UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Genworth Financial, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

6620 West Broad Street Richmond, Virginia 23230 |

April 4, 2012

Dear Stockholder,

You are invited to attend the 2012 Annual Meeting of Stockholders to be held at 9:00 a.m. local time on Thursday, May 17, 2012, at The Westin Richmond, 6631 West Broad Street, Richmond, Virginia 23230.

The Annual Meeting will include a report on our business operations, discussion and voting on the matters set forth in the accompanying Notice of Annual Meeting and proxy statement, and discussion and voting on any other business matters properly brought before the meeting.

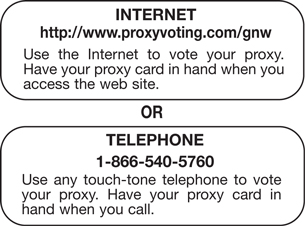

Whether or not you plan to attend, you can ensure your shares are represented at the meeting by promptly submitting your proxy by telephone, by Internet or by completing, signing, dating and returning your proxy card in the enclosed envelope.

| Cordially, |

| /s/ Michael D. Fraizer |

| Michael D. Fraizer |

| Chairman of the Board, |

| President and Chief Executive Officer |

NOTICE OF 2012 ANNUAL MEETING OF STOCKHOLDERS

9:00 a.m., May 17, 2012

The Westin Richmond

6631 West Broad Street

Richmond, Virginia 23230

April 4, 2012

To the Stockholders:

NOTICE IS HEREBY GIVEN that Genworth Financial, Inc.’s 2012 Annual Meeting of Stockholders will be held at The Westin Richmond, 6631 West Broad Street, Richmond, Virginia 23230, on Thursday, May 17, 2012, at 9:00 a.m. local time, to address all matters that may properly come before the Annual Meeting. In addition to receiving a report on our business operations, stockholders will be asked:

| (1) | to elect the eight nominees named in this proxy statement as directors for the ensuing year; |

| (2) | to approve, on an advisory basis, the compensation of our named executive officers; |

| (3) | to approve the 2012 Genworth Financial, Inc. Omnibus Incentive Plan; |

| (4) | to ratify the selection of KPMG LLP as our independent registered public accounting firm for 2012; and |

| (5) | to transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

Stockholders of record at the close of business on March 21, 2012 will be entitled to vote at the meeting and any adjournments.

| Cordially, |

| /s/ Leon E. Roday |

| Leon E. Roday |

| Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting

to Be Held on May 17, 2012

Genworth’s proxy statement and annual report to stockholders are available at:

http://bnymellon.mobular.net/bnymellon/gnw

• To be voted on at the meeting

Every stockholder’s vote is important. Please complete, sign,

date and return your proxy card, or submit your

proxy by telephone or by Internet.

1

2

3

4

5

6

Currently, nine directors serve on our Board of Directors, the terms for whom all expire at the Annual Meeting. One of our current directors, Dr. Risa J. Lavizzo-Mourey, will not stand for re-election at the Annual Meeting. Our Board of Directors adopted a resolution in March 2012, upon the recommendation of the Nominating Committee, setting the size of the Board of Directors at eight members, effective as of the Annual Meeting. Accordingly, at the Annual Meeting, eight directors are to be elected to hold office until the 2013 Annual Meeting and until their successors have been elected and have qualified. Working through its Nominating Committee, our Board of Directors continues to evaluate the optimal size for the Board and will continue to consider the addition of one or more independent directors to the Board.

The eight nominees for election at the Annual Meeting are listed on pages 8 to 11 with brief biographies and descriptions of their qualifications and skills to serve as our directors. See the Board of Directors and Committees—Board Composition section for a description of how our directors’ blend of backgrounds benefits our company. The Board of Directors has determined that seven of the eight nominees are independent directors under the New York Stock Exchange (“NYSE”) listing requirements and our Governance Principles, which are discussed below in the Corporate Governance section.

All of the nominees named in this proxy statement have been nominated by our Board of Directors to be elected by holders of our common stock. We are not aware of any reason why any nominee would be unable to serve as a director. If a nominee for election is unable to serve, the shares represented by all valid proxies will be voted for the election of any other person that our Board of Directors may nominate as a substitute.

7

|

Steven W. Alesio, 58, former Chairman of the Board of The Dun & Bradstreet Corporation. Director since March 2010.

Mr. Alesio has been a Senior Advisor at Providence Equity Partners since December 2010. Mr. Alesio was the Chairman of the Board of The Dun & Bradstreet Corporation (“D&B”) from May 2005 until his retirement in June 2010. He was initially elected to D&B’s board of directors in May 2002. Mr. Alesio served as D&B’s Chief Executive Officer from January 2005 to December 2009, its President from May 2002 to February 2007, its Chief Operating Officer from May 2002 to December 2004 and its Senior Vice President of Global Marketing, Strategy Implementation, E-Business Solutions™ and Asia-Pacific/Latin America from January 2001 to April 2002. Before joining D&B, Mr. Alesio was with the American Express Company for 19 years, most recently serving as President and General Manager of the Business Services Group and as a member of that company’s Planning and Policy Committee, a position he held from January 1996 to December 2000. During the last five years, Mr. Alesio also previously served as a director of The Dun & Bradstreet Corporation. Mr. Alesio received a B.S. in Accounting from St. Francis College and an M.B.A. from the University of Pennsylvania’s Wharton School.

Qualifications: Mr. Alesio, as the former chairman and former chief executive officer of a public company, has developed significant strategic and marketing expertise and also has substantial experience managing international operations and technology changes. Mr. Alesio also has 19 years of experience with a financial services company as well as experience with accounting and finance. | |

|

William H. Bolinder, 68, former President, Chief Executive Officer and a director of Acadia Trust N.A. Director since October 2010.

Mr. Bolinder retired in June 2006 from serving as President, Chief Executive Officer and a director of Acadia Trust N.A., positions he had held since 2003. He had previously been a member of the Group Management Board for Zurich Financial Services Group from 1994 to 2002. Mr. Bolinder joined Zurich American Insurance Company, USA in 1986 as Chief Operating Officer and became Chief Executive Officer in 1987. He has been a director of Endurance Specialty Holdings Ltd. since December 2001 and became the non-executive Chairman of the Board in March 2011. Mr. Bolinder was a director of Quanta Capital Holding Ltd. from January 2007 to October 2008. Mr. Bolinder has also served on the board of the American Insurance Association, American Institute for Chartered Property Casualty Underwriting, Insurance Institute for Applied Ethics, Insurance Institute of America, Insurance Services Office, Inc. and the National Association of Independent Insurers. Mr. Bolinder received a B.S. in Business Administration from the University of Massachusetts, Dartmouth.

Qualifications: Mr. Bolinder offers extensive experience in the insurance and financial services industry, including a combined 16 years serving in various positions with one of the world’s largest insurance companies and its U.S. subsidiary, and three years as president, chief executive officer and director of an investment advisory and trustee company. Mr. Bolinder’s current and former directorships with underwriters of specialty lines of insurance and reinsurance provide valuable knowledge regarding the international financial services sector. | |

8

|

Michael D. Fraizer, 53, Chairman of the Board, President and Chief Executive Officer of Genworth Financial, Inc. Director since May 2004.

Mr. Fraizer has been our Chairman of the Board, President and Chief Executive Officer since the completion of our initial public offering (“IPO”) in May 2004. Prior to our IPO, he was a Senior Vice President of General Electric Company (“GE”) and served as Chairman and Chief Executive Officer of GE Financial Assurance Holdings, Inc. (“GEFAHI”). Prior to serving in those roles, Mr. Fraizer served in various capacities at GE, including leadership roles at GE Capital Commercial Real Estate, GE Japan, GE Corporate Business Development and GE Corporate Audit Staff. Mr. Fraizer currently serves on the boards of the Andre Agassi Charitable Foundation and the Richmond Performing Arts CenterStage. He is also a member of the executive counsel of the Bridging Richmond Initiative, a member of the VCU School of Education Advancement Council and a Board member of Richmond’s Future. Mr. Fraizer received a B.A. in Political Science from Carleton College.

