UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material pursuant to §240.14a-12 | |

GENWORTH FINANCIAL, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous fling by registration statement number or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date filed:

| |||

This filing relates to the proposed acquisition of Genworth Financial, Inc. (the “Company”) by Asia Pacific Global Capital Co., Ltd. (“Parent”), pursuant to the terms of the Agreement and Plan of Merger, dated as of October 21, 2016 (the “Merger Agreement”), among the Company, Parent and Asia Pacific Global Capital USA Corporation.

On October 24, 2016, the Company held an investor relations call during which the Company discussed the execution of the Merger Agreement and the proposed acquisition contemplated thereby. In connection with the proposed acquisition, on the same date, the Company distributed a list of questions & answers to certain managers of the Company (the “Q&A”). Additionally, on the same date, the Company made available certain talking points for certain employees to respond to inquiries about the proposed acquisition from investors, policyholders and distribution partners and lenders. The following are copies of those communications:

China Oceanwide To Acquire Genworth Financial October 24, 2016 ©2016 Genworth Financial, Inc. All rights reserved.

This communication includes certain statements that may constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements and factors that may cause such a difference include, but are not limited to, risks and uncertainties related to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Genworth’s business and the price of Genworth’s common stock; (ii) the ability of the parties to obtain stockholder and regulatory approvals, or the possibility that they may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any such regulatory approvals; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) potential legal proceedings that may be instituted against Genworth following announcement of the transaction; (v) the risk that the proposed transaction disrupts Genworth’s current plans and operations as a result of the announcement and consummation of the transaction; (vi) potential adverse reactions or changes to Genworth’s business relationships with clients, employees, suppliers or other parties or other business uncertainties resulting from the announcement of the transaction or during the pendency of the transaction, including but not limited to such changes that could affect Genworth’s financial performance; (vii) certain restrictions during the pendency of the transaction that may impact Genworth’s ability to pursue certain business opportunities or strategic transactions; (viii) continued availability of capital and financing to Genworth before the consummation of the transaction; (ix) further rating agency actions and downgrades in Genworth’s financial strength ratings; (x) changes in applicable laws or regulations; (xi) Genworth’s ability to recognize the anticipated benefits of the transaction; (xii) the amount of the costs, fees, expenses and other charges related to the transaction; (xiii) the risks related to diverting management’s attention from the Company’s ongoing business operations; (xiv) the impact of changes in interest rates and political instability; and (xv) other risks and uncertainties described in Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Genworth’s consolidated financial condition, results of operations, credit rating or liquidity. Accordingly, forward-looking statements should not be relied upon as representing Genworth’s views as of any subsequent date, and Genworth does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Cautionary Note Regarding Forward-Looking Statements Portions of this presentation should be used in conjunction with the accompanying audio or call transcript.

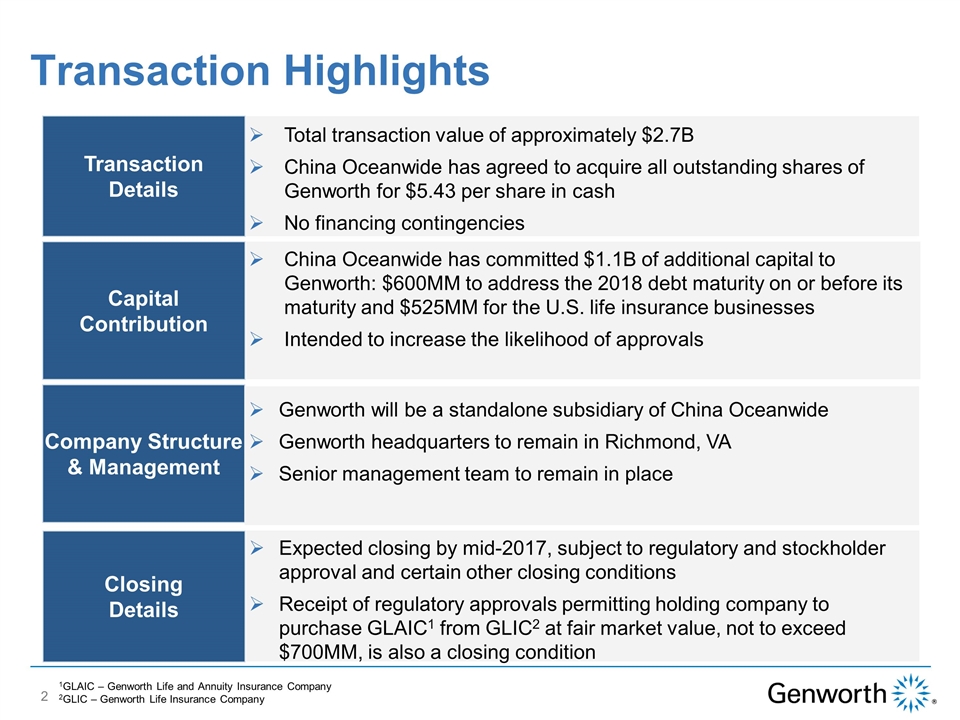

Transaction Highlights Transaction Details Total transaction value of approximately $2.7B China Oceanwide has agreed to acquire all outstanding shares of Genworth for $5.43 per share in cash No financing contingencies Capital Contribution China Oceanwide has committed $1.1B of additional capital to Genworth: $600MM to address the 2018 debt maturity on or before its maturity and $525MM for the U.S. life insurance businesses Intended to increase the likelihood of approvals Company Structure & Management Genworth will be a standalone subsidiary of China Oceanwide Genworth headquarters to remain in Richmond, VA Senior management team to remain in place Closing Details Expected closing by mid-2017, subject to regulatory and stockholder approval and certain other closing conditions Receipt of regulatory approvals permitting holding company to purchase GLAIC1 from GLIC2 at fair market value, not to exceed $700MM, is also a closing condition 1GLAIC – Genworth Life and Annuity Insurance Company 2GLIC – Genworth Life Insurance Company

Stockholder Value Creation The best price for Genworth stockholders through all-cash transaction with no financing contingencies Transaction eliminates downside risk for stockholders as a result of continued challenges facing Genworth and announced 3Q16 charges Both parties fully engaged to obtain regulatory approvals; expected closing by mid-2017 In the absence of the China Oceanwide transaction, Genworth believes long term care insurance (LTC) business performance and 3Q16 charges would: Put considerable pressure on the feasibility and timing of Genworth’s unstacking plan; Significantly increase pressure on U.S. Mortgage Insurance (MI) and other ratings; and Accelerate need to pursue other less attractive asset sale strategic alternatives to reduce debt and address ratings pressure

