Exchange Offer Informational Sessions Executive Compensation Team July 2009 ©2009 Genworth Financial, Inc. All rights reserved. Exhibit (a)(1)(H) |

Exchange Offer Informational Sessions Executive Compensation Team July 2009 ©2009 Genworth Financial, Inc. All rights reserved. Exhibit (a)(1)(H) |

1 Exchange Offer Informational Session Exchange Offer Legal Disclaimer The following presentation is provided for informational purposes only. The decision

to participate in the exchange offer is an individual one, and this

presentation is not intended to encourage or discourage participation.

Important information regarding the exchange offer is included in the Offer to

Exchange Certain Outstanding Stock Options and Stock Appreciation Rights for

Replacement Awards, dated July 13, 2009 (the “Offering

Memorandum”). You are encouraged to read the Offering

Memorandum carefully before deciding whether to participate in the exchange offer. Country-specific tax information provided is a summary only and is not intended as

tax advice. Please speak with your tax or financial advisor to determine

your personal tax obligation and the risks or benefits of participation in

this exchange offer. |

| 2 Exchange Offer Informational Session Agenda Stock Option Refresher Exchange Offer - Overview - Illustrations - Questions to Consider - Resources - Timeline Country Specific Tax Considerations Exchange Offer Website Training Glossary of Terms Stock Appreciation Rights Refresher |

3 Exchange Offer Informational Session Stock Option Refresher • It is the right to buy shares of Genworth common stock at a fixed price in the future

(the strike price). What is a Stock Option? • The strike price is the closing price of Genworth common stock on the day the stock

option is granted. What is the Strike Price? • In this example, a stock option is granted with a strike price of $5. Let’s

assume that the stock option vests and the price of the stock on the stock

market has increased to $8. The employee would be able to purchase the

stock for $5. After the employee purchases the share for $5 the

employee can decide to keep the share, or they can sell it for $8. • The employee would have the opportunity to do a “cashless exercise”, meaning

no initial cash payment is required to cover the strike price. How does a Stock Option work? $5 $8 Price you pay (Strike Price) Exercise “Gain” Realized Upon Exercise = $3* Price to purchase the shares on the open market *Before taxes and other deductions Grant Date |

4 Exchange Offer Informational Session Exchange Offer Overview Exchange Program • It allows eligible employees to exchange underwater (current stock price is

significantly below strike price for the award) stock options or SARs

for a lesser number of replacement stock options or SARs. • The replacement stock options or SARs you receive as a result of the exchange will have a strike price equal to the closing price of our common stock on the date the replacement

awards are granted, and a new vesting schedule. What Is The Exchange Program? • Participating in the exchange is voluntary. Genworth cannot provide guidance on

whether it makes sense for you to participate. Should I Participate In The Exchange? • If you choose not to participate your outstanding stock options or SARs will remain outstanding and will not be impacted by the exchange offer. What Happens To My Outstanding Stock Options And SARs If I Choose Not To Participate? |

5 Exchange Offer Informational Session Exchange Offer Overview Tax Implications • The tax consequences of participating in the exchange offer may be different depending

on the country in which you work. Participants located outside the United

States should review “Schedule A” in the Offering Memorandum. • Genworth believes participating in the exchange offer will be a non-taxable event

for United States federal income purposes. • You should consult with your tax advisor or financial planner for specific information

on tax consequences and how they may impact you. Will I Owe Taxes If I Participate In The Exchange Offer? |

6 Exchange Offer Informational Session Exchange Offer Overview Tax Implications • The tax consequences upon exercise may be different depending on the country in which you work. Participants located outside the United States should review “Schedule A” in the Offering Memorandum. • Upon exercise, any gain realized from the replacement awards will be treated as taxable

income for United States federal income tax purposes. • You should consult with your tax advisor or financial planner for specific information

on the tax consequences and how they may impact you. How Will The Replacement Awards Be Taxed Once They Are Exercised?