Qualifications: Mr. Fraizer brings insight across commercial, financial and operational aspects of our business, from his current role and history with the company. Mr. Fraizer has held a number of chief executive officer and general management roles in his 31 year career that have required strategic, financial, business transformation and business building skills in U.S. and international markets. | |

|

Nancy J. Karch, 64, former Senior Partner of McKinsey & Company. Director since October 2005.

Ms. Karch was a Senior Partner of McKinsey & Company, an independent consulting firm, from 1988 until her retirement in 2000. Prior thereto, Ms. Karch served in various executive capacities at McKinsey since 1974. She is a director of Kimberly-Clark Corp., Liz Claiborne, Inc., MasterCard Incorporated, and The Corporate Executive Board Company. Ms. Karch is also on the board of the Westchester Land Trust and Northern Westchester Hospital, both not-for-profit organizations. Ms. Karch received a B.A. in Mathematics from Cornell University, an M.S. in Mathematics from Northeastern University and an M.B.A. from Harvard Business School.

Qualifications: Ms. Karch, based on her 26 years at a global consulting firm, including 12 years as a Senior Partner, offers substantial expertise in the area of strategic and marketing issues. Ms. Karch also has substantial experience as a public company director. | |

9

|

Christine B. Mead, 56, former Executive Vice President and Chief Financial Officer of Safeco Corporation. Director since October 2009.

Ms. Mead was the Executive Vice President and Chief Financial Officer of Safeco Corporation and the Co-President of the Safeco insurance companies from November 2004 until her retirement in December 2005. From January 2002 to November 2004, Ms. Mead served as Senior Vice President, Chief Financial Officer and Secretary of Safeco Corporation. Prior to joining Safeco in 2002, Ms. Mead served in various roles at Travelers Insurance Companies from 1989 to 2001, including Senior Vice President and Chief Financial Officer, Chief Accounting Officer, and Controller. Ms. Mead also served with Price Waterhouse LLP from 1980 to 1989, and with Deloitte Haskins & Sells in the United Kingdom from 1976 to 1980. Ms. Mead also serves as a director of CLS Group Holdings AG and is on the board of the Idaho Chapter of The Nature Conservancy, a non-profit organization. Ms. Mead received a B.S. in Accounting from University College Cardiff, United Kingdom.

Qualifications: Ms. Mead brings experience as the former chief financial officer of a public company. She worked for 16 years in the insurance industry, as well as 13 years for major accounting firms. Her international background adds a unique perspective to our Board. | |

|

Thomas E. Moloney, 68, former Senior Executive Vice President and Chief Financial Officer of John Hancock Financial Services, Inc. Director since October 2009.

Mr. Moloney served as the interim Chief Financial Officer of MSC—Medical Services Company from December 31, 2007 to March 31, 2008. He retired as the Senior Executive Vice President and Chief Financial Officer of John Hancock Financial Services, Inc. in December 2004. He had served in that position since 1992. Mr. Moloney served in various other roles at John Hancock Financial Services, Inc. during his tenure from 1965 to 1992, including Vice President, Controller, and Senior Accountant. Mr. Moloney is on the boards of Nashoba Learning Group and the Boston Children’s Museum, both non-profit organizations. During the last five years, Mr. Moloney also previously served as a director of MSC—Medical Services Company (a public company). Mr. Moloney received a B.A. in Accounting from Bentley College and holds a Professional Director Certification from the Corporate Directors Group.

Qualifications: Mr. Moloney provides almost 40 years of insurance industry and accounting experience, including having served as the chief financial officer of a public insurance company. He provides extensive knowledge of accounting and finance in regard to insurance products and industry trends. | |

10

|

James A. Parke, 66, former Vice Chairman and Chief Financial Officer of GE Capital Services and former Senior Vice President of General Electric Company. Director since May 2004.

Mr. Parke retired as Vice Chairman and Chief Financial Officer of GE Capital Services and a Senior Vice President at GE in December 2005. He had served in those positions since 2002. From 1989 to 2002 he was Senior Vice President and Chief Financial Officer at GE Capital Services and a Vice President of GE. Prior thereto, from 1981 to 1989 he held various management positions in several GE businesses. He also serves as a director of buildOn, a not-for-profit corporation. Mr. Parke received a B.A. in History, Political Science and Economics from Concordia College in Minnesota.

Qualifications: Mr. Parke offers extensive experience in the areas of finance, financial services and capital markets, gained in part through his 37 years of experience with GE and GE Capital, including having served as a former Vice Chairman and Chief Financial Officer of GE Capital, where he helped build GE’s financial and insurance businesses. | |

|

James S. Riepe, 68, former Vice Chairman of T. Rowe Price Group, Inc. Director since March 2006 and Lead Director since February 2009.

Mr. Riepe is a retired Vice Chairman and a Senior Advisor at T. Rowe Price Group, Inc. Mr. Riepe served as the Vice Chairman of T. Rowe Price Group, Inc. from 1997 until his retirement in December 2005. Prior to joining T. Rowe Price Group, Inc. in 1982, Mr. Riepe was an Executive Vice President of The Vanguard Group. Mr. Riepe serves as a director of The NASDAQ OMX Group, Inc. and LPL Investment Holdings, Inc. He is a member of the University of Pennsylvania’s Board of Trustees. Mr. Riepe previously served as a director of T. Rowe Price Group, Inc. (a public company) and 57 T. Rowe Price registered investment companies (mutual funds). Mr. Riepe received a B.S. in Industrial Management, an M.B.A. and an Honorary Doctor of Laws degree from the University of Pennsylvania.

Qualifications: Mr. Riepe brings to the Board significant expertise in finance and investments gained through his experiences as a senior executive in the investment management industry, including 23 years with T. Rowe Price. | |

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR THE ELECTION OF MR. ALESIO, MR. BOLINDER, MR. FRAIZER, MS. KARCH, MS. MEAD, MR. MOLONEY, MR. PARKE AND MR. RIEPE.

11

Governance Principles

Our Governance Principles are published on Genworth’s website, as are our other corporate governance materials, including the charters adopted by the Board for each of our standing committees and any key practices adopted by the committees. To view these materials, go to www.genworth.com, click “Investors” and then click “Corporate Governance.” The Board regularly reviews corporate governance developments and may modify these principles, charters and key practices as warranted. Any modifications will be reflected in the documents on Genworth’s website.

Meeting Attendance

The Board held 11 meetings during 2011. During 2011, each of our directors attended more than 75% of the aggregate of (1) the total number of meetings of the Board of Directors (held during the period for which he or she has been a director) and (2) the total number of meetings held by all committees of the Board on which he or she served (during the periods that he or she served). As set forth in the Governance Principles, directors are expected to attend the Annual Meeting. All of our directors serving at the time of our 2011 Annual Meeting of Stockholders attended the meeting.

Board Leadership Structure

Our Board of Directors functions in a collaborative fashion that emphasizes active participation and leadership by all of its members. With respect to the role of Chairman, our Board believes that one of its most important responsibilities is determining which director is most appropriate to serve in that role. The Board has determined that, by virtue of his tenure with and extensive knowledge of the company, Mr. Fraizer is the appropriate choice to serve as Chairman of the Board at this time. The Board believes that the combination of Mr. Fraizer as both Chairman and Chief Executive Officer (“CEO”), together with Mr. Riepe, the Lead Director selected from among and by the independent directors, is currently the appropriate leadership structure for the company. The Chairman and the Lead Director provide leadership to the Board as a whole in setting its strategic priorities. In his position as CEO, Mr. Fraizer has primary responsibility for the day-to-day operations of the company and, accordingly, is able to effectively communicate the Board’s strategic findings and guidance to management. In his position as Lead Director, Mr. Riepe presides at all meetings of independent directors, is available to work with the Chairman to discuss stockholder inquiries regarding the Board and exercises the other responsibilities described below. At this time, Mr. Fraizer is the sole member of the Board who is not independent. With a supermajority of independent directors, a strong committee structure, a Lead Director with well-defined responsibilities, and the fact that the Chairman/CEO does not serve on any Board committees, Genworth’s Board of Directors is comfortable with its existing leadership structure. Our Board reviews its leadership structure from time to time as appropriate.