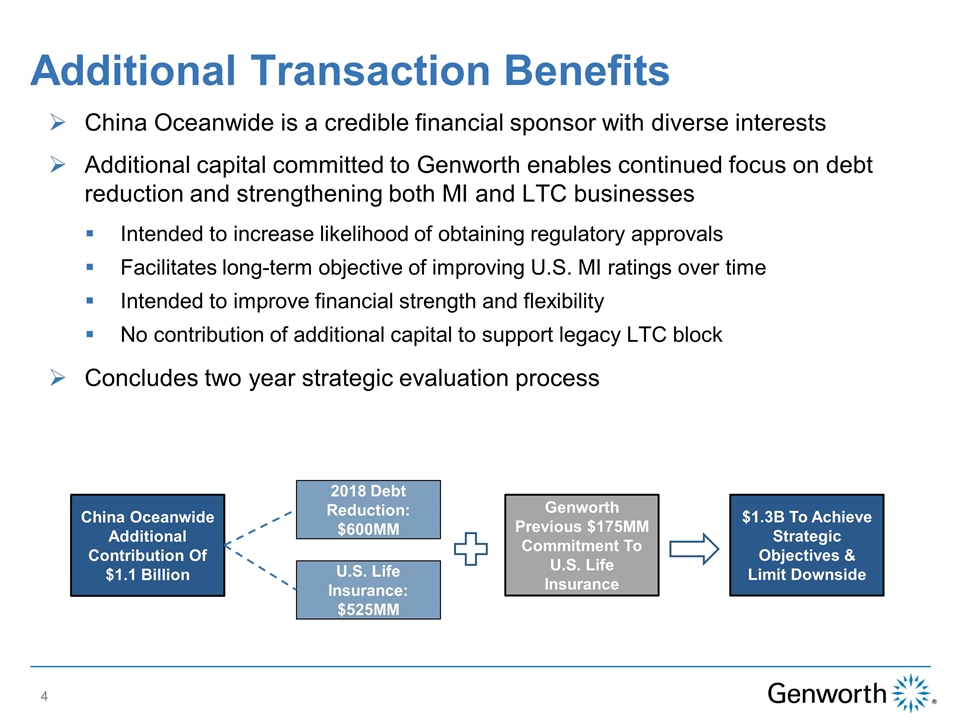

Additional Transaction Benefits China Oceanwide is a credible financial sponsor with diverse interests Additional capital committed to Genworth enables continued focus on debt reduction and strengthening both MI and LTC businesses Intended to increase likelihood of obtaining regulatory approvals Facilitates long-term objective of improving U.S. MI ratings over time Intended to improve financial strength and flexibility No contribution of additional capital to support legacy LTC block Concludes two year strategic evaluation process China Oceanwide Additional Contribution Of $1.1 Billion Genworth Previous $175MM Commitment To U.S. Life Insurance 2018 Debt Reduction: $600MM U.S. Life Insurance: $525MM $1.3B To Achieve Strategic Objectives & Limit Downside

About China Oceanwide Privately held, family owned international financial holding group Founded by Chairman Lu and headquartered in Beijing, China Well-established and diversified business portfolio Broad range of financial assets in banking, securities and insurance sectors Leading real estate developer with development projects in major Chinese cities and Los Angeles, San Francisco, New York and Hawaii Recent investments in energy, culture and media sectors A credible financial sponsor to support Genworth operations $30.7B USD total assets held by China Oceanwide group (as of 12/31/15) $5.9B USD cash held by China Oceanwide group (as of 12/31/15)

Genworth Business Priorities Genworth will operate independently under Genworth’s leadership team and maintain corporate headquarters in Richmond, Virginia Day-to-day operations are not expected to change as a result of this transaction Genworth will continue to focus on its long-term business priorities: Continued focus on multi-year LTC premium rate action plan Debt reduction to strengthen balance sheet and support debt ratings Support for MI and LTC businesses

Path To Closing Genworth stockholder approval Regulatory approvals Close Expected Mid-2017 Already in discussions with key state regulators (DE, NC, NY and VA) China, Canada, Australia and Mexico Committee On Foreign Investment In The United States (CFIUS) The preliminary proxy statement is expected to be filed within 30 business days, unless otherwise agreed by the parties Special meeting of stockholders

3Q16 Preliminary Charges & Assumption Reviews Underway $260 to $300MM after-tax increase to LTC claim reserves, following completion of claim reserve review $275 to $325MM tax charge from lower projected profitability, including higher expected LTC claim costs Annual year-end assumption reviews underway for LTC (active life reserves), life insurance and annuity products

Key Takeaways The best price for Genworth stockholders through all-cash transaction with no financing contingencies Transaction eliminates downside risk for stockholders as a result of continued challenges facing Genworth and announced 3Q16 charges China Oceanwide is a credible financial sponsor with diverse interests Additional capital committed supports Genworth’s efforts to restructure its U.S. life insurance businesses and address its 2018 debt maturity on or before its maturity Both parties fully engaged to obtain regulatory approvals; expected closing by mid-2017 Concludes two year strategic evaluation process; best outcome for Genworth and its stockholders

Important Information For Investors and Stockholders In connection with the proposed transaction, Genworth Financial, Inc. (Genworth) intends to file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the solicitation of proxies for a special meeting to be called at a future date. Promptly after filing its proxy statement in definitive form with the SEC, Genworth will mail such definitive proxy statement when available to each stockholder of Genworth entitled to vote. Genworth stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and all other relevant documents which Genworth will file with the SEC when they become available, because they will contain important information about the proposed transaction and related matters. Stockholders will also be able to obtain copies of the proxy statement, without charge, when available, at the SEC’s website at www.sec.gov or by contacting the investor relations department of Genworth at the following: David Rosenbaum, 804 662.2643 david.rosenbaum@genworth.com Participants in the Solicitation Genworth and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Genworth’s stockholders in connection with the proposed transaction. Genworth’s stockholders may obtain, without charge, more detailed information regarding such interested participants in Genworth’s Annual Report on Form 10-K filed with the SEC on February 26, 2016, its proxy statement filed with the SEC on April 1, 2016, and any Statements of Changes in Beneficial Ownership on Form 4 of such participants, filed with the SEC. Additional information will be available in the proxy statement when it becomes available. Additional Information

