UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Genworth Financial, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notice of 2005 Annual Meeting and

Proxy Statement

|

6620 West Broad Street Richmond, Virginia 23230 |

April 11, 2005

Dear Stockholder,

You are invited to attend the 2005 Annual Meeting to be held at 9:00 a.m. on Thursday, May 19, 2005, in Richmond, Virginia. This is our first stockholders’ meeting since we became a public company after completing our initial public offering in May 2004.

The Annual Meeting will include a report on our business operations, discussion and voting on the matters set forth in the accompanying notice of Annual Meeting and proxy statement, and discussion and voting on any other business matters properly brought before the meeting.

Whether or not you plan to attend, you can be sure your shares are represented at the meeting by promptly voting and submitting your proxy by phone, by Internet or by completing, signing, dating and returning your proxy form in the enclosed envelope.

| Cordially, |

|

| Michael D. Fraizer |

| Chairman of the Board, President and Chief Executive Officer |

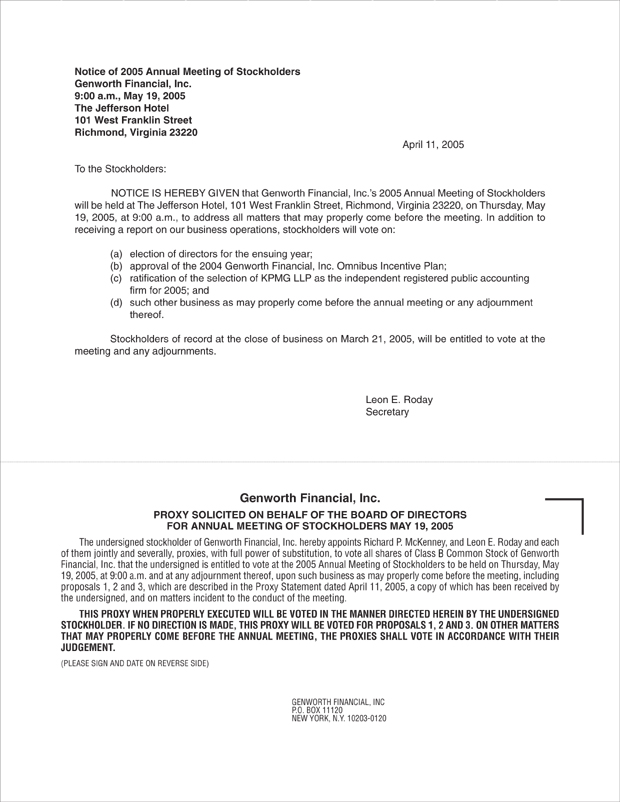

NOTICE OF 2005 ANNUAL MEETING OF STOCKHOLDERS

9:00 a.m., May 19, 2005

The Jefferson Hotel

101 West Franklin Street

Richmond, Virginia 23220

April 11, 2005

To the Stockholders:

NOTICE IS HEREBY GIVEN that Genworth Financial Inc.’s 2005 Annual Meeting of Stockholders will be held at The Jefferson Hotel, 101 West Franklin Street, Richmond, Virginia 23220, on Thursday, May 19, 2005, at 9:00 a.m., to address all matters that may properly come before the meeting. In addition to receiving a report on our business operations, stockholders will vote on:

(a) election of directors for the ensuing year;

(b) approval of the 2004 Genworth Financial, Inc. Omnibus Incentive Plan;

(c) ratification of the selection of KPMG LLP as the independent registered public accounting firm for 2005; and

(d) such other business as may properly come before the Annual Meeting or any adjournment thereof.

Stockholders of record at the close of business on March 21, 2005 will be entitled to vote at the meeting and any adjournments.

Leon E. Roday

Secretary

• To be voted on at the meeting

Every stockholder’s vote is important. Please complete, sign,

date and return your proxy form, or submit your

proxy by telephone or by Internet.

Genworth Financial, Inc.

6620 West Broad Street

Richmond, Virginia 23230

This proxy statement is furnished in connection with the solicitation of proxies by Genworth Financial, Inc. on behalf of the board of directors for the 2005 Annual Meeting of Stockholders. Distribution to stockholders of this proxy statement and a proxy form is scheduled to begin on or about April 11, 2005.

Your vote is important. Whether or not you plan to attend the 2005 Annual Meeting, please take the time to vote your shares as soon as possible. You can ensure that your shares are voted at the meeting by submitting your proxy by phone, by Internet or by completing, signing, dating and returning the enclosed proxy card in the envelope provided. Submitting your proxy by any of these methods will not affect your right to attend the meeting and vote. A stockholder who gives a proxy may revoke it at any time before it is exercised by voting in person at the Annual Meeting, by delivering a subsequent proxy or by notifying the inspector of election in writing of such revocation.

INFORMATION ABOUT THE 2005 ANNUAL MEETING AND PROXY VOTING

What matters are to be voted on at the 2005 Annual Meeting?

Genworth intends to present the following proposals for stockholder consideration and voting at the Annual Meeting:

1. The election of directors for the ensuing year;

2. Approval of the 2004 Genworth Financial, Inc. Omnibus Incentive Plan; and

3. Ratification of the selection of KPMG LLP as the independent registered public accounting firm for 2005.

What is the board’s recommendation?

The board recommends votes for items 1-3 on your proxy card.

Will any other matters be presented for a vote at the Annual Meeting?

The board of directors did not receive any notice prior to the deadline for submission of additional business that any other matters might be presented for a vote at the Annual Meeting. However, if another matter were to be properly presented, the proxies would use their own judgment in deciding whether to vote for or against it.

Who is entitled to vote?

All Genworth stockholders of record at the close of business on March 21, 2005 (the “record date”) are entitled to vote at the Annual Meeting.

What shares will be entitled to vote at the 2005 Annual Meeting?

Our voting securities consist of our Class A Common Stock, par value $0.001, of which 146,519,954 shares were outstanding on the record date and our Class B Common Stock, par value $0.001, of which 343,088,145 shares were outstanding on the record date. Each share outstanding on the record date will be entitled to one vote, except that holders of Class A Common Stock will be entitled to vote only for those directors who have been nominated by our Nominating and Corporate Governance Committee to be elected by holders of our Class A Common Stock, and the holder of our Class B Common Stock will be entitled to vote only for those directors who have been designated to our board of directors by General Electric Company (“GE”).

1

If you are the beneficial owner, but not the record owner, of Genworth’s Class A Common Stock, you will receive instructions about voting from the bank, broker or other nominee that is the stockholder of record of your shares. Contact your bank, broker or other nominee directly if you have questions.

Who can attend the 2005 Annual Meeting?

Only Genworth stockholders of record or their duly appointed proxies are entitled to attend the meeting. If you are a Genworth stockholder of record and wish to attend the meeting, please so indicate on the proxy card or as prompted by the telephone or Internet voting system.

If a bank, broker or other nominee is the record owner of your shares, you will need to have proof that you are the beneficial owner to be admitted to the meeting. A recent statement or letter from your bank or broker confirming your ownership, or presentation of a valid proxy from a bank, broker or other nominee that is the record owner of your shares, would be acceptable proof of your beneficial ownership.

Do any of Genworth’s executive officers, directors or director-nominees have any direct or indirect interest in any matter to be acted upon?

Genworth’s executive officers, directors and director-nominees (except for directors and director-nominees designated by GE) would continue to be eligible to receive grants and awards under the 2004 Genworth Financial, Inc. Omnibus Incentive Plan, the approval of which is to be voted upon at the Annual Meeting.