As more fully set forth in our Governance Principles, available on our website (to view, go to www.genworth.com, click “Investors,” then click “Corporate Governance,” then click “Governance Principles” and finally click “Governance Principles” one more time), the Lead Director’s responsibilities and authority include:

| • | presiding at all meetings of the Board when the Chairman of the Board is not present; |

| • | presiding at all meetings of the non-management and independent directors; |

| • | serving as a liaison between the CEO and the non-management and independent directors; |

| • | together with the Chairman of the Board, developing meeting agendas; |

| • | working with management to assure that meeting materials are fulfilling the needs of directors; |

| • | consulting on the meeting calendar and meeting schedules to assure there is sufficient time to discuss all agenda items; |

12

| • | periodically calling meetings of the non-management and independent directors, including at the request of such directors; and |

| • | working with the Chairman of the Board to respond to stockholder inquiries involving the Board. |

Role of Board in the Oversight of Risk

Our Board of Directors recognizes that, although risk management is primarily the responsibility of Genworth’s management, the Board plays a critical role in the oversight of risk. As a financial services company, the very nature of our business involves the underwriting, management and assumption of risks on behalf of our customers. The Board believes it is an important part of its responsibilities to oversee the company’s overall risk assessment processes and management thereof. The Board as a whole discusses with management specific business risks as part of its regular reviews of the individual business units and also on a company-wide basis as part of its strategic reviews. The Board also utilizes its committees to oversee specific risks and receives regular reports from the committees on the areas of risk for which they have oversight. The Audit Committee has responsibility for oversight of risks associated with financial accounting and reporting, including the system of internal control. This oversight includes reviewing and discussing with management the company’s risk assessment process and management policies with respect to the company’s major financial risk exposures, including investments, and the procedures utilized by management to identify and mitigate the exposure to such risks. The Compensation Committee oversees the risks relating to compensation plans and programs, as well as management development and leadership succession in the company’s various business units. Our Nominating Committee is responsible for the oversight of risks relating to corporate governance. Our Legal and Public Affairs Committee oversees risks associated with litigation, legislative and regulatory changes and compliance policies and issues, as well as government relations and potential reputational risks. We believe that our risk oversight structure is also supported by our current Board leadership structure, with the Chairman of the Board and the Lead Director working together with our independent Audit Committee and our other standing committees.

Director Independence

Our Board currently consists of nine directors, eight of whom are independent (as defined by our Governance Principles and NYSE listing standards) and one of whom is our President and CEO. For a director to be independent, the Board must determine that the director does not have any direct or indirect material relationship with Genworth. The Board has established guidelines to assist it in determining director independence, which conform to, or are more exacting than, the independence requirements of the NYSE. The independence guidelines are set forth in Section 4 of our Governance Principles, which are available on our website. In addition to applying these guidelines, the Board will consider all relevant facts and circumstances in making an independence determination. The Board has determined that Mr. Alesio, Mr. Bolinder, Ms. Karch, Ms. Mead, Mr. Moloney, Mr. Parke, and Mr. Riepe satisfy the NYSE’s independence requirements and Genworth’s independence guidelines. In addition, the Board has determined that Dr. Lavizzo-Mourey, who is currently serving on the Board but is not standing for re-election at the Annual Meeting, also satisfies the NYSE’s independence guidelines and Genworth’s independence guidelines. The Board also previously determined that J. Robert “Bob” Kerrey, who resigned from our Board effective March 14, 2012, satisfied the NYSE’s independence requirements and Genworth’s independence guidelines.

In addition to the independence guidelines discussed above, members of the Audit Committee also must satisfy additional independence requirements established by the SEC and the NYSE. Specifically, they may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from Genworth or any of its subsidiaries other than their directors’ compensation and they may not be affiliated with Genworth or any of its subsidiaries. The Board has determined that all the members of the Audit Committee satisfy the relevant SEC and NYSE independence requirements.

13

Code of Business Conduct and Ethics

All of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller, must act ethically at all times and in accordance with the policies comprising our code of business conduct and ethics set forth in our Code of Ethics. If an actual or potential conflict of interest arises for a director, the director shall promptly inform the CEO. Our Code of Ethics is published in the corporate governance section of our website. To view our Code of Ethics, go to www.genworth.com, click “Investors,” then click “Corporate Governance,” then click “Code of Business Conduct & Ethics” and finally click “Genworth Code of Ethics.” Section 11 of our Governance Principles, which are available on our website, more fully addresses our Code of Ethics. Under our Governance Principles, the Board will not permit any waiver of any ethics policy for any director or executive officer. Within the time period required by the SEC and the NYSE, we will post on our website any amendment to our Code of Ethics.

BOARD OF DIRECTORS AND COMMITTEES

Board Composition

Our Board of Directors is composed of individuals with diverse experience at policy-making levels in business, government, education and technology in areas that are relevant to the company’s global activities. Each director was nominated on the basis of the unique set of qualifications and skills he or she brings to the Board, as well as how those qualifications and skills blend with those of the others on the Board as a whole. See the Election of Directors section for a description of each director nominee’s qualifications and skills.

As a group, apart from Mr. Fraizer, our board nominees include two former chief executive officers (Mr. Alesio and Mr. Bolinder), three former chief financial officers (Ms. Mead, Mr. Moloney and Mr. Parke), three directors with a background in insurance (Mr. Bolinder, Ms. Mead and Mr. Moloney), three with experience in mergers and acquisitions (Ms. Mead, Mr. Moloney and Mr. Parke), four with risk experience (Mr. Bolinder, Ms. Mead, Mr. Moloney and Mr. Parke), three with consumer marketing experience (Mr. Alesio, Ms. Karch and Mr. Riepe) and two with distribution experience (Mr. Alesio and Ms. Karch). The blend of our directors’ unique backgrounds ensures that issues facing the company are examined and addressed with the benefit of a broad array of perspectives and expertise.

Subject to the rights of the holders of any outstanding series of our preferred stock, our certificate of incorporation provides that the number of authorized directors of our company will be fixed from time to time by a resolution adopted by our Board of Directors, but will not be less than one nor more than 15. Our Governance Principles further state that the size of the Board should be in the range of seven to 15 directors. As discussed above, our Board of Directors has set the size of the Board of Directors at eight members, effective at the Annual Meeting, but continues to evaluate the optimal size for the Board and will continue to consider the addition of one or more independent directors to the Board.

Each director elected by the holders of our common stock will serve until the next annual meeting of stockholders and until his or her successor is elected and qualified, or until the earlier of his or her death, resignation, disqualification or removal. The holders of common stock do not have cumulative voting rights in the election of directors.

Our Governance Principles provide that directors who serve as chief executive officers or in equivalent positions for other public companies should not serve on more than two other boards of public companies in addition to the Genworth Board and other directors should not serve on more than four other boards of public companies in addition to the Genworth Board.

14

Board Committees

The four standing committees of the Board are the Audit Committee, the Compensation Committee, the Nominating Committee and the Legal and Public Affairs Committee. These committees are described below. The Board has established written charters for each of its four standing committees. Our Board of Directors may also establish various other committees to assist it in carrying out its responsibilities.