China Oceanwide to Acquire Genworth Financial – Q&A

Contents

1

2

| 41. | If I receive a question from an external party, what should I do? |

12 | ||||||||||

| 42. | 12 | |||||||||||

3

| 1. | Why did Genworth agree to be acquired by China Oceanwide? |

| • | Genworth has been conducting a strategic review since December 2014. |

| • | This transaction creates greater and more certain stockholder value than our current business plan or other strategic alternatives. |

| • | Our Board of Directors believes China Oceanwide’s proposal delivers the best outcome for Genworth stockholders, including: |

| • | the best price through an all-cash transaction with no financing contingencies and |

| • | the elimination of downside risk as a result of continued challenges facing Genworth and announced 3Q16 charges. |

| • | The transaction was structured with the intention of increasing the likelihood of obtaining regulatory approval. |

| • | The $1.1 billion of capital committed supports Genworth’s efforts to restructure the U.S. life insurance (USLI) businesses and address our 2018 debt maturity, on or before its maturity. |

| • | Genworth will also continue to focus on our key business priorities, most notably executing our multi-year long term care insurance (LTC) rate action plan, which is essential to stabilizing and maintaining the viability of the legacy LTC business. |

| 2. | What is the agreement with China Oceanwide? What are the terms? |

| • | China Oceanwide has agreed to acquire all of the outstanding shares of Genworth for $5.43 per share in cash, for a total transaction value of approximately $2.7 billion. |

| • | China Oceanwide has committed to contribute to Genworth $1.1 billion in additional cash to support our efforts to complete the USLI restructuring plan by unstacking Genworth Life and Annuity Insurance Company (GLAIC) from under Genworth Life Insurance Company (GLIC) and address the 2018 debt maturity, on or before its maturity. |

| • | This capital commitment from China Oceanwide includes $600 million to address debt expiring in 2018 and $525 million to USLI, in addition to $175 million of cash previously committed by Genworth Holdings to USLI to facilitate the unstacking. |

| • | We have structured the transaction with the intention of increasing the likelihood of obtaining regulatory approval. |

| 3. | Other than the benefits to stockholders, are there additional benefits to Genworth? |

| • | China Oceanwide is a credible financial sponsor with diverse interests. |

| • | As a result of the transaction, Genworth will have the additional resources to address the 2018 debt maturity on or before its maturity, restructure our USLI businesses and stabilize our ratings over time. |

| • | Genworth will be a private company, better positioned to continue to focus on our key operational priorities. These include executing our multi-year LTC rate action |

4

| plan, which is essential to stabilizing the financial position of the legacy LTC business, strengthening our financial foundation, and supporting our mortgage insurance (MI) and LTC businesses. |

| 4. | What does it mean to be a private company vs. a public one? |

| • | Following completion of the transaction, Genworth will no longer be a publicly traded company. |

| • | We will continue to service our outstanding debt. |

| • | Genworth will continue to operate as a standalone subsidiary of China Oceanwide. |

| 5. | Who is China Oceanwide? |

| • | China Oceanwide is a privately held, family owned international financial holding group with a well-established and diversified business portfolio that includes financial services and insurance products in China, as well as real estate assets globally. |

| • | The group is majority owned by Chairman Lu; his wife and daughter own minority stakes. |

| • | With approximately $31 billion of total assets—inclusive of $5.9 billion of cash and cash equivalents—China Oceanwide owns nearly 100 subsidiaries with more than 10,000 employees. |

| • | Its businesses and operations are in key cities in China as well as in other regions and countries such as the United States, Indonesia and Australia. |

| • | In line with Genworth’s own purpose, the group has also demonstrated a strong commitment to social responsibility having donated over $250 million to the benefit of society, and actively participating in various public welfare projects. |

| 6. | Why is China Oceanwide interested in acquiring Genworth? |

| • | China Oceanwide recognizes the strength of our MI platform and the importance of LTC to address an aging population in the U.S. |

| • | The transaction enables China Oceanwide to invest in a U.S. insurer positioned in both the MI and LTC markets. |

| • | We are also pleased that like Genworth, China Oceanwide has a deep interest in providing solutions to important social issues. |

| 7. | Were there competing bids to purchase the Company? |

| • | Genworth has been engaged in a strategic review since December 2014 and the board and management have evaluated different strategic transactions as part of that review. |

| • | China Oceanwide’s proposal delivers the best price to Genworth’s stockholders for Genworth’s business and assets. |

5

| 8. | What happens if there is another bid? |

| • | The Board of Directors may consider unsolicited bids under certain circumstances. |

| 9. | What is the process for completing the transaction? When do we expect it to be complete? |

| • | The transaction, which has been approved by both companies’ boards of directors, is subject to approval by Genworth’s stockholders as well as certain other closing conditions, including the receipt of required approvals by regulators in the U.S., China, and other international markets. |

| • | Both China Oceanwide and Genworth have initiated discussions and will continue regular joint engagement with regulators in key jurisdictions to maximize the certainty of the deal closing. |

| • | Should we receive the necessary approvals, the transaction is expected to close by the middle of 2017. |

| 10. | What regulators/government agencies have to approve this? |

| • | Regulatory approvals will be required from our insurance regulators, including Delaware, Virginia, New York and North Carolina. |

| • | Additional approvals will be required including from the Australian Prudential Regulation Authority, the Minister of Finance in Canada, The Comision Nacional Seguros y de Fianzas in Mexico, Fannie Mae, and Freddie Mac. |

| • | In addition, the transaction with be reviewed by the Committee on Foreign Investment in the United States (CFIUS) and similar foreign investment regulators. |

| • | CFIUS reviews transactions that could result in control of U.S. operations by a foreign person to determine any possible impact on national security. |

| 11. | What does it mean to be owned by a foreign company? Are there any risks associated in particular with Chinese ownership? |

| • | Upon closing, Genworth will continue to operate as a standalone subsidiary of China Oceanwide. |

| • | Genworth’s senior leadership team will continue to lead the business from our current headquarters in Richmond, VA and other offices around the world. |

| • | There will be no impact to our purpose — helping families achieve the dream of homeownership and address the financial challenges of aging through our leadership positions in MI and LTC. |

| 12. | How will this transaction impact our ratings? |

| • | We believe that the charges may negatively impact our ratings in the near-term. |