How do I vote my shares?

| • | Stockholders of record may grant a proxy with respect to their shares by mail, by telephone or on the Internet. Granting a proxy by telephone or on the Internet will be available through 5:00 p.m. Eastern time on May 18, 2005. |

| • | Voting instructions appear on your proxy card. If you grant a proxy by telephone or on the Internet, please have your proxy card available. |

| • | If you are a stockholder of record or a duly appointed proxy of a stockholder of record, you may attend the meeting and vote in person. However, if your shares are held in the name of a bank, broker or other nominee, and you wish to attend the meeting to vote in person, you will have to contact your bank, broker or other nominee to obtain its proxy. Bring that document with you to the meeting. |

| • | Proxies submitted by mail, telephone or on the Internet will be voted in the manner you indicate by the individuals named on the proxy. If you do not specify how your shares are to be voted, the proxies will vote your shares FOR the election of directors who have been nominated by our Nominating and Corporate Governance Committee to be elected by holders of our Class A Common Stock, FOR approval of the 2004 Genworth Financial, Inc. Omnibus Incentive Plan, and FOR the ratification of the selection of KPMG LLP as the independent registered public accounting firm for 2005. |

May I change or revoke my proxy after it is submitted?

Yes, you may change or revoke your proxy at any time before the Annual Meeting by:

| • | returning a later-dated proxy card; |

| • | subsequently granting a proxy by telephone or on the Internet; |

| • | attending the Annual Meeting and voting in person; or |

| • | sending your notice of revocation to Leon E. Roday, our Secretary. |

Your changed proxy or revocation must be received before the polls close for voting.

2

What is a “quorum?”

In order for business to be conducted at the 2005 Annual Meeting, a quorum must be present. A quorum will be present if stockholders of record holding a majority in voting power of the outstanding shares of stock entitled to vote at the meeting are present in person or are represented by proxies.

What vote is necessary to pass the items of business at the Annual Meeting?

As the sole holder of the Class B Common Stock, GE Financial Assurance Holdings, Inc. (“GEFAHI”), a subsidiary of GE, is authorized by our certificate of incorporation to elect five directors. The four nominees for director receiving a plurality of the votes cast by holders of Class A Common Stock, at the meeting in person or by proxy, also shall be elected to our board of directors.

Except with respect to the election of directors, holders of Class A Common Stock and Class B Common Stock will vote as a single class and will be entitled to one vote per share with respect to each matter to be presented at the Annual Meeting. The favorable vote of the holders of a majority of shares voted at the meeting, in person or by proxy, is required for approval of all such matters. Under Delaware law, abstentions and broker non-votes, if any, will not be counted as votes cast. Therefore, they will have no effect on the outcome of the other matters to be voted on at the meeting.

How are abstentions and broker non-votes counted?

Abstentions and broker non-votes will be counted to determine whether a quorum is present. However, if a stockholder abstains from voting as to a particular matter, those shares will not be counted as voting for or against that matter. If a broker or other record holder of shares returns a proxy card indicating that it does not have discretionary authority to vote as to a particular matter (“broker non-votes”), those shares will not be counted as voting for or against that matter. Accordingly, abstentions and broker non-votes will have no effect on the outcome of a vote.

Who is the inspector of election?

The board of directors has appointed a representative of The Bank of New York to act as Inspector of Election at the 2005 Annual Meeting.

What are the costs for soliciting proxies for the 2005 Annual Meeting?

Proxies will be solicited on behalf of the board of directors by mail, telephone, other electronic means or in person, and we will pay the solicitation costs. Copies of proxy materials and of the annual report for 2004 will be supplied to brokers, dealers, banks and voting trustees, or their nominees, for the purpose of soliciting proxies from beneficial owners, and we will reimburse such record holders for their reasonable expenses. Georgeson Shareholder Communications, Inc. has been retained to assist in soliciting proxies at a fee of $1,500, plus distribution costs and other costs and expenses.

What is the deadline for submission of stockholder proposals for the 2006 Annual Meeting?

The rules of the Securities and Exchange Commission establish the eligibility requirements and the procedures that must be followed for a stockholder’s proposal to be included in a public company’s proxy materials. Under those rules, proposals submitted for inclusion in Genworth’s 2006 proxy materials must be received on or before the close of business on December 12, 2005. Proposals for inclusion in our 2006 proxy materials must comply with all requirements of the rules of the Securities and Exchange Commission.

In addition, our bylaws establish an advance notice procedure with regard to director nominations and proposals by stockholders intended to be presented at our 2006 Annual Meeting but not included in our 2006 proxy materials. For these nominations or other business to be properly brought before the meeting by a stockholder, the stockholder must deliver written notice to us not later than the close of business on February 18, 2006 nor earlier than the close of business on January 19, 2006. Such proposals must comply with all requirements set forth in our bylaws.

3

All notices of proposals by stockholders, whether or not intended to be included in our proxy materials, should be sent to Leon E. Roday, Secretary, Genworth Financial, Inc., 6620 West Broad Street, Richmond, Virginia 23230.

For any proposal that is not submitted for inclusion in next year’s proxy statement, but is instead sought to be presented directly at the 2006 Annual Meeting, SEC rules permit management to vote proxies in its discretion if we: (1) receive notice of the proposal before the close of business on February 25, 2006, and advise stockholders in the 2006 proxy statement about the nature of the matter and how management intends to vote on such matter; or (2) do not receive notice of the proposal prior to the close of business on February 25, 2006. Notices of intention to present proposals at the 2006 Annual Meeting should be addressed to Leon E. Roday, Secretary, Genworth Financial, Inc., 6620 West Broad Street, Richmond, Virginia, 23230.

Where can I find the voting results of the 2005 Annual Meeting?

The preliminary voting results will be announced at the meeting. The final results will be published in our quarterly report on Form 10-Q for the quarter ending June 30, 2005.

May I request electronic delivery of my proxy statement and annual report?

This Proxy Statement and Genworth’s 2004 Annual Report may be viewed online at www.genworth.com. If you are a stockholder of record, you may elect to receive future annual reports and proxy statements electronically by providing consent to electronic delivery on-line at www.giveconsent.com/gnw. Should you choose to receive your proxy materials electronically, your choice will remain in effect until you notify Genworth that you wish to resume mail delivery of these documents.

If you hold your Genworth stock through a bank, broker or other holder of record, refer to the information provided by that entity for instructions on how to elect this option.

How can I get a copy of Genworth’s annual report on Form 10-K?

To obtain without charge a copy of Genworth’s annual report on Form 10-K for the fiscal year ended December 31, 2004, address your request to Investor Relations, Genworth Financial, Inc., 6620 West Broad Street, Richmond, Virginia 23230. The annual report on Form 10-K also may be accessed at www.genworth.com and at the website of the Securities and Exchange Commission at www.sec.gov.

INFORMATION ABOUT COMMUNICATIONS WITH GENWORTH AND OUR BOARD OF DIRECTORS

How may I communicate directly with the board of directors?

The board of directors provides a process for stockholders to send communications to the board of directors. You may communicate with the board of directors, individually or as a group, as follows:

| By Mail |

By Phone |

By E-mail | ||

| The Board of Directors Genworth Financial, Inc. c/o Leon E. Roday, Secretary 6620 West Broad Street Richmond, Virginia 23230 |

1-866-717-3594 | Directors@genworth.com |

You should identify your communication as being from a Genworth stockholder. The Secretary may require reasonable evidence that your communication or other submission is made by a Genworth stockholder before transmitting your communication to the board of directors.

4

How may I communicate with the Audit Committee?

The Audit Committee has established procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls, or auditing matters. A communication or complaint to the Audit Committee regarding accounting, internal accounting controls or auditing matters may be submitted by any of the following means:

| Ombudsman | Audit Committee | |

| Anonymously | Anonymously | |

| 1-888-251-4332 | 1-866-717-3594 | |

| By E-mail Directors@genworth.com | ||

| By Mail | By Mail | |

| Genworth Ombudsman | Audit Committee | |

| Genworth Financial, Inc. | Genworth Financial, Inc. | |

| 6620 West Broad Street | 6620 West Broad Street | |

| Building #1 | Building #1 | |

| Richmond, Virginia 23230 | Richmond, Virginia 23230 | |

How may I communicate directly with the Non-Employee Directors?

