Filed Pursuant to

Rule 424(b)1

Registration No. 333-115019

PROSPECTUS

24,000,000 Equity Units

(Initially Consisting of 24,000,000 Corporate Units)

6.00% Equity Units

GE Financial Assurance Holdings, Inc., the seller and an indirect subsidiary of General Electric Company, or GE, is offering all 24,000,000 6.00% Equity Units of Genworth Financial, Inc. to be sold in this offering.

Each Equity Unit will have a stated amount of $25 and will consist of a purchase contract issued by us and, initially, a 1/40, or 2.5%, undivided beneficial ownership interest in a $1,000 principal amount senior note due May 16, 2009, issued by us, which we refer to as a Corporate Unit.

This offering of Equity Units is being made concurrently with the initial public offering of our Class A Common Stock and the offering of our 5.25% Series A Cumulative Preferred Stock by the seller pursuant to separate prospectuses. The Class A Common Stock has been approved for listing on The New York Stock Exchange under the symbol "GNW." The Corporate Units have been approved for listing on The New York Stock Exchange under the symbol "GNW Pr E." We expect trading of the Corporate Units on The New York Stock Exchange to commence on or about May 28, 2004. Prior to this offering, there has been no public market for the Corporate Units or our Class A Common Stock. This offering of Equity Units is contingent upon the completion of the offerings of our Class A Common Stock and Series A Cumulative Preferred Stock.

We will not receive any proceeds from the sale by the seller of the Equity Units in this offering or the Class A Common Stock or Series A Cumulative Preferred Stock in the concurrent offerings.

Investing in our Corporate Units involves risks. See "Risk Factors" beginning on page 22.

| |

Per Unit |

Total |

||

|---|---|---|---|---|

| Price to public | $25.00 | $600,000,000 | ||

| Underwriting discounts and commissions | $ 0.75 | $ 18,000,000 | ||

| Proceeds to seller | $24.25 | $582,000,000 |

The initial public offering price set forth above does not include accumulated contract adjustment payments and accrued interest, if any. Contract adjustment payments on the purchase contracts and interest attributable to the undivided beneficial ownership interests in the notes will accrue for purchasers in this offering from May 28, 2004.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Corporate Units to purchasers on May 28, 2004.

| Morgan Stanley | Goldman, Sachs & Co. |

Banc of America Securities LLC Deutsche Bank Securities Merrill Lynch & Co. |

Citigroup JPMorgan UBS Investment Bank |

Credit Suisse First Boston Lehman Brothers |

May 24, 2004

| |

Page |

|

|---|---|---|

| Prospectus Summary | 1 | |

| Risk Factors | 22 | |

| Forward-Looking Statements | 57 | |

| Use of Proceeds | 58 | |

| Dividend Policy | 58 | |

| Capitalization | 59 | |

| Accounting Treatment | 63 | |

| Ratio of Earnings to Fixed Charges | 64 | |

| Selected Historical and Pro Forma Financial Information | 65 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 80 | |

| Corporate Reorganization | 142 | |

| Business | 145 | |

| Regulation | 225 | |

| Management | 236 | |

| Arrangements Between GE and Our Company | 259 | |

| Description of Equity Units | 287 | |

| Description of the Purchase Contracts | 291 | |

| Certain Provisions of the Purchase Contracts and the Purchase Contract and Pledge Agreement | 302 | |

| Description of the Notes | 308 | |

| Ownership of Common Stock | 317 | |

| Description of Capital Stock | 320 | |

| Description of Certain Indebtedness | 332 | |

| Shares Eligible for Future Sale | 335 | |

| Certain United States Federal Income Tax Consequences | 337 | |

| ERISA Considerations | 345 | |

| Underwriters | 346 | |

| Legal Matters | 351 | |

| Experts | 351 | |

| Additional Information | 351 | |

| Index to Financial Statements | F-1 | |

| Glossary of Selected Insurance Terms | G-1 |

i

This summary highlights information contained elsewhere in this prospectus and may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the information set forth in "Risk Factors," before making an investment decision.

We are a leading insurance company in the U.S., with an expanding international presence, serving the life and lifestyle protection, retirement income, investment and mortgage insurance needs of more than 15 million customers. We have leadership positions in key products that we expect will benefit from a number of significant demographic, governmental and market trends. We distribute our products and services through an extensive and diversified distribution network that includes financial intermediaries, independent producers and dedicated sales specialists. We conduct operations in 20 countries and have approximately 5,850 employees.

We have the following three operating segments:

1

We also have a Corporate and Other segment, which consists primarily of net realized investment gains (losses), most of our interest and other financing expenses, unallocated corporate income and expenses, and the results of several small, non-core businesses that are managed outside our operating segments. For the year ended December 31, 2003 and the three months ended March 31, 2004, our Corporate and Other segment had a pro forma segment net loss of $4 million and pro forma segment net earnings of $9 million, respectively.

We had $12.2 billion of total stockholder's interest and $100.2 billion of total assets as of March 31, 2004, on a pro forma basis. For the year ended December 31, 2003 and the three months ended March 31, 2004, on a pro forma basis, our revenues were $9.8 billion and $2.6 billion, respectively, and our net earnings from continuing operations were $939 million and $267 million, respectively. Upon the completion of this offering, we expect our principal life insurance companies to have financial strength ratings of "AA-" (Very Strong) from S&P, "Aa3" (Excellent) from Moody's, "A+" (Superior) from A.M. Best and "AA-" (Very Strong) from Fitch, and we expect our rated mortgage insurance companies to have financial strength ratings of "AA" (Very Strong) from S&P, "Aa2" (Excellent) from Moody's and "AA" (Very Strong) from Fitch. The "AA" and "AA-" ratings are the third- and fourth-highest of S&P's 21 ratings categories, respectively. The "Aa2" and "Aa3" ratings are the third- and fourth-highest of Moody's 21 ratings categories, respectively. The "A+" rating is the second-highest of A.M. Best's 15 ratings categories. The "AA" and "AA-" ratings are the third- and fourth-highest of Fitch's 24 ratings categories, respectively.

Market Environment and Opportunities

We believe we are well positioned to benefit from a number of significant demographic, governmental and market trends, including the following:

Competitive Strengths

We believe the following competitive strengths will enable us to capitalize on opportunities in our targeted markets:

2

relationships. We refer to our approach to product diversity as "smart" breadth because we are selective in the products we offer and strive to maintain appropriate return and risk thresholds when we expand the scope of our product offerings.

Growth Strategies

Our objective is to increase operating earnings and enhance returns on equity. We intend to pursue this objective by focusing on the following strategies:

Retirement income, where we believe growth will be driven by a variety of favorable demographic trends and the approximately $4.4 trillion of invested financial assets in the U.S. that are held by people within 10 years of retirement. Our products are designed to enable the growing retired population to convert their invested assets into reliable retirement income.

Protection, particularly long-term care insurance, where we believe growth will be driven by the increasing protection needs of the expanding aging population and a shifting of the burden for funding these needs to individuals from governments and employers. For example, it is

3

estimated that approximately 70% of individuals in the U.S. aged 65 and older will require long-term care at some time in their lives, but in 2001, only 7% of individuals in the U.S. aged 55 and older had long-term care insurance.

International mortgage insurance, where we continue to see attractive growth opportunities with the expansion of homeownership and low-down-payment loans. The net premiums written in our international mortgage insurance business have increased by a compound annual growth rate of 46% for the three years ended December 31, 2003.

Product and service innovations, as illustrated by new product introductions, such as the introduction in 2002 of our GE Retirement Answer®, our introduction of innovative private mortgage insurance products in the European market, and our service innovations, which include programs such as our policyholder wellness initiatives in our long-term care insurance business and our AU Central® Internet platform in our mortgage insurance business.

Collaborative approach to key distributors, which includes a joint business improvement program (originally developed by GE), called "At the Customer, For the Customer," or ACFC, and our platinum customer service desks, which have benefited our distributors and helped strengthen our relationships with them.