|

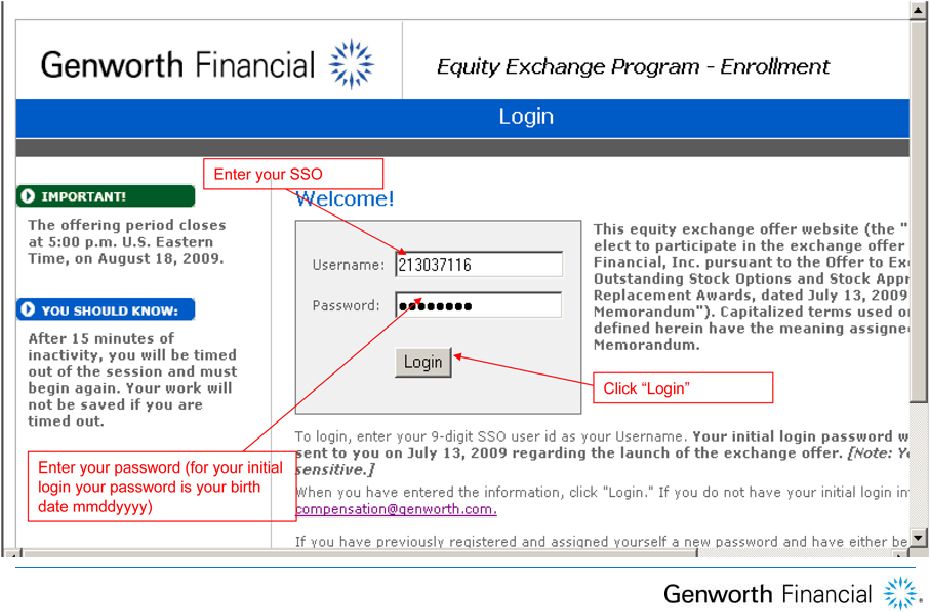

7 Exchange Offer Informational Session Exchange Offer Overview Timing • The window to participate opened on July 13, 2009. Your election to exchange your

awards must be received by 5:00 p.m. U.S. Eastern Time on August 18, 2009.

How Much Time Do I Have To Decide Whether Or Not To Participate? • You may participate by submitting your election on the exchange offer website

(http://genworth.com/optionexchange). • If you are unable to access the exchange offer website, you may request a paper election

form by contacting the executive compensation team at compensation@genworth.com. •

All elections must be properly completed and submitted by 5:00 p.m., U.S. Eastern

Time, on August 18, 2009. • For non-US participants, after you complete your on-line election, you must

print and sign the confirmation page. We must RECEIVE your completed and signed confirmation page by 5:00 p.m., U.S. Eastern Time, on August 18, 2009. How Do I Participate? |

8 Exchange Offer Informational Session Exchange Offer Overview Eligible Awards A stock option or SAR is eligible if it meets ALL of the following criteria: What Is An Eligible Award? • Has an exercise (strike price) greater than the 52-week high closing price of our

common stock on August 18, 2009 (and not below $19.50 USD); • Is not a “conversion award” granted by our former parent prior to our initial public offering and converted into a Genworth award; • Was not granted within 12 months of August 18, 2009; • Is held by an individual currently employed in one of the following countries:

Australia, Canada, Denmark, Finland, France, Germany, Greece, Ireland, Italy, New

Zealand, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom,

United States; • Is outstanding on the expiration date of the exchange offer; and • Is not held by a “named executive officer” or a member of Genworth’s Board of Directors. |

9 Exchange Offer Informational Session Exchange Offer Overview Tendering Options & SARs • The number of replacement stock options or SARs you will receive in exchange for the stock options or SARs you tender will be determined by dividing the number of stock options or SARs you tender per grant, by three, and rounding down to the nearest whole number. How Many Awards Will I Receive For The Awards I Exchange? • No. If you choose to participate in the exchange offer, you must surrender all

outstanding stock options and SARs from one or more grants of eligible stock options and SARs. Can I Exchange Only A Portion Of An Outstanding Grant Of Eligible Stock Options Or SARs? Tendering Options & SARs Example Assumptions: 1. Don’t exchange any stock options 2. Exchange 1,000 options from the ’04 grant and none from the ‘06 grant

3. Exchange 1,000 options from the ‘06 grant and none from the ‘04 grant

4. Exchange 1,000 options from the ‘04 grant and 1,000 options from the ‘06

grant – 2006 Grant: Currently hold 1,000 stock options Alternatives: – 2004 Grant: Currently hold 1,000 stock options |

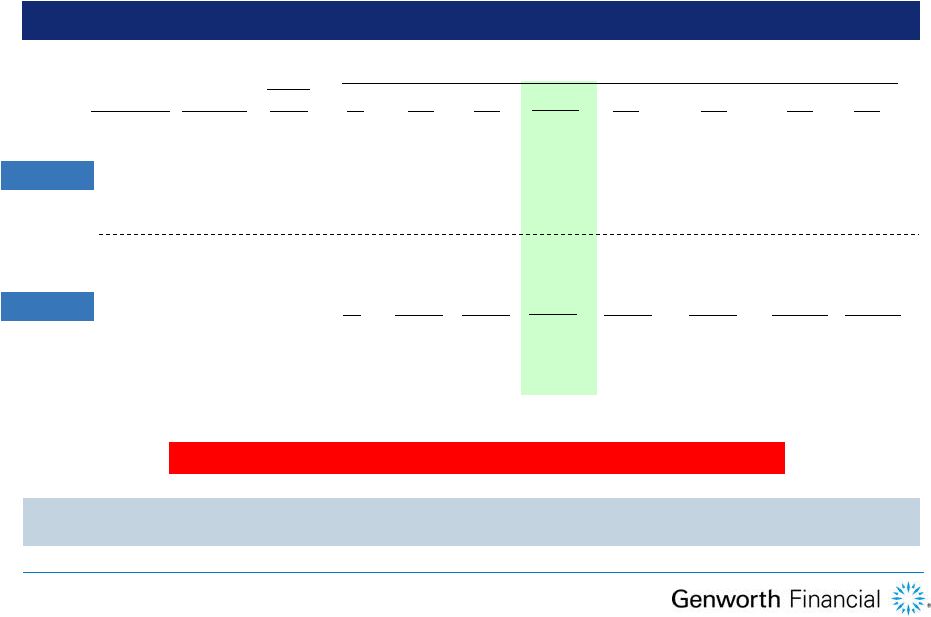

10 Exchange Offer Informational Session Exchange Offer Overview What Will The Vesting Schedule Be For The Replacement Awards? Before: Aug 19,