You may communicate with the Non-Employee Directors, individually or as a group, by any of the means set forth above or by writing to:

Non-Employee Directors of the Board of Directors

Genworth Financial, Inc.

c/o Leon E. Roday, Secretary

6620 West Broad Street

Building #1

Richmond, Virginia 23230

How do I communicate directly with Genworth?

You may communicate with Genworth by writing to:

Genworth Financial, Inc.

c/o Leon E. Roday, Secretary or c/o Investor Relations

6620 West Broad Street

Building #1

Richmond, Virginia 23230

5

At the 2005 Annual Meeting, nine directors are to be elected to hold office until the 2006 Annual Meeting and until their successors have been elected and have qualified. The nine nominees for election at the Annual Meeting are listed on pages six to eight with brief biographies. They are all currently Genworth directors. The board of directors has determined that three of the nine nominees are independent directors under New York Stock Exchange (“NYSE”) listing requirements and our Governance Principles, which are discussed below under “Corporate Governance—Governance Principles.” As described below, four of the nominees have been nominated to be elected by holders of our Class A Common Stock and five have been designated by GE to be elected by GEFAHI, a GE subsidiary and the sole holder of our Class B Common Stock. We are not aware of any reason why any nominee would be unable to serve as a director. If a nominee for election by holders of our Class A Common Stock is unable to serve, the shares represented by all valid proxies will be voted for the election of any other person that our Nominating and Corporate Governance Committee may nominate. If a nominee for election by holders of our Class B Common Stock is unable to serve, GE will be entitled to designate another person to be elected by GEFAHI.

Frank J. Borelli, 69, former Chief Financial Officer, Marsh & McLennan Companies, Inc., Director and Audit Committee Chairman, Express Scripts, Inc. and Presiding Director, Interpublic Group of Companies. Director since 2004.

Mr. Borelli has been a Senior Advisor to MMC Capital, a wholly owned subsidiary of Marsh & McLennan Companies, Inc., since his retirement from Marsh & McLennan on January 2, 2001. Prior thereto, he was Senior Vice President of Marsh & McLennan from April to December 2000 and Senior Vice President and Chief Financial Officer from September 1984 to April 2000. He is a director and Audit Committee Chairman of Express Scripts, Inc. and is Presiding Director of the Interpublic Group of Companies. He was a Director of Marsh & McLennan from May 1988 to October 2000. Mr. Borelli is past Chairman and Director of Financial Executives International and is also Chairman Emeritus of the Board of Trustees of the New York City Chapter of the National Multiple Sclerosis Society, a Trustee of St. Thomas Aquinas College and Chairman of the Nyack Hospital. Mr. Borelli received a B.B.A. in Business Administration from Bernard M. Baruch College, City University of New York in 1956. Mr. Borelli has been nominated by our Nominating and Corporate Governance Committee to be elected by holders of Genworth’s Class A Common Stock.

Elizabeth J. Comstock, 44, Vice President and Chief Marketing Officer of General Electric Company. Director since 2004.

Ms. Comstock has been Vice President and Chief Marketing Officer of GE since July 2003. From 1998 to 2003 Ms. Comstock was Vice President of Corporate Communications at GE. From 1996 to 1998 Ms. Comstock was Senior Vice President of NBC Communications and from 1993 to 1996 was Vice President of NBC News Communications. Prior thereto, Ms. Comstock served as an entertainment media director at CBS Television from 1992 to 1993 and as the New York-based head of communications for Turner Broadcasting from 1990 to 1992. Prior thereto, from 1986 to 1990 she held various positions at NBC News. Ms. Comstock received a B.S. degree in Biology from the College of William and Mary in 1982. Ms. Comstock was designated to our board of directors by GE and will be elected by holders of Genworth’s Class B Common Stock.

Pamela Daley, 52, Vice President, Corporate Business Development, General Electric Company. Director since 2004.

Ms. Daley has been Vice President, Corporate Business Development at GE since July 2004, and was Vice President and Senior Counsel for Transactions at GE from 1991 to 2004, was Senior Counsel for Transactions at GE from 1990 to 1991 and was Tax and Finance Counsel at GE from 1989 to 1990. Prior thereto, Ms. Daley was a partner at Morgan, Lewis & Bockius LLP, from 1986 to 1989 and an associate at that firm from 1979 to 1986. Ms. Daley received an A.B. in Romance Languages and Literatures from Princeton University in 1974 and a J.D. from the University of Pennsylvania in 1979. Ms. Daley was designated to our board of directors by GE and will be elected by holders of Genworth’s Class B Common Stock.

6

Dennis D. Dammerman, 59, Vice Chairman of the Board and Executive Officer, General Electric Company. Director since 2004.

Mr. Dammerman has been a Vice Chairman and Executive Officer of GE and the Chairman of GE Capital Services, Inc. since 1998. Mr. Dammerman has also been a Director of GE since 1994. From 1984 to 1998 he was Senior Vice President—Finance and Chief Financial Officer at GE, and from 1981 to 1984 he was Vice President and General Manager of GE Capital’s Real Estate Financial Services Division. Prior thereto, from 1967 to 1981 he had various financial assignments in several GE businesses. Mr. Dammerman received a B.A. from the University of Dubuque in 1967. Mr. Dammerman was designated to our board of directors by GE and will be elected by holders of Genworth’s Class B Common Stock.

Michael D. Fraizer, 46, Chairman, President and Chief Executive Officer, Genworth Financial, Inc. Director since 2004.

Mr. Fraizer has been our Chairman, President and Chief Executive Officer since the completion of our initial public offering, or IPO, and prior to the IPO was a Vice President of GE since December 1995 and a Senior Vice President of GE since June 2000. Mr. Fraizer was Chairman of the Board of GEFAHI from November 1996 to May 2004 and President and Chief Executive Officer of GEFAHI from April 1997 to June 2004. Mr. Fraizer also has been a director of GE Capital and General Electric Capital Services, Inc. Mr. Fraizer led the Consumer Savings and Insurance Group, a predecessor of GEFAHI, from February 1996 until the formation of GEFAHI in October 1996. Prior to that time, Mr. Fraizer was President and Chief Executive Officer of GE Capital Commercial Real Estate, an affiliate of our company, from July 1993 to December 1996, leading both the GE Consumer Savings and Insurance Group and GE Capital Commercial Real Estate from February to December of 1996. From July 1991 to June of 1993, he was Vice President—Portfolio Acquisitions and Ventures of GE Capital Commercial Real Estate. From December 1989 to June 1991, Mr. Fraizer was President and Managing Director, GE Japan, an affiliate of our company. From July 1983 to November 1989 Mr. Fraizer served in various capacities as a member of GE’s Corporate Audit Staff and Corporate Business Development after joining GE in June 1980 in its Financial Management Program. Mr. Fraizer received a B.A. in Political Science from Carleton College in 1980. He is a member of the board of the American Council of Life Insurers. Mr. Fraizer has been nominated by our Nominating and Corporate Governance Committee to be elected by holders of Genworth’s Class A Common Stock.

J. Robert “Bob” Kerrey, 61, President, New School University and former United States Senator. Director, Jones Apparel Group and Tenet Healthcare Corporation. Director since 2004.

Mr. Kerrey has been the President of New School University since 2001. From January 1989 to December 2000, he was a U.S. Senator for the State of Nebraska. Mr. Kerrey was a democratic candidate for President in 1992. From January 1982 to December 1987, Mr. Kerrey served as Governor of Nebraska. Prior thereto, Mr. Kerrey was an independent businessman and founder of a chain of restaurants and health clubs. Mr. Kerrey served in Vietnam as a Navy SEAL from 1966 to 1969, for which he received the Congressional Medal of Honor. He serves on the boards of Jones Apparel Group, Inc. and Tenet Healthcare Corporation. Mr. Kerrey received a B.S. in Pharmacy from the University of Nebraska in 1966. Mr. Kerrey has been nominated by our Nominating and Corporate Governance Committee to be elected by holders of Genworth’s Class A Common Stock.