The table below shows the current Board committee memberships and the number of meetings each committee held in 2011.

| Director |

Audit | Management Development and Compensation |

Nominating and Corporate Governance |

Legal and Public Affairs |

||||||||||||

| Steven W. Alesio |

X | X | ||||||||||||||

| William H. Bolinder |

X | X | ||||||||||||||

| Michael D. Fraizer* |

||||||||||||||||

| Nancy J. Karch |

X | C | ||||||||||||||

| Risa J. Lavizzo-Mourey |

X | X | ||||||||||||||

| Christine B. Mead |

X | X | ||||||||||||||

| Thomas E. Moloney |

X | C | ||||||||||||||

| James A. Parke |

C | X | ||||||||||||||

| James S. Riepe+ |

X | C | ||||||||||||||

| Number of 2011 Meetings |

13 | 8 | 5 | 5 | ||||||||||||

* Mr. Fraizer, a non-independent director, does not serve on any standing committees of the Board.

+ Lead Director

C = Committee Chair

X = Committee Member

Audit Committee

The Audit Committee consists solely of “independent” directors as defined under the applicable rules of the NYSE and the SEC. In addition, the Board has determined that all four of the Audit Committee’s current members, Ms. Mead and Messrs. Moloney, Parke and Riepe, are “audit committee financial experts,” as defined by SEC rules.

As more fully set forth in its charter, which can be found in the corporate governance section of our website (to view, go to www.genworth.com, click “Investors,” then click “Corporate Governance,” then click “Audit Committee” and finally click “Charter”), the Audit Committee is concerned primarily with the accuracy and effectiveness of the audits of our financial statements. The Audit Committee’s duties include:

| • | selecting our independent registered public accounting firm and approving the terms of its engagement; |

| • | reviewing with management and our independent registered public accounting firm our annual audited financial statements, quarterly financial statements and certain other financial information; |

| • | discussing with management and our independent registered accounting firm any audit problems or difficulties and management’s response; |

| • | overseeing risks associated with financial accounting and reporting, including the system of internal control, which includes reviewing and discussing with management the company’s risk assessment process and management policies with respect to the company’s major financial risk exposure and the procedures utilized by management to identify and mitigate the exposure to such risks; |

15

| • | discussing with management the company’s overall investment portfolio and investment strategies; |

| • | reviewing our financial reporting and accounting standards and principles; |

| • | reviewing our internal system of financial controls and the results of internal audits; |

| • | obtaining and reviewing formal written reports from the independent registered public accounting firm regarding its internal quality-control procedures; |

| • | reviewing and investigating any matters pertaining to the integrity of management, including conflicts of interest, or adherence to standards of business conduct; |

| • | establishing procedures for the receipt, retention and treatment of complaints on accounting, internal accounting controls or auditing matters; and |

| • | establishing policies and procedures for the review and approval of all proposed transactions with “Related Persons,” as that term is defined in Section 11(b) of our Governance Principles. |

The Audit Committee has determined that in view of the increased demands and responsibilities of the committee, its members generally should not serve on more than two additional audit committees of other public companies. The Audit Committee’s report appears on page 69 of this proxy statement.

Management Development and Compensation Committee

The Compensation Committee consists solely of “independent” directors under the applicable rules of the NYSE. As more fully set forth in its charter, which can be found in the corporate governance section of our website (to view, go to www.genworth.com, click “Investors,” then click “Corporate Governance,” then click “Management Development and Compensation Committee” and finally click “Charter”), the Compensation Committee’s responsibilities include:

| • | monitoring our management resources, structure, succession planning, development and selection process as well as the performance of senior executive officers; |

| • | reviewing and approving our executive compensation and incentive compensation plans; and |

| • | overseeing risks relating to management development and compensation programs. |

Under its charter, the Compensation Committee has authority to delegate any of its responsibilities to subcommittees as the Compensation Committee may deem appropriate in its sole discretion. The Compensation Committee’s report appears on page 45 of this proxy statement. Additional information regarding the Compensation Committee’s processes and procedures for consideration of executive compensation is provided in the Compensation Discussion and Analysis section below.

Nominating and Corporate Governance Committee

The Nominating Committee consists solely of “independent” directors under the applicable rules of the NYSE. As more fully set forth in its charter, which can be found in the corporate governance section of our website (to view, go to www.genworth.com, click “Investors,” then click “Corporate Governance,” then click “Nominating and Corporate Governance Committee” and finally click “Charter”), the Nominating Committee’s responsibilities include:

| • | selecting director nominees for our Board; |

| • | reviewing the Board’s committee structure and recommending committee members; |

| • | developing and annually reviewing our governance guidelines; |

| • | overseeing the annual self-evaluations of our Board and its committees; |

| • | overseeing risks related to corporate governance; and |

| • | reviewing annually director compensation and benefits. |

16

The Nominating Committee makes recommendations to our Board of Directors of candidates for election to our Board, and our Board of Directors nominates director candidates and makes recommendations to our stockholders. This committee will consider all stockholder recommendations for candidates for the Board, which should be sent to the Nominating and Corporate Governance Committee, c/o Leon E. Roday, Secretary, Genworth Financial, Inc., 6620 West Broad Street, Building #1, Richmond, Virginia 23230.

The Nominating Committee believes all director nominees should meet certain qualifications and possess certain qualities or skills that, when considered in light of the qualities and skills of the other director nominees, assist the Board in overseeing the company’s operations and developing and pursuing its strategic objectives. The Nominating Committee believes each director nominee should at a minimum:

| • | possess the highest personal and professional ethics, integrity and values; |

| • | be committed to representing the long-term interests of the stockholders; |

| • | have an inquisitive and objective perspective, practical wisdom and mature judgment; |

| • | bring a distinct skill set of value to the Board and the company when viewed alone and in combination with other directors; |

| • | be willing and able to devote sufficient time to carrying out his or her duties and responsibilities effectively; and |

| • | be committed to serve on the Board for an extended period of time. |

The Nominating Committee, as a matter of practice, takes diversity factors into account when considering potential director nominees. The company does not have a formal policy on Board diversity. The qualifications, qualities and skills required for directors are further set forth in Section 3 of Genworth’s Governance Principles, which are available on our website.

In addition to considering candidates suggested by stockholders, the Nominating Committee considers potential candidates recommended by current directors, company officers, employees and others. We have also engaged an outside search firm to assist us in identifying and evaluating potential director candidates. The Nominating Committee considers all potential candidates regardless of the source of the recommendation and determines whether potential candidates meet our qualifications, qualities and skills for directors. Where there is an interest in a particular candidate, the Nominating Committee’s review is multi-faceted and typically includes a review of written materials regarding the candidate, due diligence performed internally and externally, a review of a completed candidate questionnaire and one or more interviews with members of the Nominating Committee.

Legal and Public Affairs Committee

The principal purpose of the Legal and Public Affairs Committee is to assist the Board in its oversight responsibilities relating to our practices and positions on corporate legal, regulatory and legislative issues, compliance and consumer policies and corporate citizenship initiatives that affect our stockholders, employees and customers. As more fully set forth in its charter, which can be found in the corporate governance section of our website (to view, go to www.genworth.com, click “Investors,” then click “Corporate Governance,” then click “Legal and Public Affairs Committee” and finally click “Charter”), the Legal and Public Affairs Committee’s responsibilities include:

| • | advising on our policy on legislative and regulatory matters, including key public policy positions; |

| • | receiving reports regarding pending litigation or disputes and investigations/regulatory matters involving Genworth; |

| • | reviewing periodically the nature and amount of our political contributions and the operations of our political action committee; |

17

| • | reviewing periodically and overseeing our compliance processes and policies; |

| • | considering our policies and practices and making recommendations on matters of corporate citizenship, including philanthropic programs and financial and other support of charitable, educational and cultural organizations; and |

| • | overseeing risks associated with litigation, legislative and regulatory changes and compliance policies and issues, as well as governmental relations and potential reputational risks. |

Meetings of Non-Management and Independent Directors

Our independent directors met without management present at each regularly scheduled Board meeting during 2011. Our Governance Principles provide that the non-management directors will meet without management present at each regularly scheduled Board meeting. Michael D. Fraizer, our President and CEO, is currently the only employee of the company who serves on our Board. In addition, our Governance Principles provide that if the non-management directors include individuals who are not independent directors (whose independence is determined in accordance with the NYSE listing standards and our Governance Principles), then the independent directors on our Board will separately meet at least one time each year without the presence of non-independent directors. The Board has determined that all of our current non-management directors are also independent directors. Our Governance Principles provide that the Lead Director, currently Mr. Riepe, will preside at the meetings of the non-management directors and the independent directors. The non-management and independent directors may meet without management present at such other times as determined by the Lead Director or at the request of the non-management or independent directors.