6

| • | In addition to the purchase consideration, China Oceanwide will contribute a total of $1.1 billion in cash to support Genworth’s efforts to restructure the USLI businesses by unstacking GLAIC from under GLIC and address our 2018 debt maturity on or before its maturity. |

| 13. | What happens if the transaction is not approved or does not close? |

| • | In the absence of the China Oceanwide transaction, Genworth believes the LTC business performance and 3Q16 charge would: |

| • | put considerable pressure on the feasibility and timing of Genworth’s unstacking plan; |

| • | significantly increase the pressure on U.S. Mortgage Insurance (USMI) and other ratings; and |

| • | accelerate the need to pursue other less attractive asset sale strategic alternatives to reduce debt and address ratings pressure. |

| • | Genworth would therefore have to execute other strategic actions to address these challenges. |

| 14. | How does the acquisition impact the short- and long-term plans for Genworth’s businesses? |

| • | The acquisition will not impact our strategic priorities or our purpose — helping families address the financial challenges of aging and achieve the dream of homeownership. |

| • | Genworth will continue to focus on our key financial priorities, including strengthening the balance sheet and stabilizing and improving ratings over time, particularly in our USMI business. Genworth will also continue to focus on our key operational priorities, most notably executing the multi-year LTC rate action plan, which is essential to stabilizing the financial position of the legacy LTC business. |

| 15. | Will you get back into life and annuities? What happens to closed life and annuity blocks? |

| • | At this point in time no decisions have been made regarding a re-entry into the life and annuities market. |

| • | We will continue to service all policies within our closed life and annuity blocks. |

7

| 16. | Will the operating structure of Genworth businesses or headquarters change? |

| • | Upon completion of the transaction, Genworth will operate as a standalone subsidiary of China Oceanwide. |

| • | Genworth’s senior leadership team will continue to lead the business from our current headquarters in Richmond, VA and other offices around the world. |

| • | At this time, there are no plans to change Genworth’s current operating structure. |

| 17. | Will the name of the company change? |

| • | No. |

| 18. | Will China Oceanwide have access to Genworth’s customer or employee data? |

| • | Our data privacy and data security policies will continue to comply with all applicable regulations in all jurisdictions. |

| 19. | Will there be changes to the senior management team? |

| • | Genworth’s senior management will continue to lead the business from our current headquarters in Richmond, VA and other offices around the world. |

| • | Genworth will operate as a standalone subsidiary of China Oceanwide. |

| 20. | What will be the role of China Oceanwide in running the day-to-day operations of each business? |

| • | Genworth’s senior management team will continue to oversee the day-to-day operations. |

| 21. | What are the benefits to stockholders as a result of the acquisition? |

| • | This transaction creates greater and more certain stockholder value than our current business plan or other strategic alternatives, and is in the best interests of all Genworth stockholders. |

| • | Our Board of Directors believes China Oceanwide’s proposal delivers the best outcome for Genworth stockholders, including: |

| • | the best price through an all-cash transaction with no financing contingencies; |

| • | the elimination of downside risk as a result of continued challenges facing Genworth and announced 3Q16 charges. |

| • | The transaction was structured with the intention of increasing the likelihood of obtaining regulatory approval. |

8

| • | In the absence of the China Oceanwide transaction, Genworth believes the LTC business performance and 3Q16 charge would: |

| • | put considerable pressure on the feasibility and timing of Genworth’s unstacking plan; |

| • | significantly increase the pressure on USMI and other ratings; and |

| • | accelerate the need to pursue other less attractive asset sale strategic alternatives to reduce debt and address ratings pressure. |

| 22. | What are the benefits to bondholders as a result of the acquisition? |

| • | Genworth has been engaged in a strategic review since December 2014. |

| • | China Oceanwide will contribute a total of $1.1 billion in cash to support Genworth’s efforts to restructure the USLI businesses by unstacking GLAIC from under GLIC and address our 2018 debt maturity on or before its maturity. |

| 23. | When do you expect to hold a special meeting of stockholders to vote on this transaction? |

| • | Notice to stockholders of a special meeting date will be included in the proxy statement and related materials, which will be publicly filed with the SEC and sent to stockholders in accordance with the proxy rules and terms of the merger agreement. |

| • | We will work through the requisite stockholder approvals as well as certain other closing conditions, including regulatory approvals, over the next several months. |

| • | The transaction is expected to close by the middle of 2017. |

| 24. | When will the proxy be issued? |

| • | The preliminary proxy statement is expected to be filed within 30 business days, unless otherwise agreed by the parties. |

Distribution Partners/Lenders/Policyholders

| 25. | What are the benefits to our distribution partners, lenders and policyholders? |

| • | We are very pleased to have the financial support of China Oceanwide in order to strengthen our businesses while we uphold our existing commitments to our distribution partners, lenders and policyholders. |

| • | China Oceanwide will contribute a total of $1.1 billion in cash to support Genworth’s efforts to restructure the USLI businesses by unstacking GLAIC from under GLIC and address our 2018 debt maturity on or before its maturity. |

9

| 26. | How will this ownership change affect my relationship or how I operate with Genworth? |

| • | This transaction will have no impact on your relationship with Genworth, as the company will continue to operate as a standalone subsidiary of China Oceanwide. |

| • | For policyholders, current client service representatives will remain your point of contact for all services and will be available to answer any questions you may have. |

| • | Most importantly, we will continue to work with all our clients to provide best-in-class service with cost effective solutions. |

| • | Genworth’s day-to-day operations are not expected to change as a result of this transaction. |

| 27. | How will this affect Genworth’s existing product offerings? |

| • | This transaction will have no impact on our existing product portfolio. |

| 28. | Will there be changes to Genworth’s business portfolio? |

| • | Genworth intends to maintain our existing portfolio of businesses, including our MI businesses in Australia and Canada. |

| 29. | Does China Oceanwide have any experience in consumer lending and/or the mortgage industry? |

| • | No, however, we are not relying on China Oceanwide to provide that expertise. |

| • | Genworth will operate as a standalone subsidiary of China Oceanwide. |

| 30. | What are the implications of being the only privately held MI company in the US? |

