter From Seasonally Smaller Originations Market & Versus Prior Year From Targeted Underwriting Changes In Select Markets & Smaller Market Size Loss Ratio Down Sequentially & Versus Prior Year From A Decrease In New Delinquencies, Net Of Cures Full Year 2016 Loss Ratio Of 22%, Better Than Outlook Of 25-35% 2017 Full Year Loss Ratio Outlook 25-35% Genworth 4Q16 Earnings Presentation - February 7, 2017

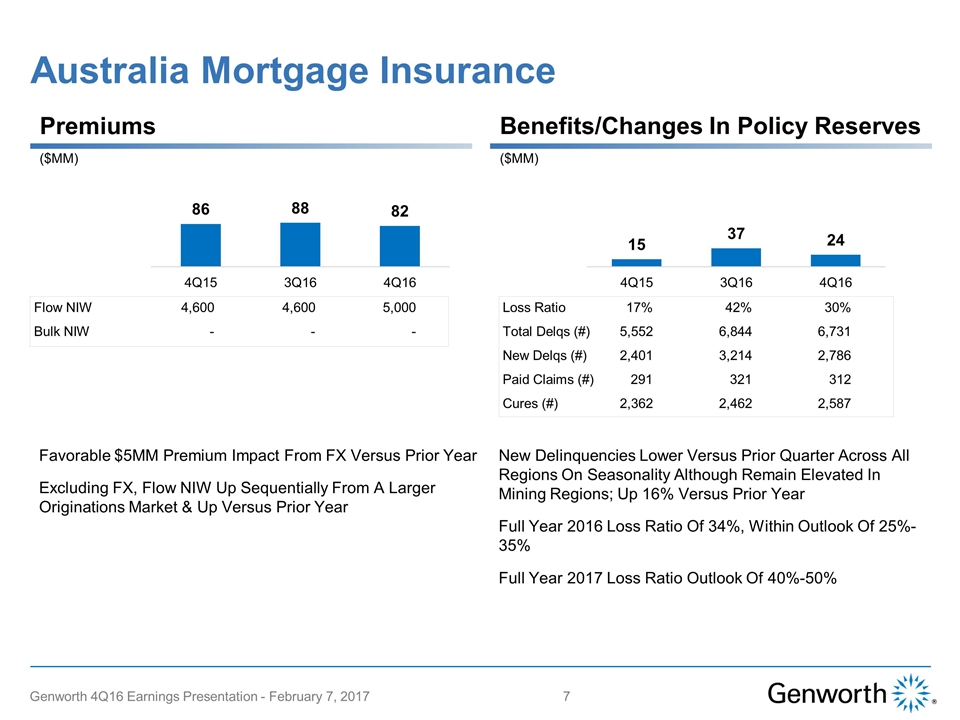

Australia Mortgage Insurance ($MM) ($MM) Benefits/Changes In Policy Reserves Premiums Flow NIW4,6004,6005,000 Bulk NIW--- Loss Ratio17%42%30% Total Delqs (#)5,5526,8446,731 New Delqs (#)2,4013,2142,786 Paid Claims (#)291321312 Cures (#)2,3622,4622,587 Favorable $5MM Premium Impact From FX Versus Prior Year Excluding FX, Flow NIW Up Sequentially From A Larger Originations Market & Up Versus Prior Year New Delinquencies Lower Versus Prior Quarter Across All Regions On Seasonality Although Remain Elevated In Mining Regions; Up 16% Versus Prior Year Full Year 2016 Loss Ratio Of 34%, Within Outlook Of 25%-35% Full Year 2017 Loss Ratio Outlook Of 40%-50% Genworth 4Q16 Earnings Presentation - February 7, 2017

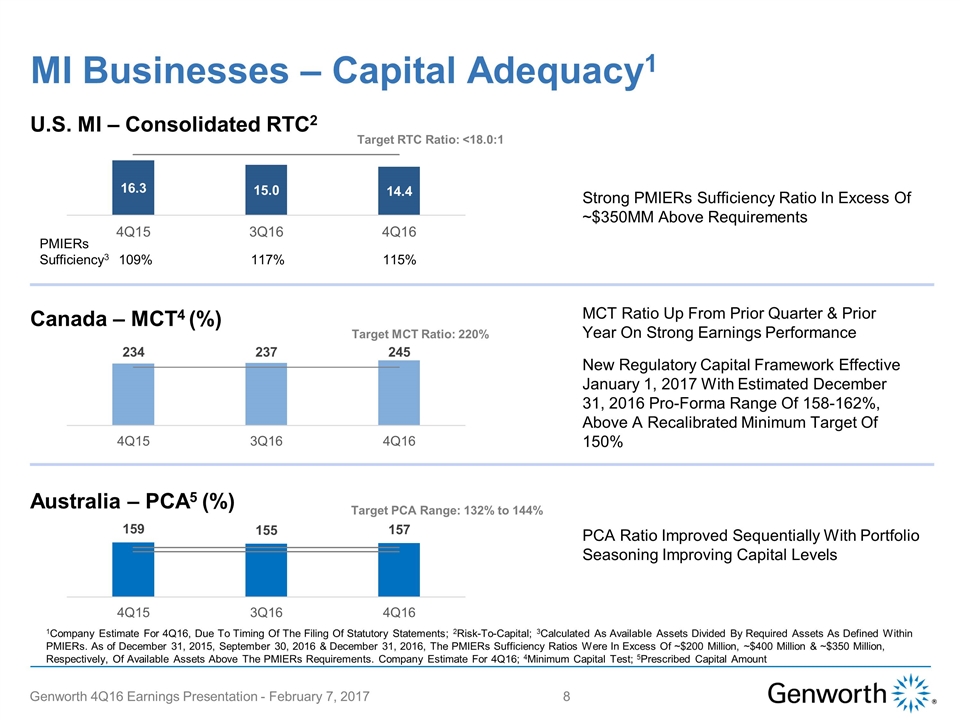

MI Businesses – Capital Adequacy1 1Company Estimate For 4Q16, Due To Timing Of The Filing Of Statutory Statements; 2Risk-To-Capital; 3Calculated As Available Assets Divided By Required Assets As Defined Within PMIERs. As of December 31, 2015, September 30, 2016 & December 31, 2016, The PMIERs Sufficiency Ratios Were In Excess Of ~$200 Million, ~$400 Million & ~$350 Million, Respectively, Of Available Assets Above The PMIERs Requirements. Company Estimate For 4Q16; 4Minimum Capital Test; 5Prescribed Capital Amount MCT Ratio Up From Prior Quarter & Prior Year On Strong Earnings Performance New Regulatory Capital Framework Effective January 1, 2017 With Estimated December 31, 2016 Pro-Forma Range Of 158-162%, Above A Recalibrated Minimum Target Of 150% Target PCA Range: 132% to 144% Target MCT Ratio: 220% PCA Ratio Improved Sequentially With Portfolio Seasoning Improving Capital Levels Strong PMIERs Sufficiency Ratio In Excess Of ~$350MM Above Requirements Australia – PCA5 (%) Canada – MCT4 (%) U.S. MI – Consolidated RTC2 Target RTC Ratio: <18.0:1 PMIERs Sufficiency3109%117%115% Genworth 4Q16 Earnings Presentation - February 7, 2017