2007 On or After: Aug 19, 2007 • Regardless of whether or not your current awards are vested all replacement awards

granted will be given new vesting schedules as follows. 1/3 per yr over 3 yrs 1/4 per yr over 4 yrs Original Grant Date New Vesting Schedule What Does 1/3 Per Year Over 3 Years Mean? • Assume you exchange 1,000 awards • You receive 333 replacement awards (1,000 / 3 rounded down to the nearest whole

number) • The new grant date is 8/19/2009 • Vesting 1/3 per year over 3 years would be according to the following schedule:

# of Awards Vesting 111 Stock Options 111 Stock Options 111 Stock Options Vesting Date 8/19/2010 8/19/2011 8/19/2012 Assumptions: |

11 Exchange Offer Informational Session nd st Exchange Offer Overview Vesting & Life Of The Replacement Awards • The replacement awards you receive will have the same expiration date as the awards you exchange. • The example below demonstrates how exchanging a grant made on May 25, 2004 would

impact the new vesting schedule and expiration date. • The example below assumes the exchange closes on Aug 18, 2009 with a new grant date of

Aug 19, 2009. How long will I have to exercise the replacement awards? May 25, 2004 1/4 per year beginning on the 2 year anniversary Original Grant Date Original Vesting May 25, 2009 Fully Vested Aug 19, 2009 1/3 per year beginning on the 1 year anniversary Replacement Award Grant Date Replacement Award Vesting Aug 19, 2012 Fully Vested* May 25, 2014 Expiration Date May 25, 2014 Expiration Date *Assumes continued service through vesting period. |

12 Exchange Offer Informational Session Disclaimers related to illustrations that follow Exchange Offer Illustrations We do not make any representations regarding the value of eligible options and SARs,

the value of replacement awards or the future price of our common stock.

We do not make any representations regarding the future value of eligible

options and SARs relative to the future value of the replacement awards.

The illustrations of hypothetical gains on the next few slides are subject to the

following assumptions and qualifications: • A replacement award exercise price of $7.00 per share for illustration purposes*

• All replacement awards and eligible stock options and SARs surrendered for exchange are fully vested and exercisable • The illustrations utilize the exchange ratio that has been set for the exchange

offer • Continued employment through the entire vesting period *Assumed solely for the purposes of the hypothetical illustration. Genworth cannot

and does not predict the future market price of its stock, and the examples do not constitute a prediction of future stock price. |

13 Exchange Offer Informational Session # Shares Illustration Of Eligible Options With A Strike Price Of $19.50 5/25/2004: $5 $15 $25 $30 $0 $0 $5,500 $10,500 Value at Different Stock Price Points 1,000 Strike Price $19.50 $35 $15,500 $40 $20,500 $45 $25,500 8/19/2009: $0 $2,664 $5,994 $7,659 333 $7.00 $9,324 $10,989 $12,654 Impact of the Exchange: $0 $2,664 $494 ($2,841) ($6,176) ($9,511) ($12,846) “Break Even” at a stock price of ~$25.74 with a strike price $7.00* Grant Date Exchange Current $25.74 $6,240 $6,240 $0 *Values Are Based On Full Vesting Of All Awards And Do Not Factor In Taxes Or Other

Deductions. Assumes Strike Price Of $7.00 For The Replacement

Awards. Actual Strike Price For The Replacement Awards May Vary. Exchange

Offer Illustrations |

14 Exchange Offer Informational Session Illustration Of Eligible Options With A Strike Price Of $32.10* “Break Even” at a stock price of ~$44.63 with a strike price $7.00* *Values Are Based On Full Vesting Of All Awards And Do Not Factor In Taxes Or Other

Deductions. Assumes Strike Price Of $7.00 For The Replacement

Awards. Actual Strike Price For The Replacement Awards May Vary. Exchange

Offer Illustrations # Shares 7/20/2005: $5 $15 $25 $30 $0 $0 $0 $0 Value at Different Stock Price Points 1,000 Strike Price $32.10 $35 $2,900 $40 $7,900 $45 $12,900 8/19/2009: $0 $2,664 $5,994 $7,659 333 $7.00 $9,324 $10,989 $12,654 Impact of the Exchange: $0 $2,664 $5,994 $7,659 $6,424 $3,089 ($246) Grant Date Exchange Current $44.63 $12,530 $12,530 $0 |

15 Exchange Offer Informational Session Illustration Of Eligible Options With A Strike Price Of $34.13* # Shares 8/09/2006: $5 $15 $25 $30 $0 $0 $0 $0 Value at Different Stock Price Points 1,000 Strike Price $34.13 $35 $870 $40 $5,870 $45 $10,870 8/19/2009: $0 $2,664 $5,994 $7,659 333 $7.00 $9,324 $10,989 $12,654 Impact of the Exchange: $0 $2,664 $5,994 $7,659 $8,454 $5,119 $1,784 Grant Date Exchange Current $47.68 $13,550 $13,546 ($4) “Break Even” at a stock price of ~$47.68 with a strike price $7.00* *Values Are Based On Full Vesting Of All Awards And Do Not Factor In Taxes Or Other