| • | We will continue to disclose key metrics, such as PMIERs compliance, that help our customers understand Genworth as a counterparty. |

| 31. | How will the sale impact my day-to-day focus? |

| • | It will not impact your daily focus, and you should continue to work toward the achievement of your performance goals and Genworth’s priorities as they relate to your role. |

| 32. | Will I be employed by Genworth or China Oceanwide? |

| • | Following completion of the transaction your employer will remain Genworth. |

| • | Genworth will operate as a standalone subsidiary of China Oceanwide. |

10

| 33. | Will the acquisition result in any layoffs at Genworth? Will there be any changes to employee compensation or benefits? |

| • | The acquisition is not intended to include a consolidation of resources; therefore, we don’t anticipate there will be an impact on most positions as a result of the transaction. |

| • | In terms of compensation and benefits, there currently are no plans to change how we treat base salary, merit increases, and bonuses. We also will continue our evolution to our new Choice Benefits platform. |

| • | As always, we will continue to review our organization and employee programs to ensure they meet our business needs. |

| 34. | What will happen to any Genworth stock that I own? |

| • | If you own Genworth stock, those shares will be purchased by China Oceanwide in the form of a cash payment to you. |

| • | Payments will occur sometime after the transaction closes. |

| • | Additional information, including timing, will be provided to all shareowners. |

| 35. | What will happen to the Genworth stock fund I have in my 401(k)? |

| • | An independent fiduciary oversees the Genworth stock fund in the 401(k), and specific details about the stock fund can be found in the Summary Plan Description. Shares held by the fund will be converted to cash at closing, or sooner, as determined by the independent fiduciary. |

| 36. | What will happen to my outstanding long-term incentives and equity awards? |

| • | Any unvested Restricted Stock Units (RSUs) held at the date of closing will be maintained, converted to a cash value at closing, and continue to vest in accordance with the original terms. |

| • | Any Cash Incentive Awards granted in lieu of equity in 2015 or 2016 will be maintained and continue to vest according to the original terms. |

| • | Any outstanding Performance Cash Awards granted in 2016 will continue to vest in accordance with the original terms, though performance will be measured using the greater of target, or estimated actual performance, as of the closing date. |

| • | Any outstanding Stock Options or |

| 37. | Will there be changes to office locations or Genworth’s Richmond headquarters’ location? |

| • | Genworth’s headquarters will remain in Richmond, VA and there are no planned changes to other office locations at this time. Like any company, we will evaluate our business needs from time to time and make decisions accordingly. |

| 38. | Will any Genworth employees be asked to relocate to China? Will there be opportunity to work in China? |

| • | No decisions to alter roles have been made at this time. |

11

| • | However, broader career opportunities may become available to Genworth employees. |

| 39. | Will any of our employee policies change to become consistent with those of China Oceanwide? |

| • | At this time, we do not anticipate any such changes as a result of the transaction. |

| 40. | Will the transaction impact our corporate giving or our commitment to our communities? |

| • | At this time, we do not anticipate any such changes as a result of the transaction. |

| 41. | If I receive a question from an external party, what should I do? |

| • | We have provided a list of talking points for client-facing employees to use to communicate with policyholders and distribution partners. |

| • | For other requests for information: |

| • | Please direct any media inquiries to Julie Westermann at 804 662.2423. |

| • | Please direct any investor inquiries to David Rosenbaum at 804 662.2643. |

| • | Inquiries from Genworth distribution partners or policyholders should be directed to their existing client service representative. |

| • | Questions from USLI policyholders should be directed to 888 436.9678; questions from USMI customers should be directed to 800 444.5664. |

| 42. | Who can I talk to if I have more questions? |

| • | You should always feel free to reach out to your immediate manager or Human Resources should you have additional questions. |

12

Important Information For Investors and Stockholders

In connection with the proposed transaction, Genworth Financial, Inc. (Genworth) intends to file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the solicitation of proxies for a special meeting to be called at a future date. Promptly after filing its proxy statement in definitive form with the SEC, Genworth will mail such definitive proxy statement when available to each stockholder of Genworth entitled to vote. Genworth stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and all other relevant documents which Genworth will file with the SEC when they become available, because they will contain important information about the proposed transaction and related matters. Stockholders will also be able to obtain copies of the proxy statement, without charge, when available, at the SEC’s website at www.sec.gov or by contacting the investor relations department of Genworth at the following:

David Rosenbaum, 804 662.2643

david.rosenbaum@genworth.com

Participants in the Solicitation

Genworth and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Genworth’s stockholders in connection with the proposed transaction. Genworth’s stockholders may obtain, without charge, more detailed information regarding such interested participants in Genworth’s Annual Report on Form 10-K filed with the SEC on February 26, 2016, its proxy statement filed with the SEC on April 1, 2016, and any Statements of Changes in Beneficial Ownership on Form 4 of such participants, filed with the SEC. Additional information will be available in the proxy statement when it becomes available.

Cautionary Note Regarding Forward-Looking Statements

This communication includes certain statements that may constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements and factors that may cause such a difference include, but are not limited to, risks and uncertainties related to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Genworth’s business and the price of Genworth’s common stock; (ii) the ability of the parties to obtain stockholder and regulatory approvals, or the possibility that they may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any such regulatory approvals; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) potential legal proceedings that may be instituted against Genworth following announcement of the transaction; (v) the risk that the proposed transaction disrupts Genworth’s current plans and operations as a result of the announcement and consummation of the transaction; (vi) potential adverse reactions or changes to Genworth’s business relationships with clients, employees, suppliers or other parties or other business uncertainties resulting from the announcement of the transaction or during the pendency of the transaction, including but not limited to such changes that could affect Genworth’s financial performance; (vii) certain restrictions during the pendency of the transaction that may impact Genworth’s ability to pursue certain business opportunities or strategic transactions; (viii) continued availability of capital and financing to Genworth before the consummation of the transaction; (ix) further rating agency actions and downgrades in Genworth’s financial strength ratings; (x) changes in applicable laws or regulations; (xi) Genworth’s ability to recognize the anticipated benefits of the transaction; (xii) the amount of the costs, fees, expenses and other charges