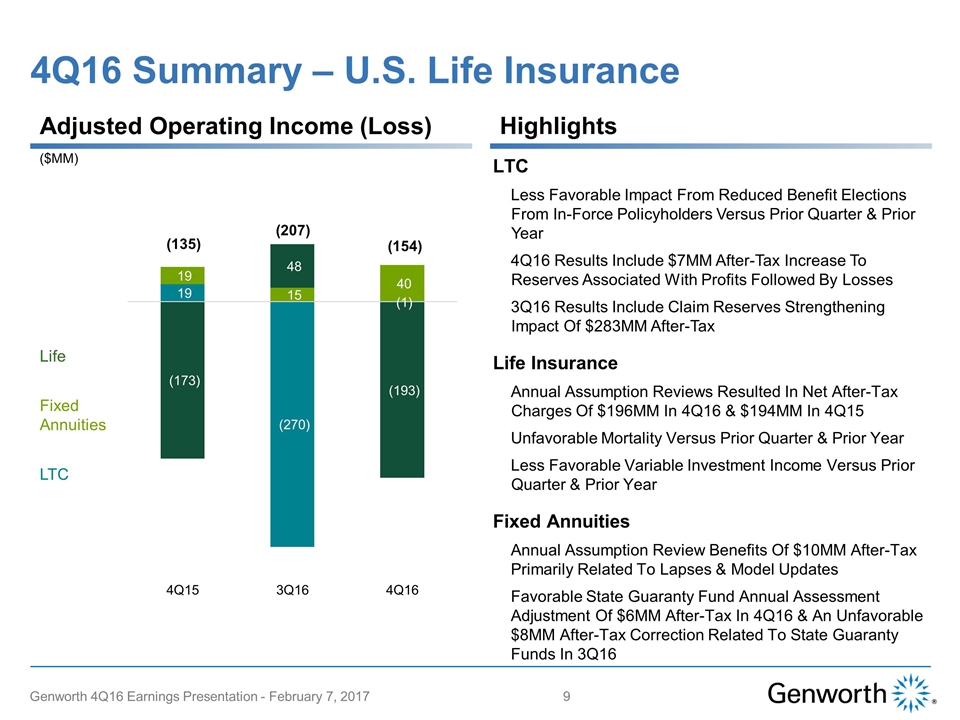

4Q16 Summary – U.S. Life Insurance ($MM) Highlights Adjusted Operating Income (Loss) (135) (207) (154) Life Fixed Annuities LTC LTC Less Favorable Impact From Reduced Benefit Elections From In-Force Policyholders Versus Prior Quarter & Prior Year 4Q16 Results Include $7MM After-Tax Increase To Reserves Associated With Profits Followed By Losses 3Q16 Results Include Claim Reserves Strengthening Impact Of $283MM After-Tax Life Insurance Annual Assumption Reviews Resulted In Net After-Tax Charges Of $196MM In 4Q16 & $194MM In 4Q15 Unfavorable Mortality Versus Prior Quarter & Prior Year Less Favorable Variable Investment Income Versus Prior Quarter & Prior Year Fixed Annuities Annual Assumption Review Benefits Of $10MM After-Tax Primarily Related To Lapses & Model Updates Favorable State Guaranty Fund Annual Assessment Adjustment Of $6MM After-Tax In 4Q16 & An Unfavorable $8MM After-Tax Correction Related To State Guaranty Funds In 3Q16 Genworth 4Q16 Earnings Presentation - February 7, 2017

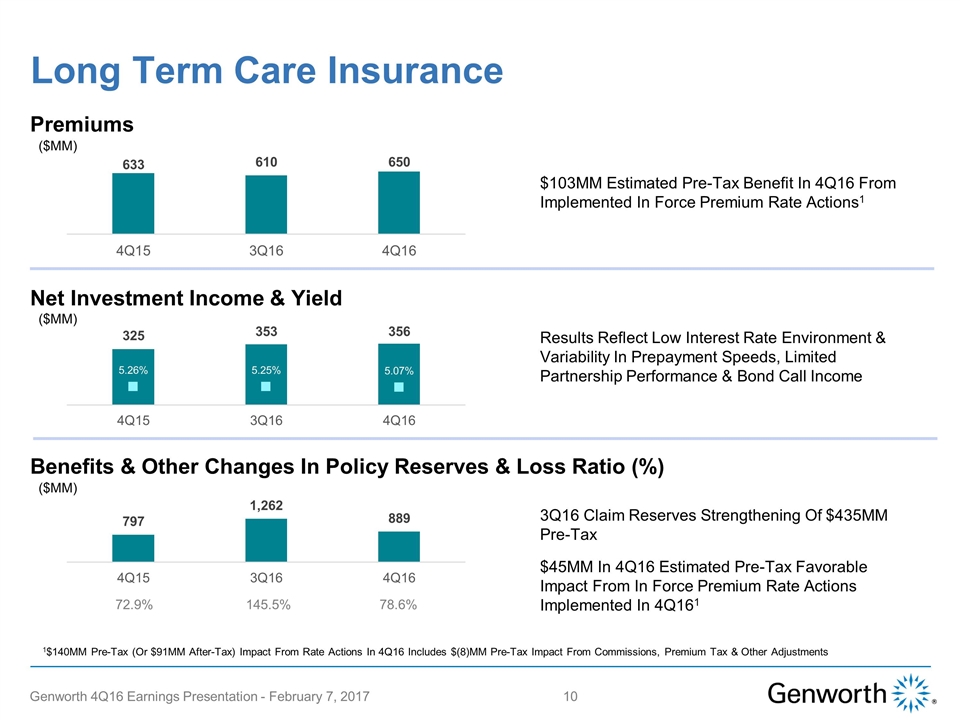

Benefits & Other Changes In Policy Reserves & Loss Ratio (%) Long Term Care Insurance Results Reflect Low Interest Rate Environment & Variability In Prepayment Speeds, Limited Partnership Performance & Bond Call Income 3Q16 Claim Reserves Strengthening Of $435MM Pre-Tax $45MM In 4Q16 Estimated Pre-Tax Favorable Impact From In Force Premium Rate Actions Implemented In 4Q161 $103MM Estimated Pre-Tax Benefit In 4Q16 From Implemented In Force Premium Rate Actions1 Net Investment Income & Yield Premiums 72.9% 145.5% 78.6% 1$140MM Pre-Tax (Or $91MM After-Tax) Impact From Rate Actions In 4Q16 Includes $(8)MM Pre-Tax Impact From Commissions, Premium Tax & Other Adjustments ($MM) ($MM) ($MM) Genworth 4Q16 Earnings Presentation - February 7, 2017

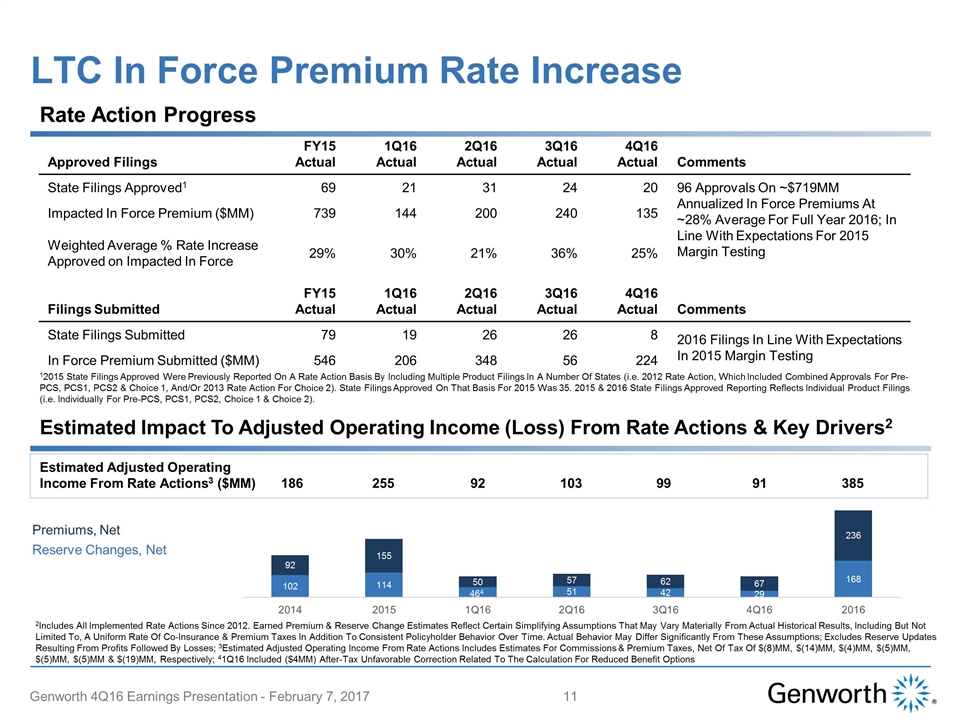

Approved Filings FY15 Actual 1Q16 Actual 2Q16 Actual 3Q16 Actual 4Q16 Actual Comments State Filings Approved1 69 21 31 24 20 96 Approvals On ~$719MM Annualized In Force Premiums At ~28% Average For Full Year 2016; In Line With Expectations For 2015 Margin Testing Impacted In Force Premium ($MM) 739 144 200 240 135 Weighted Average % Rate Increase Approved on Impacted In Force 29% 30% 21% 36% 25% Filings Submitted FY15 Actual 1Q16 Actual 2Q16 Actual 3Q16 Actual 4Q16 Actual Comments State Filings Submitted 79 19 26 26 8 2016 Filings In Line With Expectations In 2015 Margin Testing In Force Premium Submitted ($MM) 546 206 348 56 224 LTC In Force Premium Rate Increase Estimated Adjusted Operating Income From Rate Actions3 ($MM)186255 921039991385 2Includes All Implemented Rate Actions Since 2012. Earned Premium & Reserve Change Estimates Reflect Certain Simplifying Assumptions That May Vary Materially From Actual Historical Results, Including But Not Limited To, A Uniform Rate Of Co-Insurance & Premium Taxes In Addition To Consistent Policyholder Behavior Over Time. Actual Behavior May Differ Significantly From These Assumptions; Excludes Reserve Updates Resulting From Profits Followed By Losses; 3Estimated Adjusted Operating Income From Rate Actions Includes Estimates For Commissions & Premium Taxes, Net Of Tax Of $(8)MM, $(14)MM, $(4)MM, $(5)MM, $(5)MM, $(5)MM & $(19)MM, Respectively; 41Q16 Included ($4MM) After-Tax Unfavorable Correction Related To The Calculation For Reduced Benefit Options Premiums, Net Reserve Changes, Net Rate Action Progress Estimated Impact To Adjusted Operating Income (Loss) From Rate Actions & Key Drivers2 12015 State Filings Approved Were Previously Reported On A Rate Action Basis By Including Multiple Product Filings In A Number Of States (i.e. 2012 Rate Action, Which Included Combined Approvals For Pre-PCS, PCS1, PCS2 & Choice 1, And/Or 2013 Rate Action For Choice 2). State Filings Approved On That Basis For 2015 Was 35. 2015 & 2016 State Filings Approved Reporting Reflects Individual Product Filings (i.e. Individually For Pre-PCS, PCS1, PCS2, Choice 1 & Choice 2). Genworth 4Q16 Earnings Presentation - February 7, 2017