Technology initiatives, such as our GENIUS® underwriting system, which makes it easier for distributors to do business with us, improves our term life and long-term care insurance underwriting speed and accuracy, and lowers our operating costs.

Rigorous product pricing and return discipline. We intend to maintain strict product pricing disciplines that are designed to achieve our target returns on capital. Over the past two years, we introduced restructured pricing on newly issued policies in each of our operating segments and exited products that were not achieving our target returns. We expect our returns on capital to improve as the benefits of these actions emerge and as we continue our focus on maintaining target returns.

Capital efficiency enhancements. We continually seek opportunities to use our capital more efficiently to support our business, while maintaining our ratings and strong capital position. For example, in 2003, we took actions to reduce the statutory capital required to support most of our new term and universal life insurance policies and to reduce excess capital at our mortgage insurance subsidiaries by operating at an "AA/Aa2" rating level.

Investment income enhancements. As part of GE, the yield on our investment portfolio has been affected by the practice in recent years of realizing investment gains through the sale of appreciated securities and other assets during a period of historically low interest rates. This strategy was pursued to offset impairments and losses in our investment portfolio, fund consolidations and restructurings in our business and provide current income. As we transition to being an independent public company, our investment strategy will be to optimize investment income without relying on realized investment gains. We will seek to improve our investment yield by continuously evaluating our asset class mix and pursuing additional investment classes.

Ongoing operating cost reductions and efficiencies. We will continually focus on reducing our cost base while maintaining strong service levels for our customers. We expect to accomplish

4

this in each of our operating units through a wide range of cost management disciplines, including consolidating operations, using low-cost operating locations, reducing supplier costs, leveraging Six Sigma and other process improvement efforts, forming dedicated teams to identify opportunities for cost reductions and investing in new technology, particularly for web-based, digital end-to-end processes.

Formation of Genworth Financial, Inc.

We were incorporated in Delaware on October 23, 2003 in preparation for our corporate reorganization and this offering.

Prior to the completion of this offering and the concurrent offerings, we will acquire substantially all of the assets and liabilities of GE Financial Assurance Holdings, Inc., or GEFAHI. GEFAHI is an indirect subsidiary of GE and a holding company for a group of companies that provide life insurance, long-term care insurance, group life and health insurance, annuities and other investment products and U.S. mortgage insurance. We also will acquire certain other insurance businesses currently owned by other GE subsidiaries but managed by members of the Genworth management team. These businesses include international mortgage insurance, European payment protection insurance, a Bermuda reinsurer and mortgage contract underwriting.

In consideration for the assets that we will acquire and the liabilities that we will assume in connection with our corporate reorganization, we will issue to GEFAHI the following securities:

5

The liabilities we will assume from GEFAHI include ¥60 billion aggregate principal amount of 1.6% notes due 2011 issued by GEFAHI, ¥3 billion of which GEFAHI currently owns and will transfer to us. We refer to these notes in this prospectus as the Yen Notes. We have entered into arrangements to swap our obligations under these notes to a U.S. dollar obligation with a principal amount of $491 million and bearing interest at a rate of 4.84% per annum.

Prior to the completion of this offering and the concurrent offerings, GEFAHI will own 100% of our outstanding common stock, which will consist solely of Class B Common Stock. Shares of Class B Common Stock convert automatically into shares of Class A Common Stock when they are held by any person other than GE or an affiliate of GE or when GE no longer beneficially owns at least 10% of our outstanding common stock. As a result, all the shares of common stock offered in the concurrent offering consist of Class A Common Stock. Upon the completion of this offering and the concurrent offerings, GE will beneficially own approximately 70% of our outstanding common stock, assuming the underwriters' over-allotment option in the concurrent offering of Class A Common Stock is not exercised, and 66%, if it is exercised in full. GE has informed us that, after completion of this offering, it intends, subject to market conditions, to divest its remaining interest in us as soon as practicable. GE has also informed us that, in any event, it expects to reduce its interest to below 50% within two years of the completion of this offering. GE currently expects to reduce its interest through one or more additional public offerings of our common stock, but it is not obligated to divest our shares in this or any other manner.

Prior to the completion of this offering, we will enter into a number of arrangements with GE governing our separation from GE and a variety of transition and other matters, including our relationship with GE while GE remains a significant stockholder in our company. These arrangements include several significant reinsurance transactions with Union Fidelity Life Insurance Company, or UFLIC, an indirect subsidiary of GE. As part of these transactions, we will cede to UFLIC, effective as of January 1, 2004, all of our in-force structured settlement contracts, substantially all of our in-force variable annuity contracts, and a block of long-term care insurance policies that we reinsured in 2000 from The Travelers Insurance Company, a subsidiary of Citigroup, Inc., which we refer to in this prospectus as Travelers. In the aggregate, these blocks of business do not meet our target return thresholds, and although we remain liable under these contracts and policies as the ceding insurer, the reinsurance transactions will have the effect of transferring the financial results of the reinsured blocks to UFLIC. We are continuing new sales of structured settlement, variable annuity and long-term care insurance products, and we expect to achieve our targeted returns on these new sales. In addition, we will continue to service these blocks of business, which will preserve our operating scale and enable us to service and grow our new sales of these products. See "Arrangements Between GE and Our Company."

6

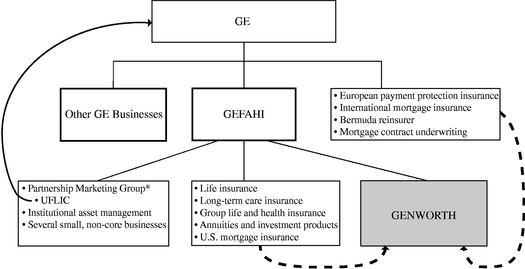

The diagram below shows the relationships among GE, GEFAHI and Genworth prior to the completion of our corporate reorganization. The dotted lines indicate the businesses that will be transferred to Genworth in connection with our corporate reorganization.

* The Partnership Marketing Group offers life and health insurance, auto club memberships and other financial products and services directly to consumers through affinity marketing arrangements with a variety of organizations. The Partnership Marketing Group historically included UFLIC, a subsidiary that offered the life and health insurance for these arrangements.

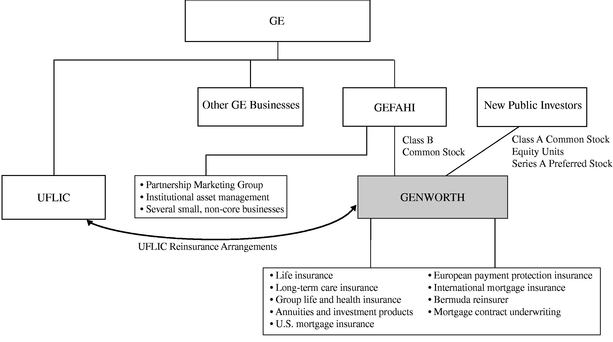

The diagram below shows the relationships among GE, GEFAHI and Genworth after the completion of our corporate reorganization and this offering.

In this prospectus, unless the context otherwise requires, "Genworth," "we," "us," and "our" refer to Genworth Financial, Inc. and its combined subsidiaries and include the operations of the businesses acquired from GEFAHI and other GE subsidiaries in connection with our corporate reorganization.

7

Unless otherwise indicated, all information in this prospectus:

8

Risks Relating to Our Company

As part of your evaluation of our company, you should consider the risks associated with our business, our separation from GE and this offering. These risks include:

For a further discussion of these and other risks, see "Risk Factors."

Additional Information

Our corporate headquarters and principal executive offices are located at 6620 West Broad Street, Richmond, Virginia 23230. Our telephone number at that address is (804) 281-6000. We maintain a variety of websites to communicate with our distributors and customers and to provide information about various insurance and investment products to the general public. None of the information on our websites is part of this prospectus.

9

What are Corporate Units?

The Equity Units offered by the seller will initially consist of 24,000,000 Corporate Units, each with a stated amount of $25. You can create Treasury Units from Corporate Units in the manner described below under "How can I create Treasury Units from Corporate Units?"

What are the components of a Corporate Unit?