David R. Nissen, 53, President and Chief Executive Officer, GE Consumer Finance, General Electric Company. Director since 2004.

Mr. Nissen has been President and CEO of GE Consumer Finance since 1993 and a Senior Vice President at GE since 2001. From 1990 to 1993, Mr. Nissen was General Manager of U.S. Consumer Financial Services at Monogram Bank, an affiliate of GE. Prior thereto, from 1980 to 1990 he held various management positions in several GE businesses. Mr. Nissen received a B.A. in Economics from Northwestern University in 1973 and an M.B.A. from the University of Chicago in 1975. Mr. Nissen was designated to our board of directors by GE and will be elected by holders of Genworth’s Class B Common Stock.

7

James A. Parke, 59, Vice Chairman and Chief Financial Officer, GE Capital and Senior Vice President, General Electric Company. Director since 2004.

Mr. Parke has been Vice Chairman and Chief Financial Officer of GE Capital and a Senior Vice President at GE since 2002. From 1989 to 2002 he was Senior Vice President and Chief Financial Officer at GE Capital and a Vice President of GE. Prior thereto, from 1981 to 1989 he held various management positions in several GE businesses. Mr. Parke received a B.A. in History, Political Science and Economics from Concordia College in Minnesota in 1968. Mr. Parke was designated to our board of directors by GE and will be elected by holders of Genworth’s Class B Common Stock.

Thomas B. Wheeler, 68, retired President and Chief Executive Officer, MassMutual Financial Group. Former Director of BankBoston, director of EstateWorks and director of Textron, Inc. Director since 2004.

Mr. Wheeler was a member of the Massachusetts Mutual (now known as MassMutual Financial Group) field sales force from May 1962 to June 1983, serving as Agent and General Agent, and served as Executive Vice President of Massachusetts Mutual’s insurance and financial management line from July 1983 to December 1986. He became President and Chief Operating Officer of MassMutual in January 1987, President and Chief Executive Officer of MassMutual in October 1988 and Chairman and Chief Executive Officer of MassMutual in March 1996. He retired as Chief Executive Officer in January 1999 and retired as Chairman in December 2000. Mr. Wheeler is a former director of BankBoston, a director of EstateWorks and a director of Textron, Inc. He is a trustee of the Basketball Hall of Fame, Conservancy of S.W. Florida and the Woods Hole Oceanographic Institution. Mr. Wheeler received a B.A. in American Studies from Yale University. Mr. Wheeler has been nominated by our Nominating and Corporate Governance Committee to be elected by holders of Genworth’s Class A Common Stock.

THE BOARD OF DIRECTORS RECOMMENDS THAT HOLDERS OF OUR

CLASS A COMMON STOCK VOTE FOR THE ELECTION OF MR. BORELLI,

MR. FRAIZER, MR. KERREY AND MR. WHEELER.

Governance Principles. Our board’s Governance Principles, which include guidelines for determining director independence and reporting concerns to non-employee directors and the Audit Committee, are included in Appendix A to this proxy statement. All of our corporate governance materials, including the Governance Principles, the charters adopted by the board for each of our standing committees and key practices, are published in the corporate governance section of Genworth’s website at www.genworth.com. We also will provide a copy of these materials in print to any stockholder who requests it. The board regularly reviews corporate governance developments and may modify these principles, charters and practices as warranted. Any modifications will be reflected on Genworth’s website.

As set forth in the Governance Principles, directors are expected to attend the Annual Meeting of stockholders.

Director Independence. Our board currently consists of nine directors, three of whom are independent (as defined by our Governance Principles and NYSE listing standards) and one of whom is our President and Chief Executive Officer. After GE ceases to be a majority stockholder and in accordance with the NYSE’s rules for listed companies, a majority of our directors will be independent. For a director to be independent, the board must determine that the director does not have any direct or indirect material relationship with Genworth. The board has established guidelines to assist it in determining director independence, which conform to, or are more exacting than, the independence requirements of the NYSE. The independence guidelines are set forth in Section 4 of the Governance Principles, at page A-2. In addition to applying these guidelines, the board will

8

consider all relevant facts and circumstances in making an independence determination. The board has determined that Mr. Borelli, Mr. Kerrey and Mr. Wheeler satisfy the NYSE’s independence requirements and Genworth’s independence guidelines.

In addition to the independence guidelines discussed above, members of the Audit Committee also must satisfy additional independence requirements established by the Securities and Exchange Commission (“SEC”) and the NYSE. Specifically, they may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from Genworth or any of its subsidiaries other than their directors’ compensation and they may not be affiliated with Genworth or any of its subsidiaries. The board has determined that all members of the Audit Committee (Mr. Borelli, Mr. Kerrey and Mr. Wheeler) satisfy the relevant SEC and NYSE independence requirements. The Board also has determined that Mr. Borelli satisfies the NYSE requirement that the Audit Committee must include a member with accounting or related management expertise and qualifies as an “audit committee financial expert” under applicable SEC rules.

So long as GE and its affiliates own more than fifty percent of the outstanding voting power of Genworth, Genworth is not subject to the NYSE rules mandating that a majority of its board be composed of independent directors and that its Management Development and Compensation Committee and Nominating and Corporate Governance Committee both be composed entirely of independent directors.

Code of Conduct. All of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller, must act ethically at all times and in accordance with the policies comprising our code of conduct set forth in our company integrity manual, Integrity: The Spirit and the Letter of Our Commitment, which is the same code of conduct used by General Electric Company, our majority stockholder. The board will not permit any waiver of any ethics policy for any director or executive officer. Our code of conduct is published on the corporate governance section of our website at www.genworth.com. We also will provide a copy of our code of conduct in print to any stockholder who requests it. Section 11 of our Governance Principles, at page A-4, more fully addresses our code of conduct.

BOARD OF DIRECTORS AND COMMITTEES

Board Composition

Subject to the rights of the holders of any outstanding series of our preferred stock, our certificate of incorporation provides that until the first date on which GE owns 50% or less of the outstanding shares of our common stock, the number of authorized directors of our company will be 9. Beginning on the first date on which GE owns 50% or less but at least 10% of the outstanding shares of our common stock, the number of authorized directors of our company will be 11. Beginning on the first date on which GE owns less than 10% of the outstanding shares of our common stock, the number of authorized directors of our company will be fixed from time to time by a resolution adopted by our board of directors, but will not be less than 1 nor more than 15.

At each election of members of our board of directors:

| • | when GE owns more than 50% of our outstanding common stock, GE as the holder of the Class B Common Stock will be entitled to elect five directors and the holders of the Class A Common Stock will be entitled to elect four directors; |

| • | when GE owns at least 33% and no more than 50% of our outstanding common stock, GE as the holder of the Class B Common Stock will be entitled to elect four directors, the holders of the Class A Common Stock will be entitled to elect five directors, and the holders of the Class A Common Stock and the Class B Common Stock, voting together as a single class, will be entitled to elect all remaining directors entitled to be elected by the holders of our common stock; |

9

| • | when GE owns at least 20% but less than 33% of our outstanding common stock, GE as the holder of the Class B Common Stock will be entitled to elect three directors, the holders of the Class A Common Stock will be entitled to elect five directors, and the holders of the Class A Common Stock and the Class B Common Stock, voting together as a single class, will be entitled to elect all remaining directors entitled to be elected by the holders of our common stock; |

| • | when GE owns at least 10% but less than 20% of our outstanding common stock, GE as the holder of the Class B Common Stock will be entitled to elect one director, the holders of the Class A Common Stock will be entitled to elect five directors and the holders of the Class A Common Stock and the Class B Common Stock, voting together as a single class, will be entitled to elect all remaining directors entitled to be elected by the holders of our common stock; and |

| • | when GE owns less than 10% of our common stock, all shares of Class B Common Stock held by GE will automatically convert into Class A Common Stock, and the holders of the Class A Common Stock will be entitled to elect all directors entitled to be elected by the holders of our common stock. |

Each director elected by the holders of the common stock will serve until the earlier of his or her death, resignation, disqualification, removal or until his successor is elected and qualified. The common stock will not have cumulative voting rights in the election of directors.

