Richmond, VA 23230

www.genworth.com

|

6620 West Broad Street Richmond, VA 23230 www.genworth.com |

August 12, 2016

VIA EDGAR

Mr. Jim B. Rosenberg

Senior Assistant Chief Accountant

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

| Re: | Genworth Financial, Inc. |

| Form 10-K for the fiscal year ended December 31, 2015 |

| Filed February 26, 2016 |

| Definitive Proxy Statement |

| Filed April 1, 2016 |

| File No. 001-32195 |

Dear Mr. Rosenberg:

Reference is made to your letter dated July 22, 2016 to Thomas J. McInerney, Chief Executive Officer, Genworth Financial, Inc. (“Genworth” or “we”), setting forth the Staff’s comments on the above-referenced filings (the “Comment Letter”). We are submitting this letter in response to the Comment Letter. The headings and numbered paragraphs in this letter correspond to the original headings and numbered paragraphs in the Comment Letter. For ease of reference, we have repeated the Staff’s comments before each of our responses.

Management’s Discussion and Analysis of Financial Condition and Results of Operations Reconciliation of net income (loss) to net operating income (loss), page 119

| 1. | Please identify net operating income (loss) and related per share amounts as non-GAAP measures similar to what you do in your earnings releases furnished in Form 8-K. |

Beginning in our Quarterly Report on Form 10-Q for the period ended June 30, 2016, filed August 3, 2016, we identified net operating income (loss) and related per share amounts as non-GAAP measures.

Mr. Jim B. Rosenberg

August 12, 2016

Page 2

| 2. | Please clarify how deducting net income attributable to non-controlling interests from income (loss) from continuing operations results in income (loss) from continuing operations available to Genworth Financial, Inc.’s common stockholders, which is what you then reconcile to net operating income (loss). Also consider revising your title “net operating income (loss)” to indicate, if true, that it relates solely to an amount available to Genworth Financial, Inc.’s common stockholders. |

Beginning in our Quarterly Report on Form 10-Q for the period ended June 30, 2016, filed August 3, 2016, we revised the title of the referenced line in our reconciliation from “net income attributable to noncontrolling interests” to “income from continuing operations attributable to noncontrolling interests” to clarify the adjustment we are making to “income (loss) from continuing operations” to arrive at “income (loss) from continuing operations available to Genworth Financial, Inc.’s common stockholders.” We also revised our title for “net operating income (loss)” to be “net operating income (loss) available to Genworth Financial, Inc.’s common stockholders.”

| 3. | Please tell us what is netted in the adjustments that reconcile income (loss) from continuing operations available to Genworth Financial, Inc.’s common stockholders to net operating income (loss). This presentation may not be consistent with question 102.11 of our non-GAAP financial measures Compliance & Disclosure Interpretations updated May 17, 2016. Consider that question as well as other questions therein updated May 17, 2016 beginning with your next filing and earnings release. |

The adjustments that reconcile income (loss) from continuing operations available to Genworth Financial, Inc.’s common stockholders to net operating income (loss) were previously presented net of taxes and the portion attributable to noncontrolling interests (to the extent applicable). Additionally, net investment gains (losses) are adjusted for deferred acquisition costs and other intangible amortization and certain benefit reserves. After our review of the Compliance & Disclosure Interpretations updated May 17, 2016, we presented our reconciling adjustments gross of taxes and added a total adjustment for taxes to the reconciliation beginning in our Quarterly Report on Form 10-Q for the period ended June 30, 2016, filed August 3, 2016. We have also included disclosure to explain how this tax adjustment is calculated. To enhance transparency, we also added disclosures to quantify the portion attributable to noncontrolling interests for each adjustment (to the extent applicable) as well as the adjustments to net investment gains (losses) for deferred acquisition costs and other intangible amortization and certain benefit reserves for transparency.