Compensation of Directors

The Nominating Committee has the responsibility for reviewing and recommending to the Board compensation and benefits for “non-management directors.” Non-management directors are those directors who are not executive officers of Genworth or its affiliates. Accordingly, all directors, other than Mr. Fraizer, are regarded as non-management directors. Mr. Fraizer does not receive any compensation for serving as a director.

The company’s compensation and benefits for non-management directors are as follows:

| • | Annual Retainer. Each non-management director is paid an annual retainer, payable in quarterly installments following the end of each quarter of service. In 2011, the amount of the annual retainer was $190,000. Of this amount, 40% of the annual retainer is paid in cash and 60% is paid in deferred stock units (“DSUs”). Instead of receiving a cash payment, non-management directors may elect to have 100% of their annual retainer paid in DSUs, provided, however, that no more than 25,000 DSUs may be granted to any non-management director in any one calendar year pursuant to the terms of the 2004 Genworth Financial, Inc. Omnibus Incentive Plan under which the DSUs are awarded. To the extent this limit would be exceeded, the remainder of a director’s annual retainer will be paid in cash. |

| • | Deferred Stock Units. Each DSU awarded to non-management directors represents the right to receive one share of our common stock in the future. DSUs are granted at the end of each quarter of service and are credited to a notional account maintained by us in the recipient’s name. The number of DSUs granted is determined by dividing the DSU value to be delivered by the fair market value of our common stock on the date of grant. DSUs accumulate regular quarterly dividends which are reinvested in additional DSUs. The DSUs will be paid out beginning one year after the director leaves the Board in a single payment or in payments over ten years, at the election of the director, or, if earlier, upon the death of the director. |

| • | Fees for Lead Director. As additional compensation for service as Lead Director, the Lead Director receives an annual cash retainer of $20,000. |

18

| • | Fees for Committee Chairs. As additional compensation for service as chairperson, the chairperson of the Audit Committee receives an annual cash retainer of $15,000. Each other standing committee chairperson receives an annual cash retainer of $10,000. |

| • | Matching Gift Program. The company offers a matching gift program that provides for the matching of employee and director charitable contributions pursuant to the contribution guidelines established by the Genworth Foundation. Each non-management director is eligible for the matching of charitable contributions on a dollar-for-dollar basis, up to a maximum matching contribution of $15,000 during any calendar year. |

| • | Reimbursement of Certain Expenses. Non-management directors are reimbursed for travel expenses to attend Board and committee meetings and to attend director education seminars, in accordance with policies approved from time to time. |

Amounts payable to non-management directors are prorated for partial years of service.

Pursuant to its charter, the Nominating Committee conducts an annual review of non-management director compensation and benefits and recommends any changes to the Board of Directors for the Board’s consideration. As part of its 2011 review, the Nominating Committee engaged Steven Hall & Partners, LLC to provide competitive market data and advice regarding outside director compensation. Based on this review, the Nominating Committee did not recommend any changes to the company’s non-management director compensation and benefits program.

The following table sets forth information concerning compensation paid or accrued by us in 2011 to our non-management directors.

2011 Director Compensation Table

| Name |

Fees Earned or Paid in Cash ($)(1) |

Stock Awards ($)(2) |

All Other Compensation ($)(3) |

Total ($) |

||||||||||||

| Steven W. Alesio |

76,000 | 114,000 | 15,000 | 205,000 | ||||||||||||

| William H. Bolinder |

76,000 | 114,000 | 15,000 | 205,000 | ||||||||||||

| Nancy J. Karch |

86,000 | 114,000 | 15,000 | 215,000 | ||||||||||||

| J. Robert Kerrey |

10,000 | 190,000 | 12,500 | 212,500 | ||||||||||||

| Risa J. Lavizzo-Mourey |

— | 190,000 | 5,000 | 195,000 | ||||||||||||

| Christine B. Mead |

76,000 | 114,000 | 15,000 | 205,000 | ||||||||||||

| Thomas E. Moloney |

76,000 | 114,000 | 15,000 | 205,000 | ||||||||||||

| James A. Parke |

15,000 | 190,000 | 15,000 | 220,000 | ||||||||||||

| James S. Riepe |

106,000 | 114,000 | 15,000 | 235,000 | ||||||||||||

| (1) | Amounts reflect the portion of the annual retainer (described above) that was paid in cash. Mr. Kerrey, Dr. Lavizzo-Mourey and Mr. Parke elected to receive $76,000 in the form of DSUs in lieu of cash. Amounts also reflect applicable committee chair fees and lead director fees. |

19

| (2) | Amounts reflect the grant date fair value of DSUs received in payment of the annual retainer (including any DSUs received in lieu of the cash portion of the annual retainer). The following table shows for each non-management director the total number of DSUs held as of December 31, 2011 (rounded down to the nearest whole share): |

| Name |

Total Number of DSUs Held as of December 31, 2011 |

|||

| Steven W. Alesio |

21,121 | |||

| William H. Bolinder |

16,557 | |||

| Nancy J. Karch |

65,691 | |||

| J. Robert Kerrey |

104,645 | |||

| Risa J. Lavizzo-Mourey |

85,317 | |||

| Christine B. Mead |

24,301 | |||

| Thomas E. Moloney |

24,301 | |||

| James A. Parke |

93,387 | |||

| James S. Riepe |

64,568 | |||

| (3) | Amounts reflect company charitable match contributions. |

Director Stock Ownership Policy

To help promote the alignment of the personal interests of the company’s directors with the interests of our stockholders, we have established a stock ownership policy for all non-management directors. Each non-management director is expected to hold at least $300,000 worth of Genworth common stock and/or DSUs while serving as a director of Genworth. This constitutes almost four times the portion of the annual retainer that is paid to a non-management director in cash (unless the director elects to receive DSUs rather than cash). Each non-management director has seven years from the date he or she becomes a non-management director to attain this ownership threshold. The DSUs held by the non-management directors settle in shares of common stock beginning one year after the director leaves the Board in a single payment or in payments over ten years, at the election of the director, or earlier upon the death of the director.

The following table shows the stock ownership as of March 21, 2012 of our non-management directors, the percentage of the ownership threshold that they have reached, and the portion of the seven-year period that has elapsed in which the non-management director must attain enough stock to satisfy his or her ownership guideline. The value of each non-management director’s stock ownership is based on the closing price of our common stock on March 21, 2012.