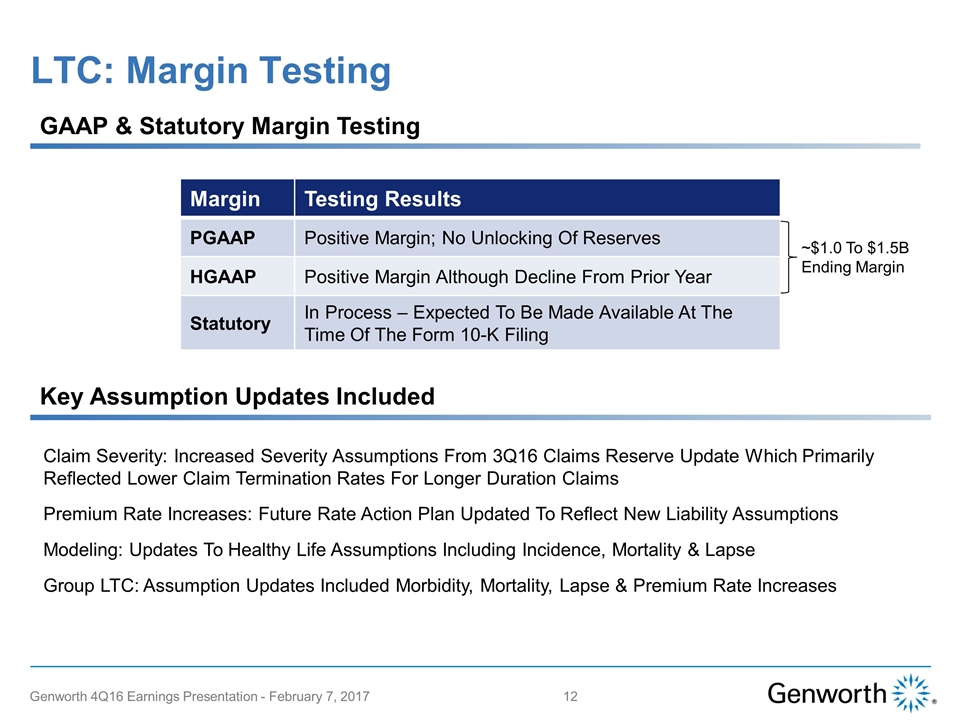

LTC: Margin Testing GAAP & Statutory Margin Testing Margin Testing Results PGAAP Positive Margin; No Unlocking Of Reserves HGAAP Positive Margin Although Decline From Prior Year Statutory In Process – Expected To Be Made Available At The Time Of The Form 10-K Filing Key Assumption Updates Included Claim Severity: Increased Severity Assumptions From 3Q16 Claims Reserve Update Which Primarily Reflected Lower Claim Termination Rates For Longer Duration Claims Premium Rate Increases: Future Rate Action Plan Updated To Reflect New Liability Assumptions Modeling: Updates To Healthy Life Assumptions Including Incidence, Mortality & Lapse Group LTC: Assumption Updates Included Morbidity, Mortality, Lapse & Premium Rate Increases Genworth 4Q16 Earnings Presentation - February 7, 2017 ~$1.0 To $1.5B Ending Margin

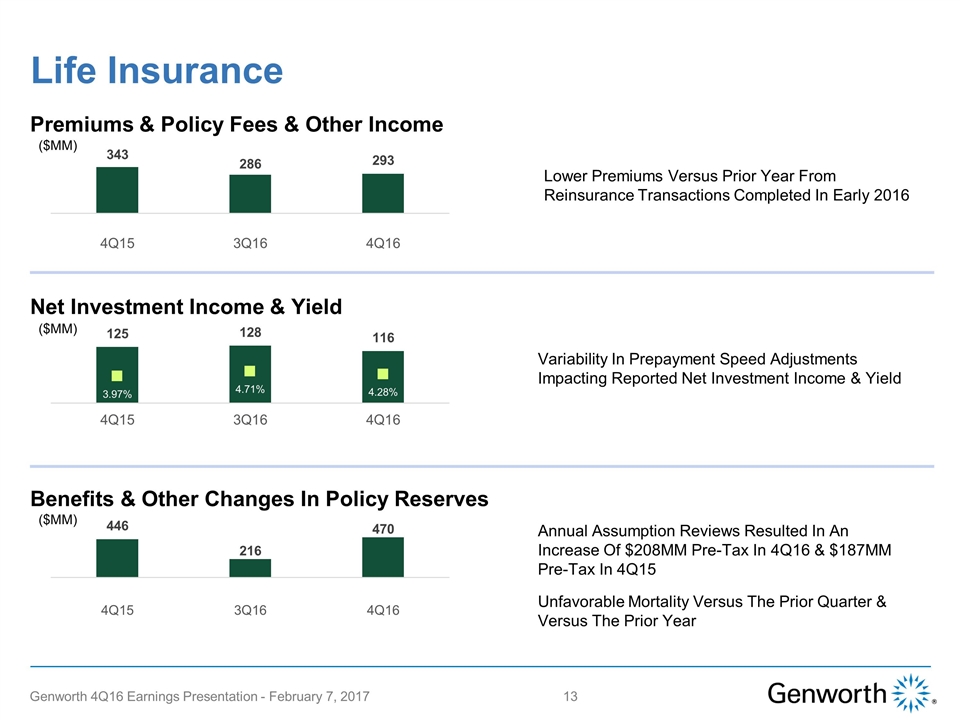

Benefits & Other Changes In Policy Reserves Life Insurance Variability In Prepayment Speed Adjustments Impacting Reported Net Investment Income & Yield Annual Assumption Reviews Resulted In An Increase Of $208MM Pre-Tax In 4Q16 & $187MM Pre-Tax In 4Q15 Unfavorable Mortality Versus The Prior Quarter & Versus The Prior Year Lower Premiums Versus Prior Year From Reinsurance Transactions Completed In Early 2016 Net Investment Income & Yield Premiums & Policy Fees & Other Income ($MM) ($MM) ($MM) Genworth 4Q16 Earnings Presentation - February 7, 2017

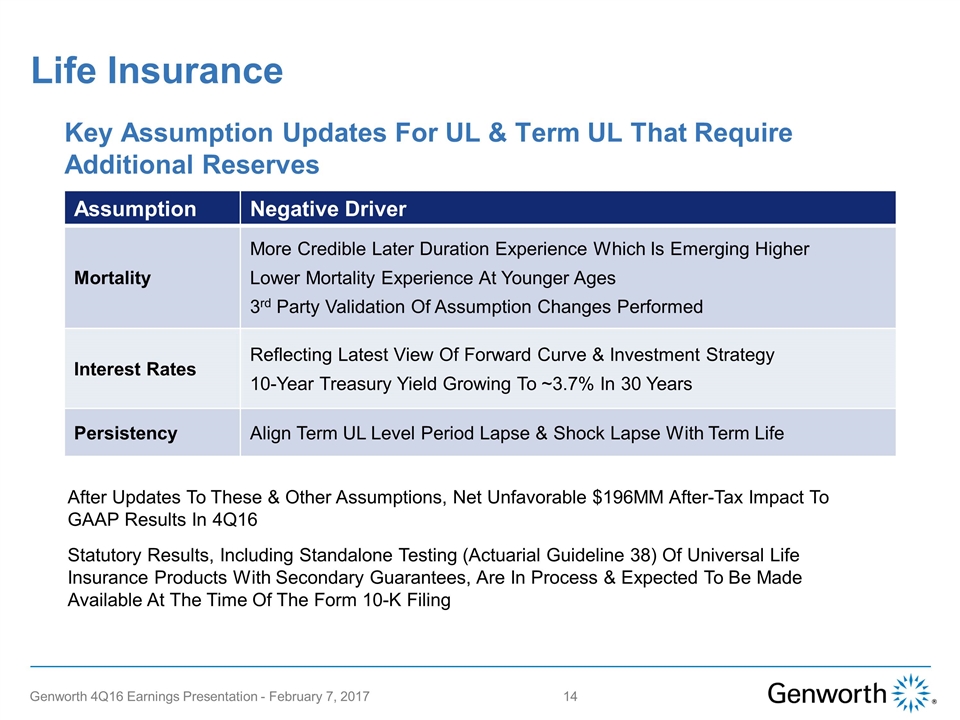

Life Insurance After Updates To These & Other Assumptions, Net Unfavorable $196MM After-Tax Impact To GAAP Results In 4Q16 Statutory Results, Including Standalone Testing (Actuarial Guideline 38) Of Universal Life Insurance Products With Secondary Guarantees, Are In Process & Expected To Be Made Available At The Time Of The Form 10-K Filing Assumption Negative Driver Mortality More Credible Later Duration Experience Which Is Emerging Higher Lower Mortality Experience At Younger Ages 3rd Party Validation Of Assumption Changes Performed Interest Rates Reflecting Latest View Of Forward Curve & Investment Strategy 10-Year Treasury Yield Growing To ~3.7% In 30 Years Persistency Align Term UL Level Period Lapse & Shock Lapse With Term Life Genworth 4Q16 Earnings Presentation - February 7, 2017 Key Assumption Updates For UL & Term UL That Require Additional Reserves