Notes to Consolidated Financial Statements

(10) Liability for Policy and Contract Claims

Long-term care insurance, page 257

| 4. | Throughout the filing you use the terms correction or corrections numerous times. For example, herein in the discussion below the table you refer to correction(s) which appear to be errors from prior years recorded in 2014 and 2015. Please explain to us the use of the term correction(s) herein and throughout the filing. To the extent correction(s) represent prior year errors that you recorded in a subsequent period, provide us your analysis for concluding that restatement was not necessary. |

Mr. Jim B. Rosenberg

August 12, 2016

Page 3

We use the term correction(s) for prior period accounting error(s) discovered after the issuance of our financial statements in the earlier period. We understand that in accordance with Accounting Standards Codification (“ASC”) 250-10-45-231 the accounting for a correction of an error in previously issued financial statements is to restate those prior period financial statements if the error is material to those financial statements. Accordingly, for each financial reporting period in which a prior period error is identified, we assess and contemporaneously document our analysis of the materiality of such errors in accordance with Statement of Financial Accounting Concepts No. 22, ASC 250-10-45-273 and U.S. Securities and Exchange Commission Staff Accounting Bulletin No. 99 (“SAB 99”) – Materiality (Topics 1N and 1M) for all respective periods impacted. This materiality assessment includes a quantitative and qualitative analysis of the impact on the financial statements.

Based upon the above mentioned guidance and our qualitative and quantitative analysis performed for each correction, as described in detail below, we believe that the corrections disclosed throughout our Annual Report on Form 10-K for the year ended December 31, 2015, filed February 26, 2016, (the “Form 10-K”), including those referenced in Note 10 Liability for Policy and Contract Claims, Long-term care insurance (“Note 10”) to our consolidated financial statements, are not material to any of the periods presented in such Form 10-K, and therefore do not require restatement of prior period financial statements.

Long-term Care Insurance Claim Reserves Corrections

As disclosed in Note 10 to the consolidated financial statements and elsewhere in our Form 10-K filing, we identified certain errors relating to our long-term care insurance (“LTC”) liability for policy and contract claims, or claim reserves, during 2014 and 2015.

In the third quarter of 2014, in connection with our annual LTC claim reserves review where we increased reserves by $604 million, we discovered an error in our LTC claim reserves. The correction of this error in the third quarter of 2014 resulted in a decrease to pre-tax earnings of $54 million and was reported throughout our Form 10-K as a “$54 million correction related to LTC benefit utilization for policies with inflation option.” The $54 million pre-tax earnings impact consisted of a gross, direct amount of $61 million (as disclosed in Note 10) less a ceded reinsurance recoverable of $7 million.

| 1 | ASC 250-10-45-23 states, “Any error in the financial statements of a prior period discovered after the financial statements are issued or are available to be issued (as discussed in Section 855-10-25) shall be reported as an error correction, by restating the prior-period financial statements.” |

| 2 | Statement of Financial Accounting Concepts No. 2, which describes the concept of materiality as “the omission or misstatement of an item in a financial report is material if, in the light of surrounding circumstances, the magnitude of the item is such that it is probable that the judgment of a reasonable person relying upon the report would have been changed or influenced by the inclusion or correction of the item.” |

| 3 | ASC 250-10-45-27 states, “In determining materiality for the purpose of reporting the correction of an error, amounts shall be related to the estimated income for the full fiscal year and also to the effect on the trend of earnings. Changes that are material with respect to an interim period but not material with respect to the estimated income for the full fiscal year or to the trend of earnings shall be separately disclosed in the interim period.” |

Mr. Jim B. Rosenberg

August 12, 2016

Page 4

The chart below presents the consolidated income statement impact of the correction of this error in the third quarter of 2014 and its impact on prior periods if such correction had been reflected in the periods when the error originated (assuming a 35% tax rate):

| Three months ended | ||||||||||||||||||||||||

| September 30, | June 30, | March 31, | Years ended December 31, | |||||||||||||||||||||

| (Amounts in millions) |

2014 | 2014 | 2014 | 2014 | 2013 | 2012 | ||||||||||||||||||

| Impacted financial statement line items |

||||||||||||||||||||||||

| Consolidated income statement |

||||||||||||||||||||||||

| Benefits and other changes in policy reserves |

||||||||||||||||||||||||

| As reported |

$ | 1,934 | $ | 1,200 | $ | 1,148 | $ | 6,418 | $ | 4,737 | $ | 5,232 | ||||||||||||