Each Corporate Unit initially consists of a purchase contract and a 1/40, or 2.5%, undivided beneficial ownership interest in $1,000 principal amount of our senior notes due May 16, 2009. The undivided beneficial ownership interest in notes corresponds to $25 principal amount of our notes. The notes will be issued in minimum denominations of $1,000 and integral multiples of $1,000, except in certain limited circumstances. Your undivided beneficial ownership interest in notes comprising part of each Corporate Unit is owned by you, but it will be pledged to us through the collateral agent to secure your obligation under the related purchase contract. If a special event redemption occurs prior to the earlier of the date of a successful remarketing and the purchase contract settlement date, the notes comprising part of the Corporate Units will be replaced by the Treasury portfolio described below under "What is the Treasury Portfolio?", and the applicable ownership interest in the Treasury portfolio will then be pledged to us through the collateral agent to secure your obligation under the related purchase contract.

What is a purchase contract?

Each purchase contract that is a component of a Corporate Unit obligates you to purchase, and obligates us to sell, on May 16, 2007, which we refer to as the purchase contract settlement date, for $25 in cash, a number of newly issued shares of our Class A Common Stock equal to the "settlement rate." The settlement rate will be calculated, subject to adjustment under the circumstances set forth in "Description of the Purchase Contracts—Anti-Dilution Adjustments," as follows:

"Applicable market value" means the average of the closing price per share of our Class A Common Stock on each of the twenty consecutive trading days ending on the third trading day immediately preceding the purchase contract settlement date, subject to adjustment under the circumstances set forth in "Description of the Purchase Contracts—Anti-Dilution Adjustments." The reference price is the initial public offering price of our Class A Common Stock. The "threshold appreciation price" represents a 21% appreciation over the reference price.

We will not issue any fractional shares of our Class A Common Stock upon settlement of a purchase contract. Instead of a fractional share, you will receive an amount of cash equal to this fraction multiplied by the applicable market value.

You may satisfy your obligation to purchase our common stock pursuant to the purchase contracts as described under "How can I satisfy my obligation under the purchase contracts?" below.

Can I settle the purchase contract early?

You can settle a purchase contract at any time following May 28, 2005 (12 calendar months following the completion of the concurrent initial public offering of our Class A Common Stock) but on or prior to the seventh business day immediately preceding the purchase contract settlement date, in the case of Corporate Units, and on or prior to the second business day immediately preceding the purchase contract

10

settlement date, in the case of Treasury Units, by paying $25 cash, in which case 1.0595 shares of our Class A Common Stock will be issued to you pursuant to the purchase contract. In addition, if we are involved in a merger in which at least 30% of the consideration for our Class A Common Stock consists of cash or cash equivalents, you will have the right to settle a purchase contract early at the settlement rate in effect immediately prior to the closing of that merger. You may only elect early settlement in integral multiples of 40 Corporate Units and 40 Treasury Units. If the Treasury portfolio has replaced the notes as a component of the Corporate Units, holders of Corporate Units may settle early on or prior to the second business day immediately preceding the purchase contract settlement date only in integral multiples of 25,000 Corporate Units. See "Description of the Purchase Contracts—Early Settlement" and "—Early Settlement Upon Cash Merger."

Your early settlement right is subject to the condition that, if required under the U.S. federal securities laws, we have a registration statement under the Securities Act of 1933 in effect and an available prospectus covering the shares of Class A Common Stock and other securities, if any, deliverable upon settlement of a purchase contract. We have agreed that, if required by U.S. federal securities laws, we will use our commercially reasonable efforts to have a registration statement in effect and to provide a prospectus covering those shares of Class A Common Stock or other securities to be delivered in respect of the purchase contracts being settled.

What is a Treasury Unit?

A Treasury Unit is a unit created from a Corporate Unit and consists of a purchase contract and a 1/40, or 2.5%, undivided beneficial ownership interest in a zero-coupon U.S. Treasury security with a principal amount of $1,000 that matures on May 15, 2007 (the business day preceding the purchase contract settlement date or earlier) (CUSIP No. 912820BX4) which we refer to as a Treasury security. The ownership interest in the Treasury security that is a component of a Treasury Unit will be owned by you, but will be pledged to us through the collateral agent to secure your obligation under the related purchase contract.

How can I create Treasury Units from Corporate Units?

Each holder of Corporate Units will have the right, at any time on or prior to the seventh business day immediately preceding the purchase contract settlement date, to substitute for the related undivided beneficial ownership interest in notes or applicable ownership interests in the Treasury portfolio, as the case may be, held by the collateral agent, Treasury securities with a total principal amount at maturity equal to the aggregate principal amount of the notes underlying the undivided beneficial ownership interests in notes for which substitution is being made. Because Treasury securities and the notes are issued in minimum denominations of $1,000, holders of Corporate Units may make this substitution only in integral multiples of 40 Corporate Units. If the Treasury portfolio has replaced the notes as a component of the Corporate Units, holders of Corporate Units may substitute Treasury securities for the applicable ownership interests in the Treasury portfolio only in integral multiples of 25,000 Corporate Units. This substitution will create Treasury Units, and the notes underlying the undivided beneficial ownership interest in notes, or the applicable ownership interests in the Treasury portfolio, will be released to the holder and such notes will be separately tradable from the Treasury Units.

How can I recreate Corporate Units from Treasury Units?

Each holder of Treasury Units will have the right, at any time on or prior to the seventh business day immediately preceding the purchase contract settlement date, to substitute for the related Treasury securities held by the collateral agent, notes or applicable ownership interests in the Treasury portfolio, as the case may be, having a principal amount equal to the aggregate principal amount at stated maturity of the Treasury securities for which substitution is being made. Because Treasury securities and the notes are issued in minimum denominations of $1,000, holders of Treasury Units may make these substitutions only in integral multiples of 40 Treasury Units. If the Treasury portfolio has replaced the notes as a component of the Corporate Units, holders of Treasury Units may substitute applicable ownership interests in the Treasury portfolio for Treasury securities only in integral multiples of 25,000 Corporate Units. This substitution will recreate Corporate Units and the applicable Treasury securities will be released to the holder and will be separately tradable from the Corporate Units.

11

What payments am I entitled to as a holder of Corporate Units?

Holders of Corporate Units will be entitled to receive quarterly cash distributions consisting of their pro rata share of interest payments on the notes, equivalent to the rate of 3.84% per year on the undivided beneficial ownership interest in notes (or distributions on the applicable ownership interests in the Treasury portfolio if the notes have been replaced by the Treasury portfolio) and contract adjustment payments payable by us at the rate of 2.16% per year on the stated amount of $25 per Corporate Unit until the earliest of the purchase contract settlement date, the early settlement date (in the case of a cash merger early settlement) and the most recent quarterly payment date on or before any early settlement of the related purchase contracts (in the case of early settlement other than upon a cash merger). Interest and contract adjustment payments accrued on the Corporate Units to but excluding May 28, 2004 will be paid to the seller and not to the purchasers of Corporate Units in this offering.

What payments will I be entitled to if I convert my Corporate Units to Treasury Units?

Holders of Treasury Units will be entitled to receive quarterly contract adjustment payments payable by us at the rate of 2.16% per year on the stated amount of $25 per Treasury Unit. There will be no distributions in respect of the Treasury securities that are a component of the Treasury Units but the holders of the Treasury Units will continue to receive the scheduled quarterly interest payments on the notes that were released to them when they created the Treasury Units as long as they continue to hold such notes.

Do we have the option to defer current payments?

No, we do not have the right to defer the payment of contract adjustment payments in respect of the Corporate Units or Treasury Units or the payment of interest on the notes.

What are the payment dates for the Corporate Units and Treasury Units?

The payments described above in respect of the Equity Units will be payable quarterly in arrears on February 16, May 16, August 16 and November 16 of each year, commencing August 16, 2004. We will make these payments to the person in whose name the Equity Unit is registered at the close of business on the first day of the month in which the payment date falls.

What is remarketing?