Our Governance Principles provide that directors who serve as chief executive officers or in equivalent positions should not serve on more than two other boards of public companies in addition to the Genworth board. Other directors should not serve on more than four other boards of public companies in addition to the Genworth board.

Board Committees

The three standing committees of the board are the Audit Committee, the Management Development and Compensation Committee and the Nominating and Corporate Governance Committee. These committees are described below. The board has established written charters for each of its three standing committees. Our board of directors may also establish various other committees to assist it in its responsibilities. However, our certificate of incorporation provides that until the first date on which GE owns less than 20% of our outstanding common stock, our board of directors will not establish an executive committee or any other committee having authority typically reserved for an executive committee.

Since the completion of the IPO, the board held five meetings during 2004, and all our directors attended more than 75% of the aggregate of (1) the total number of meetings of the board of directors, and (2) the total number of meetings held by all committees of the board on which he or she served.

Audit Committee. The Audit Committee consists of three “independent” directors as defined under the applicable rules of the New York Stock Exchange. The members of the Audit Committee are Mr. Borelli, who serves as the chair of the committee, Mr. Kerrey and Mr. Wheeler. As more fully set forth in its charter, which is attached hereto as Appendix B, this committee is concerned primarily with the accuracy and effectiveness of the audits of our financial statements. This committee’s duties include: (1) selecting the independent registered public accounting firm; (2) reviewing the scope of the audit to be conducted by them, as well as the results of their audit; (3) approving audit and non-audit services provided to the company by the independent registered public accounting firm; (4) reviewing the organization and scope of our internal system of audit, financial and disclosure controls; (5) overseeing our financial reporting activities, including our annual report, and the accounting standards and principles followed; (6) overseeing the internal audit function and its activities; and (7) conducting other reviews relating to compliance by employees with Genworth policies and applicable laws. The Audit Committee has determined that in view of the increasing demands and responsibilities of the committee, its members generally should not serve on more than two additional audit committees of other public companies. Following our IPO, there were seven meetings of the Audit Committee during 2004. The committee’s report appears on page 60.

10

Management Development and Compensation Committee. The members of the Management Development and Compensation Committee are Mr. Dammerman, who serves as the chair of the committee, Mr. Borelli and Mr. Wheeler. This committee has two primary responsibilities: (1) to monitor our management resources, structure, succession planning, development and selection process as well as the performance of key executives, and (2) to review and approve executive compensation and broad-based and incentive compensation plans. So long as GE beneficially owns more than 50% of our outstanding common stock, the Management Development and Compensation Committee will consist of three directors, one of whom will be designated by GE, two of whom will be “independent” under the applicable rules of the New York Stock Exchange and all of whom will qualify as outside directors for purposes of Section 162(m) of the Internal Revenue Code. When GE beneficially owns 50% or less of our outstanding common stock, the Management Development and Compensation Committee will consist of three directors, each of whom will be “independent” under the applicable rules of the New York Stock Exchange. Following our IPO, there were four meetings of the Management Development and Compensation Committee during 2004.

Nominating and Corporate Governance Committee. The members of the Nominating and Corporate Governance Committee are Mr. Wheeler, who serves as the chair of the committee, Mr. Borelli, Mr. Dammerman, Mr. Fraizer and Mr. Kerrey. The committee’s responsibilities include the selection of potential candidates for our board of directors and the development and annual review of our governance principles. So long as GE owns more than 50% of our outstanding common stock, this committee makes recommendations of candidates for election to our board of directors directly to our stockholders. When GE owns 50% or less of our outstanding common stock, this committee will make recommendations of candidates for election to our board of directors to our board of directors, and our board of directors will make recommendations to our stockholders. This committee does not make recommendations regarding directors designated by GE. This committee also annually reviews director compensation and benefits, and oversees annual self-evaluations of our board and its committees. It also makes recommendations to our board concerning the structure and membership of the other board committees. So long as GE beneficially owns more than 50% of our outstanding common stock, the Nominating and Corporate Governance Committee will consist of five directors, one of whom will be designated by GE, one of whom will be our chief executive officer and three of whom will be “independent” under the applicable rules of the New York Stock Exchange. See “—Controlled Company Exception”. When GE beneficially owns 50% or less of our outstanding common stock, the Nominating and Corporate Governance Committee will consist of three directors, each of whom will be “independent” under the applicable rules of the New York Stock Exchange. Following our IPO, there were four meetings of the Nominating and Corporate Governance Committee during 2004.

The Nominating and Corporate Governance Committee will consider all stockholder recommendations for candidates for the board, which should be sent to the Nominating and Corporate Governance Committee, c/o Leon E. Roday, Secretary, Genworth Financial, Inc., 6620 West Broad Street, Richmond, Virginia 23230.

The committee’s minimum qualifications and specific qualities and skills required for directors are set forth in Section 3 of Genworth’s Governance Principles, which is included in this Proxy Statement as Appendix A, at page A-1. In addition to considering candidates suggested by stockholders, the committee considers potential candidates recommended by current directors, company officers, employees and others. We have also engaged an outside search firm to assist us in identifying and evaluating potential director candidates. The committee considers all potential candidates in the same manner regardless of the source of the recommendation. The committee’s review is typically based on any written materials provided with respect to the candidate. The committee determines whether the candidate meets our general qualifications and specific qualities and skills for directors and whether requesting additional information or an interview is appropriate.

Director Compensation

Each independent director is paid an annual fee of $160,000 in quarterly installments, following the end of each quarter of service. Of this amount, 40% (or $64,000) of the annual fee is paid in cash and 60% (or $96,000)

11

is paid in deferred stock units, or DSUs. Instead of receiving a cash payment, directors may elect to have up to 100% of their annual fee paid in DSUs. The board has elected not to adopt a policy of meeting fees because attendance is expected at all scheduled board and committee meetings, absent exceptional cause. Each DSU is equal in value to a share of our stock but does not have voting rights. DSUs accumulate regular quarterly dividends which are reinvested in additional DSUs. The DSUs will be paid out in cash beginning one year after the director leaves the board. Directors may elect to take their DSU payments as a lump sum or in equal payments spread out for up to ten years.

Our independent directors are eligible to participate in our program of charitable contributions on the same terms as Genworth’s and GE’s employees (including the GE-designated directors). Under that program, we match up to $25,000 per year in contributions by each director to an eligible institution. This benefit will continue until at least the date that GE ceases to own at least 50% of our outstanding common stock.

Controlled Company Exception

GEFAHI, a subsidiary of GE, controls more than 50% of our voting power. See “Information Relating to Directors, Director Nominees, Executive Officers and Significant Stockholders—Ownership of Common Stock.” As a result, we qualify as a “controlled company” as defined in Rule 303A.00 of the NYSE Listing Rules. Therefore, we are exempt from the requirements of the NYSE Listing Rules with respect to our board of directors consisting of a majority of “independent directors” and the related rules covering the independence of directors serving on the Management Development and Compensation Committee and Nominating and Corporate Governance Committee. The controlled company exemption does not modify the independence requirements for the Audit Committee.

Meetings of Non-Employee and Independent Directors

Our Governance Principles provide that our board will meet at least three times per year without the presence of directors who are also employees of Genworth. Dennis D. Dammerman, as chair of the Management Development and Compensation Committee, has been chosen to preside over meetings of the non-employee directors. Michael D. Fraizer, our President and Chief Executive Officer, is currently the only employee of Genworth who serves on our board. In addition, our Governance Principles provide that the independent directors on our board (whose independence is determined in accordance with our Governance Principles) will meet at least once per year without the presence of non-independent directors. Mr. Borelli, as chair of the Audit Committee, has been chosen to preside over meetings of the independent directors.