| Correction |

(54 | ) | — | 4 | (50 | ) | 6 | 17 | ||||||||||||||||

| Revised to reflect correction |

1,880 | 1,200 | 1,152 | 6,368 | 4,743 | 5,249 | ||||||||||||||||||

| Percentage change |

-2.8 | % | 0.0 | % | 0.3 | % | -0.8 | % | 0.1 | % | 0.3 | % | ||||||||||||

| Total benefits and expenses |

||||||||||||||||||||||||

| As reported |

3,170 | 1,886 | 1,819 | 10,028 | 7,632 | 8,183 | ||||||||||||||||||

| Correction |

(54 | ) | — | 4 | (50 | ) | 6 | 17 | ||||||||||||||||

| Revised to reflect correction |

3,116 | 1,886 | 1,823 | 9,978 | 7,638 | 8,200 | ||||||||||||||||||

| Percentage change |

-1.7 | % | 0.0 | % | 0.2 | % | -0.5 | % | 0.0 | % | 0.2 | % | ||||||||||||

| Net income (loss) |

||||||||||||||||||||||||

| As reported |

(787 | ) | 228 | 219 | (1,048 | ) | 714 | 525 | ||||||||||||||||

| Correction |

(35 | ) | — | 3 | (32 | ) | 4 | 11 | ||||||||||||||||

| Revised to reflect correction |

(752 | ) | 228 | 216 | (1,016 | ) | 710 | 514 | ||||||||||||||||

| Percentage change |

4.4 | % | 0.0 | % | 1.4 | % | 3.1 | % | 0.6 | % | 2.1 | % | ||||||||||||

| Net income (loss) available to Genworth Financial, Inc.’s common stockholders |

||||||||||||||||||||||||

| As reported |

(844 | ) | 176 | 184 | (1,244 | ) | 560 | 325 | ||||||||||||||||

| Correction |

(35 | ) | — | 3 | (32 | ) | 4 | 11 | ||||||||||||||||

| Revised to reflect correction |

(809 | ) | 176 | 181 | (1,212 | ) | 556 | 314 | ||||||||||||||||

| Percentage change |

4.1 | % | 0.0 | % | 1.6 | % | 2.6 | % | 0.7 | % | 3.4 | % | ||||||||||||

As illustrated in the chart above, there was no impact in the second quarter of 2014. For the years ended December 31, 2011 and prior, the pre-tax impact was $27 million. These out of period corrections had less than a 1% impact on the related reinsurance recoverable and liability for policy and contract claims lines in the balance sheet for the periods shown above.

In the fourth quarter of 2014, we discovered an error in our LTC claim reserves recorded in the third quarter of 2014 for claims that were in the course of settlement. This error was reported throughout our Form 10-K as “a $67 million correction on LTC claims in course of settlement” and relates entirely to the third quarter of 2014, which is the same period the aforementioned $604 million reserve increase was recorded. The $67 million pre-tax earnings impact consisted of a gross, direct amount of $81 million (as disclosed in Note 10) less a ceded reinsurance recoverable of $14 million. This error had no impact on the full year 2014 or any other numbers presented in Note 10 as it occurred in the third quarter of 2014 and was corrected in the fourth quarter of 2014.

Mr. Jim B. Rosenberg

August 12, 2016

Page 5

The chart below presents the impact on our consolidated income statement on the period of correction in the fourth quarter of 2014 and if the correction of this error had been reflected in the third quarter of 2014 when the error originated (assuming a 35% tax rate):

| Three months ended | ||||||||

| (Amounts in millions) |

September 30, 2014 | December 31, 2014 | ||||||

| Impacted financial statement line items |

||||||||

| Income statement |

||||||||

| Benefits and other changes in policy reserves |

||||||||

| As reported |

$ | 1,934 | $ | 2,136 | ||||

| Correction |

67 | (67 | ) | |||||

| Revised to reflect correction |

2,001 | 2,069 | ||||||

| Percentage change |

3.5 | % | -3.1 | % | ||||

| Total benefits and expenses |

||||||||

| As reported |

3,170 | 3,153 | ||||||

| Correction |

67 | (67 | ) | |||||

| Revised to reflect correction |

3,237 | 3,086 | ||||||

| Percentage change |

2.1 | % | -2.1 | % | ||||

| Net income (loss) |

||||||||

| As reported |

(787 | ) | (708 | ) | ||||

| Correction |

44 | (44 | ) | |||||

| Revised to reflect correction |

(831 | ) | (664 | ) | ||||

| Percentage change |

-5.6 | % | 6.2 | % | ||||

| Net income (loss) available to Genworth Financial, Inc.’s common stockholders |

||||||||

| As reported |

(844 | ) | (760 | ) | ||||

| Correction |

44 | (44 | ) | |||||

| Revised to reflect correction |

(888 | ) | (716 | ) | ||||

| Percentage change |

-5.2 | % | 5.8 | % | ||||

This out of period correction had less than a 1% impact on the related reinsurance recoverable and liability for policy and contract claims lines in the balance sheet for the period shown above.