Unless the Treasury portfolio has replaced the notes as a component of the Corporate Units as a result of a special event redemption, remarketing of the notes will be attempted on May 9, 2007 (the fifth business day immediately preceding the purchase contract settlement date) and, if the remarketing on that date fails, on May 10, 2007 (the fourth business day immediately preceding the purchase contract settlement date) and, if the remarketing on that date fails, on May 11, 2007 (the third business day immediately preceding the purchase contract settlement date), the fifth, fourth and third business days, respectively, immediately preceding the purchase contract settlement date of May 16, 2007. The remarketing agent will use its reasonable efforts to obtain a price for the notes to be remarketed that results in proceeds of at least 100% of the aggregate principal amount of such notes.

Upon a successful remarketing, the portion of the proceeds equal to the total principal amount of the notes underlying the Corporate Units will automatically be applied to satisfy in full the Corporate Unit holders' obligations to purchase Class A Common Stock under the related purchase contracts. If any proceeds remain after this application, the remarketing agent will remit such proceeds for the benefit of the holders. We will separately pay a fee to the remarketing agent for its services as remarketing agent. Corporate Unit holders whose notes are remarketed will not be responsible for the payment of any remarketing fee in connection with the remarketing.

What happens if the notes are not successfully remarketed?

Unless the Treasury portfolio has replaced the notes as a component of the Corporate Units as a result of a special event redemption, if (1) despite using its reasonable efforts, the remarketing agent cannot remarket the notes in a remarketing on or prior to May 11, 2007 (the third business day immediately preceding the purchase contract settlement date), other than to us, at a price equal to or greater than 100% of the aggregate principal amount of the notes remarketed, or (2) the remarketing has not occurred because

12

a condition precedent to the remarketing has not been fulfilled, in each case resulting in a failed final remarketing, holders of all notes will have the right to put their notes to us for an amount equal to the principal amount of their notes, plus accrued and unpaid interest, on the purchase contract settlement date. A holder of Corporate Units will be deemed to have automatically exercised this put right with respect to the notes underlying such Corporate Units unless, prior to 5:00 p.m., New York City time, on the second business day immediately prior to the purchase contract settlement date, the holder provides written notice of an intention to settle the related purchase contracts with separate cash and on or prior to the business day immediately preceding the purchase contract settlement date delivers to the collateral agent $25 in cash per purchase contract. This settlement with separate cash may only be effected in integral multiples of 40 Corporate Units. Unless a holder of Corporate Units has settled the related purchase contracts with separate cash on or prior to the purchase contract settlement date, the holder will be deemed to have elected to apply a portion of the proceeds of the put price equal to the principal amount of the notes against such holder's obligations to us under the related purchase contracts, thereby satisfying such obligations in full, and we will deliver to the holder our Class A Common Stock pursuant to the related purchase contracts.

Do I have to participate in the remarketing?

You may elect not to participate in any remarketing and to retain the notes underlying the undivided beneficial ownership interests in notes comprising part of your Corporate Units by (1) creating Treasury Units at any time on or prior to the seventh business day immediately prior to the purchase contract settlement date or (2) notifying the purchase contract agent of your intention to pay cash to satisfy your obligation under the related purchase contracts on or prior to the seventh business day before the purchase contract settlement date and delivering the cash payment required under the purchase contracts to the collateral agent on or prior to the sixth business day before the purchase contract settlement date. You can only elect to satisfy your obligation in cash in increments of 40 Corporate Units. See "Description of the Purchase Contracts—Notice to Settle with Cash."

If I am holding a note as a separate security from the Corporate Units, can I still participate in a remarketing of the notes?

If you hold notes separately you may elect, in the manner described in this prospectus, to have your notes remarketed by the remarketing agent along with the notes underlying the Corporate Units. See "Description of the Notes—Optional Remarketing of Notes that are not Included in Corporate Units." You may also participate in any remarketing by recreating Corporate Units from your Treasury Units at any time on or prior to the seventh business day immediately prior to the purchase contract settlement date.

How can I satisfy my obligation under the purchase contracts?

You may satisfy your obligations under the purchase contracts as follows:

In addition, the purchase contract and pledge agreement that governs the Corporate Units and Treasury Units provides that your obligations under the purchase contracts will be terminated without any further action upon the termination of the purchase contracts as a result of our bankruptcy, insolvency or reorganization.

13

If you settle a purchase contract early (other than as a result of a cash merger early settlement), or if your purchase contract is terminated as a result of our bankruptcy, insolvency or reorganization, you will have no right to receive any accrued but unpaid contract adjustment payments.

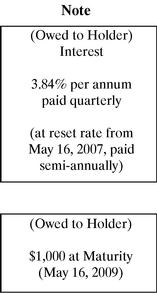

What interest payments will I receive on the notes or on the undivided beneficial ownership interests in notes?

The notes will bear interest initially at the rate of 3.84% per year from the original issuance date to the purchase contract settlement date, initially payable quarterly in arrears on February 16, May 16, August 16 and November 16 of each year until the purchase contract settlement date. On and after the purchase contract settlement date, interest on each note will be payable semi-annually in arrears on May 16 and November 16 of each year, commencing November 16, 2007, at the reset interest rate or, if the interest rate has not been reset, at the rate of 3.84% per year. Interest will be payable to the person in whose name the note is registered at the close of business on the first day of the month in which the interest payment date falls. Interest accrued to but excluding May 28, 2004 will be paid to the seller and not to the purchasers of Corporate Units in this offering.

When will the interest rate on the notes be reset and what is the reset rate?

The interest rate on the notes will be reset on May 16, 2007 in connection with the remarketing as described above under "What is remarketing?" The reset rate will be the interest rate determined by the remarketing agent as the rate the notes should bear in order for the aggregate principal amount of notes remarketed to have an aggregate market value on the remarketing date of at least 100% of the aggregate principal amount of such notes. The reset rate may be higher or lower than the initial interest rate of the notes depending on the results of the remarketing and market conditions at that time. The interest rate on the notes will not be reset if there is not a successful remarketing and the notes will continue to bear interest at the initial interest rate. The reset rate may not exceed the maximum rate, if any, permitted by applicable law.

When may the notes be redeemed?

The notes are redeemable at our option, in whole but not in part, upon the occurrence and continuation of a tax event or an accounting event at any time prior to the earlier of the date of a successful remarketing and the purchase contract settlement date, as described in this prospectus under "Description of the Notes—Optional Redemption—Special Event." Following any such redemption of the notes, which we refer to as a special event redemption, the redemption price for the notes that are a component of the Corporate Units will be paid to the collateral agent who will use a portion of the redemption price to purchase the Treasury portfolio described below and remit any remaining proceeds to the holders. Thereafter, the applicable ownership interests in the Treasury portfolio will replace the notes as a component of the Corporate Units and will be pledged to us through the collateral agent. Holders of notes that are not a component of the Corporate Units will receive directly the redemption price paid in such special event redemption.

What is the Treasury portfolio?

If a special event redemption as described under "Description of the Notes—Optional Redemption—Special Event" occurs prior to the earlier of the date of a successful remarketing and the purchase contract settlement date, the notes will be replaced by the Treasury portfolio. The Treasury portfolio is a portfolio of U.S. Treasury securities consisting of:

14

What is the ranking of the notes?

The notes will rank equally with all of our other unsecured and unsubordinated obligations. The notes will not be obligations of or guaranteed by any of our subsidiaries. As a result, the notes will be structurally subordinated to all debt and other liabilities of our subsidiaries (including liabilities to policyholders and contractholders), which means that creditors of our subsidiaries will be paid from their assets before holders of the notes would have any claims to those assets. As of March 31, 2004, on a pro forma basis, our subsidiaries had outstanding $82,057 million of total liabilities, including $1,573 million of debt (excluding, in each case, intercompany liabilities). The indenture under which the notes will be issued will not limit our ability, or the ability of our subsidiaries, to issue or incur other debt or liabilities (secured or unsecured) or issue preferred stock. As a holding company, we depend on the ability of our subsidiaries to transfer funds to us to meet our obligations, including our obligations to pay interest on the notes. See "Risk Factors—Risks Relating to Our Businesses—As a holding company, we depend on the ability of our subsidiaries to transfer funds to us to pay dividends and to meet our obligations" and "Description of the Notes."