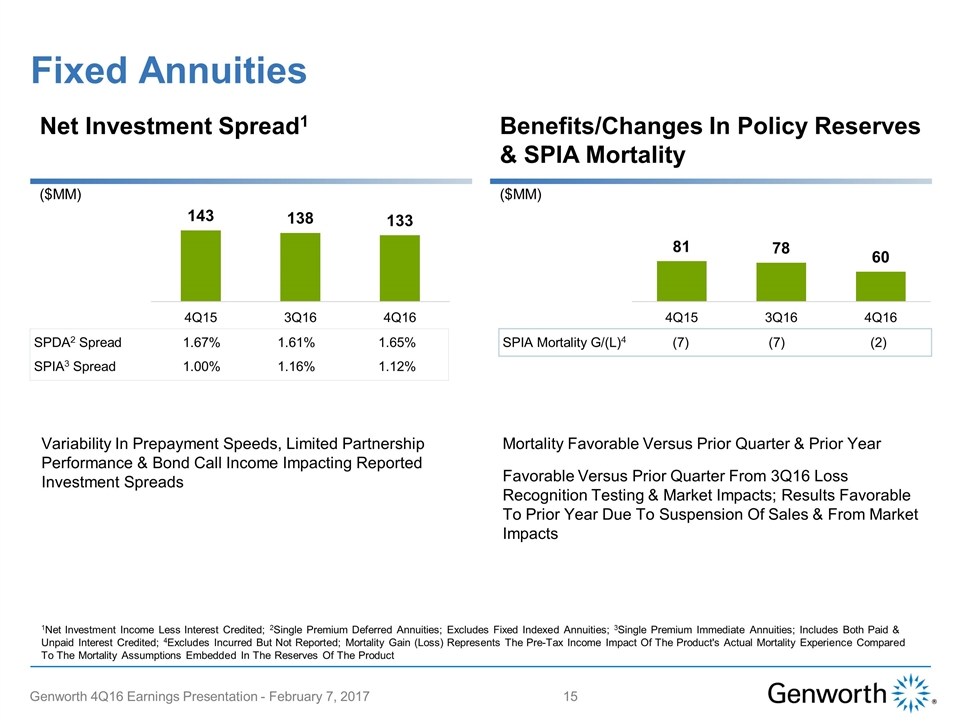

SPDA2 Spread1.67%1.61%1.65% SPIA3 Spread1.00%1.16%1.12% Fixed Annuities 1Net Investment Income Less Interest Credited; 2Single Premium Deferred Annuities; Excludes Fixed Indexed Annuities; 3Single Premium Immediate Annuities; Includes Both Paid & Unpaid Interest Credited; 4Excludes Incurred But Not Reported; Mortality Gain (Loss) Represents The Pre-Tax Income Impact Of The Product's Actual Mortality Experience Compared To The Mortality Assumptions Embedded In The Reserves Of The Product ($MM) ($MM) Benefits/Changes In Policy Reserves & SPIA Mortality Net Investment Spread1 SPIA Mortality G/(L)4(7)(7)(2) Variability In Prepayment Speeds, Limited Partnership Performance & Bond Call Income Impacting Reported Investment Spreads Mortality Favorable Versus Prior Quarter & Prior Year Favorable Versus Prior Quarter From 3Q16 Loss Recognition Testing & Market Impacts; Results Favorable To Prior Year Due To Suspension Of Sales & From Market Impacts Genworth 4Q16 Earnings Presentation - February 7, 2017

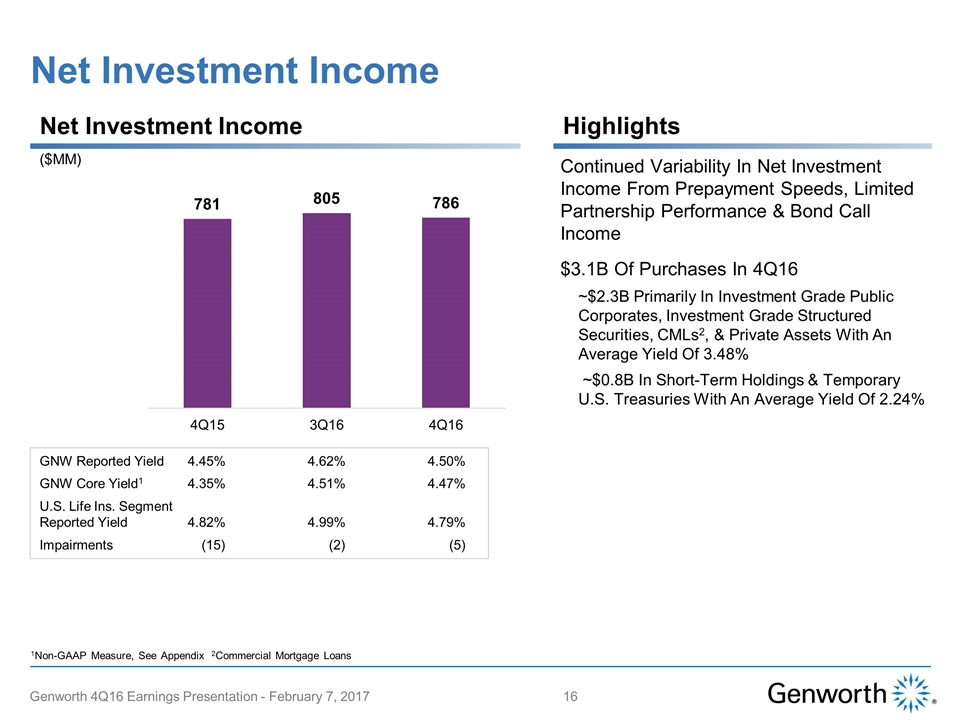

Net Investment Income ($MM) Highlights Net Investment Income 1Non-GAAP Measure, See Appendix 2Commercial Mortgage Loans GNW Reported Yield4.45%4.62%4.50% GNW Core Yield14.35%4.51%4.47% U.S. Life Ins. Segment Reported Yield4.82%4.99%4.79% Impairments(15)(2)(5) Continued Variability In Net Investment Income From Prepayment Speeds, Limited Partnership Performance & Bond Call Income $3.1B Of Purchases In 4Q16 ~$2.3B Primarily In Investment Grade Public Corporates, Investment Grade Structured Securities, CMLs2, & Private Assets With An Average Yield Of 3.48% ~$0.8B In Short-Term Holdings & Temporary U.S. Treasuries With An Average Yield Of 2.24% Genworth 4Q16 Earnings Presentation - February 7, 2017