While these errors were not determined to be material to our consolidated financial statements individually or in the aggregate, as described below in our quantitative and qualitative analysis, because the related controls could have resulted in a material misstatement in our consolidated financial statements, we concluded a material weakness existed in our internal controls over financial reporting as of December 31, 2014, as reported in management’s report on internal control in our Annual Report on Form 10-K for the year ended December 31, 2014, filed March 2, 2015.

During 2015, in connection with our efforts to remediate our material weakness in internal control over financial reporting, we discovered additional corrections related to our LTC claim reserves. These prior period corrections lowered claim reserves by a net total pre-tax impact of $10 million. The $25 million of net favorable corrections and adjustments in 2015, disclosed in Note 10 to the consolidated financial statements in our Form 10-K, also included a $15 million change in accounting estimate related to LTC claim loss adjustment expenses. Each of these corrections was individually and in the aggregate, as shown below, assessed for materiality. The correction of these net pre-tax errors of $10 million in 2015 did not change or distort our consolidated earnings trends for the full year or interim periods during 2015.

Mr. Jim B. Rosenberg

August 12, 2016

Page 6

Quantitative Materiality Analysis

We quantitatively analyzed the impact of all errors recorded in a period individually and in the aggregate, to evaluate the net impact of all corrections, as part of our consideration of materiality and the need to restate previously issued financial statements. We compared our reported net income (loss) and reported net income (loss) available to Genworth Financial, Inc.’s common stockholders to what the revised measures would be in the event we corrected the aggregate out of period items recorded during a particular period. The chart below presents our quantitative analysis for the years ended December 31, 2014 and 2015:

| (Amounts in millions) |

As reported | Corrections | If corrected | Percentage change |

||||||||||||

| Year ended December 31, 2014 |

||||||||||||||||

| Consolidated income statement |

||||||||||||||||

| Net loss |

$ | (1,048 | ) | $ | 61 | $ | (987 | ) | 5.8 | % | ||||||

| Net loss available to Genworth Financial, Inc.’s common stockholders |

(1,244 | ) | 61 | (1,183 | ) | 4.9 | % | |||||||||

| Year ended December 31, 2015 |

||||||||||||||||

| Consolidated income statement |

||||||||||||||||

| Net loss |

(413 | ) | 44 | (369 | ) | 10.6 | % | |||||||||

| Net loss available to Genworth Financial, Inc.’s common stockholders |

(615 | ) | 49 | (566 | ) | 8.0 | % | |||||||||

The majority of the impact in 2014 was driven by the errors in our LTC claim reserves, as described above, which represented less than 10% of our LTC claim reserves change that was made in the third quarter of 2014 and less than 1% of the 2014 total benefits and other changes in policy reserves line on the consolidated income statement. During 2014, as disclosed in our Form 10-K, we recorded charges to increase our LTC claim reserves by $604 million in the third quarter of 2014 and loss recognition testing on our acquired LTC block of $710 million in the fourth quarter of 2014. Given the relatively sizable amount of these LTC-related charges that were incurred in both quarters (independent of the corrections), we determined the incremental impact of the corrections recorded in 2014 was immaterial, as these adjustments would not impact the judgment of a reasonable person relying upon our consolidated financial statements or segment results as reported for either the full year or interim periods. We also examined the impact on the period of origin of all corrections made in 2014, as well as any previous corrections, on prior annual and quarterly periods. For example, the 2013 net income impact of out of period corrections was 2.1%.

The impact of the out of period corrections of errors in 2015 increased our net loss and net loss available to Genworth Financial, Inc.’s common stockholders by 10.6% and 8.0%, respectively. Given the magnitude of this impact, we then looked to qualitative factors as part of our materiality assessment and determined that none of these qualitative factors, individually or taken together, indicated that the corrections were material. For example, none of the corrections would have changed a loss to income or vice versa for our consolidated financial statements for the full year or interim periods during 2015 and in each case the corrections incrementally increased the losses reported. In addition, there have been significant fluctuations in our results of operations over the