What are the principal United States federal income tax consequences related to Equity Units and notes?

An owner of Equity Units will be treated as owning an undivided beneficial interest in the purchase contract and the notes, the applicable ownership interests in the Treasury portfolio or Treasury securities constituting the Equity Unit, and by purchasing the Equity Units you will be deemed to have agreed to treat the purchase contracts and notes, the applicable ownership interests in the Treasury portfolio or Treasury securities in that manner for all tax purposes. In addition, you will be deemed to have agreed to allocate all of the purchase price paid for Equity Units to your undivided interest in notes, which will establish your initial tax basis in your interest in each purchase contract as $0 and your initial tax basis in your undivided interest in notes as $25. You will be required to include in gross income interest payments on the notes when such interest is paid or accrued in accordance with your regular method of tax accounting. If the Treasury portfolio has replaced the notes as a component of the Corporate Units as a result of a special event redemption, a beneficial owner of Corporate Units will generally be required to include in gross income its allocable share of any interest payments made with respect to the applicable ownership interests in the Treasury portfolio and, if appropriate, original issue discount on the applicable ownership interests in the Treasury portfolio as it accrues on a constant yield to maturity basis, or, if appropriate, acquisition discount on the applicable ownership interests in the Treasury portfolio. We intend to report contract adjustment payments as income to you, but you may want to consult your tax advisor concerning possible alternative characterizations.

FOR ADDITIONAL INFORMATION, SEE "CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES."

Are there conditions to the closing of this offering of the Equity Units?

This offering of Equity Units is conditioned upon the completion of the offerings of the Class A Common Stock and the Series A Preferred Stock by the seller. The offerings of the Class A Common Stock and the Series A Preferred Stock are conditioned upon the completion of this offering.

What are the rights and privileges of the Class A Common Stock?

The shares of our Class A Common Stock that you will be obligated to purchase under the purchase contracts have one vote per share for all matters on which stockholders are entitled to vote, except:

The specific number of directors that holders of the Class A Common Stock and the Class B Common Stock will have the separate rights to elect and remove will vary, depending upon the percentage of our common stock owned by GE. See "Description of Capital Stock—Common Stock."

15

What are the uses of proceeds from the offering?

We will not receive any proceeds this offering of Equity Units by the seller.

The Offering—Explanatory Diagrams

The following diagrams illustrate some of the key features of the purchase contracts, undivided beneficial ownership interests in notes, Corporate Units and Treasury Units.

The following diagrams assume that the notes are successfully remarketed, there has not been a special event redemption and the interest rate on the notes is reset on the reset effective date.

Purchase Contract

Corporate Units and Treasury Units both include a purchase contract under which the holder agrees to purchase shares of our Class A Common Stock on the purchase contract settlement date. In addition, these purchase contracts include unsecured contract adjustment payments as shown in the diagrams on the following pages.

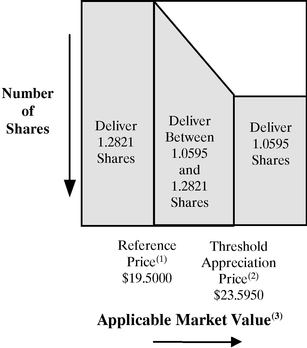

Number of Shares Delivered

Upon Settlement of a Purchase Contract on the

Purchase Contract Settlement Date

| Notes: | (1) | The "reference price" is the initial public offering price of our Class A Common Stock. | ||

| (2) | The "threshold appreciation price" represents a 21% appreciation over the reference price. | |||

| (3) | The "applicable market value" means the average of the closing price per share of our Class A Common Stock on each of the twenty consecutive trading days ending on the third trading day immediately preceding the purchase contract settlement date. |

16

Corporate Units

A Corporate Unit consists of two components as described below:

Notes:

17

Treasury Units

A Treasury Unit consists of two components as described below:

The Notes

Notes have the terms described below(1):

Notes:

18

Summary Historical and Pro Forma Financial Information

The following table sets forth summary historical combined and pro forma financial information. You should read this information in conjunction with the information under "Selected Historical and Pro Forma Financial Information," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our combined financial statements and the related notes included elsewhere in this prospectus.

Prior to the completion of this offering, we will acquire substantially all of the assets and liabilities of GEFAHI. We also will acquire certain other insurance businesses currently owned by other GE subsidiaries but managed by members of the Genworth management team. These businesses include international mortgage insurance, European payment protection insurance, a Bermuda reinsurer and mortgage contract underwriting. In consideration for the assets that we will acquire and the liabilities that we will assume in connection with our corporate reorganization, we will issue to GEFAHI 489.5 million shares of our Class B Common Stock, $600 million of our Equity Units, $100 million of our Series A Preferred Stock, the $2.4 billion Short-term Intercompany Note and the $550 million Contingent Note.

We have prepared our combined financial statements as if Genworth had been in existence throughout all relevant periods. Our historical combined financial information and statements include all businesses that were owned by GEFAHI including those that will not be transferred to us, as well as the other insurance businesses that we will acquire from other GE subsidiaries, each in connection with our corporate reorganization.

The unaudited pro forma information set forth below reflects our historical combined financial information, as adjusted to give effect to the transactions described under "Selected Historical and Pro Forma Financial Information" as if each had occurred as of January 1, 2003, in the case of earnings information, and March 31, 2004, in the case of financial position information. The following transactions are reflected in the pro forma financial information:

The unaudited pro forma information below is based upon available information and assumptions that we believe are reasonable. The unaudited pro forma financial information is for illustrative and informational purposes only and is not intended to represent or be indicative of what our financial condition or results of operations would have been had the transactions described above occurred on the dates indicated. The unaudited pro forma information also should not be considered representative of our future financial condition or results of operations.

In addition to the pro forma adjustments to our historical combined financial statements, various other factors will have an effect on our financial condition and results of operations after the completion of this offering, including those discussed under "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

19

| |

Historical |

Pro forma |

|||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Three months ended March 31, |

Years ended December 31, |

Three months ended March 31, |

Year ended December 31, |

|||||||||||||||||||||||||||||||

| (Amounts in millions, except per share amounts) |

2004 |

2003 |

2003(1) |

2002 |

2001 |

2000(2) |

1999 |

2004 |

2003 |

2003 |

|||||||||||||||||||||||||

| Combined Statement of Earnings Information |

|||||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Premiums | $ | 1,722 | $ | 1,587 | $ | 6,703 | $ | 6,107 | $ | 6,012 | $ | 5,233 | $ | 4,534 | $ | 1,619 | $ | 1,478 | $ | 6,252 | |||||||||||||||

| Net investment income | 1,020 | 992 | 4,015 | 3,979 | 3,895 | 3,678 | 3,440 | 755 | 721 | 2,928 | |||||||||||||||||||||||||

| Net realized investment gains | 16 | 21 | 10 | 204 | 201 | 262 | 280 | 15 | 20 | 38 | |||||||||||||||||||||||||

| Policy fees and other income | 263 | 231 | 943 | 939 | 993 | 1,053 | 751 | 166 | 135 | 557 | |||||||||||||||||||||||||

| Total revenues | 3,021 | 2,831 | 11,671 | 11,229 | 11,101 | 10,226 | 9,005 | 2,555 | 2,354 | 9,775 | |||||||||||||||||||||||||