13

related to the transaction; (xiii) the risks related to diverting management’s attention from the Company’s ongoing business operations; (xiv) the impact of changes in interest rates and political instability; and (xv) other risks and uncertainties described in Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Genworth’s consolidated financial condition, results of operations, credit rating or liquidity. Accordingly, forward-looking statements should not be relied upon as representing Genworth’s views as of any subsequent date, and Genworth does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

14

INVESTOR/MEDIA TALKING POINTS

Announcement Details

| • | Genworth has agreed to be acquired by China Oceanwide for $5.43 per share in cash, for a total transaction value of approximately $2.7 billion. |

| • | We believe this is the best price for Genworth stockholders through an all-cash transaction with no financing contingencies. |

| • | This transaction offers greater and more certain stockholder value as compared to the company’s business plan and other strategic alternatives. |

| • | The transaction eliminates downside risk for stockholders caused by continued challenges facing Genworth and announced 3Q16 charges. |

| • | We have structured the transaction with the intention of increasing the likelihood of obtaining regulatory approval. |

| • | China Oceanwide has committed to contribute to Genworth $1.1 billion in additional cash to support our efforts to complete the U.S. life insurance (USLI) restructuring plan by unstacking Genworth Life and Annuity Insurance Company (GLAIC) from under Genworth Life Insurance Company (GLIC) and address the 2018 debt maturity, on or before its maturity. |

| • | This capital commitment from China Oceanwide includes $600 million to address debt expiring in 2018 and $525 million to USLI, in addition to $175 million of cash previously committed by Genworth Holdings to USLI to facilitate the unstacking. |

Implications

| • | Genworth will maintain our commitment to meeting the needs of our policyholders. |

| • | Genworth’s senior management team will continue to lead the business from our current headquarters in Richmond, Virginia and other offices around the world. |

| • | Genworth intends to maintain our existing portfolio of businesses, including our Canadian and Australian mortgage insurance businesses |

| • | Unlike other mergers and acquisitions, this transaction does not include a consolidation of resources and no specific expense or job reductions are planned as a result. |

| • | In terms of compensation and benefits, there are currently no plans to change how we treat base salary, merit increases, and bonuses. As always, we will continue to review our organization to ensure it meets business needs. |

1

| • | The transaction with China Oceanwide requires the approval of our stockholders and is also subject to other closing conditions, including the receipt of required approvals by regulators in the United States, China and other international markets. |

| • | We have already begun the process of securing these approvals and expect the transaction to close by the middle of 2017. |

Transaction Rationale

| • | Genworth has been conducting a strategic review since December 2014. |

| • | Our Board of Directors believes that China Oceanwide’s proposal delivers the best outcome for Genworth’s stockholders, including: |

| • | the best price through an all-cash transaction with no financing contingencies and |

| • | the elimination of downside risk as a result of continued challenges facing Genworth and announced 3Q16 charges. |

| • | The capital commitment from China Oceanwide strengthens our businesses and increases the likelihood of obtaining regulatory approval. |

| • | Genworth will also continue to focus on our key operational priorities, most notably executing our multi-year long term care insurance (LTC) rate action plan, which is essential to stabilizing and maintaining the viability of the legacy LTC business. |

China Oceanwide

| • | China Oceanwide is a privately held, family owned international financial holding group with a well-established and diversified business portfolio that includes financial services and insurance products in China, as well as real estate assets globally. |

| • | China Oceanwide recognizes the strength of our mortgage insurance platform and the importance of LTC to address an aging population in the U.S. |

| • | The transaction enables China Oceanwide to invest in a U.S. insurer positioned in both the MI and LTC markets. |

| • | We are also pleased that like Genworth, China Oceanwide has a deep interest in providing solutions to important social issues. |

| • | China Oceanwide is a strong financial sponsor with assets of approximately $31 billion, including $5.9 billion in cash. |

Next Steps

| • | The transaction, which has been approved by both companies’ boards of directors, is subject to approval by Genworth’s stockholders as well as certain closing conditions, |

2

| including the receipt of regulatory approvals in the U.S., China, and other international markets. |

| • | The preliminary proxy statement is expected to be filed within 30 business days, unless otherwise agreed by the parties. |

| • | Both China Oceanwide and Genworth have initiated discussions and will continue regular joint engagement with regulators in key jurisdictions to maximize the certainty of closing the transaction by the middle of 2017. |

Conclusion

| • | This transaction concludes the strategic review that we have been conducting over the last two years and allows us to focus on key business priorities including executing our LTC rate action plan, strengthening our balance sheet and improving our ratings. |

| • | Again, the deal with China Oceanwide delivers the best outcome for our stockholders as compared to the company’s business plan and other strategic alternatives. |

Important Information For Investors and Stockholders

In connection with the proposed transaction, Genworth Financial, Inc. (Genworth) intends to file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the solicitation of proxies for a special meeting to be called at a future date. Promptly after filing its proxy statement in definitive form with the SEC, Genworth will mail such definitive proxy statement when available to each stockholder of Genworth entitled to vote. Genworth stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and all other relevant documents which Genworth will file with the SEC when they become available, because they will contain important information about the proposed transaction and related matters. Stockholders will also be able to obtain copies of the proxy statement, without charge, when available, at the SEC’s website at www.sec.gov or by contacting the investor relations department of Genworth at the following:

David Rosenbaum, 804 662.2643

david.rosenbaum@genworth.com

Participants in the Solicitation

Genworth and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Genworth’s stockholders in connection with the proposed transaction. Genworth’s stockholders may obtain, without charge, more detailed information regarding such interested participants in

3

Genworth’s Annual Report on Form 10-K filed with the SEC on February 26, 2016, its proxy statement filed with the SEC on April 1, 2016, and any Statements of Changes in Beneficial Ownership on Form 4 of such participants, filed with the SEC. Additional information will be available in the proxy statement when it becomes available.