Mr. Jim B. Rosenberg

August 12, 2016

Page 7

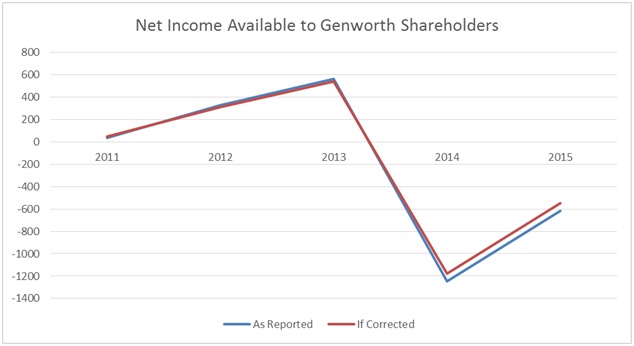

past five years as our net income (loss) available to Genworth Financial, Inc.’s common stockholders has ranged from income of $38 million in 2011, $325 million in 2012 and $560 million in 2013 and then to losses of $1.2 billion in 2014 and $615 million in 2015. As a result, the correction of these matters in 2015 did not change or distort our consolidated nor segment earnings trends for the full year or interim periods during 2015. Also, for the full year or interim periods during 2015, none of the corrections hid a failure to meet analysts’ consensus expectations. Additionally, we considered other qualitative factors, which are described below in more detail.

For the out of period corrections in 2015, we also evaluated the impact on individual line items on the income statement beyond net income (loss) and net income (loss) available to Genworth Financial, Inc.’s common stockholders and noted that the individual line items were impacted by 1.0% or less, with the exception of amortization of deferred acquisition costs and intangibles and loss from discontinued operations, net of taxes, which were impacted by 6.0% and 3.2%, respectively. The change to amortization of deferred acquisition costs and intangibles resulting from the corrections was only marginal in light of additional items recorded during 2015, including a pre-tax impairment of deferred acquisition costs of $455 in the third quarter of 2015 and unfavorable unlocking in our universal life insurance products of pre-tax $123 million in the fourth quarter of 2015. As a result of the relatively sizable amount of these items on amortization of deferred acquisition costs and intangibles, we believed the magnitude of the corrections recorded in 2015 on this line item would not impact the judgment of a reasonable person relying upon our consolidated financial statements. Further, we did not believe corrections on these line items would have been meaningful to a user of our financial statements as non-cash amortization has no economic impact on the operations of the businesses and discontinued operations represent businesses that are no longer part of our ongoing operations. Our experience is that these are not measures that investors typically use to evaluate our performance. Accordingly, we did not expect any of the corrections, individually nor in the aggregate, to result in a significant positive or negative market reaction. We also examined the impact on the period of origin for all corrections made in 2015, as well as previous corrections. The net income (loss) impacts of out of period corrections was updated to 3.7% for 2014 and 3.4% for 2013. We also evaluated the interim periods of 2015 and did not believe the impacts to individual line items or in the aggregate were material.

Mr. Jim B. Rosenberg

August 12, 2016

Page 8

These quantitative impacts for the past five years on our consolidated net income (loss) available to Genworth Financial, Inc.’s common stockholders are illustrated below:

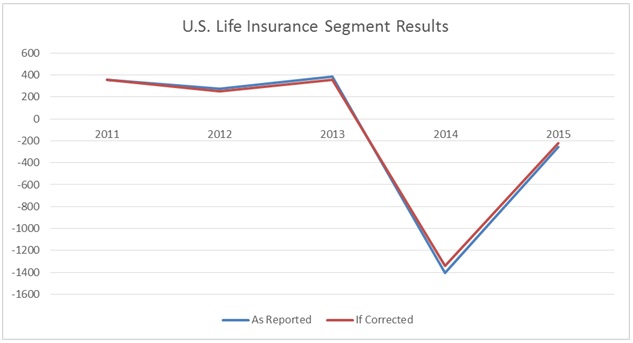

These quantitative impacts for the past five years on our U.S. Life Insurance segment results are illustrated below:

Mr. Jim B. Rosenberg

August 12, 2016

Page 9

Based on our analysis and as illustrated in the graphs above, even if the out of period corrections of errors had been corrected in the relevant periods, these corrections would not have had a substantial impact on, nor mask a change in, our earnings trends in any impacted period. In addition, we quantitatively and qualitatively analyze the impact of corrections in relation to individual line item amounts, subtotals and totals in the financial statements. All out of period corrections, individually and in the aggregate, had less than 1% impact on the related line(s) in the balance sheet.

Qualitative Materiality Analysis

The corrections recorded in 2014 and 2015 arise from precise inputs into, or calculation methods for, financial statement estimates, primarily judgmental insurance reserves with inherent imprecision, that will be updated when experience emerges, and our view on future expectations on experience changes.