Benefits and expenses: |

|||||||||||||||||||||||||||||||||||

| Benefits and other changes in policy reserves | 1,348 | 1,253 | 5,232 | 4,640 | 4,474 | 3,586 | 3,286 | 1,086 | 996 | 4,191 | |||||||||||||||||||||||||

| Interest credited | 396 | 409 | 1,624 | 1,645 | 1,620 | 1,456 | 1,290 | 330 | 343 | 1,358 | |||||||||||||||||||||||||

| Underwriting, acquisition, and insurance expenses, net of deferrals |

508 | 488 | 1,942 | 1,808 | 1,823 | 1,813 | 1,626 | 414 | 404 | 1,614 | |||||||||||||||||||||||||

| Amortization of deferred acquisition costs and intangibles(3) |

345 | 300 | 1,351 | 1,221 | 1,237 | 1,394 | 1,136 | 286 | 251 | 1,144 | |||||||||||||||||||||||||

| Interest expense | 47 | 27 | 140 | 124 | 126 | 126 | 78 | 43 | 25 | 133 | |||||||||||||||||||||||||

| Total benefits and expenses | 2,644 | 2,477 | 10,289 | 9,438 | 9,280 | 8,375 | 7,416 | 2,159 | 2,019 | 8,440 | |||||||||||||||||||||||||

Earnings from continuing operations before income taxes |

377 |

354 |

1,382 |

1,791 |

1,821 |

1,851 |

1,589 |

396 |

335 |

1,335 |

|||||||||||||||||||||||||

| Provision for income taxes | 117 | 100 | 413 | 411 | 590 | 576 | 455 | 129 | 95 | 396 | |||||||||||||||||||||||||

| Net earnings from continuing operations | $ | 260 | $ | 254 | $ | 969 | $ | 1,380 | $ | 1,231 | $ | 1,275 | $ | 1,134 | $ | 267 | $ | 240 | $ | 939 | |||||||||||||||

Pro forma earnings from continuing operations per share: |

|||||||||||||||||||||||||||||||||||

| Basic | $ | 0.53 | $ | 0.52 | $ | 1.98 | $ | 0.55 | $ | 0.49 | $ | 1.92 | |||||||||||||||||||||||

| Diluted | $ | 0.53 | $ | 0.52 | $ | 1.98 | $ | 0.54 | $ | 0.49 | $ | 1.92 | |||||||||||||||||||||||

| Pro forma shares outstanding: | |||||||||||||||||||||||||||||||||||

| Basic | 489.5 | 489.5 | 489.5 | 489.5 | 489.5 | 489.5 | |||||||||||||||||||||||||||||

| Diluted | 490.0 | 490.0 | 490.0 | 490.0 | 490.0 | 490.0 | |||||||||||||||||||||||||||||

Selected Segment Information |

|||||||||||||||||||||||||||||||||||

| Total revenues: | |||||||||||||||||||||||||||||||||||

| Protection | $ | 1,566 | $ | 1,472 | $ | 6,153 | $ | 5,605 | $ | 5,443 | $ | 4,917 | $ | 1,489 | $ | 1,393 | $ | 5,839 | |||||||||||||||||

| Retirement Income and Investments | 976 | 958 | 3,781 | 3,756 | 3,721 | 3,137 | 725 | 689 | 2,707 | ||||||||||||||||||||||||||

| Mortgage Insurance | 263 | 227 | 982 | 946 | 965 | 895 | 263 | 227 | 982 | ||||||||||||||||||||||||||

| Affinity(4) | 139 | 137 | 566 | 588 | 687 | 817 | — | — | — | ||||||||||||||||||||||||||

| Corporate and Other | 77 | 37 | 189 | 334 | 285 | 460 | 78 | 45 | 247 | ||||||||||||||||||||||||||

| Total | $ | 3,021 | $ | 2,831 | $ | 11,671 | $ | 11,229 | $ | 11,101 | $ | 10,226 | $ | 2,555 | $ | 2,354 | $ | 9,775 | |||||||||||||||||

Net earnings (loss) from continuing operations: |

|||||||||||||||||||||||||||||||||||

| Protection | $ | 124 | $ | 131 | $ | 487 | $ | 554 | $ | 538 | $ | 492 | $ | 123 | $ | 124 | $ | 481 | |||||||||||||||||

| Retirement Income and Investments | 31 | 42 | 151 | 186 | 215 | 250 | 32 | 26 | 93 | ||||||||||||||||||||||||||

| Mortgage Insurance | 103 | 85 | 369 | 451 | 428 | 414 | 103 | 85 | 369 | ||||||||||||||||||||||||||

| Affinity(4) | (2 | ) | — | 16 | (3 | ) | 24 | (13 | ) | — | — | — | |||||||||||||||||||||||

| Corporate and Other | 4 | (4 | ) | (54 | ) | 192 | 26 | 132 | 9 | 5 | (4 | ) | |||||||||||||||||||||||

| Total | $ | 260 | $ | 254 | $ | 969 | $ | 1,380 | $ | 1,231 | $ | 1,275 | $ | 267 | $ | 240 | $ | 939 | |||||||||||||||||

20

| |

Historical |

Pro forma |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

March 31, |

December 31, |

March 31, |

||||||||||||||||||||

| (Dollar amounts in millions) |

2004 |

2003(1) |

2002 |

2001 |

2000(2) |

1999 |

2004 |

||||||||||||||||

| Combined Statement of Financial Position Information |

|||||||||||||||||||||||

| Total investments | $ | 81,466 | $ | 78,693 | $ | 72,080 | $ | 62,977 | $ | 54,978 | $ | 48,341 | $ | 61,749 | |||||||||

| All other assets | 25,070 | 24,738 | 45,277 | 41,021 | 44,598 | 27,758 | 38,457 | ||||||||||||||||

| Total assets | $ | 106,536 | $ | 103,431 | $ | 117,357 | $ | 103,998 | $ | 99,576 | $ | 76,099 | $ | 100,206 | |||||||||

Policyholder liabilities |

$ |

67,346 |

$ |

66,545 |

$ |

63,195 |

$ |

55,900 |

$ |

48,291 |

$ |

45,042 |

$ |

66,841 |

|||||||||

| Non-recourse funding obligations(5) | 600 | 600 | — | — | — | — | 600 | ||||||||||||||||

| Short-term borrowings | 2,496 | 2,239 | 1,850 | 1,752 | 2,258 | 990 | 2,400 | ||||||||||||||||

| Long-term borrowings | 516 | 529 | 472 | 622 | 175 | 175 | 516 | ||||||||||||||||

| All other liabilities | 18,153 | 17,718 | 35,088 | 31,559 | 35,865 | 18,646 | 17,601 | ||||||||||||||||

| Total liabilities | $ | 89,111 | $ | 87,631 | $ | 100,605 | $ | 89,833 | $ | 86,589 | $ | 64,853 | $ | 87,958 | |||||||||

| Accumulated nonowner changes in stockholder's interest | $ | 2,976 | $ | 1,672 | $ | 835 | $ | (664 | ) | $ | (424 | ) | $ | (862 | ) | $ | 1,987 | ||||||

| Total stockholder's interest | 17,425 | 15,800 | 16,752 | 14,165 | 12,987 | 11,246 | 12,248 | ||||||||||||||||

U.S. Statutory Information |

|||||||||||||||||||||||

Statutory capital and surplus(6) |

7,129 |

7,021 |

7,207 |

7,940 |

7,119 |

6,140 |

|||||||||||||||||

| Asset valuation reserve | 453 | 413 | 390 | 477 | 497 | 500 | |||||||||||||||||

21

You should carefully consider the following risks before investing in our Equity Units. These risks could materially affect our business, results of operations or financial condition and cause the trading price of our Equity Units, the notes and the Class A Common Stock to decline. You could lose part or all of your investment.

Risks Relating to Our Businesses

Interest rate fluctuations could adversely affect our business and profitability.

Our insurance and investment products are sensitive to interest rate fluctuations and expose us to the risk that falling interest rates will reduce our "spread," or the difference between the returns we earn on the investments that support our obligations under these products and the amounts that we must pay policyholders and contractholders. Because we may reduce the interest rates we credit on most of these products only at limited, pre-established intervals, and because some of them have guaranteed minimum crediting rates, declines in interest rates may adversely affect the profitability of those products. For example, interest rates declined to unusually low levels from 2001 to 2003. During this period, our net earnings from spread-based products, such as fixed and income annuities and guaranteed investment contracts, declined from $207 million for the year ended December 31, 2001 to $138 million for the year ended December 31, 2003.