Cautionary Note Regarding Forward-Looking Statements

This communication includes certain statements that may constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements and factors that may cause such a difference include, but are not limited to, risks and uncertainties related to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Genworth’s business and the price of Genworth’s common stock; (ii) the ability of the parties to obtain stockholder and regulatory approvals, or the possibility that they may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any such regulatory approvals; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) potential legal proceedings that may be instituted against Genworth following announcement of the transaction; (v) the risk that the proposed transaction disrupts Genworth’s current plans and operations as a result of the announcement and consummation of the transaction; (vi) potential adverse reactions or changes to Genworth’s business relationships with clients, employees, suppliers or other parties or other business uncertainties resulting from the announcement of the transaction or during the pendency of the transaction, including but not limited to such changes that could affect Genworth’s financial performance; (vii) certain restrictions during the pendency of the transaction that may impact Genworth’s ability to pursue certain business opportunities or strategic transactions; (viii) continued availability of capital and financing to Genworth before the consummation of the transaction; (ix) further rating agency actions and downgrades in Genworth’s financial strength ratings; (x) changes in applicable laws or regulations; (xi) Genworth’s ability to recognize the anticipated benefits of the transaction; (xii) the amount of the costs, fees, expenses and other charges related to the transaction; (xiii) the risks related to diverting management’s attention from the Company’s ongoing business operations; (xiv) the impact of changes in interest rates and political instability; and (xv) other risks and uncertainties described in Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Genworth’s consolidated financial condition, results of operations, credit rating or liquidity. Accordingly, forward-looking statements should not be relied upon as representing Genworth’s views as of any subsequent date, and Genworth does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

4

POLICYHOLDER TALKING POINTS

Announcement Details

| • | Genworth has agreed to be acquired by China Oceanwide for $5.43 per share in cash, for a total transaction value of approximately $2.7 billion. |

| • | China Oceanwide has committed to contribute to Genworth $1.1 billion in additional cash to strengthen our financial flexibility and stabilize our businesses. |

| • | Genworth will become a standalone subsidiary of China Oceanwide. |

| • | China Oceanwide is a privately held, family owned international financial holding group with a well-established and diversified business portfolio that includes financial services and insurance products in China, as well as real estate assets globally. |

| • | Genworth has structured the transaction with the intention of increasing the likelihood of obtaining regulatory approvals. |

Implications of Announcement for Policyholders

| • | Genworth will maintain our commitment to meeting the needs of our policyholders |

| • | Helping policyholders address the financial challenges of aging and achieve the dream of homeownership remain our top priorities. |

| • | We will continue to provide best-in-class service with cost effective solutions for our clients. |

| • | Your current client service representative will remain your point of contact for all services and will be available to answer any questions you may have. |

| • | Genworth will also continue to operate independently under Genworth’s leadership team from our corporate headquarters in Richmond, Virginia and other offices around the world. |

Transaction Rationale

| • | As a result of the transaction, Genworth will be a private company, better positioned to continue to focus on our key operational priorities. These include executing our multi-year long term care insurance (LTC) rate action plan, which is essential to stabilizing the financial position of the legacy LTC business, strengthening our financial foundation, and supporting our mortgage insurance (MI) and LTC businesses. |

| • | China Oceanwide recognizes the strength of our MI platform and the importance LTC to address an aging population in the U.S. |

© 2016 Genworth Financial, Inc. All rights reserved.

Conclusion

| • | Again, we expect that this transaction will have no impact on your relationship with Genworth or on existing policies while Genworth continues to fulfill all policy obligations. |

| • | If you have any additional questions, please reach out to your current client service representative. |

| • | Thank you for your continued commitment to Genworth. |

Important Information For Investors and Stockholders

In connection with the proposed transaction, Genworth Financial, Inc. (Genworth) intends to file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the solicitation of proxies for a special meeting to be called at a future date. Promptly after filing its proxy statement in definitive form with the SEC, Genworth will mail such definitive proxy statement when available to each stockholder of Genworth entitled to vote. Genworth stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and all other relevant documents which Genworth will file with the SEC when they become available, because they will contain important information about the proposed transaction and related matters. Stockholders will also be able to obtain copies of the proxy statement, without charge, when available, at the SEC’s website at www.sec.gov or by contacting the investor relations department of Genworth at the following:

David Rosenbaum, 804 662.2643

david.rosenbaum@genworth.com

Participants in the Solicitation

Genworth and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Genworth’s stockholders in connection with the proposed transaction. Genworth’s stockholders may obtain, without charge, more detailed information regarding such interested participants in Genworth’s Annual Report on Form 10-K filed with the SEC on February 26, 2016, its proxy statement filed with the SEC on April 1, 2016, and any Statements of Changes in Beneficial Ownership on Form 4 of such participants, filed with the SEC. Additional information will be available in the proxy statement when it becomes available.

Cautionary Note Regarding Forward-Looking Statements

2

© 2016 Genworth Financial, Inc. All rights reserved.

This communication includes certain statements that may constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements and factors that may cause such a difference include, but are not limited to, risks and uncertainties related to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Genworth’s business and the price of Genworth’s common stock; (ii) the ability of the parties to obtain stockholder and regulatory approvals, or the possibility that they may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any such regulatory approvals; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) potential legal proceedings that may be instituted against Genworth following announcement of the transaction; (v) the risk that the proposed transaction disrupts Genworth’s current plans and operations as a result of the announcement and consummation of the transaction; (vi) potential adverse reactions or changes to Genworth’s business relationships with clients, employees, suppliers or other parties or other business uncertainties resulting from the announcement of the transaction or during the pendency of the transaction, including but not limited to such changes that could affect Genworth’s financial performance; (vii) certain restrictions during the pendency of the transaction that may impact Genworth’s ability to pursue certain business opportunities or strategic transactions; (viii) continued availability of capital and financing to Genworth before the consummation of the transaction; (ix) further rating agency actions and downgrades in Genworth’s financial strength ratings; (x) changes in applicable laws or regulations; (xi) Genworth’s ability to recognize the anticipated benefits of the transaction; (xii) the amount of the costs, fees, expenses and other charges related to the transaction; (xiii) the risks related to diverting management’s attention from the Company’s ongoing business operations; (xiv) the impact of changes in interest rates and political instability; and (xv) other risks and uncertainties described in Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Genworth’s consolidated financial condition, results of operations, credit rating or liquidity. Accordingly, forward-looking statements should not be relied upon as representing Genworth’s views as of any subsequent date, and Genworth does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

3

© 2016 Genworth Financial, Inc. All rights reserved.