Deductions. Assumes Strike Price Of $7.00 For The Replacement

Awards. Actual Strike Price For The Replacement Awards May Vary. Exchange

Offer Illustrations |

16 Exchange Offer Informational Session Illustration Of Eligible Options With A Strike Price Of $30.52* “Break Even” at a stock price of ~$42.26 with a strike price $7.00* *Values Are Based On Full Vesting Of All Awards And Do Not Factor In Taxes Or Other

Deductions. Assumes Strike Price Of $7.00 For The Replacement

Awards. Actual Strike Price For The Replacement Awards May Vary. Exchange

Offer Illustrations # Shares 7/31/2007: $5 $15 $25 $30 $0 $0 $0 $0 Value at Different Stock Price Points 1,000 Strike Price $30.52 $35 $4,480 $40 $9,480 $45 $14,480 8/19/2009: $0 $2,664 $5,994 $7,659 333 $7.00 $9,324 $10,989 $12,654 Impact of the Exchange: $0 $2,664 $5,994 $7,659 $4,844 $1,509 ($1,826) Grant Date Exchange Current $42.26 $11,740 $11,742 $2 |

17 Exchange Offer Informational Session Illustration Of Eligible Options With A Strike Price Of $22.80* “Break Even” at a stock price of ~$30.69 with a strike price $7.00* *Values Are Based On Full Vesting Of All Awards And Do Not Factor In Taxes Or Other

Deductions. Assumes Strike Price Of $7.00 For The Replacement

Awards. Actual Strike Price For The Replacement Awards May Vary. Exchange

Offer Illustrations # Shares 2/13/2008: $5 $15 $25 $30 $0 $0 $2,200 $7,200 Value at Different Stock Price Points 1,000 Strike Price $22.80 $35 $12,200 $40 $17,200 $45 $22,200 8/19/2009: $0 $2,664 $5,994 $7,659 333 $7.00 $9,324 $10,989 $12,654 Impact of the Exchange: $0 $2,664 $3,794 $459 ($2,876) ($6,211) ($9,546) Grant Date Exchange Current $30.69 $7,890 $7,889 ($1) |

| 18 Exchange Offer Informational Session Questions to Consider 1. Have I reviewed all the relevant documents including the Offering Memorandum

& specifically the Risk Factors related to the exchange offer? 2. At what price do I anticipate Genworth’s stock to trade over the life of the grant(s) I hold? 3. Am I comfortable with a new three or four year vesting schedule for replacement

awards? 4. Am I planning on retiring in the next 12 months? 5. Have I reviewed any potential tax implications with my financial or tax advisor? 6. Are there other personal financial circumstances that may impact my decision on whether or not I should participate in the exchange offer? |

| 19 Exchange Offer Informational Session 1. Exchange offer website http://genworth.com/optionexchange: Where employees can make their elections to participate in the exchange. In addition it has links to

information & documents related to the exchange offer (Offering

Memorandum, translations, etc.) 2. Executive compensation team – compensation@genworth.com: email resource to utilize after you have read through the Offering Memorandum. Will be able to assist

you with any questions about the exchange offer website. 3. Local Human Resources Manager. Exchange Offer Resources |

| 20 Exchange Offer Informational Session July 13, 2009 – Offer commences & Exchange offer website opens August 18, 2009, 5 pm. U.S. Eastern Time – Exchange offer closes – Deadline for properly completed and submitted election being RECEIVED by the executive compensation team – Exchanged awards are cancelled August 19, 2009 – Replacement awards are priced and issued September 2009 – New award packages and online grant materials

delivered to participants Exchange Offer Timeline |

| 21 Exchange Offer Informational Session Exchange Offer Country Specific Tax Considerations |

22 Exchange Offer Informational Session Exchange Offer Country Specific Tax Information Australia • Important Note: The Australian Government has announced a major change in the

way employee equity-based awards are taxed in Australia. If the changes

are implemented as announced, the tax rules will change for ‘qualifying’ awards acquired on or after July 1, 2009. Acquisitions of shares and rights prior to July 1, 2009

will not be affected. A consultation process has commenced.

However, the tax treatment of acquisitions of shares and rights after July 1, 2009 can only be determined with certainty after the necessary legislation has been enacted.

• The amount of tax due is likely based on the ‘deemed value’ of the replacement grants (as determined by a valuation table contained in the Australian tax legislation).