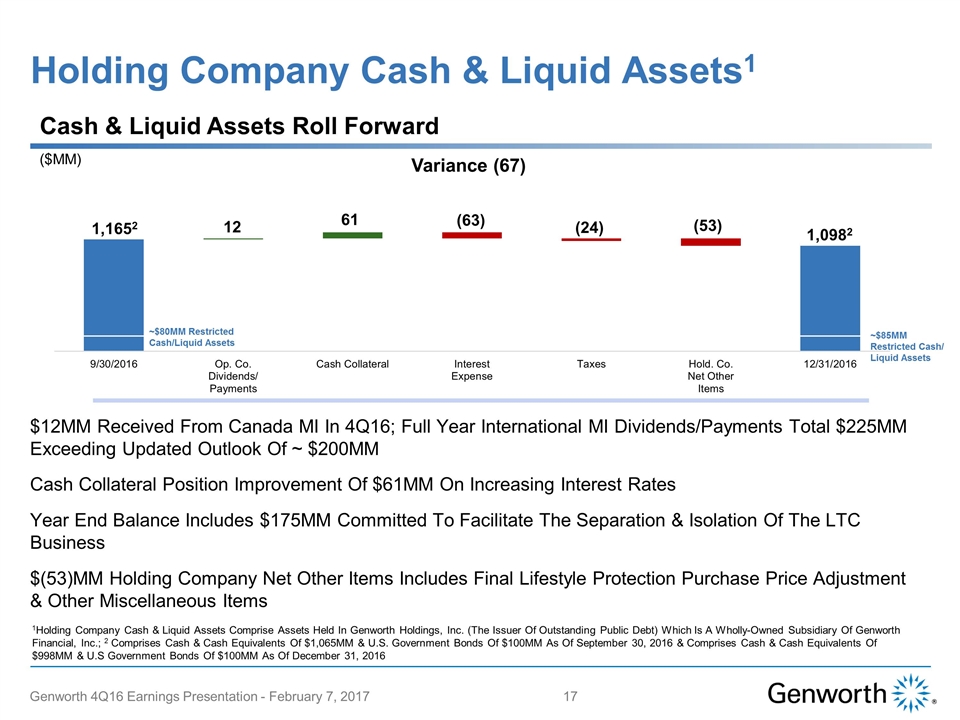

Variance (67) 1Holding Company Cash & Liquid Assets Comprise Assets Held In Genworth Holdings, Inc. (The Issuer Of Outstanding Public Debt) Which Is A Wholly-Owned Subsidiary Of Genworth Financial, Inc.; 2 Comprises Cash & Cash Equivalents Of $1,065MM & U.S. Government Bonds Of $100MM As Of September 30, 2016 & Comprises Cash & Cash Equivalents Of $998MM & U.S Government Bonds Of $100MM As Of December 31, 2016 $12MM Received From Canada MI In 4Q16; Full Year International MI Dividends/Payments Total $225MM Exceeding Updated Outlook Of ~ $200MM Cash Collateral Position Improvement Of $61MM On Increasing Interest Rates Year End Balance Includes $175MM Committed To Facilitate The Separation & Isolation Of The LTC Business $(53)MM Holding Company Net Other Items Includes Final Lifestyle Protection Purchase Price Adjustment & Other Miscellaneous Items ~$85MM Restricted Cash/ Liquid Assets ($MM) Cash & Liquid Assets Roll Forward Holding Company Cash & Liquid Assets1 1.5x Debt Int. Exp. ~$80MM Restricted Cash/Liquid Assets (53) Genworth 4Q16 Earnings Presentation - February 7, 2017

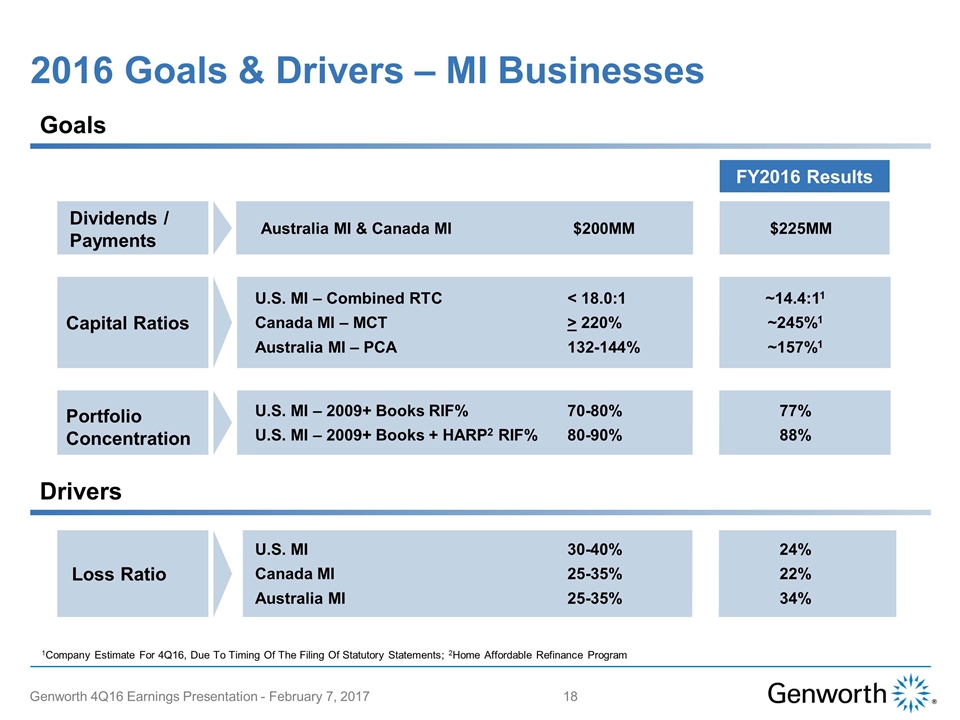

2016 Goals & Drivers – MI Businesses 1Company Estimate For 4Q16, Due To Timing Of The Filing Of Statutory Statements; 2Home Affordable Refinance Program Dividends / Payments Capital Ratios U.S. MI – Combined RTC< 18.0:1~14.4:11 Canada MI – MCT> 220%~245%1 Australia MI – PCA132-144%~157%1 Portfolio Concentration U.S. MI – 2009+ Books RIF%70-80%77% U.S. MI – 2009+ Books + HARP2 RIF%80-90%88% Loss Ratio U.S. MI30-40%24% Canada MI25-35%22% Australia MI25-35%34% Goals Drivers FY2016 Results Australia MI & Canada MI$200MM$225MM Genworth 4Q16 Earnings Presentation - February 7, 2017

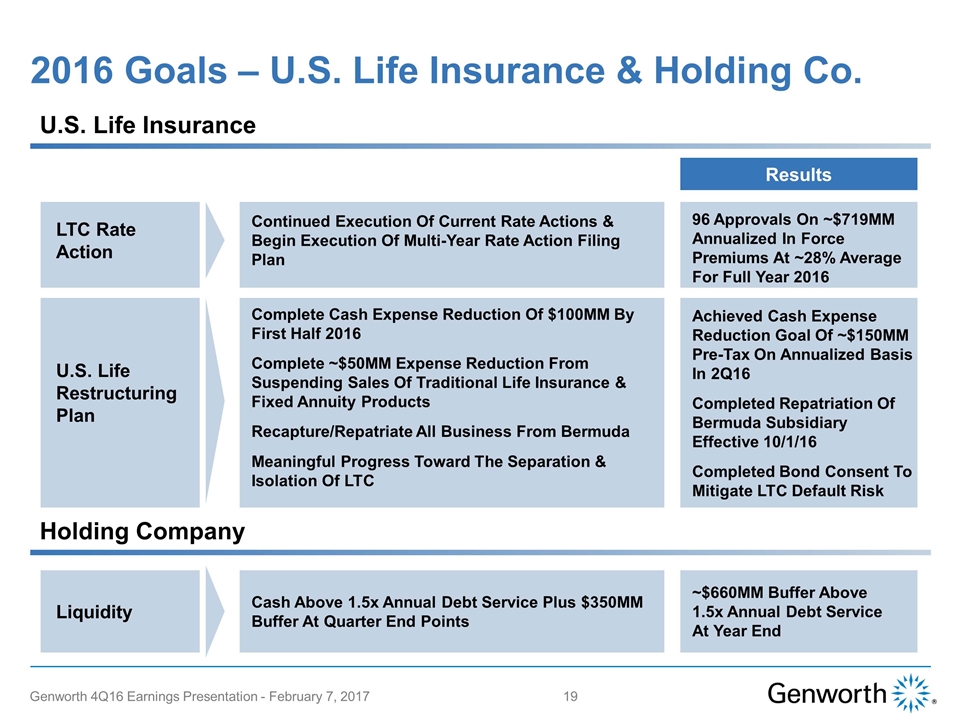

2016 Goals – U.S. Life Insurance & Holding Co. U.S. Life Insurance Holding Company LTC Rate Action Continued Execution Of Current Rate Actions & Begin Execution Of Multi-Year Rate Action Filing Plan U.S. Life Restructuring Plan Complete Cash Expense Reduction Of $100MM By First Half 2016 Complete ~$50MM Expense Reduction From Suspending Sales Of Traditional Life Insurance & Fixed Annuity Products Recapture/Repatriate All Business From Bermuda Meaningful Progress Toward The Separation & Isolation Of LTC Liquidity Cash Above 1.5x Annual Debt Service Plus $350MM Buffer At Quarter End Points 96 Approvals On ~$719MM Annualized In Force Premiums At ~28% Average For Full Year 2016 Achieved Cash Expense Reduction Goal Of ~$150MM Pre-Tax On Annualized Basis In 2Q16 Completed Repatriation Of Bermuda Subsidiary Effective 10/1/16 Completed Bond Consent To Mitigate LTC Default Risk ~$660MM Buffer Above 1.5x Annual Debt Service At Year End Results Genworth 4Q16 Earnings Presentation - February 7, 2017