| Director |

Number of Shares/DSUs Held (#) |

Value as of March 21, 2012 ($) |

Stock Ownership Guideline ($) |

Stock Held as % of Guideline |

% of Time Elapsed to Attain Guideline |

|||||||||||||||

| Steven W. Alesio |

71,121 | 631,554 | 300,000 | 211 | 29 | |||||||||||||||

| William H. Bolinder |

16,557 | 147,026 | 300,000 | 49 | 21 | |||||||||||||||

| Nancy J. Karch |

70,166 | 623,074 | 300,000 | 208 | 91 | |||||||||||||||

| Risa J. Lavizzo-Mourey |

98,317 | 873,055 | 300,000 | 291 | 62 | |||||||||||||||

| Christine B. Mead |

27,301 | 242,433 | 300,000 | 81 | 35 | |||||||||||||||

| Thomas E. Moloney |

26,301 | 233,553 | 300,000 | 78 | 35 | |||||||||||||||

| James A. Parke |

343,387 | 3,049,277 | 300,000 | 1,016 | 84 | |||||||||||||||

| James S. Riepe |

87,568 | 777,604 | 300,000 | 259 | 86 | |||||||||||||||

20

INFORMATION RELATING TO DIRECTORS, DIRECTOR NOMINEES, EXECUTIVE OFFICERS AND SIGNIFICANT STOCKHOLDERS

Ownership of Genworth Common Stock

The following table sets forth information as of March 21, 2012, regarding the beneficial ownership of our common stock by:

| • | all persons (including any “group” as that term is used in Section 13(d)(3) of the Exchange Act) known by us to own beneficially more than 5% of any class of our common stock (based on the most recently available information filed with the SEC); |

| • | the named executive officers included in the 2011 Summary Compensation Table below; |

| • | each of our directors; and |

| • | all directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. Except as indicated in the footnotes to the table, each of the directors and executive officers possesses sole voting and investment power with respect to all shares set forth opposite his or her name. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock issuable upon the exercise of stock options or stock appreciation rights (“SARs”) or upon the conversion of restricted stock units (“RSUs”) held by that person that are currently exercisable or convertible, or are exercisable or convertible within 60 days of March 21, 2012, are deemed to be issued and outstanding. These shares, however, are not deemed outstanding for purposes of computing percentage ownership of any other stockholder. As of March 21, 2012, there were 491,475,307 shares of common stock outstanding and no shares of any other class of voting securities outstanding.

21

The address of each director and executive officer listed below is c/o Genworth Financial, Inc., 6620 West Broad Street, Richmond, Virginia 23230.

| Beneficial Ownership | ||||||||

| Name of Beneficial Owner |

Number of Shares |

Percentage | ||||||

| NWQ Investment Management Company, LLC (1) |

37,223,215 | 7.6 | % | |||||

| Dodge & Cox (2) |

36,992,236 | 7.5 | % | |||||

| Highfields Capital Management LP (3) |

30,710,442 | 6.3 | % | |||||

| Capital Research Global Investors (4) |

27,226,070 | 5.5 | % | |||||

| FMR LLC (5) |

26,672,786 | 5.4 | % | |||||

| The Vanguard Group, Inc. (6) |

25,323,440 | 5.2 | % | |||||

| Michael D. Fraizer (7) |

1,238,547 | * | ||||||

| Martin P. Klein (8) |

7,500 | * | ||||||

| Patrick B. Kelleher (9) |

104,879 | * | ||||||

| Ronald P. Joelson (10) |

88,312 | * | ||||||

| Leon E. Roday (11) |

147,172 | * | ||||||

| Kevin D. Schneider (12) |

137,492 | * | ||||||

| Steven W. Alesio |

50,000 | * | ||||||

| William H. Bolinder |

— | — | ||||||

| Nancy J. Karch |

4,475 | * | ||||||

| Risa J. Lavizzo-Mourey |

13,000 | * | ||||||

| Christine B. Mead |

3,000 | * | ||||||

| Thomas E. Moloney |

2,000 | * | ||||||

| James A. Parke |

250,000 | * | ||||||

| James S. Riepe |

23,000 | * | ||||||

| All directors and executive officers as a group (19 persons) (13) |

2,421,191 | * | ||||||

| * | Less than 1%. |

| (1) | Information obtained solely by reference to the Schedule 13G/A filed with the SEC on February 14, 2012 by NWQ Investment Management Company, LLC (“NWQ”). NWQ reported that it has sole power to vote or direct the vote of 27,777,457 shares and sole power to dispose or to direct the disposition of 37,223,215 shares. NWQ reported that such securities are beneficially owned by its clients, which clients may include investment companies registered under the Investment Company Act of 1940 and/or employee benefit plans, pensions, charitable funds or other institutional and high net worth clients. The address for NWQ is 2049 Century Park East, 16th Floor, Los Angeles, California 90067. |

| (2) | Information obtained solely by reference to the Schedule 13G filed with the SEC on February 10, 2012 by Dodge & Cox. Dodge & Cox reported that it has sole power to vote or direct the vote of 35,098,336 shares that it beneficially owns and that it has sole power to dispose or to direct the disposition of 36,992,236 shares. Dodge & Cox further reported that it is an Investment Advisor registered under Section 203 of the Investment Advisors Act of 1940 and that the clients of Dodge & Cox, including investment companies registered under the Investment Company Act of 1940 and other managed accounts, have the right to receive or power to direct the receipt of dividends from, and the proceeds from the sale of, our common stock. The address for Dodge & Cox is 555 California Street, 40th Floor, San Francisco, CA 94104. |

| (3) | Information obtained solely by reference to the Schedule 13G/A filed with the SEC on February 14, 2012 by Highfields Capital Management LP (“Highfields Capital Management”), the investment manager to each of Highfields Capital I LP (“Highfields I”), Highfields Capital II LP (“Highfields II”), and Highfields Capital III L.P. (“Highfields III”). Highfields GP LLC (“Highfields GP”) is the general partner of Highfields Capital Management. Highfields Associates LLC (“Highfields Associates”) is the general partner of each of Highfields I, Highfields II and Highfields III. Each of Highfields Capital Management, Highfields GP, |

22

| Highfields Associates, Highfields I, Highfields II and Highfields III disclaims beneficial ownership of any securities owned beneficially or of record by any person or persons other than itself. Jonathon S. Jacobson is a Managing Member of Highfields GP and a Senior Managing Member of Highfields Associates. Mr. Jacobson may be deemed to have voting and dispositive power with respect to all of the shares of common stock held by Highfields I, Highfields II and Highfields III. Mr. Jacobson disclaims beneficial ownership of any securities owned beneficially or of record by any other person or persons. The address of Mr. Jacobson, Highfields Capital Management, Highfields GP, Highfields Associates, Highfields I and Highfields II is c/o Highfields Capital Management, LP, John Hancock Tower, 200 Clarendon Street, 59th Floor, Boston, Massachusetts 02116. The address of Highfields III is c/o Goldman Sachs (Cayman) Trust, Limited, Suite 3307, Gardenia Court, 45 Market Street, Camana Bay, P.O. Box 896, Grand Cayman KY1-1103, Cayman Islands. |

| (4) | Information obtained solely by reference to the Schedule 13G filed with the SEC on February 13, 2012 by Capital Research Global Investors (“CRMC”). CRMC reported that it has sole power to vote or direct the vote of 27,226,070 shares that it beneficially owns and that it has sole power to dispose or to direct the disposition of 27,226,070 shares. CRMC further reported that it is the beneficial owner of the 27,226,070 shares as a result of CRMC acting as investment adviser to various investment companies registered under Section 8 of the Investment Company Act of 1940. The address for CRMC is 333 South Hope Street, Los Angeles, California 90071. |