During periods of increasing market interest rates, we must offer higher crediting rates on interest-sensitive products, such as universal life insurance and fixed annuities, and we must increase crediting rates on in-force products to keep these products competitive. In addition, increases in market interest rates may cause increased policy surrenders, withdrawals from life insurance policies and annuity contracts and requests for policy loans, as policyholders and contractholders seek to shift assets to products with perceived higher returns. Increases in crediting rates, as well as surrenders and withdrawals, could have an adverse effect on our financial condition and results of operations. An increase in policy surrenders and withdrawals also may require us to accelerate amortization of deferred acquisition costs or other intangibles or cause an impairment of goodwill, which would reduce our net earnings.

Our long-term care insurance products also expose us to the risk of interest rate fluctuations. The pricing and expected future profitability of these products are based in part on expected investment returns. Over time, long-term care insurance products generally produce positive cash flows as customers pay periodic premiums, which we invest as we receive them. Declining interest rates may reduce our ability to achieve our targeted investment margins and may adversely affect the profitability of our long-term care insurance products.

In our mortgage insurance business, rising interest rates generally reduce the volume of new mortgages, resulting in a decrease in the volume of new insurance written. Rising interest rates also can increase the monthly mortgage payments for insured homeowners with adjustable rate mortgages, or ARMs, which could have the effect of increasing default rates on ARM loans and thereby increasing our exposure on our mortgage insurance policies. This is particularly relevant in our non-U.S. mortgage insurance business, where ARMs are the predominant mortgage product. Declining interest rates increase the rate at which insured borrowers refinance their existing mortgages, thereby resulting in cancellations of the mortgage insurance covering the refinanced loans. Declining interest rates also generally are associated with home price appreciation, which may provide insured borrowers the option of canceling their mortgage insurance coverage earlier than we anticipated in pricing that coverage. These cancellations could have an adverse effect on our results from our mortgage insurance business.

Interest rate fluctuations also could have an adverse effect on the results of our investment portfolio. During periods of declining market interest rates, the interest we receive on variable interest rate investments decreases. In addition, during those periods, we are forced to reinvest the cash we receive as interest or return of principal on our investments in lower-yielding high-grade instruments or in lower-credit instruments to maintain comparable returns. Issuers of fixed-income securities also may

22

decide to prepay their obligations in order to borrow at lower market rates, which exacerbates the risk that we may have to invest the cash proceeds of these securities in lower-yielding or lower-credit instruments. Declining interest rates from 2001 to 2003 contributed to a decrease in our weighted average investment yield from 6.5% for the year ended December 31, 2001 to 5.2% for the year ended December 31, 2003. For additional information regarding our investment portfolio, see "Business—Investments." For additional information regarding the sensitivity of the fixed maturities in our investment portfolio to interest rate fluctuations, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures About Market Risk—Sensitivity analysis."

Downturns and volatility in equity markets could adversely affect our business and profitability.

Significant downturns and volatility in equity markets could have an adverse effect on our financial condition and results of operations in three principal ways. First, market downturns and volatility may cause potential new purchasers of our products to refrain from purchasing products, such as variable annuities and variable life insurance, that have returns linked to the performance of the equity markets and may cause current policyholders and contractholders to withdraw cash values from those products. The sharp declines in the equity markets during 2001 and 2002 have had adverse impacts on our sales of variable annuities and other products linked to equity markets. For example, our deposits for variable annuities decreased by 28% from $2,309 million for the year ended December 31, 2001 to $1,667 million for the year ended December 31, 2002.

Second, downturns and volatility in equity markets can have an adverse effect on the revenues and returns from our separate account and private asset management products and services. Because these products depend on fees related primarily to the value of assets under management, declines in the equity markets have reduced our revenues by reducing the value of the investment assets we manage. For example, the recent equity market downturn caused a reduction in the value of the separate account assets underlying our variable life insurance policies, variable annuities and assets under management. As a result, our policy fees and other income in our Retirement Income and Investments segment decreased by 7% from $243 million for the year ended December 31, 2002 to $225 million for the year ended December 31, 2003. In addition, some of our variable annuity products contain guaranteed minimum death benefits and guaranteed minimum income payments tied to the investment performance of the assets held within the variable annuity. A significant market decline could result in declines in account values which could increase our payments under the guaranteed minimum death benefits and certain income payments in connection with variable annuities, which could have an adverse effect on our financial condition and results of operations.

Third, we are exposed to equity risk on our holdings of common stock and other equities. An economic downturn, corporate malfeasance or a variety of other factors could cause declines in the value of our equity portfolio and cause our net earnings to decline. For additional information regarding the sensitivity of the equity securities in our investment portfolio to equity market fluctuations, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures About Market Risk—Sensitivity analysis."

Defaults in our fixed-income securities portfolio may reduce our earnings.

Issuers of the fixed-income securities that we own may default on principal and interest payments. As of each of March 31, 2004 and December 31, 2003 and 2002, 93% of our fixed maturities had ratings equivalent to investment-grade. Nevertheless, as a result of the economic downturn and recent corporate malfeasance, the number of companies defaulting on their debt obligations increased dramatically in 2001 and 2002. As of March 31, 2004 and December 31, 2003 and 2002, we had fixed maturities in or near default (where the issuer has missed payment of principal or interest or entered bankruptcy) with a fair value of $177 million, $190 million and $181 million, respectively. An economic downturn, further events of corporate malfeasance or a variety of other factors could cause declines in the value of our fixed maturities porfolio and cause our net earnings to decline.

23

We recognized gross capital gains of $27 million, $181 million, $473 million, $790 million and $814 million for the three months ended March 31, 2004 and 2003 and the years ended December 31, 2003, 2002 and 2001, respectively. We realized these capital gains in part to offset default-related losses during those periods. However, capital gains may not be available in the future, and if they are, we may elect not to recognize capital gains to offset losses.

A downgrade or a potential downgrade in our financial strength or credit ratings could result in a loss of business and adversely affect our financial condition and results of operations.

Financial strength ratings, which various ratings organizations publish as measures of an insurance company's ability to meet contractholder and policyholder obligations, are important to maintaining public confidence in our products, the ability to market our products and our competitive position. A downgrade in our financial strength ratings, or the announced potential for a downgrade, could have a significant adverse effect on our financial condition and results of operations in many ways, including:

In connection with our initial public offering and separation from GE, our principal life insurance companies were downgraded from financial strength ratings of "AA" (Very Strong) by S&P and "Aa2" (Excellent) by Moody's, to "AA-" (Very Strong) and "Aa3" (Excellent), respectively. In addition, as a result of our 2003 decision to reduce excess capital at our mortgage insurance subsidiaries, our mortgage insurance companies were downgraded from financial strength ratings of "AAA" (Extremely Strong) by S&P and Fitch and "Aaa" (Exceptional) by Moody's to "AA" (Very Strong) by S&P and Fitch and "Aa2" (Excellent) by Moody's. Although we do not believe that these downgrades have negatively affected our business overall in any material respect, we cannot assure you that they will not have an adverse effect over time or that our ratings will not be further downgraded in the future. The "AA" and "AA-" ratings are the third- and fourth-highest of S&P's 21 ratings categories, respectively. The "Aa2" and "Aa3" ratings are the third- and fourth-highest of Moody's 21 ratings categories, respectively. The "AA" rating is the third-highest of Fitch's 24 ratings categories.

The charters of the Federal National Mortgage Corporation, or Fannie Mae, and the Federal Home Loan Mortgage Corporation, or Freddie Mac, only permit them to buy high loan-to-value mortgages that are insured by a "qualified insurer," as determined by each of them. Their current rules effectively provide that they will accept mortgage insurance only from private mortgage insurers with financial strength ratings of at least "AA-" by S&P and "Aa3" by Moody's. If our mortgage insurance companies' financial strength ratings decrease below the thresholds established by Fannie Mae and Freddie Mac, we would not be able to insure mortgages purchased by Fannie Mae or Freddie Mac. Approximately 69% and 68% of the loans we insured in the U.S. during the three months ended March 31, 2004 and the year ended December 31, 2003, respectively, were sold to either Fannie Mae or Freddie Mac. An inability to insure mortgage loans sold to Fannie Mae or Freddie Mac, or their transfer of our existing policies to an alternative mortgage insurer, would have an adverse effect on our financial condition and results of operations.

In 2003, the U.S. Office of Federal Housing Enterprise Oversight announced a risk-based capital rule that treats credit enhancements issued by private mortgage insurers with financial strength ratings of "AAA" more favorably than those issued by "AA" rated insurers. Neither Fannie Mae nor Freddie Mac has adopted policies that distinguish between "AA" rated and "AAA" rated mortgage insurers.

24

However, if Fannie Mae or Freddie Mac adopts policies that treat "AAA" rated insurers more favorably than "AA" rated insurers, our competitive position may suffer.

Our mortgage insurance subsidiaries in Canada and Australia are also subject to local regulations that require them to maintain specified financial strength ratings to continue their operations.

In addition to the financial strength ratings of our insurance subsidiaries, ratings agencies also publish credit ratings for our company. The credit ratings have an impact on the interest rates we pay on the money we borrow. Therefore, a downgrade in our credit ratings could increase our cost of borrowing and have an adverse effect on our financial condition and results of operations.

The ratings of our insurance subsidiaries are not evaluations directed to the protection of investors in our common stock.

The ratings of our insurance subsidiaries described under "Business—Financial Strength Ratings" reflect each rating agency's current opinion of each subsidiary's financial strength, operating performance and ability to meet obligations to policyholders and contractholders. These factors are of concern to policyholders, contractholders, agents, sales intermediaries and lenders. Ratings are not evaluations directed to the protection of investors in our common stock. They are not ratings of our common stock and should not be relied upon when making a decision to buy, hold or sell our shares of common stock or any other security. In addition, the standards used by rating agencies in determining financial strength are different from capital requirements set by state insurance regulators. We may need to take actions in response to changing standards set by any of the ratings agencies, as well as statutory capital requirements, which could cause our business and operations to suffer.

If our reserves for future policy benefits and claims are inadequate, we may be required to increase our reserve liabilities, which could adversely affect our results of operations and financial condition.

We establish reserve liabilities to provide for future obligations under our insurance policies, annuities and other investment products, and mortgage insurance contract underwriting arrangements. Reserves do not represent an exact calculation of liability, but rather are estimates of expected net policy and contract benefits and claims payments over time. Our reserving assumptions and estimates require significant judgments and, therefore, are inherently uncertain. We cannot determine with precision the ultimate amounts that we will pay for actual benefit and claim payments, the timing of those payments, or whether the assets supporting our policy and contract liabilities will increase to the levels we estimate before payment of benefits or claims. We continually monitor our reserves. If we conclude that our reserves are insufficient to cover actual or expected policy and contract benefits and claims payments, we would be required to increase our reserves and incur income statement charges for the period in which we make the determination, which could adversely affect our results of operations and financial condition. For more information on how we set our reserves, see "Business—Reserves."

As a holding company, we depend on the ability of our subsidiaries to transfer funds to us to pay dividends and to meet our obligations.

We will act as a holding company for our insurance subsidiaries and will not have any significant operations of our own. Dividends from our subsidiaries and permitted payments to us under our tax sharing arrangements with our subsidiaries will be our principal sources of cash to pay stockholder dividends and to meet our obligations. These obligations will include our operating expenses, interest and principal on debt and contract adjustment payments on our Equity Units. These obligations also include amounts we will owe to GE under the tax matters agreement that we and GE will enter into prior to the completion of this offering. If the cash we receive from our subsidiaries pursuant to dividend payment and tax sharing arrangements is insufficient for us to fund any of these obligations, we may be required to raise cash through the incurrence of debt, the issuance of additional equity or the sale of assets.

25

The payment of dividends and other distributions to us by our insurance subsidiaries is regulated by insurance laws and regulations. In general, dividends in excess of prescribed limits are deemed "extraordinary" and require insurance regulatory approval. See "Regulation." During the years ended December 31, 2003, 2002 and 2001, we received dividends from our insurance subsidiaries of $1,472 million ($1,400 million of which were deemed "extraordinary"), $840 million ($375 million of which were deemed "extraordinary") and $410 million (none of which were deemed "extraordinary"), respectively. In addition, during the years ended December 31, 2003, 2002 and 2001, we received dividends from insurance subsidiaries related to discontinued operations of $495 million, $62 million and $0, respectively. Based on statutory results as of December 31, 2003, our subsidiaries could pay dividends of $1,121 million to us in 2004 without obtaining regulatory approval. However, as a result of the dividends we will pay in connection with our corporate reorganization, most of our insurance subsidiaries will not be able to pay us any additional dividends for the twelve months following this offering without prior regulatory approval. As part of our corporate reorganization, we will retain cash at the holding company level which we believe will be adequate to fund our dividend payments, debt service, obligations under the tax matters agreement and other obligations until our subsidiaries can resume paying dividends to us. In addition, the ability of our insurance subsidiaries to pay dividends to us, and our ability to pay dividends to our stockholders, are subject to various conditions imposed by the rating agencies for us to maintain our ratings.

Some of our investments are relatively illiquid.

Our investments in privately placed fixed maturities, mortgage loans, policy loans, limited partnership interests, real estate and restricted investments held by securitization entities are relatively illiquid. These asset classes represented approximately 30% of the carrying value of our total cash and invested assets as of March 31, 2004, on a pro forma basis. If we require significant amounts of cash on short notice in excess of our normal cash requirements, we may have difficulty selling these investments in a timely manner, be forced to sell them for less than we otherwise would have been able to realize, or both. For example, our floating rate funding agreements generally contain "put" provisions through which a contractholder may terminate the funding agreement for any reason after giving notice within the contract's specified notice period, which is generally 90 days but can be less than 30 days. As of March 31, 2004, the aggregate amount of our outstanding funding agreements with put option features was approximately $2.4 billion, and the aggregate amount of funding agreements with put option notice periods of 30 days or less was $450 million. If an unexpected number of contractholders exercise this right and we are unable to access other liquidity sources, we may have to liquidate assets quickly. Our inability to quickly dispose of illiquid investments could have an adverse effect on our financial condition and results of operations.

Intense competition could negatively affect our ability to maintain or increase our market share and profitability.

Our businesses are subject to intense competition. We believe the principal competitive factors in the sale of our products are product features, price, commission structure, marketing and distribution arrangements, brand, reputation, financial strength ratings and service.

Many other companies actively compete for sales in our protection and retirement income and investments markets, including other major insurers, banks, other financial institutions and specialty providers. The principal direct and indirect competitors for our mortgage insurance business include other private mortgage insurers, as well as federal and state governmental and quasi-governmental agencies in the U.S., including the Federal Housing Administration, or FHA, and to a lesser degree, the Veterans Administration, or VA, Fannie Mae and Freddie Mac, as well as local and state housing finance agencies. We also compete in our mortgage insurance business with structured transactions in the capital markets and with other financial instruments designed to manage credit risk, such as credit default swaps and credit linked notes, with lenders who forego mortgage insurance, or self-insure, on loans held in their portfolios, and with lenders that provide mortgage reinsurance through captive

26

mortgage reinsurance programs. In Canada and some European countries, our mortgage insurance business competes directly with government entities, which provide comparable mortgage insurance. Government entities with which we compete typically do not have the same capital requirements and do not have the same profit objectives as we do. Although private companies, such as our company, establish pricing terms for their products to achieve targeted returns, these government entities may offer products on terms designed to accomplish social or political objectives or reflect other non-economic goals.

In many of our product lines, we face competition from competitors that have greater market share or breadth of distribution, offer a broader range of products, services or features, assume a greater level of risk, have lower profitability expectations or have higher financial strength ratings than we do. Many competitors offer similar products and use similar distribution channels. The substantial expansion of banks' and insurance companies' distribution capacities and expansion of product features in recent years have intensified pressure on margins and production levels and have increased the level of competition in many of our business lines.

We may be unable to attract and retain independent sales intermediaries and dedicated sales specialists.