Appendix Genworth 4Q16 Earnings Presentation - February 7, 2017

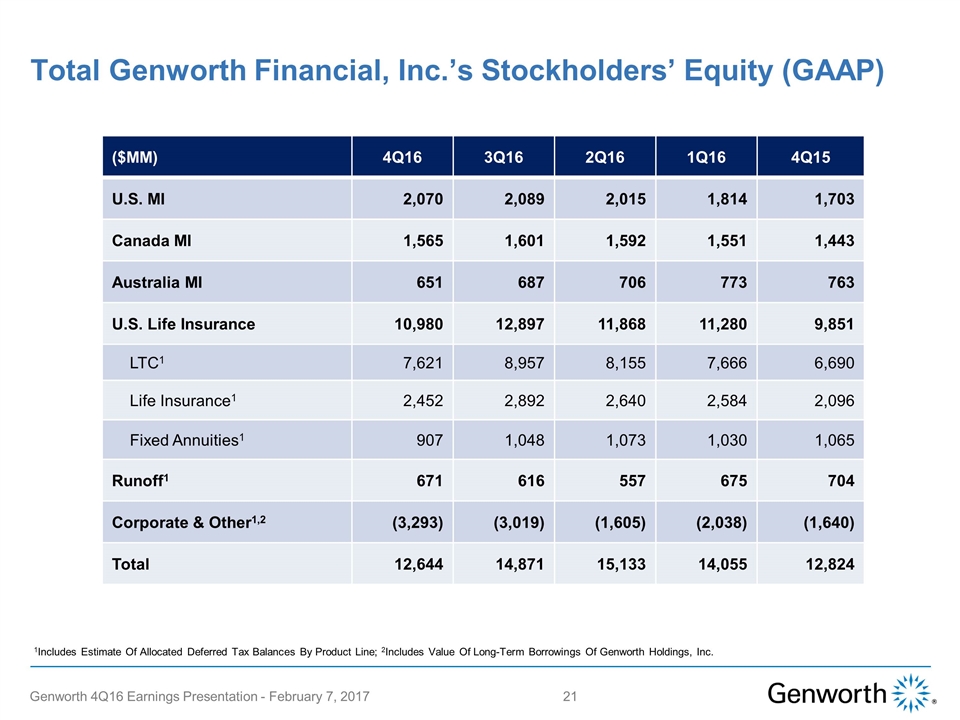

Total Genworth Financial, Inc.’s Stockholders’ Equity (GAAP) ($MM) 4Q16 3Q16 2Q16 1Q16 4Q15 U.S. MI 2,070 2,089 2,015 1,814 1,703 Canada MI 1,565 1,601 1,592 1,551 1,443 Australia MI 651 687 706 773 763 U.S. Life Insurance 10,980 12,897 11,868 11,280 9,851 LTC1 7,621 8,957 8,155 7,666 6,690 Life Insurance1 2,452 2,892 2,640 2,584 2,096 Fixed Annuities1 907 1,048 1,073 1,030 1,065 Runoff1 671 616 557 675 704 Corporate & Other1,2 (3,293) (3,019) (1,605) (2,038) (1,640) Total 12,644 14,871 15,133 14,055 12,824 1Includes Estimate Of Allocated Deferred Tax Balances By Product Line; 2Includes Value Of Long-Term Borrowings Of Genworth Holdings, Inc. 21 Genworth 4Q16 Earnings Presentation - February 7, 2017

Use Of Non-GAAP Measures This presentation includes the non-GAAP financial measures entitled "adjusted operating income (loss).” The chief operating decision maker evaluates segment performance and allocates resources on the basis of adjusted operating income (loss). The company defines adjusted operating income (loss) as loss from continuing operations excluding the after-tax effects of income attributable to noncontrolling interests, net investment gains (losses), goodwill impairments, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, gains (losses) on insurance block transactions, restructuring costs and infrequent or unusual non-operating items. Gains (losses) on insurance block transactions are defined as gains (losses) on the early extinguishment of non-recourse funding obligations, early termination fees for other financing restructuring and/or resulting gains (losses) on reinsurance restructuring for certain blocks of business. The company excludes net investment gains (losses) and infrequent or unusual non-operating items because the company does not consider them to be related to the operating performance of the company's segments and Corporate and Other activities. A component of the company's net investment gains (losses) is the result of impairments, the size and timing of which can vary significantly depending on market credit cycles. In addition, the size and timing of other investment gains (losses) can be subject to the company's discretion and are influenced by market opportunities, as well as asset-liability matching considerations. Goodwill impairments, gains (losses) on the sale of businesses, gains (losses) on the early extinguishment of debt, gains (losses) on insurance block transactions and restructuring costs are also excluded from adjusted operating income (loss) because, in the company's opinion, they are not indicative of overall operating trends. Infrequent or unusual non-operating items are also excluded from adjusted operating income (loss) if, in the company's opinion, they are not indicative of overall operating trends. While some of these items may be significant components of net loss available to Genworth’s common stockholders in accordance with GAAP, the company believes that adjusted operating income (loss) and measures that are derived from or incorporate adjusted operating income (loss) are appropriate measures that are useful to investors because they identify the income (loss) attributable to the ongoing operations of the business. Management also uses adjusted operating income (loss) as a basis for determining awards and compensation for senior management and to evaluate performance on a basis comparable to that used by analysts. However, the items excluded from adjusted operating income (loss) have occurred in the past and could, and in some cases will, recur in the future. Adjusted operating income (loss) are not substitutes for net loss available to Genworth’s common stockholders determined in accordance with GAAP. In addition, the company's definition of adjusted operating income (loss) may differ from the definitions used by other companies. Adjustments to reconcile net loss attributable to Genworth’s common stockholders and adjusted operating income (loss) assume a 35 percent tax rate (unless otherwise indicated) and are net of the portion attributable to noncontrolling interests. Net investment gains (losses) are also adjusted for DAC and other intangible amortization and certain benefit reserves. The company recognized an estimated pre-tax loss of $140 million in the fourth quarter of 2015 for the planned sale of the mortgage insurance business in Europe. The company also incurred a $6 million tax benefit in the fourth quarter of 2015 related to the planned sale of this business. These transactions were excluded from adjusted operating income (loss) for the periods presented as they related to a gain (loss) on the sale of businesses. In the third quarter of 2016, the company recorded a pre-tax expense of $2 million related to restructuring costs as part of an expense reduction plan as the company evaluates and appropriately sizes its organizational needs and expenses. In the fourth quarter of 2015, the company also recorded a pre-tax expense of $5 million related to restructuring costs. There were no infrequent or unusual items excluded from adjusted operating income (loss) during the periods presented. This presentation includes the non-GAAP financial measure entitled "core yield" as a measure of investment yield. The company defines core yield as the investment yield adjusted for items that do not reflect the underlying performance of the investment portfolio. Management believes that analysis of core yield enhances understanding of the investment yield of the company. However, core yield is not a substitute for investment yield determined in accordance with GAAP. In addition, the company’s definition of core yield may differ from the definitions used by other companies. A reconciliation of core yield to reported GAAP yield is included in this appendix. Genworth 4Q16 Earnings Presentation - February 7, 2017