| (5) | Information obtained solely by reference to the Schedule 13G/A filed with the SEC on February 14, 2012 by FMR LLC (“FMR”). FMR reported that it has sole power to vote or direct the vote of 162,994 shares that it beneficially owns and that it has sole power to dispose or to direct the disposition of 26,672,786 shares. FMR further reported that various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, our common stock and that no one person’s interest is more than 5% of our total outstanding common stock. Fidelity Management & Research Company (“Fidelity”), a wholly-owned subsidiary of FMR and an investment adviser registered under the Investment Advisers Act of 1940 (“Investment Advisers Act”), is the beneficial owner of 26,509,792 shares as a result of acting as investment adviser to various investment companies (the “Funds”). Edward C. Johnson 3d (Chairman of FMR) and FMR, through its control of Fidelity, and the Funds each has sole power to dispose of all 26,509,792 shares owned by the Funds. Members of the family of Edward C. Johnson 3d are the predominant owners, directly or through trusts, of Series B common shares of FMR, representing 49% of the voting power of FMR. The Johnson family group and all other Series B shareholders of FMR have entered into a shareholders’ voting agreement under which all Series B shares will be voted in accordance with the majority vote of Series B shares. Neither FMR nor Edward C. Johnson 3d has the sole power to vote or direct the voting of the shares owned directly by the Funds, which power resides with the Board of Trustees of the Funds. Fidelity Management Trust Company (“FMTC”), a wholly-owned subsidiary of FMR and a bank as defined in Section 3(a)(6) of the Securities Exchange Act of 1934 (“Exchange Act”), is the beneficial owner of 157,974 shares as a result of its serving as investment manager of the institutional accounts. Edward C. Johnson 3d and FMR, through its control of FMTC, each has sole dispositive power over all 157,974 shares and sole power to vote or to direct the voting of all 157,974 shares owned by institutional accounts as reported above. Strategic Advisers, Inc. (“Strategic Advisers”), a wholly-owned subsidiary of FMR and an investment adviser registered under the Investment Advisers Act, provides investment advisory services to individuals. As such, FMR’s beneficial ownership includes 3,103 shares of the company, beneficially owned through Strategic Advisers. Pyramis Global Advisors Trust Company (“Pyramis”), an indirect wholly-owned subsidiary of FMR and a bank as defined in Section 3(a)(6) of the Exchange Act, is the beneficial owner of 1,917 shares as a result of its serving as investment manager of institutional accounts owning such shares. Edward C. Johnson 3d and FMR, through its control of Pyramis, each has sole dispositive power over all 1,917 shares and sole power to vote or to direct the voting of all 1,917 shares owned by the institutional accounts managed by Pyramis as reported above. The address for FMR is 82 Devonshire St., Boston, Massachusetts, 02109. |

| (6) | Information obtained solely by reference to the Schedule 13G filed with the SEC on February 10, 2012 by The Vanguard Group, Inc. (“Vanguard”). Vanguard reported that it has sole power to vote or direct the vote of 677,189 shares that it beneficially owns, and that it has sole power to dispose or to direct the disposition |

23

| of 24,646,251 shares and has shared power to dispose or to direct the disposition of 677,189 shares. Vanguard further reported that Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of Vanguard, is the beneficial owner of 677,189 shares or 0.13% of the our common stock as a result of its serving as investment manager of collective trust accounts. The address for Vanguard is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| (7) | Includes (a) 93,911 shares of common stock issuable upon the exercise of stock options that are vested or will vest within 60 days of March 21, 2012 and (b) 341,891 shares of common stock issuable upon the exercise of 3,910,618 SARs that are vested or will vest within 60 days of March 21, 2012 (the number of shares issuable upon exercise of SARs is calculated based on the excess of the closing price of our common stock on March 21, 2012 over the base price of the SARs). Also includes 28,458 shares that Mr. Fraizer contributed to a grantor retained annuity trust (“GRAT”) in August 2010 and 60,000 shares that Mr. Fraizer contributed to a GRAT in February 2012. |

| (8) | Includes 7,500 shares of common stock issuable upon the conversion of RSUs that are vested or will vest within 60 days of March 21, 2012. |

| (9) | Includes 78,830 shares of common stock issuable upon the exercise of 430,527 SARs that are vested or will vest within 60 days of March 21, 2012 (the number of shares issuable upon exercise of SARs is calculated based on the excess of the closing price of our common stock on March 21, 2012 over the base price of the SARs). |

| (10) | Includes 44,979 shares of common stock issuable upon the exercise of 192,667 SARs that are vested or will vest within 60 days of March 21, 2012 (the number of shares issuable upon exercise of SARs is calculated based on the excess of the closing price of our common stock on March 21, 2012 over the base price of the SARs). |

| (11) | Includes (a) 46,644 shares of common stock issuable upon the exercise of stock options that are vested or will vest within 60 days of March 21, 2012 and (b) 44,320 shares of common stock issuable upon the exercise of 386,587 SARs that are vested or will vest within 60 days of March 21, 2012 (the number of shares issuable upon exercise of SARs is calculated based on the excess of the closing price of our common stock on March 21, 2012 over the base price of the SARs). Also includes 20 shares held by trusts for children and 14,413 shares that Mr. Roday contributed to a GRAT in September 2010. |

| (12) | Includes (a) 71,397 shares of common stock issuable upon the exercise of stock options that are vested or will vest within 60 days of March 21, 2012 and (b) 25,459 shares of common stock issuable upon the exercise of 181,417 SARs that are vested or will vest within 60 days of March 21, 2012 (the number of shares issuable upon exercise of SARs is calculated based on the excess of the closing price of our common stock on March 21, 2012 over the base price of the SARs). |

| (13) | Includes (a) 314,241 shares of common stock issuable upon the exercise of stock options that are vested or will vest within 60 days of March 21, 2012, (b) 695,855 shares of common stock issuable upon the exercise of 5,671,868 SARs that are vested or will vest within 60 days of March 21, 2012 (the number of shares issuable upon exercise of SARs is calculated based on the excess of the closing price of our common stock on March 21, 2012 over the base price of the SARs) and (c) 9,166 shares of common stock issuable upon conversion of RSUs that are vested or will vest within 60 days of March 21, 2012. |

24

Ownership of Genworth Canada Common Shares

In July 2009, Genworth MI Canada Inc. (“Genworth Canada”), our indirect subsidiary, completed the initial public offering of its common shares. Following completion of Genworth Canada’s initial public offering, we beneficially own 57.5% of the common shares of Genworth Canada. The following table sets forth information as of March 21, 2012, regarding the beneficial ownership of the common shares of Genworth Canada by:

| • | the named executive officers included in the 2011 Summary Compensation Table below; |

| • | each of our directors; and |

| • | all directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. Directors and executive officers possess sole voting and investment power with respect to all shares set forth by their name. As of March 21, 2012, there were 98,666,796 common shares of Genworth Canada outstanding and no shares of any other class of voting securities outstanding.

| Beneficial Ownership | ||||||||

| Name of Beneficial Owner |

Number of Shares |

Percentage | ||||||

| Michael D. Fraizer |

6,040 | * | ||||||

| Patrick B. Kelleher |

1,208 | * | ||||||

| Martin P. Klein |

— | — | ||||||

| Ronald P. Joelson |

604 | * | ||||||

| Kevin D. Schneider |

— | — | ||||||

| Leon E. Roday |

3,020 | |||||||

| Steven W. Alesio |

— | — | ||||||

| William H. Bolinder |

— | — | ||||||

| Nancy J. Karch |

— | — | ||||||

| Risa J. Lavizzo-Mourey |

— | — | ||||||

| Christine B. Mead |

— | — | ||||||

| Thomas E. Moloney |

— | — | ||||||

| James A. Parke |

— | — | ||||||

| James S. Riepe |

— | — | ||||||

| All directors and executive officers as a group (19 persons) |

18,848 | * | ||||||

| * | Less than 1%. |

25

COMPENSATION DISCUSSION AND ANALYSIS

This section provides an overview and analysis of our compensation programs and policies, including the material compensation decisions made under the programs with respect to the following executive officers, whom we refer to as our “named executive officers” or “NEOs:”

| • | Michael D. Fraizer, Chairman of the Board, President and Chief Executive Officer; |

| • | Martin P. Klein, Senior Vice President––Chief Financial Officer (“CFO”), who joined the company in April 2011 and has served as our CFO since May 2011; |

| • | Patrick B. Kelleher, Executive Vice President––Genworth, with responsibility for our Insurance and Wealth Management Division, who also served as CFO until May 2011; |

| • | Ronald P. Joelson, Senior Vice President––Chief Investment Officer; |

| • | Leon E. Roday, Senior Vice President, General Counsel and Secretary; and |

| • | Kevin D. Schneider, Senior Vice President––Genworth, with responsibility for our U.S. Mortgage Insurance segment. |

Executive Summary

Key compensation decisions and developments in 2011 and 2012 are summarized below, followed by a discussion of the background and rationale for these actions. We also provide an analysis of our performance over the last several years and the alignment of executive compensation with such performance, with a particular focus on CEO compensation.