DISTRIBUTION PARTNER & LENDER TALKING POINTS

Announcement Details

| • | Genworth has agreed to be acquired by China Oceanwide for $5.43 per share in cash, for a total transaction value of approximately $2.7 billion. |

| • | We have structured the transaction with the intention of increasing the likelihood of obtaining regulatory approval. |

| • | China Oceanwide has committed to contribute to Genworth $1.1 billion in additional cash to support our efforts to complete the U.S. life insurance (USLI) restructuring plan by unstacking Genworth Life and Annuity Insurance Company (GLAIC) from under Genworth Life Insurance Company (GLIC) and address the 2018 debt maturity, on or before its maturity. |

| • | This capital commitment from China Oceanwide includes $600 million to address debt expiring in 2018 and $525 million to USLI, in addition to $175 million of cash previously committed by Genworth Holdings to USLI to facilitate the unstacking. |

Implications of Announcement on Distribution Partners and Lenders

| • | Genworth will maintain our commitment to meeting the needs of our policyholders, distribution partners and lenders. This includes our underwriters and wholesale support, as well as customer service and claims – all of whom are prepared to keep providing the quality service you expect. |

| • | Genworth’s senior management team will continue to lead the business from our current headquarters in Richmond, Virginia and other offices around the world. |

| • | Genworth intends to maintain our existing portfolio of businesses, including our Canadian and Australian mortgage insurance businesses. |

Transaction Rationale

| • | Genworth has been conducting a strategic review since December 2014. |

| • | After evaluating several strategic options and significant analysis, we believe the agreement with China Oceanwide presents the best outcome for Genworth’s stockholders as compared to the company’s business plan and other strategic alternatives. |

| • | As a result of the transaction, Genworth will be a private company, better positioned to continue to focus on our key operational priorities. These include executing our multi-year |

© 2016 Genworth Financial, Inc. All rights reserved.

| long term care insurance (LTC) rate action plan, which is essential to stabilizing the financial position of the legacy LTC business, strengthening our financial foundation, and supporting our mortgage insurance (MI) and LTC businesses. |

China Oceanwide

| • | China Oceanwide is a privately held, family owned international financial holding group with a well-established and diversified business portfolio that includes financial services and insurance products in China, as well as real estate assets globally. |

| • | China Oceanwide recognizes the strength of our MI platform and the importance of LTC to address an aging population in the U.S. |

| • | The transaction enables China Oceanwide to invest in a U.S. insurer positioned in both the MI and LTC markets. |

| • | We are also pleased that like Genworth, China Oceanwide has a deep interest in providing solutions to important social issues. |

| • | China Oceanwide is a strong financial sponsor with assets of approximately $31 billion, including $5.9 billion in cash. |

Next Steps

| • | The transaction, which has been approved by both companies’ boards of directors, is subject to approval by Genworth’s stockholders as well as certain closing conditions, including the receipt of regulatory approvals in the U.S., China, and other international markets. |

| • | Both China Oceanwide and Genworth have initiated discussions and will continue regular joint engagement with regulators in key jurisdictions to maximize the certainty of closing the transaction by the middle of 2017. |

Conclusion

| • | This transaction concludes the strategic review that we have been conducting over the last two years and allows us to focus on key business priorities, including executing our LTC rate action plan, strengthening our balance sheet and improving our ratings. |

| • | This transaction is not expected to impact your relationship with Genworth, nor is it expected to impact existing policies. Genworth will continue to fulfill all policy obligations. |

| • | If you have any additional questions, please do not hesitate to reach out to your daily point of contact. |

2

© 2016 Genworth Financial, Inc. All rights reserved.

| • | Thank you for your continued commitment to Genworth. |

Important Information For Investors and Stockholders

In connection with the proposed transaction, Genworth Financial, Inc. (Genworth) intends to file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the solicitation of proxies for a special meeting to be called at a future date. Promptly after filing its proxy statement in definitive form with the SEC, Genworth will mail such definitive proxy statement when available to each stockholder of Genworth entitled to vote. Genworth stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and all other relevant documents which Genworth will file with the SEC when they become available, because they will contain important information about the proposed transaction and related matters. Stockholders will also be able to obtain copies of the proxy statement, without charge, when available, at the SEC’s website at www.sec.gov or by contacting the investor relations department of Genworth at the following:

David Rosenbaum, 804 662.2643

david.rosenbaum@genworth.com

Participants in the Solicitation

Genworth and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Genworth’s stockholders in connection with the proposed transaction. Genworth’s stockholders may obtain, without charge, more detailed information regarding such interested participants in Genworth’s Annual Report on Form 10-K filed with the SEC on February 26, 2016, its proxy statement filed with the SEC on April 1, 2016, and any Statements of Changes in Beneficial Ownership on Form 4 of such participants, filed with the SEC. Additional information will be available in the proxy statement when it becomes available.

Cautionary Note Regarding Forward-Looking Statements

This communication includes certain statements that may constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes

3

© 2016 Genworth Financial, Inc. All rights reserved.

and results may differ materially from those in the forward-looking statements and factors that may cause such a difference include, but are not limited to, risks and uncertainties related to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Genworth’s business and the price of Genworth’s common stock; (ii) the ability of the parties to obtain stockholder and regulatory approvals, or the possibility that they may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any such regulatory approvals; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) potential legal proceedings that may be instituted against Genworth following announcement of the transaction; (v) the risk that the proposed transaction disrupts Genworth’s current plans and operations as a result of the announcement and consummation of the transaction; (vi) potential adverse reactions or changes to Genworth’s business relationships with clients, employees, suppliers or other parties or other business uncertainties resulting from the announcement of the transaction or during the pendency of the transaction, including but not limited to such changes that could affect Genworth’s financial performance; (vii) certain restrictions during the pendency of the transaction that may impact Genworth’s ability to pursue certain business opportunities or strategic transactions; (viii) continued availability of capital and financing to Genworth before the consummation of the transaction; (ix) further rating agency actions and downgrades in Genworth’s financial strength ratings; (x) changes in applicable laws or regulations; (xi) Genworth’s ability to recognize the anticipated benefits of the transaction; (xii) the amount of the costs, fees, expenses and other charges related to the transaction; (xiii) the risks related to diverting management’s attention from the Company’s ongoing business operations; (xiv) the impact of changes in interest rates and political instability; and (xv) other risks and uncertainties described in Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Genworth’s consolidated financial condition, results of operations, credit rating or liquidity. Accordingly, forward-looking statements should not be relied upon as representing Genworth’s views as of any subsequent date, and Genworth does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

4

© 2016 Genworth Financial, Inc. All rights reserved.