12

INFORMATION RELATING TO DIRECTORS, DIRECTOR NOMINEES, EXECUTIVE OFFICERS AND SIGNIFICANT STOCKHOLDERS

The following table sets forth information as of April 1, 2005 regarding the beneficial ownership of our common stock by:

| • | all persons known by us to own beneficially more than 5% of any class of our common stock; |

| • | our chief executive officer and each of the persons who were the four other most highly compensated executive officers in 2004; |

| • | each of our directors; and |

| • | all directors and executive officers as a group. |

Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock issuable upon the exercise of stock options or conversion of other securities held by that person that are currently exercisable or convertible, or are exercisable or convertible within 60 days of April 1, 2005 are deemed to be issued and outstanding. These shares, however, are not deemed outstanding for purposes of computing percentage ownership of each other stockholder. As of April 1, 2005, there were 227,021,128 shares of Class A Common Stock and 243,216,559 shares of Class B Common Stock outstanding. The percentages in the table below are based on a total of 470,237,687 shares of common stock outstanding.

Except for GEFAHI, each of the persons listed below is the beneficial owner of shares of our Class A Common Stock. GEFAHI is the beneficial owner of all of the outstanding shares of our Class B Common Stock and no shares of our Class A Common Stock. The Class B Common Stock may be owned only by GE and its affiliates. Upon any sale or other disposition by GE and its affiliates of shares of Class B Common Stock to any person other than GE or an affiliate of GE, such shares of Class B Common Stock automatically convert into shares of Class A Common Stock. In addition, on the first date on which GE and its affiliates no longer beneficially owns at least 10% of the aggregate number of shares of Class A Common Stock and Class B Common Stock outstanding, all outstanding shares of Class B Common Stock automatically convert into shares of Class A Common Stock. Shares of Class B Common Stock convert into shares of Class A Common Stock on a share-for-share basis.

GE beneficially owns approximately 51.7% of our outstanding common stock (consisting of 100% of our outstanding shares of Class B Common Stock and no shares of Class A Common Stock). GE’s transfer of assets to us in our corporate reorganization has been structured to qualify for the election under section 338 of the Internal Revenue Code, and GE has received a ruling from the U.S. Internal Revenue Service that the transfer will qualify for that election provided that certain conditions are met. Among those conditions is that GE must complete its disposition of more than 50% by value of its interest in Genworth by May 27, 2006. GE has informed us that its failure to satisfy this condition and to qualify for the tax election would result both in significant additional tax liability for GE and in elimination of the section 338 benefit (and Genworth’s associated liability) that is the subject of the Tax Matters Agreement, as discussed under “Certain Relationships and Transactions—Relationship with GE—Tax Matters Agreement.” Accordingly, GE has informed us that it fully intends to and expects to meet this condition and has adopted a Plan of Divestiture under which it will effect the divestiture of more than 50% of our stock. GE has informed us that it intends to implement methods that it deems suitable to divest of our common stock in order to carry out the Plan of Divestiture and to satisfy this divestiture condition.

13

The address of each director and executive officer listed below is c/o Genworth Financial, Inc., 6620 West Broad Street, Richmond, Virginia 23230.

| Name and Address of Beneficial Owner |

Beneficial Ownership |

||||

| Number |

Percentage |

||||

| GEFAHI(1) |

243,216,559 | 51.7 | % | ||

| NWQ Investment Management Company, LLC(2) |

16,090,930 | 3.4 | |||

| Dodge & Cox(3) |

15,992,200 | 3.4 | |||

| FMR Corp.(4) |

12,397,300 | 2.6 | |||

| Michael D. Fraizer(5) |

1,423,726 | * | |||

| Thomas H. Mann(6) |

170,300 | * | |||

| Pamela S. Schutz(6) |

75,774 | * | |||

| George R. Zippel(6) |

63,534 | * | |||

| K. Rone Baldwin(6) |

79,279 | * | |||

| Frank J. Borelli |

— | * | |||

| Elizabeth J. Comstock(7) |

— | * | |||

| Pamela Daley(7) |

— | * | |||

| Dennis D. Dammerman(7) |

— | * | |||

| J. Robert Kerrey |

— | * | |||

| David R. Nissen(7) |

— | * | |||

| James A. Parke(7) |

— | * | |||

| Thomas B. Wheeler |

— | * | |||

| All directors and executive officers as a group (22 persons) |

2,057,741 | * | |||

| * | Less than 1%. |

| (1) | The address for GEFAHI is 6620 West Broad Street, Richmond, Virginia 23230. GE, as the ultimate parent of GEFAHI, beneficially owns all shares of our common stock owned of record by GEFAHI. The address for GE is 3135 Easton Turnpike, Fairfield, Connecticut 06828. |

| (2) | Information obtained solely by reference to the Schedule 13G filed with the SEC on February 14, 2005 by NWQ Investment Management Company, LLC (“NWQ”). NWQ reported that it has sole power to vote or direct the vote of 13,765,475 shares and sole power to dispose or to direct the disposition of 16,090,930 shares. NWQ reported that such securities are beneficially owned by its clients, which clients may include investment companies registered under the Investment Company Act of 1940 and/or employee benefit plans, pension funds, endowment funds or other institutional clients. The address for NWQ is 2049 Century Park East, 4th Floor, Los Angeles, California 90067. |

| (3) | Information obtained solely by reference to the Schedule 13G filed with the SEC on February 10, 2005 by Dodge & Cox. Dodge & Cox reported that it has sole power to vote or direct the vote of 15,145,500 shares, shared power to vote or to direct the vote of 132,700 shares, and sole power to dispose or to direct the disposition of 15,992,200 shares. Dodge & Cox reported that such securities are beneficially owned by its clients, which clients may include investment companies registered under the Investment Company Act of 1940 and/or employee benefit plans, pension funds, endowment funds or other institutional clients. The address for Dodge & Cox is 555 California Street, 40th Floor, San Francisco, California 94104. |

| (4) | Information obtained solely by reference to the Schedule 13G filed with the SEC on February 14, 2005 by FMR Corp. (“FMR”). FMR reported that it has no power to vote or direct the vote of any shares that it beneficially owns and that it has sole power to dispose or to direct the disposition of 12,397,300 shares. FMR reported that it filed such report as a parent holding company. FMR further reported that various persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, our common stock and that no one person’s interest is more than five percent of our total outstanding common stock. The address for FMR is 82 Devonshire St., Boston, Massachusetts, 02109. |

14

| (5) | Reflects (a) shares of Class A Common Stock issuable upon the exercise of unvested employee stock options, to the extent that such unvested employee stock options vest within 60 days of April 1, 2005, (b) shares of Class A Common Stock issuable upon the exercise of vested employee stock options, and (c) shares of Class A Common Stock issuable upon the vesting of restricted stock units and stock appreciation rights, to the extent that such restricted stock units and stock appreciation rights vest within 60 days of April 1, 2005. |

| (6) | Reflects (a) shares of Class A Common Stock issuable upon the exercise of unvested employee stock options, to the extent that such unvested employee stock options vest within 60 days of April 1, 2005, and (b) shares of Class A Common Stock issuable upon the vesting of restricted stock units, to the extent that such restricted stock units vest within 60 days of April 1, 2005. |

| (7) | Each of the specified persons is a director or officer of GE and disclaims beneficial ownership of any shares of our common stock owned by GEFAHI. |

15

REPORT OF THE MANAGEMENT DEVELOPMENT AND COMPENSATION COMMITTEE

The Management Development and Compensation Committee of the board of directors carries out the board of directors responsibilities with respect to determining the compensation for our executive officers, overseeing the development of executive succession plans and administration of the company’s executive compensation programs. We approve all of the policies under which compensation is paid or awarded to our executives, and individually review the performance of, and all compensation actions affecting, our executive officers – the chief executive officer (CEO), presidents and the senior vice presidents.