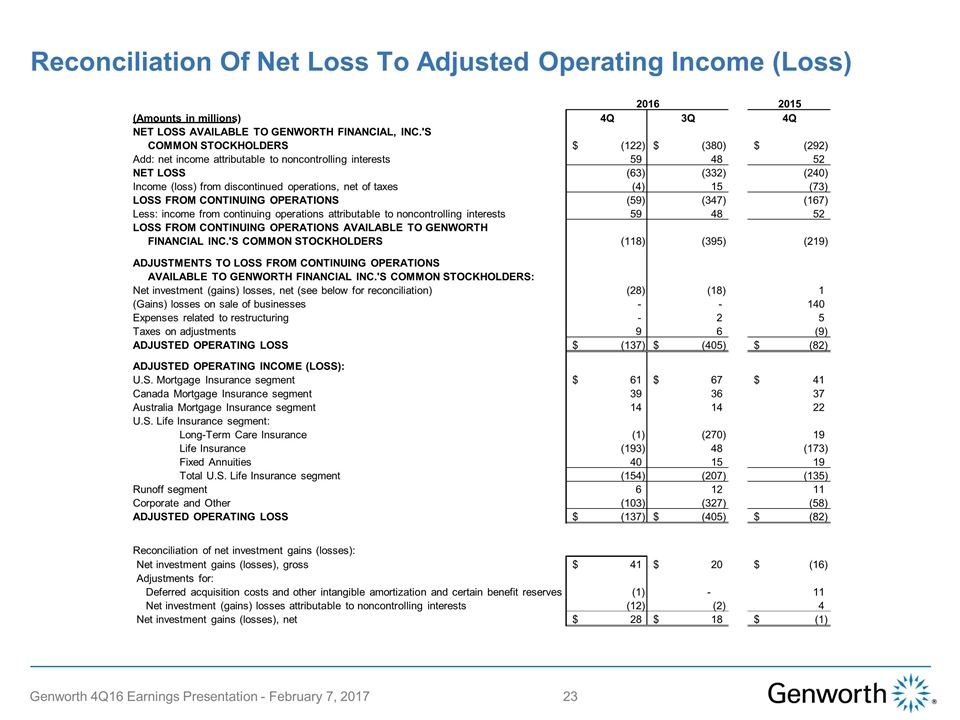

Reconciliation Of Net Loss To Adjusted Operating Income (Loss) Genworth 4Q16 Earnings Presentation - February 7, 2017 2015 (Amounts in millions) 4Q 3Q 4Q NET LOSS AVAILABLE TO GENWORTH FINANCIAL, INC.'S COMMON STOCKHOLDERS (122) $ (380) $ (292) $ Add: net income attributable to noncontrolling interests 59 48 52 NET LOSS (63) (332) (240) Income (loss) from discontinued operations, net of taxes (4) 15 (73) LOSS FROM CONTINUING OPERATIONS (59) (347) (167) Less: income from continuing operations attributable to noncontrolling interests 59 48 52 LOSS FROM CONTINUING OPERATIONS AVAILABLE TO GENWORTH FINANCIAL INC.'S COMMON STOCKHOLDERS (118) (395) (219) ADJUSTMENTS TO LOSS FROM CONTINUING OPERATIONS AVAILABLE TO GENWORTH FINANCIAL INC.'S COMMON STOCKHOLDERS: Net investment (gains) losses, net (see below for reconciliation) (28) (18) 1 (Gains) losses on sale of businesses - - 140 Expenses related to restructuring - 2 5 Taxes on adjustments 9 6 (9) ADJUSTED OPERATING LOSS (137) $ (405) $ (82) $ ADJUSTED OPERATING INCOME (LOSS): U.S. Mortgage Insurance segment 61 $ 67 $ 41 $ Canada Mortgage Insurance segment 39 36 37 Australia Mortgage Insurance segment 14 14 22 U.S. Life Insurance segment: Long-Term Care Insurance (1) (270) 19 Life Insurance (193) 48 (173) Fixed Annuities 40 15 19 Total U.S. Life Insurance segment (154) (207) (135) Runoff segment 6 12 11 Corporate and Other (103) (327) (58) ADJUSTED OPERATING LOSS (137) $ (405) $ (82) $ Reconciliation of net investment gains (losses): Net investment gains (losses), gross 41 $ 20 $ (16) $ Adjustments for: Deferred acquisition costs and other intangible amortization and certain benefit reserves (1) - 11 Net investment (gains) losses attributable to noncontrolling interests (12) (2) 4 Net investment gains (losses), net 28 $ 18 $ (1) $ 2016

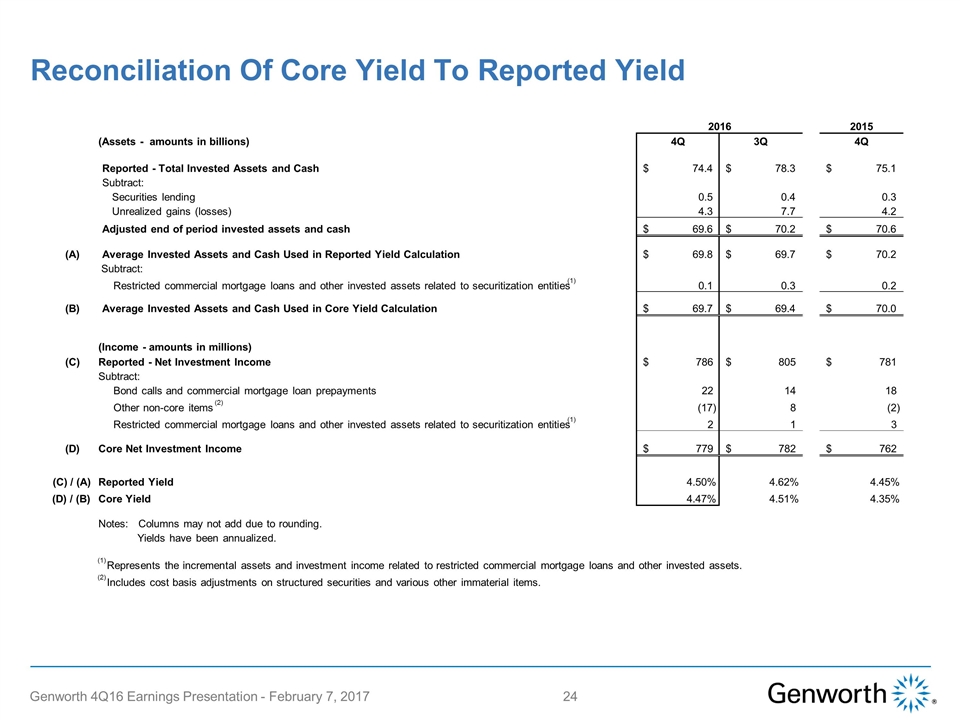

Reconciliation Of Core Yield To Reported Yield Genworth 4Q16 Earnings Presentation - February 7, 2017 2015 (Assets - amounts in billions) 4Q 3Q 4Q Reported - Total Invested Assets and Cash 74.4 $ 78.3 $ 75.1 $ Subtract: Securities lending 0.5 0.4 0.3 Unrealized gains (losses) 4.3 7.7 4.2 Adjusted end of period invested assets and cash 69.6 $ 70.2 $ 70.6 $ (A) Average Invested Assets and Cash Used in Reported Yield Calculation 69.8 $ 69.7 $ 70.2 $ Subtract: Restricted commercial mortgage loans and other invested assets related to securitization entities (1) 0.1 0.3 0.2 (B) Average Invested Assets and Cash Used in Core Yield Calculation 69.7 $ 69.4 $ 70.0 $ (Income - amounts in millions) (C) Reported - Net Investment Income 786 $ 805 $ 781 $ Subtract: Bond calls and commercial mortgage loan prepayments 22 14 18 Other non-core items (2) (17) 8 (2) Restricted commercial mortgage loans and other invested assets related to securitization entities (1) 2 1 3 (D) Core Net Investment Income 779 $ 782 $ 762 $ (C) / (A) Reported Yield 4.50% 4.62% 4.45% (D) / (B) Core Yield 4.47% 4.51% 4.35% Notes: Columns may not add due to rounding. Yields have been annualized. 2016 (1) Represents the incremental assets and investment income related to restricted commercial mortgage loans and other invested assets. (2) Includes cost basis adjustments on structured securities and various other immaterial items.

Definition Of Selected Operating Performance Measures Management uses selected operating performance measures including ''sales" and "insurance in force" or "risk in force" which are commonly used in the insurance industry as measures of operating performance. Management regularly monitors and reports sales metrics as a measure of volume of new and renewal business generated in a period. Sales refer to new insurance written for mortgage insurance. Sales do not include renewal premiums on policies or contracts written during prior periods. The company considers new insurance written to be a measure of the company's operating performance because they represent a measure of new sales of insurance policies or contracts during a specified period, rather than a measure of the company's revenues or profitability during that period. Management regularly monitors and reports insurance in force and risk in force. Insurance in force for the mortgage insurance businesses is a measure of the aggregate original loan balance for outstanding insurance policies as of the respective reporting date. Risk in force for the U.S. mortgage insurance business is based on the coverage percentage applied to the estimated current outstanding loan balance. For risk in force in the mortgage insurance businesses in Canada and Australia, the company has computed an “effective” risk in force amount, which recognizes that the loss on any particular loan will be reduced by the net proceeds received upon sale of the property. Effective risk in force has been calculated by applying to insurance in force a factor of 35% that represents the highest expected average per-claim payment for any one underwriting year over the life of the company's mortgage insurance businesses in Canada and Australia. In Australia, the company has certain risk share arrangements where it provides pro-rata coverage of certain loans rather than 100% coverage. As a result, for loans with these risk share arrangements, the applicable pro-rata coverage amount provided is used when applying the factor. The company considers insurance in force and risk in force to be measures of the company's operating performance because they represent measures of the size of the business at a specific date which will generate revenues and profits in a future period, rather than measures of the company's revenues or profitability during that period. Management also regularly monitors and reports a loss ratio for the company’s businesses. For the mortgage insurance businesses, the loss ratio is the ratio of incurred losses and loss adjustment expenses to net earned premiums. For the long term care insurance business, the loss ratio is the ratio of benefits and other changes in reserves less tabular interest on reserves less loss adjustment expenses to net earned premiums. The company considers the loss ratio to be a measure of underwriting performance in these businesses and helps to enhance the understanding of the operating performance of the businesses. An assumed tax rate of 35% is utilized in certain adjustments to adjusted operating income (loss) and in the explanation of specific variances of operating performance and investment results. These operating performance measures enable the company to compare its operating performance across periods without regard to revenues or profitability related to policies or contracts sold in prior periods or from investments or other sources. The company allocates the consolidated provision for income taxes to its operating segments. The allocation methodology applies a specific tax rate to the pre-tax income (loss) of each segment, which is then adjusted in each segment to reflect the tax attributes of items unique to that segment such as foreign income. The difference between the consolidated provision for income taxes and the sum of the provision for income taxes in each segment is reflected in Corporate and Other activities. The annually-determined tax rates and adjustments to each segment’s provision for income taxes are estimates which are subject to review and could change from year to year. Results Of Operations By Segment Genworth 4Q16 Earnings Presentation - February 7, 2017