We also considered other qualitative factors in accordance with SAB 99. None of the corrections recorded in 2014 and 2015, individually or in the aggregate:

| • | have a substantial impact on, nor mask a change in, our earnings trends in any impacted period, as clearly shown in the graphs above on both consolidated net income and our U.S Life Insurance segment results; |

| • | change a loss to income or vice versa for our consolidated or segment results; |

| • | impact intra-segment reporting; |

| • | have any impact on compliance with any regulatory requirements; |

| • | affect compliance with our loan covenants or other contractual requirements; |

| • | have the effect of increasing management’s compensation by satisfying any requirements for the award of any form of incentive compensation; or |

| • | involve the concealment of an unlawful transaction. |

In addition, we did not believe the corrections recorded in 2014 and 2015, individually or in the aggregate, affected other information that we believed to be important to, and used by, our stockholders, potential investors, and analysts, including operating earnings, investment losses, capital and liquidity. None of the corrections hid a failure to meet analysts’ consensus expectations. Accordingly, we did not expect any of the corrections, individually nor in the aggregate, to result in a significant positive or negative market reaction.

Further, none of the out of period accounting errors, discovered after the issuance of our financial statements in the earlier period, were intentional.

In considering all of these relevant facts and circumstances, we do not believe there are any qualitative considerations, for any of the corrections during 2014 or 2015, which indicate the corrections are material to our financial statements.

Conclusion

As described above, after careful consideration of all relevant facts and circumstances, while certain of the corrections individually and in the aggregate may be considered quantitatively large, we determined that the nature and magnitude of the corrections recorded

Mr. Jim B. Rosenberg

August 12, 2016

Page 10

in each period were unlikely to change or significantly influence the judgment, or alter the decision-making process, of a reasonable person relying on our consolidated financial statements and segment results. The trend of consolidated earnings and segment results were not affected by these corrections, nor was a trend in consolidated earnings or segment results masked by these corrections. For transparency, we clearly and thoroughly disclosed these corrections in our earnings releases and Annual and Quarterly Reports filed on Form 10-K and Form 10-Q, including for the correction of the error related to LTC benefit utilization for policies with inflation option that arose prior to 2011 and was not material to earnings in any full year or interim periods. Accordingly, based on the quantitative and qualitative considerations, we concluded the corrections were not material to our consolidated financial statements nor our segment results, and therefore a restatement was not necessary. Given the inherent judgmental nature of these conclusions, we thoroughly reviewed them with our audit committee and external auditors, KPMG LLP, contemporaneously with making the determinations. As part of this review, we also assessed and discussed with our audit committee and external auditors the related impacts of these errors to our Internal Control over Financial Reporting.

Definitive Proxy Statement on Form DEF 14A

Executive Compensation, page 50

| 5. | We refer to the discussion of the long term equity grants and the accompanying table on page 41. Please confirm that in future filings you will expand your discussion to explain the factors that the Committee considered in determining the approximate compensation value intended to be delivered to each named executive officer. |

We confirm that in future Definitive Proxy Statement on Form DEF 14A filings we will expand our discussion to explain the factors that the Committee considered in determining the approximate compensation value intended to be delivered to each named executive officer.

Mr. Jim B. Rosenberg

August 12, 2016

Page 11

* * * * *

We acknowledge the following:

| • | Genworth is responsible for the adequacy and accuracy of the disclosure in its filings; |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to Genworth’s filings; and |

| • | Genworth may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

We appreciate the opportunity to work with the Staff to continue to enhance our financial disclosures. Should you have any questions regarding our responses, please contact Kelly L. Groh at (804) 281-6321 or Matthew D. Farney at (804) 662-2447.

Sincerely,

| /s/ Kelly L. Groh | /s/ Matthew D. Farney | |||

| Kelly L. Groh | Matthew D. Farney | |||

| Executive Vice President and | Vice President and Controller | |||

| Chief Financial Officer | (Principal Accounting Officer) | |||

| (Principal Financial Officer) | ||||

cc:

Lisa Vanjoske, Assistant Chief Accountant, U.S. Securities and Exchange Commission

Dorman Yale, Staff Attorney, U.S. Securities and Exchange Commission

Suzanne Hayes, Assistant Director, U.S. Securities and Exchange Commission

Thomas J. McInerney, President and Chief Executive Officer, Genworth Financial, Inc.

James A. Parke, Audit Committee Chair, Board of Directors, Genworth Financial, Inc.

Edward J. Metzger, Lead Engagement Partner, KPMG LLP