The committee is composed of three directors, a majority of whom are independent, and once GE ceases to be a majority stockholder all of the members of the committee will be independent. The committee is advised by an independent compensation consultant retained by the committee and under the direction of the committee. For more information about the committee’s charter and key practices, visit the corporate governance section of the Genworth Financial website at www.genworth.com.

Executive Compensation Philosophy

We believe our principal responsibility in compensating executives is to enable the company to attract, motivate, reward and retain executives of superior ability who are dedicated to the long-term interests of the stockholders. We use a variety of compensation elements to achieve these goals, including:

| • | Salary |

| • | Annual bonus |

| • | Stock options and stock appreciation rights |

| • | Restricted stock units |

| • | Long-term performance awards |

We discuss below how we have used these awards and a number of other steps to strengthen the alignment of our executives’ interests with the long-term interests of investors and other stakeholders.

Components of Executive Compensation

Each element of the company’s executive compensation program serves a somewhat different purpose:

| • | Salary. Salary payments are made to compensate for ongoing performance throughout the year. |

| • | Annual Bonus. Annual bonuses for executive officers are based on our evaluation of the significance of each executive’s contribution in the performance year to both short-term objectives and their impact on the long-term interests of stockholders. Bonuses are paid in February for the prior year’s performance and are based upon our evaluation of each executive officer’s individual performance in the prior year in the context of our assessment of the overall performance of the company and the executive’s business unit. This includes an assessment of the executive’s contribution to the achievement of financial performance and other key goals established for the company at the beginning of the performance year. |

| • | Stock Options and Stock Appreciation Rights. We consider stock options and stock appreciation rights (SARs) to be an extremely effective form of compensation for officers and other key employees because they provide incentives for superior performance leading to enhanced stockholder value. Stock options and SARs also encourage employee retention because they vest over a period of years. Each stock option permits the executive to purchase one share of Genworth stock from the company at the market price of Genworth stock on the date of grant. SARs, which are only payable in stock, permit the executive to receive shares of Genworth stock from the company equal in value to the difference between the price of Genworth |

16

| stock on the day the SARs were granted and the market price on the day they are exercised, multiplied by the number of SARs exercised. SARs deliver the same economic value to the executive at the same cost to the company as stock options, but with less dilution. |

In connection with our IPO in 2004, the company granted stock options to over 5,700 employees worldwide as “founding members” to ensure broad-based employee alignment with the long-term interests of stockholders. Also in connection with the IPO, we granted SARs, instead of stock options, to the company’s CEO and other executive officers. These grants are exercisable in four equal annual installments beginning two years after the grant date.

| • | Restricted Stock Units. We anticipate we will grant restricted stock units (RSUs) periodically to provide strong incentives for superior performance and to encourage retention since unvested RSUs are forfeited if the executive leaves the company prior to the lapse of restrictions. In connection with the IPO, we converted GE RSUs held by our employees into Genworth RSUs, maintaining the previous provisions and vesting schedule. Restrictions on those converted RSUs lapse in varying increments, typically ranging from three years to retirement. |

| • | Long-Term Performance Awards. We will periodically grant long-term performance incentive awards to senior operating managers and key executives to provide additional emphasis on the attainment of specific financial measurements designed to enhance long-term stockholder value. Such a grant was made in 2004. |

All of the awards described above are granted in accordance with the terms of the 2004 Genworth Financial Inc., Omnibus Incentive Plan (the “Genworth Omnibus Plan”), established in connection with the company’s IPO. That plan is described in more detail under “Approval of the 2004 Genworth Financial, Inc. Omnibus Incentive Plan” in this proxy statement, and is being presented for stockholder approval at this, the first, annual stockholders’ meeting.

Executive Compensation Policy Actions

We have taken the following policy actions in 2004 to further align the interests of the company’s officers with investors’ long-term interests:

| • | Stock Ownership Guidelines. To help demonstrate the alignment of the personal interest of the company’s executive officers with the interests of stockholders, we established the following guidelines for the amount of Genworth stock, as a multiple of the executive’s base salary, that must be held by the executive: |

| Executive Level | Multiple | Time to Attain | ||

| CEO |

5 x salary | 5 years | ||

| Segment Presidents and |

2 x salary | 5 years |

The number of shares of stock that must be held will be determined by multiplying the executive’s annual base salary in effect on the date the executive becomes subject to the ownership requirements by the applicable multiple shown above, and dividing the result by the average closing price of the company’s stock during the immediately preceding 12 months. In the case of executive officers who became subject to the ownership guidelines in 2004, the number of shares was established by dividing the executive’s annual base salary in effect on the date of our IPO by the IPO price ($19.50) of the company’s Class A Common Stock. In order to meet this stock ownership requirement, an executive may count all shares of stock owned by the executive, including stock held in the company’s 401(k) plan, stock units held in any deferral plan and any company RSUs, but excluding any RSUs that lapse upon retirement. Each executive must attain ownership of the required stock ownership level within five years after GE ceases to own more than 50% of the company’s outstanding stock (or if later, within five years of becoming an executive officer) and maintain ownership of at least such amount of the company’s stock while they hold office.

17

In order to assist any particular executive in obtaining the required level of stock ownership, each executive will be given the option, exercisable at any time during the five-year period above, to elect to receive a portion of his or her annual bonus, including long-term performance awards, in shares of our Class A Common Stock. In the event that an executive fails to reach a required level of stock ownership during the five-year period above, we will require the executive to be paid, in lieu of any annual cash bonus payments, in shares of our Class A Common Stock until the applicable required level of stock ownership is obtained.

Recognizing the importance of stock ownership by the CEO and other executive officers, the founders grant of SARs also represents significant alignment of the interests of the executives with the stockholders and will further encourage stock ownership once the SARs vest and are exercised.

| • | Stock Holding Period. In order to minimize any possible appearance of an incentive for executives to seek to cause short-term increases in the price of Genworth shares in order to exercise stock options or SARs and sell the stock for unwarranted personal gains, we require that executive officers hold for at least nine months the shares of Genworth stock that they receive by exercising stock options or SARs (net of any shares applied for a cashless exercise or to pay applicable taxes). This requirement applies to the CEO and the other executive officers. |

| • | Prohibit Stock Option Repricing. We affirm a policy prohibiting the repricing of stock options, including by amendments to outstanding options to lower their exercise price, and the cancellation of outstanding options and replacing them with new options. |

| • | Change of Control. The committee believes the best time to consider the appropriateness of change of control provisions is when a change of control is not imminent and before the lack of such a plan poses a risk to corporate policy effectiveness. As a result, the committee thoughtfully evaluated the considerations, implications and economics of a change of control plan and has adopted one that balances the cost to the company and its stockholders relative to potential damage from distraction or loss of key executives. The committee recognizes the importance of reducing the risk that the fear of job loss will influence executives considering strategic opportunities that may include a change of control of our company, and avoiding distractions that may result from potential, rumored or actual changes of control. Severance benefits are only paid if a change of control occurs and an executive is terminated without cause or by the designated executives for good reason. The definition of change of control specifically excludes a change in the ownership level of GE or its affiliates. The plan is described beginning on page 28 of this proxy statement. |

Factors Considered in Making Compensation Decisions

We individually review the performance of the executive officers and establish and approve every compensation action for them. We review the compensation actions for all of the company’s officers and regularly evaluate the effectiveness of the different elements of the company’s basic executive compensation programs for all of the company’s executives.

Our judgments regarding executive officer compensation are primarily based on our assessment of each executive officer’s leadership performance and potential to enhance long-term stockholder value. In determining the amount and mix of compensation elements for each executive officer, we rely upon our judgment about each individual, not upon rigid guidelines or formulas or short-term changes in the company’s stock price. Key factors affecting our judgments include: the nature and scope of the officer’s responsibilities; the officer’s contribution to the company’s financial results; the officer’s effectiveness in leading the company’s initiatives to increase customer value, productivity and growth; the officer’s contribution to the company’s commitment to corporate responsibility including the officer’s success in creating a culture of unyielding integrity and compliance with applicable laws and the company’s ethics policies; and the officer’s commitment to community leadership and diversity.