Cautionary Note Regarding Forward-Looking Statements This press release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially due to global political, economic, business, competitive, market, regulatory and other factors and risks, including, but not limited to, the following: risks related to the proposed transaction with China Oceanwide Holdings Group Co., Ltd. (China Oceanwide) including: the company's inability to complete the transaction in a timely manner or at all; the company's inability to obtain stockholder or regulatory approvals, or the possibility that the parties may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any such regulatory approvals; legal proceedings may be instituted against the company in connection with the proposed transaction; the proposed transaction may disrupt the company's current plans and operations; certain restrictions during the pendency of the transaction may impact the company's ability to pursue certain business opportunities or strategic transactions; there may be insufficient continued availability of capital and financing to the company before the consummation of the transaction; there may be further rating agency actions and downgrades in the company's financial strength ratings; there may be changes in applicable laws or regulations; the company may not recognize the anticipated benefits of the transaction; the amount of the costs, fees, expenses and other charges related to the transaction may be material; management's attention may be diverted from the company's ongoing business operations; the merger agreement may be terminated in circumstances that would require the company to pay China Oceanwide a fee; the company's ability to attract, recruit, retain and motivate current and prospective employees may be adversely affected; and disruptions and uncertainty relating to the transaction, whether or not it is completed, may harm the company's relationships with its employees, customers, distributors, vendors or other business partners, and may result in a negative impact on the company's business; strategic risks in the event the proposed transaction with China Oceanwide is not consummated including: the company's inability to successfully execute alternative strategic plans to effectively address its current business challenges (including with respect to the restructuring of its U.S. life insurance businesses, debt obligations, cost savings, ratings and capital); the company's inability to attract buyers for any businesses or other assets it may seek to sell, or securities it may seek to issue, in each case, in a timely manner on anticipated terms; failure to obtain any required regulatory, stockholder and/or noteholder approvals or consents, or the company's challenges changing or being more costly or difficult to successfully address than currently anticipated or the benefits achieved being less than anticipated; inability to achieve anticipated cost-savings in a timely manner; adverse tax or accounting charges; and inability to increase the capital needed in the company's businesses in a timely manner and on anticipated terms, including through improved business performance, reinsurance or similar transactions, asset sales, securities offerings or otherwise, in each case as and when required; risks relating to estimates, assumptions and valuations including: risks related to the impact of the company's annual review of assumptions and methodologies related to its long term care insurance claim reserves in the third quarter of 2016 and its margin reviews in the fourth quarter of 2016; inadequate reserves and the need to increase reserves (including any changes the company may make in the future to its assumptions, methodologies or otherwise in connection with periodic or other reviews); inaccurate models; deviations from the company's estimates and actuarial assumptions or other reasons in its long term care insurance, life insurance and/or annuity businesses; accelerated amortization of deferred acquisition costs (DAC) and present value of future profits (PVFP) (including any changes it may make in the future to its assumptions, methodologies or otherwise in connection with periodic or other reviews); adverse impact on the company's financial results as a result of projected profits followed by projected losses (as is currently the case with its long term care insurance business); and changes in valuation of fixed maturity, equity and trading securities; risks relating to economic, market and political conditions including: downturns and volatility in global economies and equity and credit markets; interest rates and changes in rates (particularly given the historically low interest rate environment) have adversely impacted, and may continue to materially adversely impact, the company's business and profitability; deterioration in economic conditions or a decline in home prices that adversely affect the company's loss experience in mortgage insurance; political and economic instability or changes in government policies; and fluctuations in foreign currency exchange rates and international securities markets; Genworth 4Q16 Earnings Presentation - February 7, 2017

Cautionary Note Regarding Forward-Looking Statements Genworth 4Q16 Earnings Presentation - February 7, 2017 regulatory and legal risks including: extensive regulation of the company's businesses and changes in applicable laws and regulations; litigation and regulatory investigations or other actions; dependence on dividends and other distributions from the company's subsidiaries (particularly its international subsidiaries) and the inability of any subsidiaries to pay dividends or make other distributions to the company, including as a result of the performance of its subsidiaries and insurance, regulatory or corporate law restrictions; adverse change in regulatory requirements, including risk-based capital; changes in regulations adversely affecting the company's international operations; inability to meet or maintain the private mortgage insurer eligibility requirements (PMIERs); inability of the company's U.S. mortgage insurance subsidiaries to meet minimum statutory capital requirements and hazardous financial condition standards; the influence of Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac) and a small number of large mortgage lenders on the U.S. mortgage insurance market and adverse changes to the role or structure of Fannie Mae and Freddie Mac; adverse changes in regulations affecting the company's mortgage insurance businesses; inability to continue to implement actions to mitigate the impact of statutory reserve requirements; impact of additional regulations pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act); and changes in accounting and reporting standards; liquidity, financial strength ratings, credit and counterparty risks including: insufficient internal sources to meet liquidity needs and limited or no access to capital (including the company's inability to enter into a credit facility); recent or future adverse rating agency actions, including with respect to rating downgrades or potential downgrades or being put on review for potential downgrade (including in connection with the company's recent announcement of a material increase to the company's universal life insurance reserves), all of which could have adverse implications for the company, including with respect to key business relationships, product offerings, business results of operations, financial condition and capital needs, strategic plans, collateral obligations and availability and terms of hedging, reinsurance and borrowings; defaults by counterparties to reinsurance arrangements or derivative instruments; defaults or other events impacting the value of the company's fixed maturity securities portfolio; and defaults on the company's commercial mortgage loans or the mortgage loans underlying its investments in commercial mortgage-backed securities and volatility in performance; operational risks including: inability to retain, attract and motivate qualified employees or senior management; ineffective or inadequate risk management in identifying, controlling or mitigating risks; reliance on, and loss of, key customer or distribution relationships; availability, affordability and adequacy of reinsurance to protect the company against losses; competition; competition in the company's mortgage insurance businesses from government and government-owned and government-sponsored enterprises (GSEs) offering mortgage insurance; material weakness in, or ineffective, internal control over financial reporting; and failure or any compromise of the security of the company's computer systems, disaster recovery systems and business continuity plans and failures to safeguard, or breaches of, its confidential information; insurance and product-related risks including: the company's inability to increase sufficiently, and in a timely manner, premiums on in force long term care and life insurance policies and/or reduce in force benefits, and charge higher premiums on new policies, in each case, as currently anticipated and as may be required from time to time in the future (including as a result of the company's failure to obtain any necessary regulatory approvals or unwillingness or inability of policyholders to pay increased premiums), including to offset the impact on the company's margins of updated claim reserves assumptions in connection with its annual review of its long term care insurance claim reserves in the third quarter of 2016 and its annual U.S. life insurance assumption reviews in the fourth quarter of 2016; the company's inability to reflect future premium increases and other management actions in its margin calculation as anticipated; failure to sufficiently increase new sales for the company's long term care insurance products; inability to realize anticipated benefits of the company's rescissions, curtailments, loan modifications or other similar programs in its mortgage insurance businesses; premiums for the significant portion of the company's mortgage insurance risk in force with high loan-to-value ratios may not be sufficient to compensate the company for the greater risks associated with those policies; decreases in the volume of high loan-to-value mortgage originations or increases in mortgage insurance cancellations; increases in the use of alternatives to private mortgage insurance and reductions in the level of coverage selected; potential liabilities in connection with the company's U.S. contract underwriting services; and medical advances, such as genetic research and diagnostic imaging, and related legislation that impact policyholder behavior in ways adverse to the company; other risks including: occurrence of natural or man-made disasters or a pandemic; impairments of or valuation allowances against the company's deferred tax assets; the possibility that in certain circumstances the company will be obligated to make payments to General Electric Company (GE) under the tax matters agreement with GE even if its corresponding tax savings are never realized and payments could be accelerated in the event of certain changes in control; and provisions of the company's certificate of incorporation and bylaws and the tax matters agreement with GE may discourage takeover attempts and business combinations that stockholders might consider in their best interests; and risks relating to the company's common stock including: the continued suspension of payment of dividends; and stock price fluctuations. The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise.