UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material pursuant to §240.14a-12 | |

GENWORTH FINANCIAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

This filing relates to the proposed acquisition of Genworth Financial, Inc. (the “Company”) by Asia Pacific Global Capital Co., Ltd. (“Parent”), pursuant to the terms of the Agreement and Plan of Merger, dated as of October 21, 2016, among the Company, Parent and Asia Pacific Global Capital USA Corporation.

On October 23, 2016, the Company’s Chief Executive Officer sent a letter to the Company’s employees regarding the proposed acquisition. On the same date, the Company made the following letter to the Company’s distributors, policyholders and lenders. Additionally, on the same date, in connection with the proposed acquisition, the Company made available a list of questions & answers (the “Q&A”) and the following infographic to certain employees. The following is a copy of those letters, the Q&A and the infographic:

Dear Colleagues:

I’m very pleased to share with you that we have entered into a definitive agreement under which Genworth will be acquired by China Oceanwide Holdings Group Co., Ltd. (China Oceanwide), a family owned international financial holding company. This is a critical development for our company that concludes our two-year strategic review process. The Board of Directors and I believe this transaction delivers the best benefits to Genworth and our stockholders.

Genworth will be a private company, better positioned to continue to focus on our key operational priorities. These include executing our multi-year long term care insurance (LTC) rate action plan, which is essential to stabilizing the financial position of the legacy LTC business, strengthening our financial foundation, and supporting our mortgage insurance (MI) and LTC businesses. As a result of the transaction, Genworth will have the additional resources to address the 2018 debt maturity, on or before its maturity, and restructure our U.S. Life Insurance businesses.

What to Expect Going Forward

I have great confidence in Genworth’s future under our new ownership. While there is still work to be done, the transaction will alleviate some of the pressures we have been operating under for some time now. Further, China Oceanwide recognizes the strength of our MI platform and the importance of LTC to address an aging population in the U.S.

During my career, I have been fortunate to work with various Chinese insurance companies and look forward to working with our new owner. Genworth will now be part of a company with insurance and financial services businesses in the world’s two largest economies. Through numerous meetings with China Oceanwide’s leadership over the past several months, I have been impressed by Chairman Lu and his team’s thorough analyses and understanding of our markets.

Following closing of the transaction, we will continue to operate as an independent subsidiary of China Oceanwide, under the leadership of Genworth’s Senior Leadership Team. We will need all of our employees to continue our work on our purpose of helping people manage the financial challenges of aging and achieving the dream of homeownership. We will maintain our committed focus on meeting the needs of our distribution partners, lenders, and policyholders.

This is big news and I expect it will generate a lot of questions—particularly about what it means for you. First off, unlike other mergers and acquisitions, this transaction does not include a consolidation of resources and no specific expense or job reductions are planned as a result. We may, however, change some jobs as we move from a public to a private company.

In terms of compensation and benefits, there currently are no plans to change how we treat base salary, merit increases, and bonuses. We also will continue our evolution to our new Choice Benefits platform. As always, we will continue to review our organization and employee programs to ensure they meet our business needs.

The transaction with China Oceanwide requires the approval of our stockholders and certain regulators in the United States, China and other international markets, as well as the satisfaction of other closing conditions. We have already begun the process of securing these approvals and expect the transaction to close by the middle of 2017.

How to Learn More

To learn more, we will be hosting an all-employee meeting tomorrow morning at 10:00 AM. I hope you will join Kevin, Kelly and me.

In the interim, you can find more information on the transaction here, including an infographic describing the transaction, plus a list of frequently asked questions.

Thanks to Employees

This milestone achievement would not have been possible without the dedication and commitment each and every one of you have shown through this challenging period for our company. During this time of prolonged uncertainty, you stayed focused on our strategic priorities and serving our policyholders, and I can’t thank you enough for everything you have done.

I would like to particularly thank the dozens of team members around the company who have worked tirelessly to reach this agreement, securing this positive way forward for Genworth. While we still have work ahead of us to improve our businesses, I am confident that China Oceanwide will help position us for success.

As a reminder, if you receive any calls from investors, please direct them to David Rosenbaum at 804 662.2643; please direct calls from the media to Julie Westermann, at 804 662.2423.

Again, I’m very excited about the opportunities that the transaction will bring for Genworth, and I’m looking forward to sharing more information with you during the meeting.

Sincerely,

Important Information For Investors and Stockholders

In connection with the proposed transaction, Genworth Financial, Inc. (Genworth) intends to file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the solicitation of proxies for a special meeting to be called at a future date. Promptly after filing its proxy statement in definitive form with the SEC, Genworth will mail such definitive proxy statement when available to each stockholder of Genworth entitled to vote. Genworth stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and all other relevant documents which Genworth will file with the SEC when they become available, because they will contain important information about the proposed transaction and related matters. Stockholders will also be able to obtain copies of the proxy statement, without charge, when available, at the SEC’s website at www.sec.gov or by contacting the investor relations department of Genworth at the following:

David Rosenbaum, 804 662.2643

david.rosenbaum@genworth.com

Participants in the Solicitation

Genworth and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Genworth’s stockholders in connection with the proposed transaction. Genworth’s stockholders may obtain, without charge, more detailed information regarding such interested participants in Genworth’s Annual Report on Form 10-K filed with the SEC on February 26, 2016, its proxy statement filed with the SEC on April 1, 2016, and any Statements of Changes in Beneficial Ownership on Form 4 of such participants, filed with the SEC. Additional information will be available in the proxy statement when it becomes available.

Cautionary Note Regarding Forward-Looking Statements

This communication includes certain statements that may constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements and factors that may cause such a difference include, but are not limited to, risks and uncertainties related to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Genworth’s business and the price of Genworth’s common stock; (ii) the ability of the parties to obtain stockholder and regulatory approvals, or the possibility that they may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any such regulatory approvals; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) potential legal proceedings that may be instituted against Genworth following announcement of the transaction; (v) the risk that the proposed transaction disrupts Genworth’s current plans and operations as a result of the announcement and consummation of the transaction; (vi) potential adverse reactions or changes to Genworth’s business relationships with clients, employees, suppliers or other parties or other business uncertainties resulting from the announcement of the transaction or during the pendency of the transaction, including but not limited to such changes that could affect Genworth’s financial performance; (vii) certain restrictions during the pendency of the transaction that may impact Genworth’s ability to pursue certain business opportunities or strategic transactions; (viii) continued availability of capital and financing to Genworth before the consummation of the transaction; (ix) further rating agency actions and downgrades in Genworth’s financial strength ratings; (x) changes in applicable laws or regulations; (xi) Genworth’s ability to recognize the anticipated benefits of the transaction; (xii) the amount of the costs, fees, expenses and other charges related to the transaction; (xiii) the risks related to diverting management’s attention from the Company’s ongoing business operations; (xiv) the impact of changes in interest rates and political instability; and (xv) other risks and uncertainties described in Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Genworth’s consolidated financial condition, results of operations, credit rating or liquidity. Accordingly, forward-looking statements should not be relied upon as representing Genworth’s views as of any subsequent date, and Genworth does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they

were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Contact Information:

| Investors: | David Rosenbaum, 804 662.2643 | |

| david.rosenbaum@genworth.com | ||

| Media: | Stephen Cohen, 347 489.6602 | |

| stephen.cohen@teneostrategy.com | ||

| OR | ||

| Julie Westermann, 804 662.2423 | ||

| julie.westermann@genworth.com | ||

A Message from Genworth’s President and CEO Tom McInerney

Dear Genworth Policyholders, Distribution Partners and Lenders,

I’m pleased to announce that Genworth has agreed to be acquired by China Oceanwide for $5.43 per share in cash, for a total transaction value of approximately $2.7 billion. Our Board of Directors believes that this transaction creates greater and more certain value to stockholders than the company’s current business plan or other strategic alternatives.

China Oceanwide has also committed to contribute to Genworth $1.1 billion in additional cash to support Genworth’s efforts to restructure our U.S. life insurance businesses and address our 2018 debt maturity, on or before its maturity.

China Oceanwide is a privately held, family owned international financial holding group with a well-established and diversified business portfolio that includes financial services and insurance products in China, as well as real estate assets globally. Following closing of the transaction, Genworth will be a standalone subsidiary of China Oceanwide.

As we begin this new phase, I want to emphasize that serving our policyholders will always be our top priority and there will be no changes to any existing policies nor disruptions to any services our policyholders receive. We remain fully committed to our purpose — helping families achieve the dream of homeownership and address the financial challenges of aging.

Genworth’s management team and day-to-day interactions with our policyholders, distribution partners and lenders are not expected to change as a result of this transaction. We will continue to lead our businesses from Genworth’s current headquarters in Richmond, Virginia and other offices around the world. We also intend to maintain our existing portfolio of businesses, including Genworth Mortgage Insurance Australia and Canada.

We are very pleased to have the financial support of China Oceanwide in order to improve and strengthen our businesses while we uphold our existing commitments to our policyholders, distribution partners and lenders.

For more information on the terms of the agreement, please refer to our press release announcement here. As always, we will continue to prioritize our great service to you, and we will continue to share further details with you as they become available.

We are very excited about what this transaction means for us, our policyholders and our partners. Again, we want to reiterate that this transaction is not expected to have an impact on your relationship with Genworth, nor is it expected to have an impact on existing policies. Genworth will continue to fulfill all policy obligations. Thank you for your continued commitment to Genworth.

Sincerely,

Tom McInerney

President and Chief Executive Officer

Genworth Financial

Important Information For Investors and Stockholders

In connection with the proposed transaction, Genworth Financial, Inc. (Genworth) intends to file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the solicitation of proxies for a special meeting to be called at a future date. Promptly after filing its proxy statement in definitive form with the SEC, Genworth will mail such definitive proxy statement when available to each stockholder of Genworth entitled to vote. Genworth stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and all other relevant documents which Genworth will file with the SEC when they become available, because they will contain important information about the proposed transaction and related matters. Stockholders will also be able to obtain copies of the proxy statement, without charge, when available, at the SEC’s website at www.sec.gov or by contacting the investor relations department of Genworth at the following:

David Rosenbaum, 804 662.2643

david.rosenbaum@genworth.com

Participants in the Solicitation

Genworth and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Genworth’s stockholders in connection with the proposed transaction. Genworth’s stockholders may obtain, without charge, more detailed information regarding such interested participants in Genworth’s Annual Report on Form 10-K filed with the SEC on February 26, 2016, its proxy statement filed with the SEC on April 1, 2016, and any Statements of Changes in Beneficial Ownership on Form 4 of such participants, filed with the SEC. Additional information will be available in the proxy statement when it becomes available.

Cautionary Note Regarding Forward-Looking Statements

This communication includes certain statements that may constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements and factors that may cause such a difference include, but are not limited to, risks and uncertainties related to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Genworth’s business and the price of Genworth’s common stock; (ii) the ability of the parties to obtain stockholder and regulatory approvals, or the possibility that they may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any such regulatory approvals; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) potential legal proceedings that may be instituted against Genworth following

announcement of the transaction; (v) the risk that the proposed transaction disrupts Genworth’s current plans and operations as a result of the announcement and consummation of the transaction; (vi) potential adverse reactions or changes to Genworth’s business relationships with clients, employees, suppliers or other parties or other business uncertainties resulting from the announcement of the transaction or during the pendency of the transaction, including but not limited to such changes that could affect Genworth’s financial performance; (vii) certain restrictions during the pendency of the transaction that may impact Genworth’s ability to pursue certain business opportunities or strategic transactions; (viii) continued availability of capital and financing to Genworth before the consummation of the transaction; (ix) further rating agency actions and downgrades in Genworth’s financial strength ratings; (x) changes in applicable laws or regulations; (xi) Genworth’s ability to recognize the anticipated benefits of the transaction; (xii) the amount of the costs, fees, expenses and other charges related to the transaction; (xiii) the risks related to diverting management’s attention from the Company’s ongoing business operations; (xiv) the impact of changes in interest rates and political instability; and (xv) other risks and uncertainties described in Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Genworth’s consolidated financial condition, results of operations, credit rating or liquidity. Accordingly, forward-looking statements should not be relied upon as representing Genworth’s views as of any subsequent date, and Genworth does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

China Oceanwide to Acquire Genworth Financial – Employee FAQ

| 1. | Why did Genworth agree to be acquired by China Oceanwide? |

| • | Genworth has been conducting a strategic review since December 2014. |

| • | This transaction creates greater and more certain stockholder value than our current business plan or other strategic alternatives. |

| • | Our Board of Directors believes China Oceanwide’s proposal delivers the best outcome for Genworth stockholders, including: |

| • | the best price through an all-cash transaction with no financing contingencies and |

| • | the elimination of downside risk as a result of continued challenges facing Genworth and announced 3Q16 charges. |

| • | The transaction was structured with the intention of increasing the likelihood of obtaining regulatory approval. |

| • | The $1.1 billion of capital committed supports Genworth’s efforts to restructure the U.S. life insurance (USLI) businesses and address our 2018 debt maturity, on or before its maturity. |

| • | Genworth will also continue to focus on our key business priorities, most notably executing our multi-year long term care insurance (LTC) rate action plan, which is essential to stabilizing and maintaining the viability of the legacy LTC business. |

| 2. | What are the terms of the agreement with China Oceanwide? |

| • | China Oceanwide has agreed to acquire all of the outstanding shares of Genworth for $5.43 per share in cash, for a total transaction value of approximately $2.7 billion. |

| • | China Oceanwide has committed to contribute to Genworth $1.1 billion in additional cash to support our efforts to complete the USLI restructuring plan by unstacking Genworth Life and Annuity Insurance Company (GLAIC) from under Genworth Life Insurance Company (GLIC) and address the 2018 debt maturity, on or before its maturity. |

| • | This capital commitment from China Oceanwide includes $600 million to address debt expiring in 2018 and $525 million to USLI, in addition to $175 million of cash previously committed by Genworth Holdings to USLI to facilitate the unstacking. |

| • | We have structured the transaction with the intention of increasing the likelihood of obtaining regulatory approval. |

| 3. | Who is China Oceanwide? |

| • | China Oceanwide is a privately held, family owned international financial holding group with a well-established and diversified business portfolio that includes financial services and insurance products in China, as well as real estate assets globally. |

| • | The group is majority owned by Chairman Lu; his wife and daughter own minority stakes. |

| • | With approximately $31 billion of total assets—inclusive of $5.9 billion of cash and cash equivalents—China Oceanwide owns nearly 100 subsidiaries with more than 10,000 employees. |

| • | Its businesses and operations are in key cities in China as well as in other regions and countries such as the United States, Indonesia and Australia. |

| • | In line with Genworth’s own purpose, the group has also demonstrated a strong commitment to social responsibility having donated over $250 million to the benefit of society, and actively participating in various public welfare projects. |

| 4. | Why is China Oceanwide interested in acquiring Genworth? |

| • | China Oceanwide recognizes the strength of our MI platform and the importance of LTC to address an aging population in the U.S. |

| • | The transaction enables China Oceanwide to invest in a U.S. insurer positioned in both the MI and LTC markets. |

| • | We are also pleased that like Genworth, China Oceanwide has a deep interest in providing solutions to important social issues. |

| 5. | What are the benefits to stockholders as a result of the acquisition? |

| • | This transaction creates greater and more certain stockholder value than our current business plan or other strategic alternatives, and is in the best interests of all Genworth stockholders. |

| • | Our Board of Directors believes China Oceanwide’s proposal delivers the best outcome for Genworth stockholders, including: |

| • | the best price through an all-cash transaction with no financing contingencies; |

| • | the elimination of downside risk as a result of continued challenges facing Genworth and announced 3Q16 charges. |

| • | The transaction was structured with the intention of increasing the likelihood of obtaining regulatory approval. |

| 6. | Will the operating structure of Genworth businesses or headquarters change? |

| • | Upon completion of the transaction, Genworth will operate as a standalone subsidiary of China Oceanwide. |

| • | Genworth’s senior leadership team will continue to lead the business from our current headquarters in Richmond, VA and other offices around the world. |

| • | At this time, there are no plans to change Genworth’s current operating structure. |

| 7. | Will China Oceanwide have access to Genworth’s customer or employee data? |

| • | Our data privacy and data security policies will continue to comply with all applicable regulations in all jurisdictions. |

| 8. | What is the process for completing the transaction? When do we expect it to be complete? |

| • | The transaction, which has been approved by both companies’ boards of directors, is subject to approval by Genworth’s stockholders as well as certain other closing conditions, including the receipt of required approvals by regulators in the U.S., China, and other international markets. |

| • | Both China Oceanwide and Genworth have initiated discussions and will continue regular joint engagement with regulators in key jurisdictions to maximize the certainty of the deal closing. |

| • | Should we receive the necessary approvals, the transaction is expected to close by the middle of 2017. |

| 9. | How will the sale impact my day-to-day focus? |

| • | It will not impact your daily focus, and you should continue to work toward the achievement of your performance goals and Genworth’s priorities as they relate to your role. |

| 10. | Will the acquisition result in any layoffs at Genworth? Will there be any changes to employee compensation or benefits? |

| • | The acquisition is not intended to include a consolidation of resources; therefore, we don’t anticipate there will be an impact on most positions as a result of the transaction. |

| • | In terms of compensation and benefits, there currently are no plans to change how we treat base salary, merit increases, and bonuses. We also will continue our evolution to our new Choice Benefits platform. |

| • | As always, we will continue to review our organization and employee programs to ensure they meet our business needs. |

| 11. | If I receive a question from an external party, what should I do? |

| • | We have provided a list of talking points for client-facing employees to use to communicate with policyholders and distribution partners. |

| • | For other requests for information: |

| • | Please direct any media inquiries to Julie Westermann at 804 662.2423. |

| • | Please direct any investor inquiries to David Rosenbaum at 804 662.2643. |

| • | Inquiries from Genworth distribution partners or policyholders should be directed to their existing client service representative. |

| • | Questions from USLI policyholders should be directed to 888 436.9678; questions from USMI customers should be directed to 800 444.5664. |

| 12. | Who can I talk to if I have more questions? |

| • | You should always feel free to reach out to your immediate manager or Human Resources should you have additional questions. |

Important Information For Investors and Stockholders

In connection with the proposed transaction, Genworth Financial, Inc. (Genworth) intends to file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in connection with the solicitation of proxies for a special meeting to be called at a future date. Promptly after filing its proxy statement in definitive form with the SEC, Genworth will mail such definitive proxy statement when available to each stockholder of Genworth entitled to vote. Genworth stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and all other relevant documents which Genworth will file with the SEC when they become available, because they will contain important information about the proposed transaction and related matters. Stockholders will also be able to obtain copies of the proxy statement, without charge, when available, at the SEC’s website at www.sec.gov or by contacting the investor relations department of Genworth at the following:

David Rosenbaum, 804 662.2643

david.rosenbaum@genworth.com

Participants in the Solicitation

Genworth and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Genworth’s stockholders in connection with the proposed transaction. Genworth’s stockholders may obtain, without charge, more detailed information regarding such interested participants in Genworth’s Annual Report on Form 10-K filed with the SEC on February 26, 2016, its proxy statement filed with the SEC on April 1, 2016, and any Statements of Changes in Beneficial Ownership on Form 4 of such participants, filed with the SEC. Additional information will be available in the proxy statement when it becomes available.

Cautionary Note Regarding Forward-Looking Statements

This communication includes certain statements that may constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements and factors that may cause such a difference include, but are not limited to, risks and uncertainties related to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Genworth’s business and the price of Genworth’s common stock; (ii) the ability of the parties to obtain stockholder and regulatory approvals, or the possibility that they may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any such regulatory approvals; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) potential legal proceedings that may be instituted against Genworth following announcement of the transaction; (v) the risk that the proposed transaction disrupts Genworth’s current plans and operations as a result of the announcement and consummation of the transaction; (vi) potential adverse reactions or changes to Genworth’s business relationships with clients, employees, suppliers or other parties or other business uncertainties resulting from the announcement of the transaction or during the pendency of the transaction, including but not limited to such changes that could affect Genworth’s financial performance; (vii) certain restrictions during the pendency of the transaction that may impact Genworth’s ability to pursue certain business opportunities or strategic transactions; (viii) continued availability of capital and financing to Genworth before the consummation of the transaction; (ix) further rating agency actions and downgrades in Genworth’s financial strength ratings; (x) changes in applicable laws or regulations; (xi) Genworth’s ability to recognize the anticipated benefits of the transaction; (xii) the amount of the costs, fees, expenses and other charges

related to the transaction; (xiii) the risks related to diverting management’s attention from the Company’s ongoing business operations; (xiv) the impact of changes in interest rates and political instability; and (xv) other risks and uncertainties described in Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Genworth’s consolidated financial condition, results of operations, credit rating or liquidity. Accordingly, forward-looking statements should not be relied upon as representing Genworth’s views as of any subsequent date, and Genworth does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

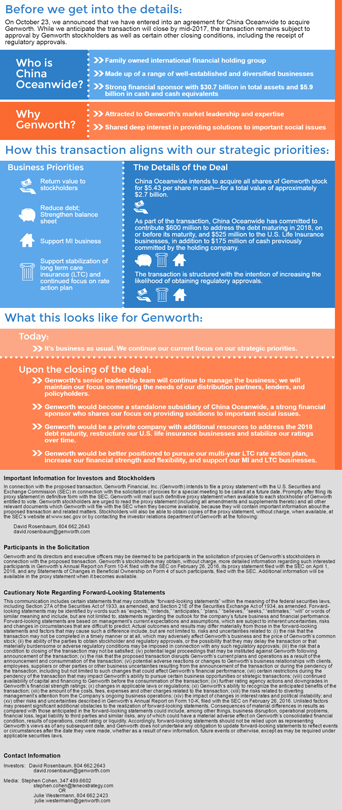

Before we get into the details:

On October 23, we

announced that we have entered into an agreement for China Oceanwide to acquire Genworth. While we anticipate the transaction will close by mid-2017, the transaction remains subject to approval by Genworth stockholders as well as certain other

closing conditions, including the receipt of regulatory approvals.

Who is China Oceanwide?

Family owned international financial holding group

Made up of a range of well-established and

diversified businesses

Strong financial sponsor with $30.7 billion in total assets and $5.9 billion in cash and cash equivalents

Why Genworth?

Attracted to Genworth’s market leadership and expertise

Shared deep interest in providing solutions to important social issues

How this transaction

aligns with our strategic priorities:

Business Priorities

Return value to

stockholders

Reduce debt;

Strengthen balance sheet

Support Ml business

Support stabilization of long term care insurance (LTC) and continued

focus on rate action plan

The Details of the Deal

China Oceanwide intends to

acquire all shares of Genworth stock for $5.43 per share in cash—for a total value of approximately $2.7 billion.

As part of the transaction, China Oceanwide

has committed to contribute $600 million to address the debt maturing in 2018, on or before its maturity, and $525 million to the U.S. Life Insurance businesses, in addition to $175 million of cash previously committed by the holding company.

The transaction is structured with the intention of increasing the likelihood of obtaining regulatory approvals.

What this looks like for Genworth:

Today:

It’s business as usual. We continue our current focus on our strategic priorities.

Upon

the closing of the deal:

Genworth’s senior leadership team will continue to manage the business; we will maintain our focus on meeting the needs of our

distribution partners, lenders, and policyholders.

Genworth would become a standalone subsidiary of China Oceanwide, a strong financial sponsor who shares our

focus on providing solutions to important social issues.

Genworth would be a private company with additional resources to address the 2018 debt maturity,

restructure our U.S. life insurance businesses and stabilize our ratings over time.

Genworth would be better positioned to pursue our multi-year LTC rate action

plan, increase our financial strength and flexibility, and support our Ml and LTC businesses.

Important Information for Investors and Stockholders

In connection with the proposed transaction, Genworth Financial, Inc. (Genworth) intends to file a proxy statement with the U.S. Securities and Exchange Commission (SEC) in

connection with the solicitation of proxies for a special meeting to be called at a future date. Promptly after filing its proxy statement in definitive form with the SEC, Genworth will mail such definitive proxy statement when available to each

stockholder of Genworth entitled to vote. Genworth stockholders are urged to read the proxy statement (including all amendments and supplements thereto) and all other relevant documents which Genworth will file with the SEC when they become

available, because they will contain important information about the proposed transaction and related matters. Stockholders will also be able to obtain copies of the proxy statement, without charge, when available, at the SEC’s website at

www.sec.gov or by contacting the investor relations department of Genworth at the following:

David Rosenbaum, 804 662.2643

david.rosenbaum@genworth.com

Participants in the Solicitation

Genworth and its directors and executive officers may be deemed to be participants in the solicitation of proxies of Genworth’s stockholders in connection with the proposed

transaction. Genworth’s stockholders may obtain, without charge, more detailed information regarding such interested participants in Genworth’s Annual Report on Form 10-K filed with the SEC on February 26, 2016, its proxy statement filed

with the SEC on April 1, 2016, and any Statements of Changes in Beneficial Ownership on Form 4 of such participants, filed with the SEC. Additional information will be available in the proxy statement when it becomes available.

Cautionary Note Regarding Forward-Looking Statements

This communication includes certain

statements that may constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements may be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “will” or words of

similar meaning and include, but are not limited to, statements regarding the outlook for the company’s future business and financial performance. Forward-looking statements are based on management’s current expectations and assumptions,

which are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from those in the forward-looking statements and factors that may cause such a

difference include, but are not limited to, risks and uncertainties related to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Genworth’s business and the price of Genworth’s

common stock; (ii) the ability of the parties to obtain stockholder and regulatory approvals, or the possibility that they may delay the transaction or that materially burdensome or adverse regulatory conditions may be imposed in connection with any

such regulatory approvals; (iii) the risk that a condition to closing of the transaction may not be satisfied; (iv) potential legal proceedings that may be instituted against Genworth following announcement of the transaction; (v) the risk that the

proposed transaction disrupts Genworth’s current plans and operations as a result of the announcement and consummation of the transaction; (vi) potential adverse reactions or changes to Genworth’s business relationships with clients,

employees, suppliers or other parties or other business uncertainties resulting from the announcement of the transaction or during the pendency of the transaction, including but not limited to such changes that could affect Genworth’s financial

performance; (vii) certain restrictions during the pendency of the transaction that may impact Genworth’s ability to pursue certain business opportunities or strategic transactions; (viii) continued availability of capital and financing to

Genworth before the consummation of the transaction; (ix) further rating agency actions and downgrades in Genworth’s financial strength ratings; (x) changes in applicable laws or regulations; (xi) Genworth’s ability to recognize the

anticipated benefits of the transaction; (xii) the amount of the costs, fees, expenses and other charges related to the transaction; (xiii) the risks related to diverting management’s attention from the Company’s ongoing business

operations; (xiv) the impact of changes in interest rates and political instability; and (xv) other risks and uncertainties described in Genworth’s Annual Report on Form 10-K, filed with the SEC on February 26, 2016. Unlisted factors may

present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things,

business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Genworth’s consolidated financial condition, results of operations, credit

rating or liquidity. Accordingly, forward-looking statements should not be relied upon as representing Genworth’s views as of any subsequent date, and Genworth does not undertake any obligation to update forward-looking statements to reflect

events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Contact Information

Investors: David Rosenbaum, 804 662.2643

david.rosenbaum@genworth.com

Media: Stephen Cohen, 347 489.6602

stephen.cohen@teneostrategy.com

OR

Julie Westermann, 804 662.2423

julie.westermann@genworth.com