• The disposal of underwater stock options may result in a taxable event when replaced with stock options granted at an ‘at market’ strike price. Country-specific Tax Information Provided Is A Summary Only And Is Not Intended As Tax

Advice. Please Speak With Your Tax Or Financial Advisor To Determine

Your Personal Tax Obligation And The Risks Or Benefits Of Participation In

This Exchange Offer. |

23 Exchange Offer Informational Session Exchange Offer Country Specific Tax Information Denmark • The disposal of underwater stock options may result in a taxable event when replaced with stock options granted at an ‘at market’ exercise price. • The taxable value at grant related to the exchange would either be determined as the

Black-Scholes value of the existing options or the replacement options. • Please speak with your tax or financial advisor to determine your personal tax

obligation. Country-specific Tax Information Provided Is A Summary Only And Is Not Intended As Tax

Advice. Please Speak With Your Tax Or Financial Advisor To Determine

Your Personal Tax Obligation And The Risks Or Benefits Of Participation In

This Exchange Offer. |

24 Exchange Offer Informational Session Exchange Offer Country Specific Tax Information United Kingdom • There are no adverse tax implications related to the exchange of non-qualified Stock Options. • Participants that exchange outstanding Qualified Stock Options would receive

non- qualified Stock Options in exchange • Participants who elect to exchange their Qualified Stock Options for non-qualified awards may have the opportunity to receive Qualified Stock Options at future grants. • Please speak with your tax or financial advisor to determine your personal tax

obligation. Country-specific Tax Information Provided Is A Summary Only And

Is Not Intended As Tax Advice. Please Speak With Your Tax Or Financial

Advisor To Determine Your Personal Tax Obligation And The Risks Or Benefits Of

Participation In This Exchange Offer. |

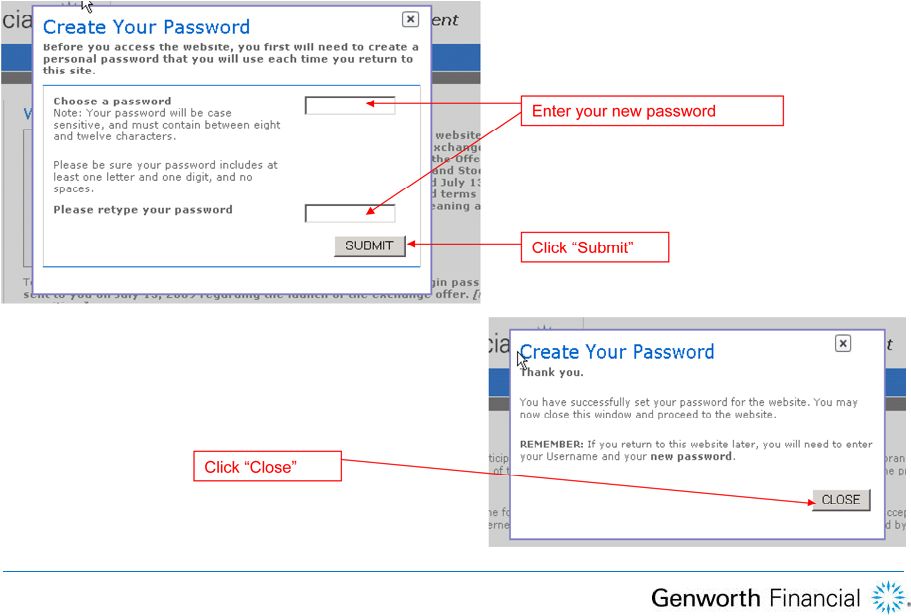

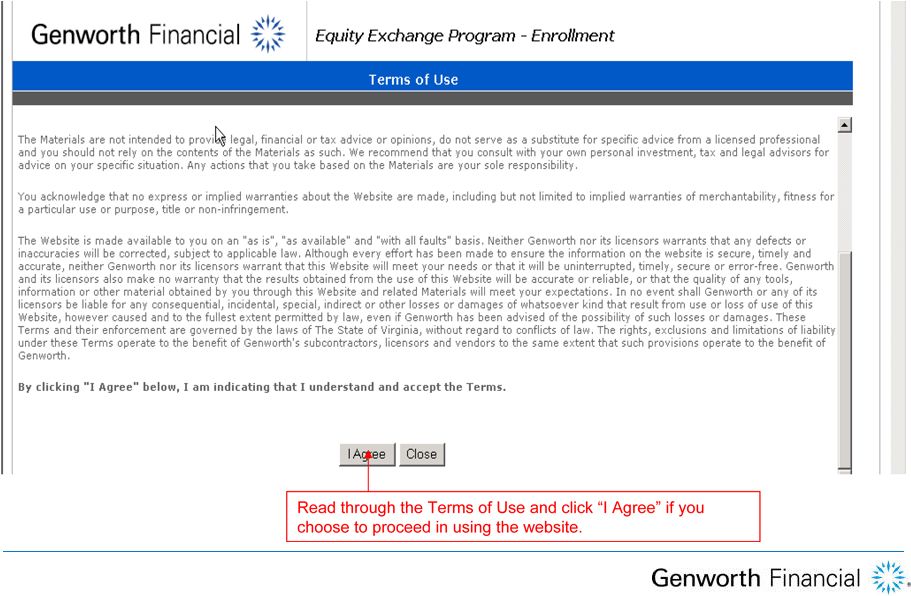

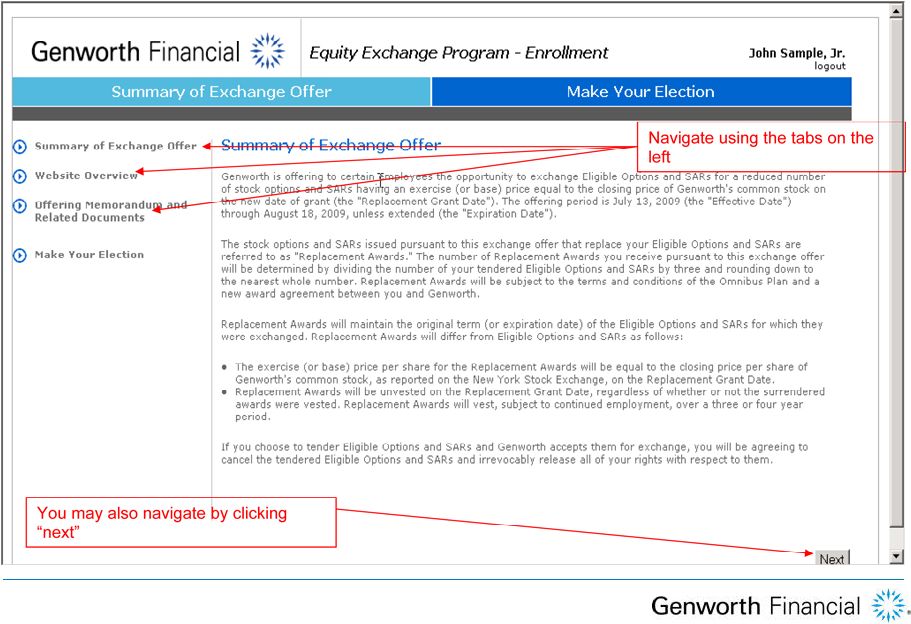

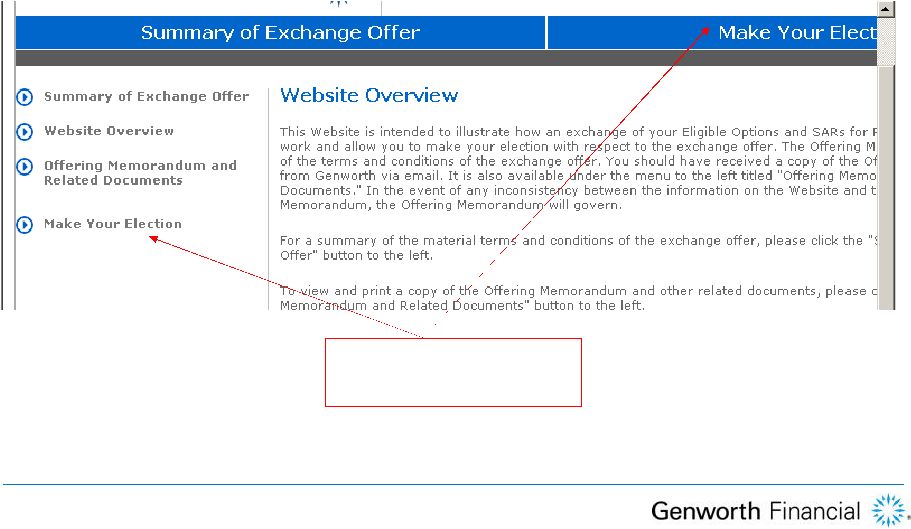

| 25 Exchange Offer Informational Session Exchange Offer Website Training |

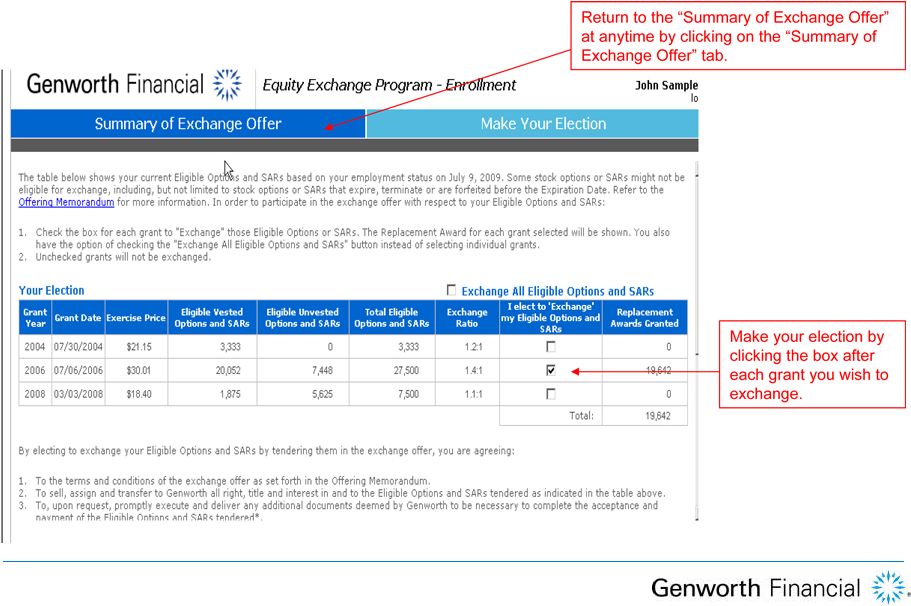

26 Exchange Offer Informational Session Exchange Offer – Website Training |

27 Exchange Offer Informational Session Exchange Offer – Website Training |

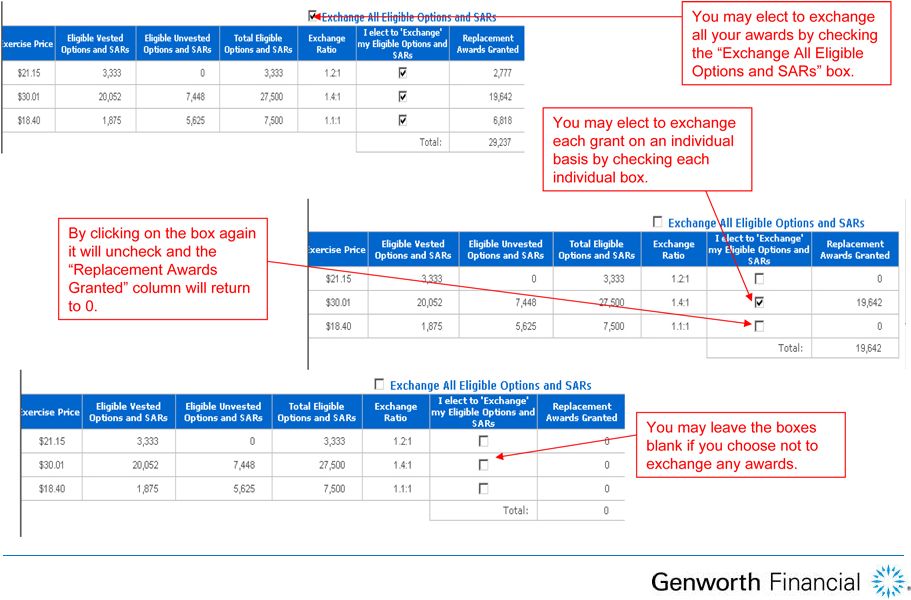

28 Exchange Offer Informational Session Exchange Offer – Website Training |

29 Exchange Offer Informational Session Exchange Offer – Website Training |

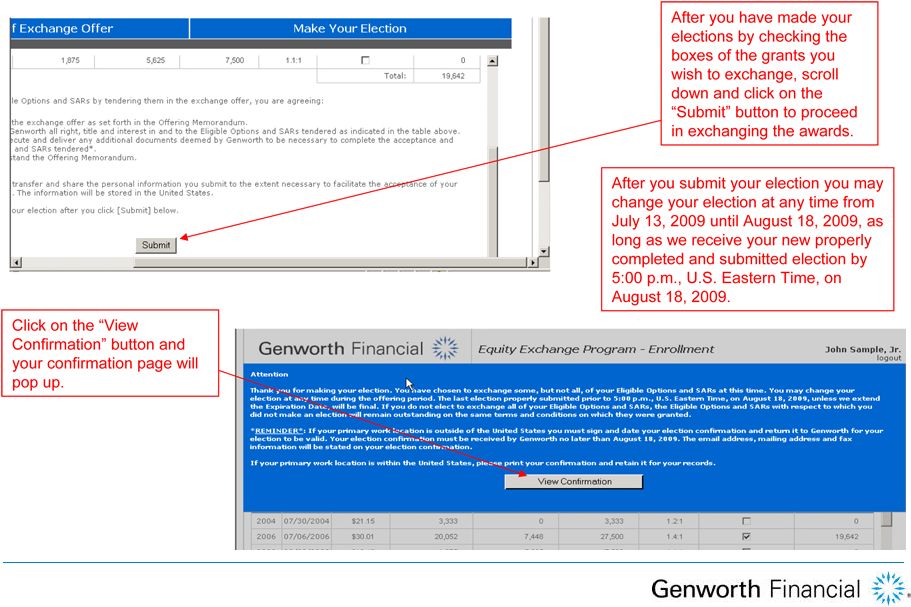

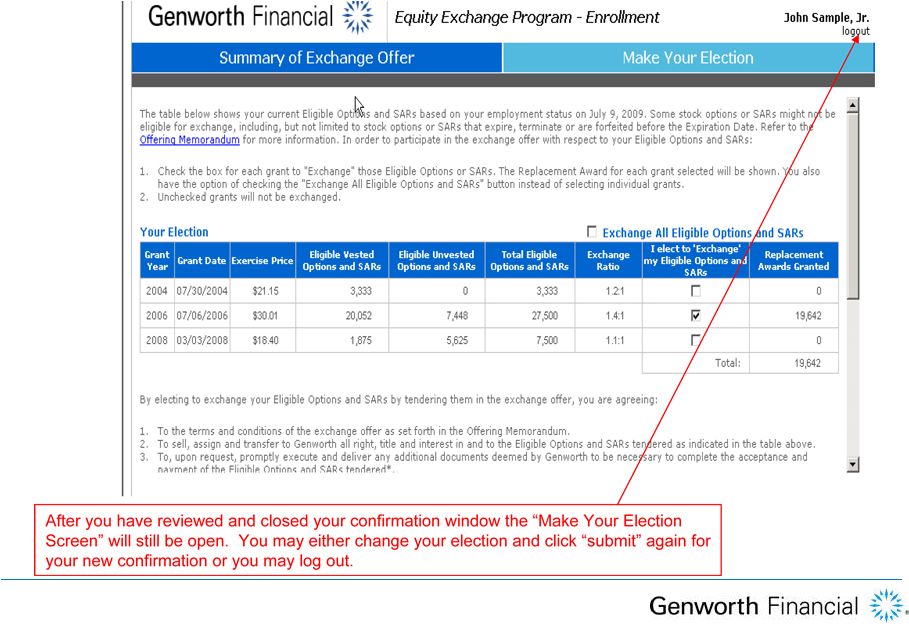

30 Exchange Offer Informational Session Exchange Offer – Website Training Go to the “Make Your Election” page at any time by clicking either “Make Your Election” tabs. |

31 Exchange Offer Informational Session Exchange Offer – Website Training |

32 Exchange Offer Informational Session Exchange Offer – Website Training |

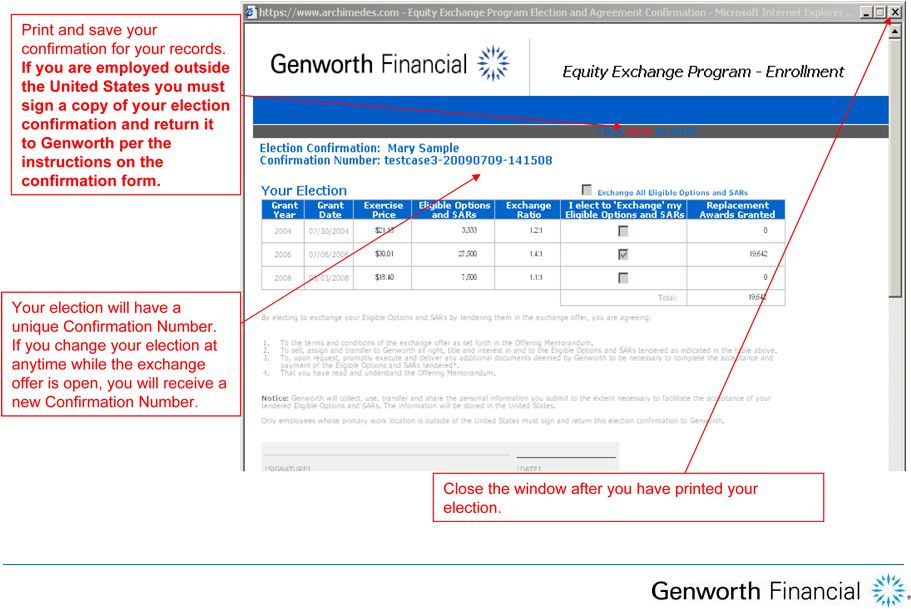