2011 Key Compensation Decisions and Developments

| • | Paid our CEO an annual incentive award for performance in 2011 at 33% of his target, and paid below target annual incentive awards to each of our other named executive officers. |

| • | Paid awards under our 2010-2011 mid-term incentive that ranged from zero to 14.4% of target for our named executive officers. |

| • | Implemented a 2011-2013 mid-term incentive plan that rewards rebuilding stockholder value through increased return on equity and narrowing the gap between our stock price and book value per share over that 3-year period. |

| • | Made regular annual equity grants to our named executive officers consisting solely of SARs (which, like stock options, only deliver value when the stock price increases above the price on the date of grant), that include a limit on the maximum share value upon exercise in order to reduce the grant date fair value expense to the company (“Capped SARs”). |

| • | Closed our 2005 Change of Control Plan to new participants and adopted a 2011 Change of Control Plan, which does not include any excise tax gross-up provisions for any participants including Mr. Klein, our new CFO. |

| • | Adopted clawback and anti-hedging policies for our executive officers. |

2012 Key Decisions and Developments

| • | As part of our total mid- and long-term incentive approach, the Compensation Committee decided not to implement a new mid-term incentive plan for the 2012-2014 performance cycle. Instead, the Compensation Committee replaced the mid-term incentive with grants of Capped SARs to our named executive officers, designed to provide meaningful long-term incentives that reward only stock price appreciation. |

26

| • | We adopted, subject to stockholder approval, a 2012 Genworth Financial, Inc. Omnibus Incentive Plan that will enable us to continue to make stock-based and other incentive awards to our employees and non-employee directors. |

2011 Performance Summary

For Genworth, 2011 was a year of repositioning actions targeted at strengthening the company’s balance sheet in anticipation of a continued uncertain environment, and developing a foundation for improved stockholder value. At business portfolio and product line levels, we took important steps to improve our focus around leadership positions, strengthen risk buffers and capital generation, and support future redeployment of capital. Actions completed or that we continue to pursue include the planned minority initial public offering (“IPO”) of our Australian mortgage insurance business, shifting new business mix and volumes, selling or exiting non-strategic lines and blocks of business, further streamlining our cost base, and adding to our holding company capital flexibility.1

The company reported net operating income2 of $214 million for 2011, or $0.44 per basic share, compared with a net operating income of $126 million, or $0.26 per basic share, in 2010. Although these results represent year-over-year improvement, we fell short of our goals for company net operating income, net operating earnings per basic share (“Net Operating EPS”)3 and operating return on equity (“ROE”)4 in 2011. The shortfall for 2011 was caused largely by the challenging U.S. housing and employment markets, which negatively impacted our U.S. Mortgage Insurance segment. We did make progress in repositioning our business portfolio for improved performance, continuing to strengthen our investment portfolio, and increasing risk buffers and financial flexibility. Our holding company ended 2011 with approximately $950 million of cash and liquid securities, which exceeded our buffer target of maintaining cash balances of at least two times our holding company’s annual debt service expense.

In our Insurance and Wealth Management Division, we delivered improved net operating income and ROE through our International Protection, Wealth Management and U.S. Life Insurance segments. We generally met our net operating income and ROE goals in our U.S. Life Insurance segment due to improved performance in life and long-term care insurance. We completed various product re-pricing actions to improve margins and adjust for the low interest rate environment, introduced a new generation of long-term care insurance products, expanded the use of reinsurance to manage capital, and generated $265 million in dividends to the holding company. We also made strategic decisions to exit the variable annuity lines, sold our Medicare supplement insurance business, and entered into an agreement to sell our tax and accounting advisor unit (expected to close in the first half of 2012).

In our Mortgage Insurance Division, prolonged depressed housing market and economic conditions resulted in losses in our U.S. Mortgage Insurance segment that exceeded forecasts and affected the overall financial results for the division and the company. We developed capital strategies that allowed for the prudent writing of

| 1 | Beginning in the fourth quarter of 2011, the company changed its operating business segments to better align its businesses. Under the new structure, we operate through three divisions: Insurance and Wealth Management (including the U.S. Life Insurance, International Protection, which includes the lifestyle protection insurance business, and Wealth Management segments); Mortgage Insurance (including the International Mortgage Insurance and U.S. Mortgage Insurance segments); and Corporate and Runoff (including the Runoff segment and Corporate and Other activities). |

| 2 | “Net operating income (loss)” equals income (loss) from continuing operations excluding net income attributable to noncontrolling interests, after-tax net investment gains (losses) and infrequent or unusual non-operating items. |

| 3 | “Net operating EPS” equals net operating income divided by the weighted-average basic shares outstanding. |

| 4 | “Operating return on equity” equals net operating income (loss) divided by our average ending stockholders’ equity, excluding accumulated other comprehensive income (loss) in our average ending stockholders’ equity, for the most recent five quarters. All references in this proxy statement to “ROE” refer to operating return on equity. |

27

new business and generation of new capital. Separately, we exceeded expectations with respect to loss mitigation savings and profitability of new insurance written after mid-2008. Financial results in our International Mortgage Insurance segment were below expectations, particularly due to increased loss levels in Australia and Ireland, along with higher interest expense and slowing origination markets. We ended the year with strong capital positions and generated dividends of $213 million to the holding company from that segment. We also announced our intention to pursue an IPO of up to 40% of our Australian mortgage insurance business, which will rebalance company exposure to housing risk, support future growth opportunities for that business by providing expanded access to the capital markets, and support capital deployment opportunities.

Impact of Performance on 2011 Compensation

We believe that, in the aggregate, our compensation program for our NEOs has yielded an appropriate pay-for-performance relationship for 2011 and over a longer time horizon. As described above, the company’s performance in 2011 was below targeted levels, and as a result annual cash incentive compensation in 2011 was below target for our named executive officers. Similarly, our mid- and long-term incentives, which are tied to company and stock price performance over a longer period, have yielded limited value based on the company’s failure to fully achieve those performance targets and our stock price performance. When considered together, our 2011 compensation programs demonstrate a strong pay-for-performance alignment between our named executive officers and stockholder interests.

We emphasize the importance of the Compensation Committee’s judgment of performance against financial and non-financial objectives in our annual incentive program, rather than a pure formula-based approach. This supports a more effective incentive and reward structure for executives during a time when substantial variables persist regarding external market volatility, shifting global regulatory and capital requirements, and strategic alternatives under review by the Board and management. As described in more detail below, for 2011, Mr. Fraizer was awarded an annual incentive at 33% of his target, which reflects a decrease over the prior year. This award was made considering his leadership to strategically reposition the company for improved stockholder value, manage risks in an uncertain environment, maintain sound international performance and support the transition of the U.S. life companies. This award was significantly below target given total company net operating income, net operating EPS and ROE performance was below expectations relative to goals established at the outset of 2011. The Compensation Committee also considered the company’s stock price performance in addition to strategic steps taken to rebuild mid- to long-term stockholder value. Other named executive officers were each awarded below target annual incentives, with the amount for each named executive officer differing based on the Compensation Committee’s judgment of financial and non-financial performance of each individual and the organizations they are responsible for relative to goals established at the outset of 2011.

Pursuant to our 2010-2011 mid-term incentive, we made payouts ranging from zero to 14.4% of target to our named executive officers. The 2010-2011 mid-term incentive, established in early 2010, was intended to reward performance across several independently weighted financial metrics, including total company goals and segment-specific goals. Performance in our U.S. Mortgage Insurance segment, as well as total company performance, was below threshold levels, thus earning no payouts for those weighted portions. Below-target payouts were earned by some named executive officers relating to above threshold levels of performance in our other operating segments. For more information, see the Mid-Term & Other Long-Term Incentives section below.