18

With respect to annual bonus awards to be earned in 2005, the committee adopted measures and established the maximum awards payable to our executive officers (see “Incentive Compensation Plan” in this proxy statement). As was the case in 2004, the performance measures for 2005 are positive annual net earnings as determined under U.S. GAAP (“Net Earnings”) and positive annual earnings from continuing operations before income taxes and accounting changes as determined under U.S. GAAP (“Consolidated Operating Earnings”). The actual annual awards payable to our executive officers for 2005 will depend on various company-specific and individual-specific performance measures, as determined by the committee. For 2005, the company-specific performance measures include, but are not limited to, Net Earnings and Consolidated Operating Earnings, as well as net operating earnings, net operating earnings per share and per diluted share, and operating return on equity.

In the process of reviewing each component of compensation separately, and in the aggregate, we also examine the internal relationships among the executive officers and determine whether the differences are appropriate. We also consider the compensation levels and performance of a comparison group of major companies that are most likely to compete with us for the services of executive officers, specifically similarly sized companies within the insurance and financial services industry.

Section 162(m) of the Internal Revenue Code restricts deductibility of annual individual compensation in excess of $1 million provided to our CEO and the next four highest paid executive officers if certain conditions set forth in the Code are not fully satisfied. To the extent practicable, we intend to preserve the deductibility of compensation paid to the company’s executive officers while maintaining compensation programs that effectively attract and retain superior talent. Accordingly, compensation provided under the company’s Omnibus Incentive Plan is generally intended to be tax-deductible. On occasion, however, it may not be possible to satisfy all conditions of the Code for deductibility and still meet our compensation needs. In such limited situations, certain compensation paid to some executives may not be tax-deductible.

Executive Compensation Actions

Prior to the company’s IPO, the CEO and other executive officers named in the Summary Compensation Table were employees of GE. Most of the compensation actions for the executive officers in 2004 were determined by GE. Such actions included determination of executive officer salaries, setting annual bonus targets and goals, conversion of outstanding GE options, SARs and RSUs to Genworth awards, awarding “Founders Grant” options and SAR awards, and establishing long-term performance award levels and goals. Our board of directors affirmed those compensation decisions, and then chartered this committee to provide future oversight to those and any other compensation actions relating to the executive officers. This committee, however, determined annual bonus payouts for our executive officers based on the degree of achievement relative to pre-established, objective financial performance goals. That level of achievement was then applied to the plan design in determining actual bonuses earned.

Compensation of the Chief Executive Officer

In 2004, we reviewed all components of Mr. Fraizer’s compensation, including salary, annual bonus, long-term incentives, benefits, deferred compensation, and perquisites. Based on this review, we find Mr. Fraizer’s total compensation to be commensurate with the market.

Specifically, we paid Mr. Fraizer $1,025,000 in salary, which had been his base salary rate since 2003, before the company’s IPO. We also paid Mr. Fraizer an annual bonus of $1,800,000 based on our assessment of the level of actual achievement relative to the pre-determined key performance metrics and the application of the bonus plan design. We used the same metrics and process in determining the bonuses of the other executive officers.

19

In connection with the company’s IPO, Mr. Fraizer was granted 1,900,000 SARs, as one of the “founding members” of our company. The size of the award was determined considering similar grants provided to CEOs during recent IPOs of similarly-sized companies in the financial services industry. Mr. Fraizer’s grant of SARs vests in four equal installments beginning on the second anniversary of the grant date. As stated previously, over 5,700 of the company’s employees worldwide received “Founders Grants” of stock options to establish immediate alignment of employee to long-term stockholder interests.

As part of a balanced incentive package, we also provided Mr. Fraizer with a long-term performance award opportunity equal to two times his salary and bonus (as of March 1, 2004) at target, one times his salary and bonus at threshold, and two-and-a-half times his salary and bonus at maximum. The payout will be based on the company’s achievement relative to financial performance targets for ROE growth and operating earnings growth measured over the three-year 2004-2006 period. We believe these performance metrics will be major drivers for our long-term strategy to enhance stockholder value. If the threshold level of performance is not achieved, no payouts will be delivered.

In the process of affirming each component of Mr. Fraizer’s compensation separately, and in the aggregate, we examined the relationship between Mr. Fraizer’s pay and that of the other officers of the company. We believe the relative differences are appropriate. We had discussions and made decisions relative to Mr. Fraizer’s bonus payout in 2004 in executive session, without the CEO present.

In summary, a substantial portion of Mr. Fraizer’s potential compensation for 2004 was at risk and based on the achievement of specific performance results. As a result, we believe his total compensation package meets our compensation objectives, is in line with our compensation philosophy, and supports the company’s business strategy.

The foregoing report on executive compensation is provided by the undersigned members of the Management Development and Compensation Committee of the board of directors of Genworth Financial, Inc.

Dennis D. Dammerman, Chair

Frank J. Borelli

Thomas B. Wheeler

20

Benefit Plans—Transition from GE to Genworth Plans

Prior to the IPO, our employees were covered under GE benefit plans. For so long as GE owns more than 50% of our outstanding common stock, we will be part of the GE group, and our employees generally will continue to be eligible to participate in GE benefit plans, except as noted below. These GE benefit plans include the GE 1990 Long-Term Incentive Plan providing stock options, stock appreciation rights, or SARs, restricted stock unit awards, or RSUs, and long-term performance incentive awards; the GE Incentive Compensation Plan providing annual incentive compensation; retirement programs providing pension, 401(k), health and life insurance benefits; medical, dental and vision benefits for active employees; disability and life insurance protection; and severance.

When GE ceases to own more than 50% of our outstanding common stock, we anticipate that our employees will be covered by the benefit plans that we expect to establish. However, for our non-U.S. employees, benefit transition may be delayed, by mutual agreement between GE and us, for up to six months following the date that GE ceases to own more than 50% of our outstanding common stock (such date, whether delayed or not, is referred to as the “International Benefit Transition Date”).

Prior to the IPO, some of the employees of our business received certain awards under the GE 1990 Long-Term Incentive Plan. The treatment of these outstanding awards in connection with the IPO are described below under “—GE 1990 Long-Term Incentive Plan.” Following the completion of the IPO, our employees are no longer eligible to receive new awards under the GE 1990 Long-Term Incentive Plan.

In connection with the IPO, we established plans for our selected employees providing for cash or other bonus awards, stock options, stock awards, restricted stock, other equity-related awards and long-term performance awards. However, certain of our employees continue to participate in the GE Incentive Compensation Plan based on our company- and individual-specific performance measures. Our corresponding plan providing for annual cash or other bonus awards will not become effective until the date that GE ceases to own more than 50% of our outstanding common stock. See “Approval of the 2004 Genworth Financial, Inc. Omnibus Incentive Plan” and “—Incentive Compensation Plan” for information concerning these plans.

Until GE ceases to own more than 50% of our outstanding common stock or, in the case of our applicable non-U.S. employees, the International Benefit Transition Date, we will continue to reimburse GE for the costs incurred by GE and its affiliates for continuing coverage of our employees in the GE benefit plans. We also will continue to reimburse GE for the reasonable costs incurred by GE and its affiliates for cooperating in the operation and administration of our benefit plans, including our plans providing for stock options, stock awards, restricted stock, other equity-related awards and long-term performance awards and, to some extent, for the tax benefits we realize in connection with these compensation and benefit plans and arrangements. See “Certain Relationships and Transactions—Relationship with GE—Employee Matters Agreement” for information concerning our benefit plans, our reimbursement obligations to GE, and other employment matters, and see “Certain Relationships and Transactions—Relationship with GE—Tax Matters Agreement.”

GE 1990 Long-Term Incentive Plan

Prior to the IPO, some of our executive employees received stock options, SARs, RSUs and long-term performance incentive awards under the GE 1990 Long-Term Incentive Plan. The following is a description of the treatment of those awards in connection with the IPO and our separation from GE.