33 Exchange Offer Informational Session Exchange Offer – Website Training |

34 Exchange Offer Informational Session Exchange Offer – Website Training |

35 Exchange Offer Informational Session Exchange Offer – Website Training |

| 36 Exchange Offer Informational Session Exchange Offer – Glossary of Key Terms Exchange Ratio: It is the ratio used to determine how many replacement options or SARs will be granted for the exchanged options that are cancelled. A SAR allows a holder to benefit from the appreciation of Genworth stock between the grant date and the vesting date. Stock Appreciation Right (SAR): Stock options & SARs you still hold (both vested & unvested) but are not exercised. Outstanding Stock Options & SARs: Legal document filed with the SEC which states the objectives, risks and terms of the exchange offer. Offering Memorandum: A method of converting stock options into stock that requires no initial cash payment. The strike price is covered by selling some of the option shares. Cashless Exercise: |

37 Exchange Offer Informational Session Exchange Offer – Glossary of Key Terms Glossary of Terms Vesting: When your stock options become exercisable, they are referred to as being “vested”. The vesting schedule applicable

to your stock options will be set forth in your stock option grant agreement(s). The strike price is the closing price of Genworth common stock on the day the stock option is granted. Strike Price: A stock option or SAR is considered “underwater” if the exercise price of the stock option or SAR is higher than the current market price. Underwater: It is the right to buy shares of Genworth common stock at a fixed price in the future (the strike price). Stock Option: |

38 Exchange Offer Informational Session Stock Appreciation Right Refresher Stock Appreciation Rights (SARs) • A SAR has the same economic value as a stock option but are delivered primarily to our

executive officers. A SAR allows a holder to benefit from the

appreciation of Genworth stock between the grant date and the vesting date.

A SAR represents the right to receive the difference between the value of

the underlying Genworth stock on the date of exercise over the grant price

of the award, payable in shares of stock. What Is A SAR? • A SAR is similar to a stock option, except that when you exercise a SAR, you do not have

to pay an exercise price to receive shares. Instead you are receiving the “appreciation” of the underlying stock, which is equal to the current value of the shares less the grant

price. How Does A SAR Work? $5 $8 Grant Price “Appreciation” Realized Upon Exercise = $3* Price to purchase the shares on the open market *Before taxes and other deductions Grant Date Exercise |